Summary

Key insights

Key highlights on long-term scenarios and 10-year return forecasts

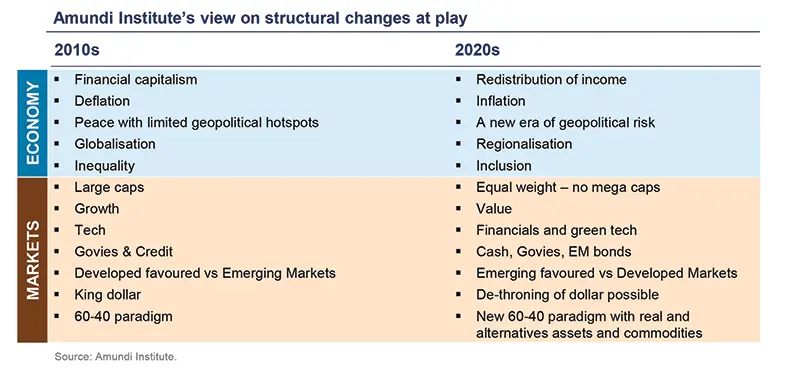

In 2022, the war in Ukraine impacted the energy supply outlook and also had implications for the net zero path. Security, affordability (in volume and prices) and sustainability of the energy supply were challenged, driving the need to diversify the energy supply mix. While this has somewhat accelerated the shift towards greener energy sources, it has also led to a more uncoordinated response, as each country moved to secure its own needs. These developments come on top of inflation remaining high, having originally stemmed from the Covid-induced supply bottlenecks, which are becoming less sticky. Taking a long-term view of these disruptive trends, and their implications on long-term asset class forecasts and strategic allocation, we are pleased to share with you the annual update of our capital market assumptions (CMA) publication. Here are ten key takeaways from this year’s edition:

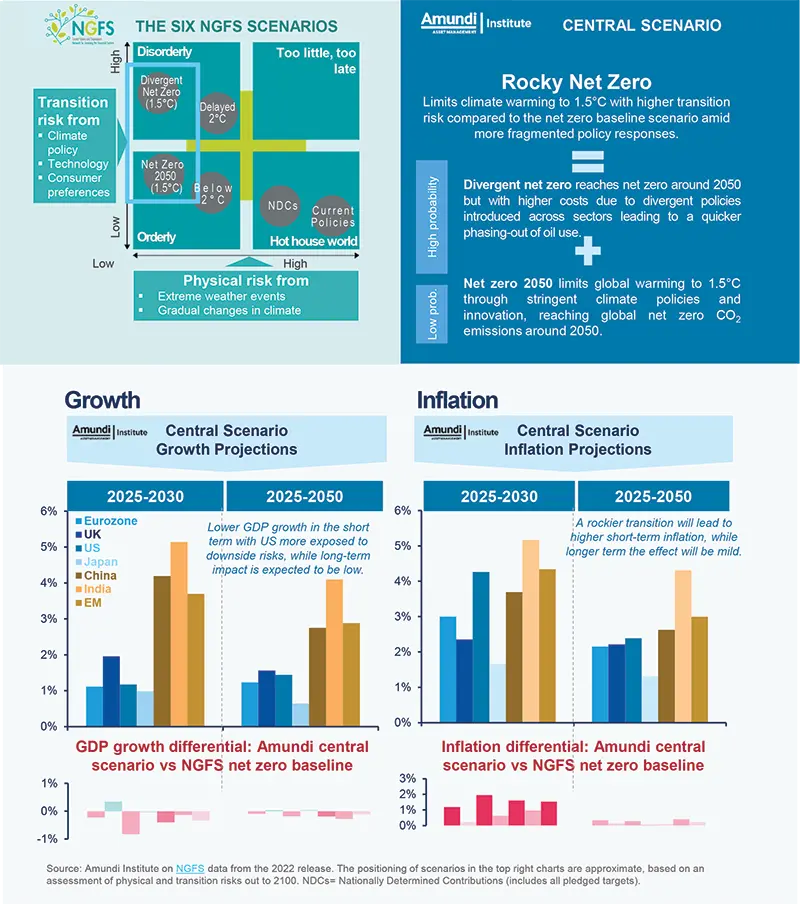

1| Moving towards a «Rocky net zero path» with diverging policies

While the spike in energy costs is adding a sense of urgency to the transition, greater focus on national strategic independence as a consequence of the war in Ukraine is increasing the likelihood of a move towards a disorderly scenario, which is predominant in characterising our baseline.

2| Short-term higher inflation and a more uncertain future path

The transition implies a weaker but more sustainable growth path ahead. In the short term, high inflation episodes will occur, driven by rising carbon prices (although the implementation of carbon pricing remains an issue) and higher commodity prices, structurally supported by the transition’s demand for investment.

3| Central banks to fight inflation while seeking to aid the transition

Central banks will have to carefully handle their balance sheets in the future to help finance green investments, while short-term interest rate management will continue to be policymakers’ key tool for combating inflationary swings. Hence, central banks could stay dovish on balance sheets but hawkish on short-term rates.

4| Limiting the induced social costs of the transition will be key

Corporations could manage a rebalancing of profits towards labour. A potential rebalancing in the labour-profit share of income (with a 7% increase in the former’s favour), could result in a cumulated 10% decrease in profits over the next 20 years (with regional differences) and reverse a trend that started in the 2000s.

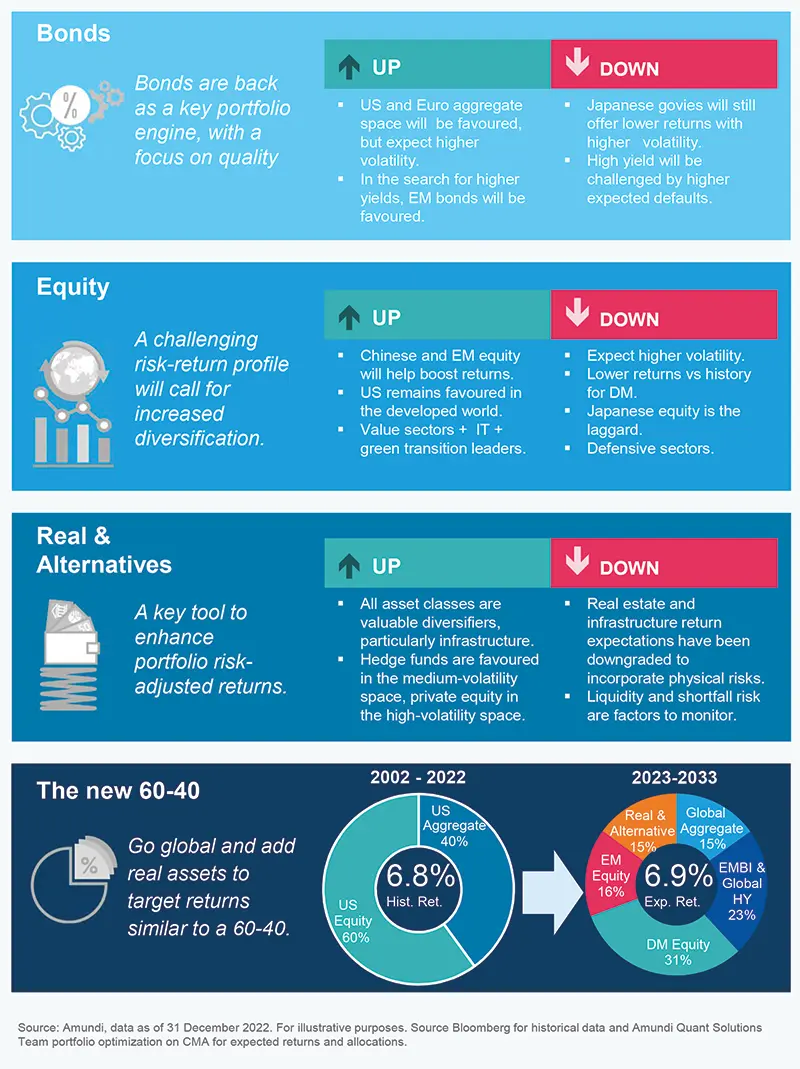

5| Bonds are heading back to the future, after a ‘lost decade’

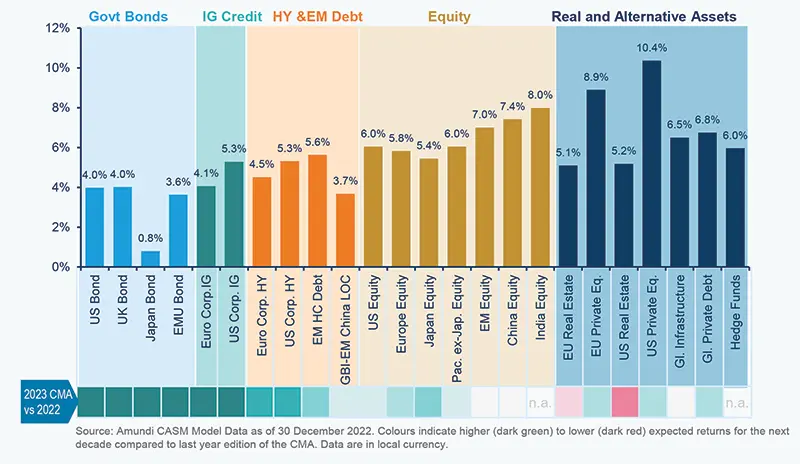

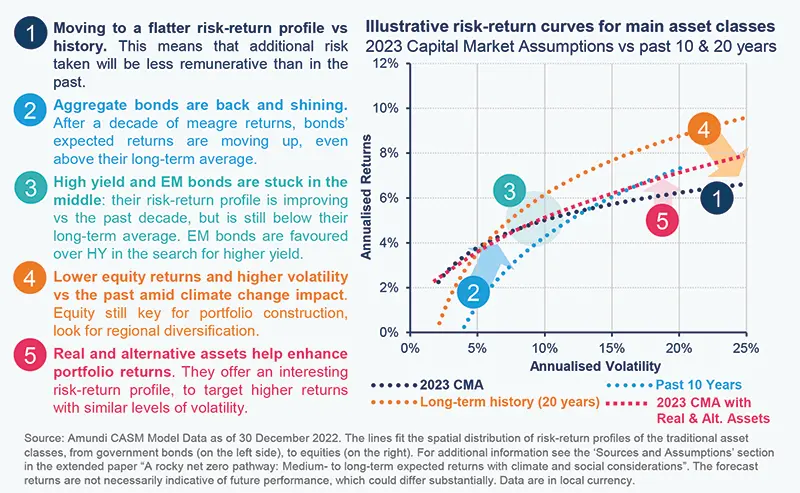

Bonds’ return profile is starting to move back to its long-term trend, but we expect uncertainty – deriving from the transition and a weaker macro scenario – to cause higher volatility over the next decade. Investment grade credit will also benefit from higher government bond valuations, while the relative appeal of HY and EM bonds will be challenged by potentially higher default rates.

6| Equity returns will be lower compared to the past decade, but better than last year’s forecasts, with regional diversification in focus

Expectations are only marginally higher than in 2022, despite the widespread reset in valuations, as the many challenges implied by the macro-financial backdrop are weighing on the earnings path. China and Emerging Markets are expected to top the equity returns ranking, but their returns’ improvement is relatively mild in risk-adjusted terms.

7| Value investing and energy transition themes will remain in the spotlight over the coming decade

Looking at sectors’ expected returns, the outlook for Value investing is positive, and Financials are expected to top the 10-year returns scoreboard. Leaders in the green transition will also be favoured. On the other hand, defensive sectors are losing attractiveness.

8| Real and alternative assets and commodities will be important tools for building inflation-resilient portfolios

Real and alternative assets, in particular, offer a complementary risk-return profile to traditional asset classes, but they bring higher liquidity risk compared to public markets. Private equity is at the top of the expected returns ranking while, on a risk-adjusted basis, global private debt is favoured. Hedge funds also offer an appealing risk-return profile, similar to that of the credit space, but with more appealing returns.

9| The coming decade will call for enhanced diversification

Moderate risk portfolios (6% volatility target) could achieve around 5% annual returns in EUR (6.6% in USD), with a 70% bond / 30% equity type allocation. USD investors will be more tilted towards aggregate bonds, while EUR investors will have to count more on equity as well as real and alternative assets.

10| To target higher returns, investors will have to count on EM equity, as well as real and alternative assets

Dynamic risk profiles (12% volatility target) will continue to count on equity in a 60-40 style of allocation. One-third of the equity allocation will be tilted towards EM equity, while adding real and alternative assets can help reduce the equity tilt and achieve higher returns with the same level of risk. Trends in the FX world could also offer opportunities to seek additional sources of return, in a more challenging investment backdrop.

Infographic

A rocky net zero transition path: macroeconomic implications

Asset class & portfolio views for the next decade

2023 Capital Market Assumptions (CMA) have improved vs last year’s forecasts, particularly for bonds

Five main changes vs historical risk-return patterns

Compass

For a short overview, click on the article below: