Summary

Foreword

Global warming and the Net Zero transition have far-reaching implications for investors. In particular, embracing a Net Zero path will impact investors’ asset allocation in two ways.

- Strategic asset allocation decisions will need to consider how the transition will impact economic and financial variables and thereby, the returns investors can expect in the future across asset classes1. Our findings suggest that the transition will lower the expected returns of risky asset classes (e.g., equity, high yield credit). Corporate cost structures will be negatively impacted, leading to lower earnings growth. Yet, we also recognise that responsible investors will favour sectors and companies which lead the innovation required to make the transition happen.

- Investors can embrace the Net Zero path within their equity and corporate bond allocations to ensure their portfolios are Net Zero aligned. In doing so, investors will have to reassess traditional asset allocation approaches, so as to reflect the fundamental shifts in the world’s economy caused by climate change. A bottom-up approach to asset allocation has been gaining traction, as the urgency among investors and regulators to address climate change gathers pace. This urgency is demonstrated by investor and asset manager coalitions, such as the Net Zero Asset Owner Alliance, as well as the Net Zero Asset Managers Initiative. As part of these initiatives, financial institutions are setting science-based climate targets, with the ultimate goal of reaching carbon neutrality by 2050.

For climate targets to be realised, the asset allocation decision can be implemented in different ways: using a passive climate-aligned benchmark, embracing a Net Zero active cross-asset allocation or using an active cross-asset strategy which incorporates specific targets for green investments. Asset owners will inevitably face trade-offs when introducing climate considerations into their portfolios. The most prevalent one is a trade-off between portfolio diversification and the incorporation of climate targets.

Our findings suggest that the short term financial cost of integrating Net Zero considerations into investors’ asset allocation is limited, and should be offset over the long run as corporates gradually transition towards low-carbon models. Although our analysis shows that incorporating Net Zero targets can be costly in terms of tracking error (TE) in the near term, the TE differential should be mitigated as the economy becomes more aligned towards a 1.5°C trajectory over the long term. On the other hand, the reduction in carbon intensity levels is significant as we incorporate Net Zero pockets into standard asset allocation strategies.

Finally, we believe that embracing climate considerations can have positive effects for investors over the long term and open active management opportunities in themes such as water quality, renewable energy, recycling / waste management, green buildings and green bonds.

Over the long term, an active approach can enable investors to overcome the risks associated with incorporating Net Zero targets in their portfolios.

Given the systemic impact of climate change, asset allocation decisions should broaden to integrate risks and opportunities stemming from the Net Zero transition. Amundi is committed to accompanying institutional investors in their asset allocation exercise to transition their portfolios.

Why integrate Net Zero targets in asset allocation?

The risk-return advantage

Integrating Net Zero targets into asset allocation can provide benefits from a risk-return perspective. Indeed, the low-carbon transition is likely to bring about significant opportunities for investors, as new business models emerge that will probably perform better in the future. The benefits of adopting Net Zero targets can include:

- Identification of new trends – A future Net Zero economy is likely to be structurally different from the economy we know today, having experienced significant inter- and intra-industry transformations. While it is impossible to predict whether Net Zero portfolios will outperform business-as-usual portfolios, integrating Net Zero considerations into portfolios today will allow investors to anticipate these shifts, and thus be better positioned in this future carbon-neutral economy.

- Risk mitigation – Net Zero portfolios are less likely to be impacted by transition risks. We define those risks as those relating to regulatory, legal, technological and market changes brought about by the move towards a climate-friendly society. These can arise both at the issuer level (e.g., carbon pricing being introduced for utilities companies) and at the investor level (e.g., the Sustainable Finance Disclosure Regulation (SFDR) in Europe, or Article 29 of the Energy and Climate Law in France).

Integrating Net Zero targets and reducing greenhouse gas (GHG) emissions can also contribute to mitigating the physical risks arising from climate change. Examples of these risks include: a corporate or project exposed to asset damage, and disruptions to supply chains or business operations. This reduction in physical risks will be indirect but, in the long run, the fall in GHG emissions will reduce issuers’ exposure to extreme weather events.

Better impact measurement

Beyond the risk-return argument, integrating Net Zero targets into asset allocation makes sense from an impact perspective. Long-term institutional investors should consider integrating climate considerations across all asset classes in their portfolios. It is important to note, however, that for now, we focus only on publicly-listed equities and credit for several reasons. There is currently a lack of available metrics to measure the progress of unlisted assets in terms of climate performance while, at the same time, this asset class lacks depth and liquidity. As for sovereign debt, a Net Zero methodology is currently being developed by the industry. Hence, we can expect to integrate this asset class in the near future once a robust Net Zero target-setting process is available.

Moreover, the Net Zero objective encompasses different sub-objectives (e.g., investing in low-carbon corporates versus investing in companies contributing to the energy transition via solutions and technologies). These would be difficult to include in a single investment strategy. As a result, integrating Net Zero considerations into the asset allocation process is a way to target several sub-objectives that contribute to reaching the Net Zero goal by 2050.

Additionally, to establish a consistent overall carbon emissions trajectory for each asset owner, Net Zero key performance indicators (KPIs) must be calculated and monitored across all the owner’s investment portfolios.

Introducing Net Zero Transition and Net Zero Contribution Portfolios

In line with Amundi’s research on building Net Zero portfolios, we are focusing on two main building blocks: Net Zero Transition portfolios and Net Zero Contribution portfolios2.

Net Zero Transition Portfolios

The objective of this building block is to gradually decarbonise investment portfolios in line with the objectives set by the Paris Agreement and ultimately reach carbon neutrality by 2050. The main investment approaches to achieve this objective include:

- Guiding equity or credit investments in order to align corporates with a trajectory compatible with the target of limiting global warming to 1.5°C above pre-industrial levels.

- Divesting from issuers that do not show sufficient effort to transition.

It is important to note, however, that divestment should be used as a last-resort solution. In fact, institutional investors are in a position, through their engagement efforts, to accompany investee companies in their transition and make sure that portfolios seek carbon reductions in the real world. In other words, reduced portfolio emissions must not simply result from not investing in the most polluting sectors.

On the contrary, asset managers can actively engage with corporates in the High Climate Impact Sectors (HCIS) (i.e., the sectors that will need to experience the biggest changes in their business models to achieve a low-carbon transition) and encourage companies to accelerate their decarbonisation efforts.

Net Zero Contribution Portfolios

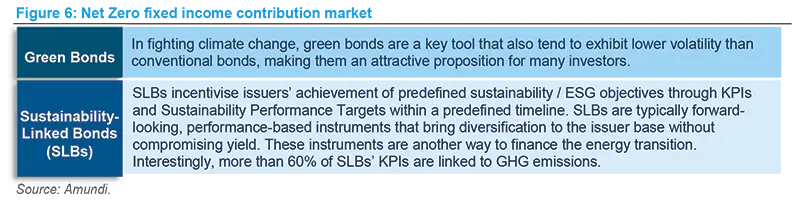

These portfolios are meant to invest in projects and corporates that develop technologies and solutions contributing to the energy transition. They usually improve the green share of an allocation by investing in climate-friendly businesses. We measure the green share as the sum of revenues aligned with the European Taxonomy and the allocation to green use-of-proceeds bonds. These bonds finance projects with environmental and climate benefits, such as wind farms, solar or hydropower infrastructure, smart grids, green buildings and clean transportation. Importantly, they provide a concrete way to track the impact of climate investments (e.g., the amounts of CO2 emissions avoided per million of euros invested). This bucket can also include green equity pockets (i.e., financing companies that develop climate technologies that will be key to achieving the energy transition and mitigating global warming), with exposure to areas such as clean energy, water and waste management and energy efficiency.

Net Zero investing goes beyond the concept of low-carbon portfolios. Indeed, besides the decarbonisation dimension, Net Zero investment portfolios must include a second dimension, the contribution pillar, or how to finance the transition to a green economy.

The financial impact of building a Net Zero portfolio

Understanding the impact of switching to a Net Zero asset allocation is key for responsible investors. To grasp the implications of such a change, we compared several implementations of Net Zero asset allocations against a standard (i.e., not climate-aligned) asset allocation composed of equity and corporate bond benchmarks. We analyse these asset allocations along dimensions such as their financial performance and risk (both ex-ante and ex-post where available), sectoral composition, and ESG and climate performance measured in terms of ESG ratings and carbon emissions.

Different types of asset allocations used in the study

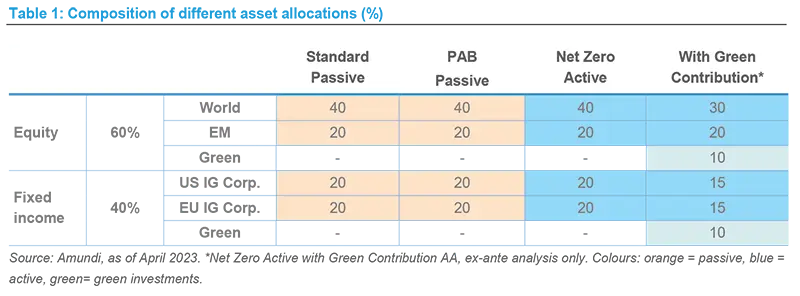

We introduced four different implementations of a similar asset allocation (AA) in this analysis.

- Standard Passive AA (60% in equities, 40% in fixed income): composed of standard (i.e., non-climate) equity and fixed income MSCI indices3.

- PAB Passive AA: composed of MSCI Paris-Aligned equity and fixed income indices4.

- Net Zero Active AA: composed of active Net Zero Transition equity and corporate bond strategies.

- Net Zero Active with Green Contribution AA: composed of active Net Zero Transition equity and corporate bond strategies, and Net Zero Contribution equity and bond strategies.

As historical data was not available for the active Net Zero solutions, only an ex-ante analysis has been performed on the Net Zero Active and Net Zero Active with Green Contribution AAs. In Table 1 below, we show the weights of different allocations studied in this analysis. The allocation proposed for the Net Zero Active with Green Contribution AA is 80%/20% on transition and contribution portfolios respectively, with additional allocations to green equities and green bonds.

In general, a 20% allocation to green assets can be considered high, given the total amount of these assets in the market today. Sustainability bonds represent around 5% of the global bond market5. However, as we expect their share to rise as the economy embarks on the transition, we decided to use a larger allocation for our analysis. Of course, an investor could decide to start with a lower allocation and increase it gradually as the market evolves.

Portfolio Performance

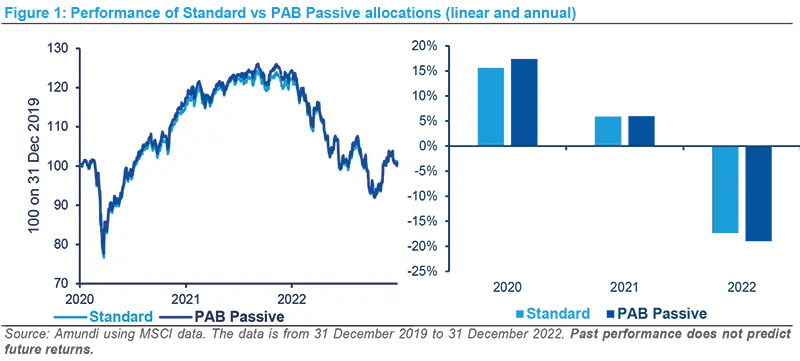

For the period, 01/01/2020 to 31/12/2022, the Standard and PAB Passive AAs displayed similar performance, with the PAB Passive AA slightly outperforming in 2020 and 2021 (see Figure 1 below). However, this outperformance was offset in 2022 due to the positive returns from the energy sector, in which the PAB AA is underweight.

Portfolio Risk

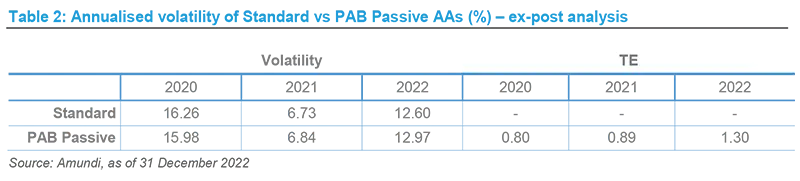

We measured portfolio risk in terms of volatility and TEs against the Standard AA (Table 2)6. The ex-post analysis showed that the Standard AA and the PAB Passive AA volatilities were close. As expected, the PAB Passive AA has a relatively small TE over the timeframe 01/01/2020 to 31/12/2022. The year 2022 exhibited a sharp increase in the TE, which can be largely explained by the decoupling of the energy sector’s performance from the overall market performance.

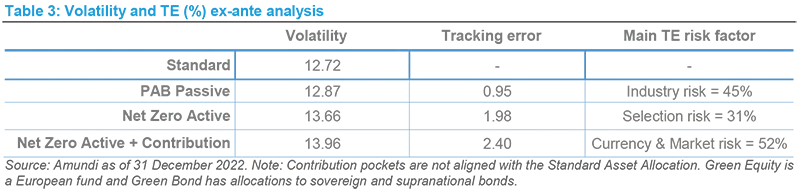

We complemented our ex-post analysis, based on historical figures, with an ex-ante analysis7 based on the asset allocation compositions as of 31 December 2022 in Table 3. In doing so, we observed that all the Net Zero AAs have volatilities similar to that of the Standard AA.

With respect to TEs, the PAB Passive AA has the smallest error with the industry factor8 being its main contributor. This reflects the sectoral deviation between the PAB and the standard benchmark. The Net Zero Active AA has a higher TE, which is expected when comparing an active and a passive strategy. Indeed, our analysis shows that the main contributor to the TE for the Net Zero Active AA is selection risk9.

Finally, the Net Zero Active with Green Contribution AA demonstrates the highest TE at 2.40%. However, this figure should not be misinterpreted. The green equity pocket is a European equity strategy, replacing a global equity pocket in the Standard AA. As for the green bond strategy, it contains some sovereign and supranational entity bonds whereas the Standard fixed income pocket is purely composed of corporate bonds. Thus, adding the green contribution pockets leads to a higher TE compared to the standard AA, with currency and market risks being its biggest contributors.

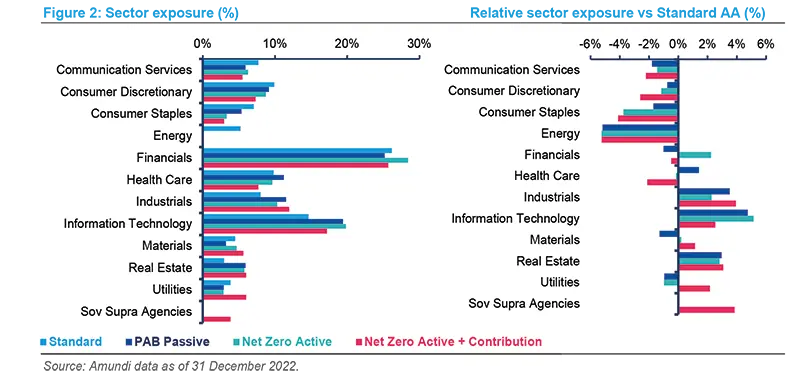

Sector exposure of different AAs

Unsurprisingly, Net Zero Asset Allocations show some degree of sectoral deviations compared to the Standard one (see Figure 2). The highest deviations are linked to the energy (-5.2% for all Net Zero AAs) and technology sectors (+4.8% for PAB Passive AA and +5.2% for Net Zero Active AA). Interestingly, adding the green contribution pockets to the AA affects the sectoral exposure, particularly with regard to the industrials, materials and utilities sectors. It increases their exposure, unsurprisingly, as these companies are critical for the transition of the economy towards Net Zero. We expect the transition to also have an important impact on the sectoral structure of the market portfolio. Thus, sectorial deviations of the Net Zero AAs studied here anticipate these structural changes, putting an investor in a better position to profit from these changes.

ESG and Climate

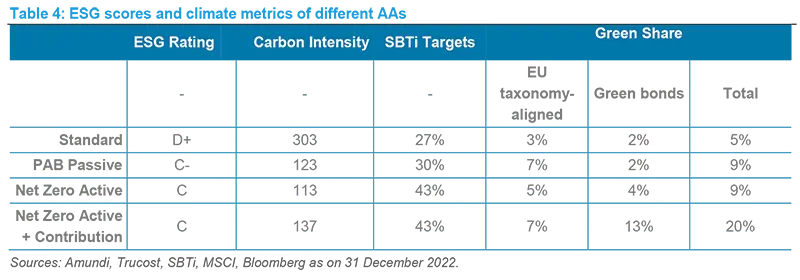

An investor implementing a Net Zero strategy expects to gain in terms of ESG and climate performance. All Net Zero asset allocations offer significant improvements in climate performance compared to the Standard AA across a complete set of ESG and climate metrics (Table 4).

Focusing on the ESG score, calculated using Amundi’s proprietary methodology, we see that the PAB Passive AA offers a slight overall improvement with a C- rating compared to the D+ rating of the Standard AA. The Net Zero Active AA performs better in this respect, with an average C rating, on par with the Net Zero Active with Green Contribution AA. Turning to carbon intensity, the PAB Passive and Net Zero Active AAs show a fall of 59% and 63% in total carbon intensity respectively compared to the Standard AA. Similarly, the Net Zero Active with Green Contribution AA offers a 55% reduction in total carbon intensity compared to the Standard AA. Its slightly higher carbon intensity is due to the fact that the contribution pocket invests in companies belonging to more carbon-intensive sectors in order to achieve a larger transition impact.

Furthermore, another important metric to look at is whether a company has set a time-bound target to reduce its carbon emissions. This can be done through the Science Based Target Initiative (SBTi), which provides guidance to companies in setting carbon-reduction objectives and assesses the validity of their targets. Companies that have set objectives validated by SBTi should be favoured in Net Zero transition portfolios, as they can contribute to the decarbonisation over time. Around 27% of companies in the Standard AA have a certified SBTi target, but this number increases to 30% in the PAB Passive AA and up to 43% in the Net Zero Active and Net Zero Active with Green Contribution AAs.

The last metric analysed in this study was the “green share” of the different asset allocations. We measured it as the sum of EU Taxonomy-aligned revenues and use-of-proceeds green bonds. This definition should be considered as being restrictive because the EU Taxonomy-aligned revenues methodology is very selective. At 9%, the PAB Passive and Net Zero Active AAs showed a higher green share compared with the Standard AA. Importantly, this metric is useful to understand and illustrate the added value of the contribution pocket. The green share of the Net Zero Active with Green Contribution AA was 20%, four times more than the one included in the Standard AA and more than twice those of other Net Zero AAs. As expected, the allocation to contribution portfolios increases the financing of technologies and projects crucial for achieving global climate goals.

| Science Based Targets initiative (SBTi) |

|---|

| Born out of a partnership between the CDP, the UN Global Compact, the World Resources Institute and the World Wildlife Fund, the SBTi provides technical assistance and resources to help companies set their climate objectives. It provides an independent assessment of decarbonisation targets and thereby promotes best practices in emissions reduction in line with the most recent climate science. Through its work, the SBTi mobilises the private sector – companies and financial institutions alike – to take the lead on climate action. By December 2022, more than 2,000 organisations around the world had set emissions reduction targets through the initiative and 1,600 more had committed to develop and submit targets within 24 months. |

In summary, the above analysis has determined three main messages for investors:

- Integrating Net Zero targets into investors’ asset allocation has an impact in the short term on key portfolio metrics. This impact materialises mainly through higher TEs, especially for the Net Zero Active AAs with a contribution pocket. This is expected given the fact that the economy is not yet aligned with global decarbonisation goals. It would be interesting to do a similar analysis with a developed market versus an emerging market bias. Indeed, with countries in Europe being more advanced in the energy transition process, we expect the TEs to be lower in developed market Net Zero strategies than those in the emerging markets.

- With respect to financial performance, we notice the similar performance of the Standard and PAB Passive AAs, with the latter slightly outperforming in 2020 and 2021.

- In terms of ESG and climate performance, we observe a significant improvement in ESG and climate metrics in the Net Zero AAs compared to the standard one. This is particularly the case for the Net Zero Active AA which shows an important reduction in carbon intensity and a good proportion of corporates having set science-based targets. The Net Zero Active with Green Contribution AA performs very well when it comes to its share of EU Taxonomy-aligned revenues and green bonds.

The short term financial cost of integrating Net Zero considerations into investors’ asset allocation is limited and should be offset in the long run as corporates gradually transition towards low-carbon models.

Integrating Net Zero targets in equity investing

A stock-driven Net Zero approach

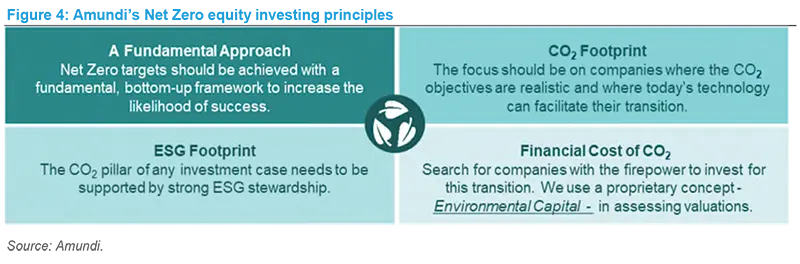

In our view, investors can seek to deliver attractive risk-adjusted returns and at the same time target a 10% reduction in carbon intensity per annum. To achieve this, the focus should be on selecting those companies with realistic CO2 targets as well as robust social (S) and governance (G) frameworks.

Being active investors, we believe that carbon objectives cannot be met by simply relying on quantitative CO2 data. Rather, it is essential to use a forward-looking approach based on companies’ quantitative data combined with a qualitative analysis of their businesses. This approach to stock selection helps to understand the cost of a company’s carbon transition, its ability to transition, as well as whether we believe its valuation may offer attractive upside potential over the medium term.

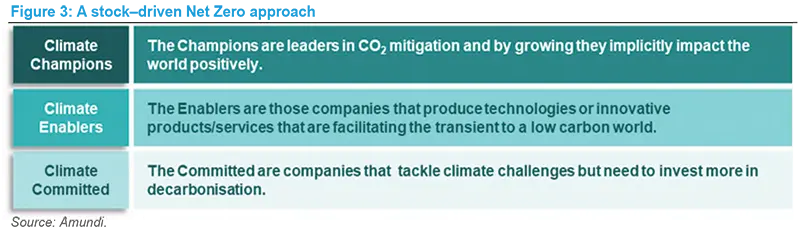

We see three main types of large-cap companies that Net Zero investors should consider: “Climate Champions”, “Climate Committed” and “Climate Enablers” (see Figure 3). These are companies that can contribute the most towards the rise in businesses’ decarbonisation, energy efficiency and digitalisation (i.e., in industrials, technology and materials sectors).

A broadly equal distribution across the three company types can help to build a Net Zero equity allocation with no structural style biases and a high level of diversification across all major market sectors within the Net Zero universe. This is important to avoid having an excessive growth bias that could be harmful in certain market environments. For example, 2022 was not a year for green investors focused on near-term performance. Headwinds, such as the Ukraine war, surging energy costs, supply chain-driven inflation and interest rate hikes triggered a style rotation away from growth stocks. A takeaway from this is the importance of a diversified, inclusive approach that goes beyond just selecting the best-in-class champions.

Main principles for building Net Zero equity portfolios

In searching for companies that are likely to achieve their Net Zero goals, we think investors should focus on four principles:

Engagement with management to discuss strategy, capital allocation and markets is also paramount. In particular, ESG engagement on environmental issues is crucial in fully understanding a company’s ability and commitment to tackling climate change challenges. In addition, while many companies might have good intentions from an environmental perspective, they can lack a well-established overall ESG framework, which is also critical.

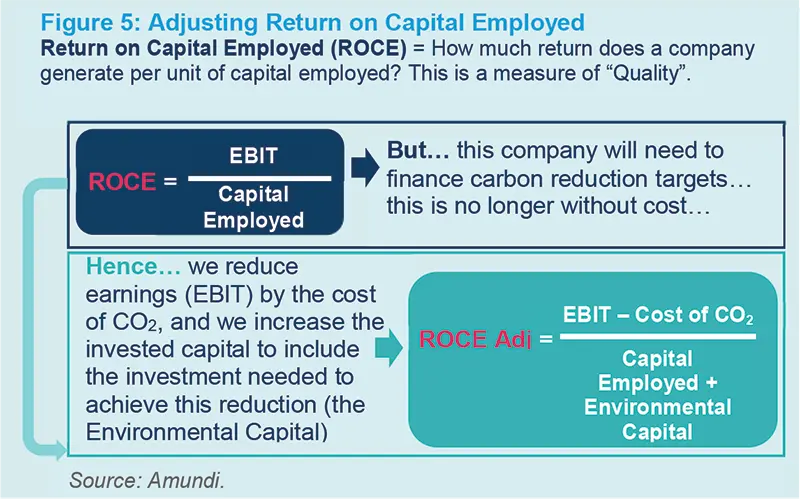

Finally, this energy transition does not come for free. We like to invest in those companies who have the financial firepower to make the investment needed to transition towards their Net Zero ambitions. Historically, investors assessed quality by looking at Returns on Capital Employed (ROCE), i.e., how much return a business generates per unit of investment. However, we now recognise that carbon emissions have a real cost and should be factored into our ROCE framework. This concept is called “Environmental Capital”. In more technical terms, ROCE is calculated by dividing a company’s earnings by its invested capital. When we factor in the “Environmental Capital”, we reduce the company’s earnings by the estimated carbon cost during a year. Conversely, we increase the company’s invested capital by its “Environmental Capital”, i.e., the present value of the future investments needed to reach the Net Zero goals. In summary, we reduce earnings and increase investment, making it harder for companies to look attractive. Clearly, the hurdle is higher for carbon-intensive businesses, making this approach an effective means of levelling the playing field within our analysis.

We believe that companies will need to contribute financially, as their operating environments approach their limits. Hence, we developed the concept of “Environmental Capital” which adjusts a company’s returns to account for its transition to a low-carbon world.

Main themes for Net Zero equity investors

We anticipate that the pace of the energy transition will accelerate and investment opportunities are likely to materialise earlier than expected. These will be supported by the wave of fiscal incentives that are coming down the track, many of which will boost the competitiveness of Net Zero industries10. We are particularly interested in themes which we believe have strong tailwinds such as reducing food waste, sustainable farming and decarbonising the real estate sector.

Case Study: A climate enabler – an information technology services and consulting company

Company overview: The company is a global leader in IT services, partnering with companies to transform their businesses through technology. It helps them move from local, inefficient and energy-intensive IT systems to more efficient cloud-based systems. Having a large exposure to the utilities and energy sectors, this business plays a crucial role in decarbonisation.

Climate policy: The company’s climate policy includes a commitment to: reduce GHG emissions by 80% by 2030 from a 2015 base year; and increase annual sourcing of renewable electricity from 25% in 2015 to 100% by 2025. Its policy also targets a reduction in scope 3 GHG emissions from business travel and employee commuting.

Expectations going forward: Our fundamental analysis highlights that the company is best placed to capture structural growth in key IT spending categories, such as the digital industry. The business is gaining market share from tier-2 players which lack the product breadth to compete on large tenders. In terms of financial strength, free cash flow has consistently beaten expectations and we expect this to continue driven by efficiency measures. Importantly, our valuation analysis, which includes our adjustment for environmental capital, supports our positive view of the company. Finally, from our engagement with management, we believe they are active in addressing any item that may reflect negatively upon the company’s ESG rating.

Integrating Net Zero targets in fixed income investing

A bottom-up driven fixed income Net Zero approach

When building a Net Zero fixed income allocation, we believe investors should rely on a bottom-up process that integrates climate performance indicators to ensure that they are investing in corporates that fit the Net Zero criteria, while not compromising on performance potential.

The key climate indicators are based on:

- Historical carbon emissions: Carbon emissions correspond to companies' annual emissions and are expressed in tons of CO2 equivalent. We define the carbon intensity for each company by relating its emissions to its turnover.

- Forward-looking indicators of carbon reduction ambitions: We believe that carbon reduction targets that are validated by the SBTi display a company’s commitment to decarbonising its business activities. This is key in assessing strategies’ exposure to transition risks, as it measures the awareness and responsiveness of corporates to risks arising with the transition to a low-carbon economy. We also consider temperature metrics which aim to measure the alignment of a corporate’s carbon emissions trajectory with overall climate goals. They are derived from the cumulated gap between the corporate trajectory and its reference sectorial trajectory.

The analysis of a corporate’s credit fundamentals should take into account the material impact of climate and ESG issues on a corporate’s credit metrics and hence its ability to service its debt. It is also important to incorporate standalone ESG analysis, specifically in assessing the corporate’s ESG policy and its capability to implement it in the context of the transition towards a low-carbon world. The issuer’s social responsibility vis-à-vis their employees and society are also important elements to consider. In our view, the energy transition should be inclusive and take into account social factors in order to be achievable. Based on this, we think investors should adopt a long-term value approach, focusing on the divergence between fundamentals and market valuations.

Sector-wise, some of the High Climate Impact Sectors (HCISs), namely those with significant exposure to fossil fuels (e.g., coal, oil, gas), can be difficult to include within a Net Zero approach. However, investors’ engagement with these corporates (and others) can play an important role in accelerating their transition journeys. Investors can use their influence to encourage companies to set ambitious carbon reduction targets and support them in keeping up their decarbonisation efforts. Monitoring a company’s actual decarbonisation versus its initial commitments is also key to ensuring a well-informed dialogue.

We strongly believe that if we are to reach Net Zero emissions by 2050, investors should continue to finance corporates operating in high-emitting activities, which are actively ‘walking-the–talk’ on their transition journeys. We have therefore adopted the Paris-Aligned benchmark approach, which sets a minimum exposure to HCISs (e.g., the utilities, construction and materials sectors) of at least 75% of the market benchmark value.

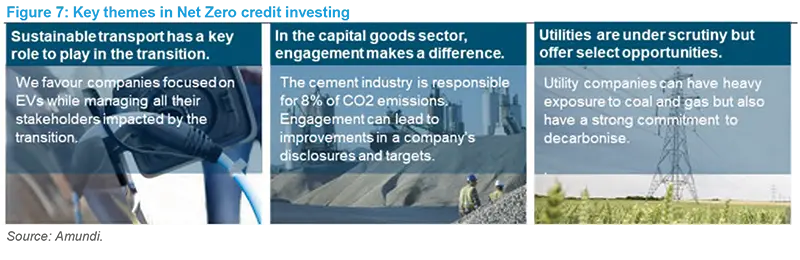

Net Zero credit investing: main areas of focus

Integrating the Net Zero approach into credit investing is an opportunity to invest in issuers that fit Net Zero criteria, while not compromising diversification, quality and performance. From our experience, we believe there is no detrimental cost associated specifically with a Net Zero approach, as the filtered investment universe for the Net Zero framework remains broad enough to actively manage strategies, engage with corporates and generate alpha. In addition, this filtered investment universe is expected to continue to grow as corporates increasingly commit to Net Zero. As such, we have also seen the Net Zero contribution markets expand year-on-year through the market for labelled bonds.

We are convinced that bond investors can play a crucial role in supporting companies as they embrace the transition towards a climate-friendly economy. This support can be to help them engage in Net Zero investing.

ESG themes offer attractive investment opportunities

We have identified attractive opportunities even among the carbon-intensive areas of the economy, such as the transportation, capital goods and utilities sectors.

Let us keep in mind that companies’ footprints are being increasingly scrutinised on social (“S”) concerns, particularly those surrounding social inequalities. Thus, we embed the ‘Just Transition’ within our strategies. This seeks to minimise the negative impacts of the shift to a low-carbon economy. We believe that companies that have embedded social factors in their transition plans are more likely to succeed in their decarbonisation journey.

For example, sustainable transport is a good example of this; it has a key part to play in reaching the Paris Agreement’s objectives. As a result, we favour some companies in the automobile sector focused on electric vehicles (EVs). The shift towards EVs needs significant investment and will impact the competition hierarchy in this sector. Thus, it is important to identify companies moving in the right direction to achieve carbon neutrality.

The move towards electric vehicles will have a huge social impact, with the decline in the number of employees forecast to reach 30% by 2030. This is the reason why a ‘Just Transition’ is at the heart of our investment selection process. Specifically, we evaluate how companies manage all of their stakeholders impacted by the transition: workers, clients, societies and regions.

Case Study: An attractive investment in the utilities sector

Company overview: While this European utility currently has sizeable exposure to coal and gas, it has demonstrated a strong commitment to decarbonise its business activities and has therefore been included in our Net Zero strategies.

Climate policy: The business has established a clear and credible 1.5°C pathway which has been validated by the SBTi. Capital expenditure commitments have been introduced, aimed at increasing renewables in its capacity mix, with a target of 80% renewable generation by 2030 and 100% by 2040. Also, strong internal incentives are also deployed throughout the company. For example, 10% of the performance targets related to climate change mitigation are part of the long-term remuneration of the executive management team.

Expectations going forward: The management is planning to phase out thermal coal by 2027 and gas-fired generation by 2040. Overall, we believe the company’s climate-friendly commitments are achievable, an important factor in supporting our investment case.

Integrating Net Zero targets in multi-asset investing

Multi-Asset Net Zero investing along the capital structure

The objective of a multi-asset Net Zero investment approach is to progressively reduce the carbon intensity of a portfolio to reach Net Zero by 2050, while financing transition efforts.

In our view, a multi-asset approach can help to optimise the available opportunity set across several dimensions:

- First, as climate change creates financing needs across all economic activities at a global scale, multi-asset investors can explore all asset classes, geographic areas and sectors with a dynamic asset allocation approach. For example, investors can look beyond traditional stocks and bonds and access additional levers to finance the transition, such as green bonds which finance specific projects that avoid carbon emissions. Or investors can actively look for opportunities in sectors that best fit the economic outlook.

- Second, the road to Net Zero has complex implications at different levels, spanning from the global macroeconomic backdrop to companies' fundamentals and valuations. Therefore, each asset class and company exposure are analysed in terms of their risk / return and carbon trade-off. This means investors should embrace an active stance on issuers across the capital structure (equity, standard bonds and green bonds) in order to achieve their risk / return and carbon intensity objectives while at the same time benefitting from the opportunities available (for example favouring equities versus bonds depending on the economic cycle or the valuation framework).

This allows investors to have a clear climate focus while achieving a high degree of diversification. In fact, if a cross-asset allocation is built by the blending together of a Net Zero focus at each single asset class level, the result could lead to a high concentration on specific names and / or sectors, and an inefficient use of carbon budget to finance the climate transition. However, an active Net Zero multi-asset approach can target a higher level of diversification but, at the same time, avoid too much concentration on a single name and more efficiently use its carbon budget to finance the transition across equities and credit. In doing so, this approach can make the most of investment opportunities consistent with a Net Zero 2050 pathway.

A multi-asset approach is particularly suited to Net Zero investing.

By accessing different asset classes across the capital structure, investors can contribute towards the financing of the green transition and achieve attractive risk-adjusted returns in the process.

Main principles for building multi-asset Net Zero portfolios

Designing Net Zero portfolios is not just a question of decarbonisation. We are convinced that such strategies should also contribute to financing the transition toward a green economy. Considering that financing the transition is usually carbon intensive, investors typically face a trade-off that can be difficult to address. Therefore, we believe Net Zero investors should build their allocation by embracing a core-satellite approach, combining:

- Core “Low-Carbon” investments (around 70%-80% of the allocation). The core part should be dominated by large-cap names with credible decarbonisation plans and a relatively low-carbon intensity compared to their sectors. It should include mainstream names in the technology, financials and telecoms sectors, for instance. This core allocation seeks to generate a surplus in terms of carbon budget which can be redeployed to invest in targeted climate solutions.

- Satellite “Climate Solutions” (around 20%-30% of the allocation). The satellite, or ‘solutions’ part, may include equities and green bonds in businesses focusing on themes such as responsible production, efficient consumption and the circular economy. We also explore supranational entities and governments that issue green bonds to finance climate-friendly projects.

In targeting Net Zero, it is also important to apply an Exclusion Policy to the investment universe. This policy ensures that investors can avoid: companies that are not aligned with the Paris Agreement on Climate (notably oil companies); businesses involved in environmentally-controversial activities; and companies with the lowest ESG ratings and poor climate credentials (lowest environmental scores and / or have a severe impact on biodiversity). The resulting Net Zero allocation tends to have a higher score across the Environmental, Social and Governance categories than the corresponding ESG universe and a lower CO2 intensity.

ESG themes offering attractive investment opportunities

Case Study: A Nordic renewable energy / wind provider

Company overview: Established in 2018, this company develops, constructs and operates offshore and onshore wind and solar farms, bioenergy plants and energy storage facilities. Over the last ten years, the business has transformed from being one of the most fossil fuel-intensive utility in Europe to one of the world's largest producers of offshore wind energy.

Climate policy: 89% of the company’s energy generation is green and 99% of EBITDA is taxonomy aligned. The company’s scope 1, 2 and 3 GHG intensity has fallen materially over the last decade. The management has put a supply chain decarbonisation programme in place and this is being cautiously monitored by the team.

Expectations going forward: We expect the company to continue to carry on building its leading position in the fast-growing renewable sector. Its focus is to grow its installed renewable capacity to 50 GW by 2030, which means more than doubling its current capacity. The business is well on track to fully exit coal in 2023.

Sources:

1 Amundi Institute, “A rocky-net-zero-pathway”, March 2023.

2 Barahhou, I., Ben Slimane, M., Oulid Azouz N., and Roncalli, T. (2022) “Net Zero Investment Portfolios - Part 1. The Comprehensive Integrated Approach”.

3 The Standard active AA composed of these indices: the MSCI World Index (USD), the MSCI Emerging Markets Index (USD), the MSCI USD Investment Grade Corporate Bond Index and the MSCI EUR Investment Grade Corporate Bond Index.

4 EU Paris-aligned benchmarks (PABs) are indices whose total emission levels are aligned with the Paris Agreement which seeks to limit the rise in global temperatures to well below 2°C above pre-industrial levels, and to pursue efforts to keep the rise to 1.5°C. PAB Passive AA composed of these indices: the MSCI World Climate Paris-Aligned Index (USD), the MSCI Emerging Markets Climate Paris-Aligned Index (USD), the MSCI USD IG Climate Paris-Aligned Corporate Bond Index and the MSCI EUR IG Climate Paris-Aligned Corporate Bond Index.

5 Bank of International Settlements Quarterly Review (September 2022), “Sovereigns and sustainable bonds: challenges and new options”.

6 Volatility is the annualised standard deviation of the daily returns and the tracking error is the annualised standard deviation of the daily returns differences between the Net Zero and standard strategies.

7 The Barra Optimiser was used.

8 Industry risk is the risk attributed to industry factors.

9 Selection risk is specific to an asset and is uncorrelated with the risks of other assets.

10 One example is the recent introduction of the EU’s Green Deal Industrial Plan designed to boost the competitiveness of Net Zero industries.

With the contribution of

Andrew ARBUTHNOTT,

Tegwen LE BERTHE,

Joan ELBAZ,

Gilles DAUPHINE,

Laura FIOROT,

Piergaetano IACCARINO,

Mathieu JOUANNEAU,

Jean Gabriel MORINEAU,

Paula NIALL,

Thierry RONCALLI,

Francesco SANDRINI,

Sofia SANTARSIERO,

Alexis SCIAU

and Raphaël SOBOTKA