Summary

The slowdown in inflation and economic growth should support bonds and multi-asset investing moving towards 2024.

- Falling inflation and changing communication from the Fed boosted bonds and equities in November.

- The inflation and growth trend is positive for bonds, with US bonds recording their best month in November since May 1985.*

- After this strong rally, markets will likely focus on the upcoming communication from Central Banks, due in mid December.

* Refers to Bloomberg US Aggregate Bond Index.

November has been an exceptional month with global 50% bonds and 50% equity allocation posting the second highest monthly performance in 30 years, just slightly below the Nov-2020 post Covid rebound. With inflation coming down, the communication from the Fed has changed turning more comfortable with the current levels of rates. Expectations of a potential soft landing of for the US economy (deceleration in growth with no recession) also contributed to the optimism. However, future monetary policy depends on how soon inflation returns to target level, and the extent of the economic slowdown. Thus, from here the market direction going forward is less clear. Regarding bonds, despite the recent reduction in yields, they still offer value and they could also benefit in case of a further economic slowdown which has not yet been priced in by the market.

Actionable ideas

- Multi Asset investing

A flexible approach to allocation, that considers multiple asset classes may benefit from a better environment for bonds and the ability to exploit opportunities across the economic cycle.

- Favour quality credit in the search for income

As growth slows in developed markets and Central Bank rates are close to peak, in our view, high rated corporate credit offers in our view a good balance between quality and income.

This week at a glance

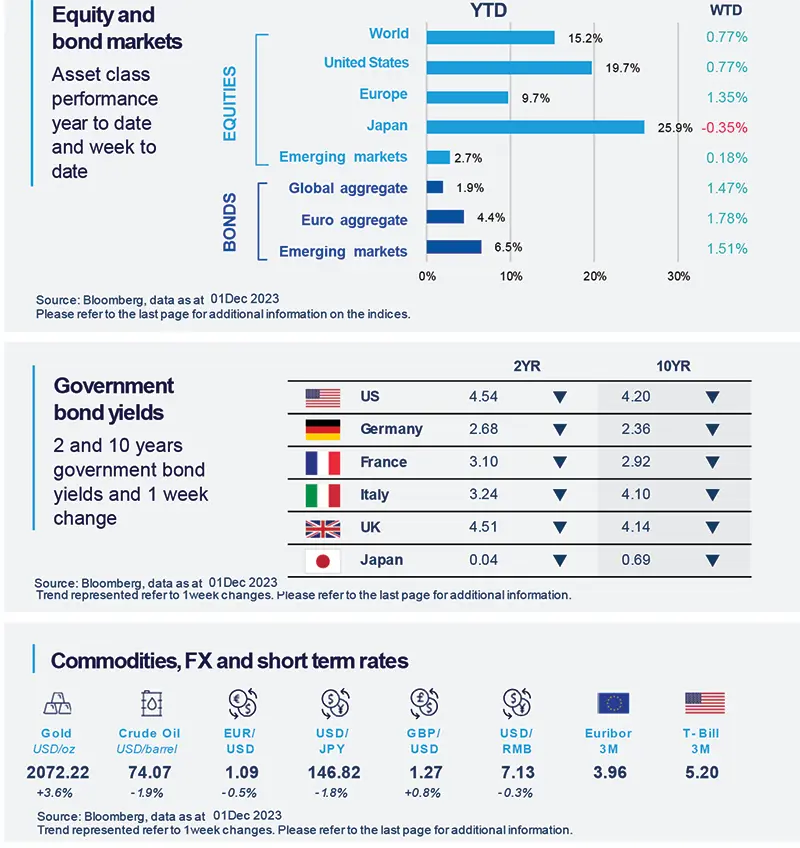

Bonds rose this week as yields fell on expectations that the Fed is close to its peak policy rates. US and European stocks were also positive. Gold prices extended their gains, and oil closed the week lower after OPEC+ members agreed, in-principle, to additional supply cuts.

Amundi Investment Institute Macro Focus

Americas

US savings rate ticks up slightly in October

Nominal personal income was softer in October, as employee compensation slowed to 0.2% (month-on-month), with labor compensation growth being the weakest since December 2022. Nominal personal spending also declined from 0.7% to 0.2% in October. But the savings rate ticked up slightly from 3.7% (in September) to 3.8%, as income stayed above spending in the month.

Europe

Eurozone inflation surprises on the downside in November

Both headline (2.4%, year-on-year) and core inflation (3.6%) came in lower-than-expected in November. Although details are not yet available and some of the weakness may be related to one-off items, we think the momentum in inflation seems to be weakening fast. Looking ahead, the weak economic growth we expect, could reinforce this disinflation trend.

Asia

Chinese recovery momentum is slowing

China's composite PMI declined for the second month in a row to 50.4 in November. The Services PMI dipped below 50 for the first time since the economy reopened. The manufacturing PMI dropped to 49.4 after a temporary increase in September. This recent data suggests the pace of China's economic recovery has slowed in Q4.

Key Dates

|

5 Dec Q3 GDP: Brazil, South Africa, |

6 & 7 Dec |

8 Dec US labour data, |