Summary

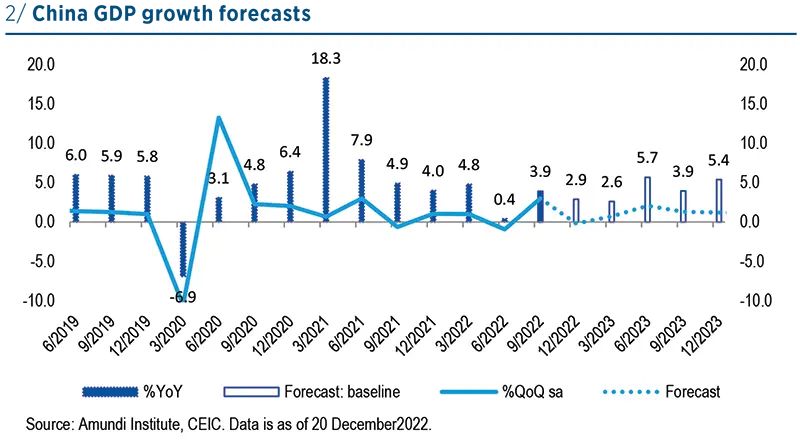

2022 ended in an abrupt fast-track reopening. In one month, China dropped most of its Covid-related restrictions, vowed to support the housing market more, and set pro-growth policies. We expect the Chinese economy to be separated from the global slowdown in 2023, accelerating from a low base.

Fast-track reopening

The refined zero-Covid policy (with 20 measures) introduced on 12 November was initially envisioned by the leadership as an effective tool to balance growth and the Covid outbreak. However, with the highly infectious Omicron variants, the virus quickly spread and cases continued to rise across the country despite these measures. Meanwhile, localities were confused on how to implement new policies. Most of them opted to tighten the restrictions, in order to flatten the infection curve. Economic activity stayed depressed, and social unrest increased amid poorly-executed Covid policies. After the refined zero-Covid policy proved to be ineffective in containing the outbreak, China chose to embark on a fast-track reopening instead of reverting to hard-core lockdowns. Since late November, the country has removed testing requirements for most travel, allowed home quarantines for positive cases, and introduced the second booster for the senior population.

The faster and earlier reopening caught the Chinese public as well as the market by surprise, given that the medical system is far from being prepared. In this regard, the initial stage of reopening will be chaotic, accompanied by a surge in hospitalisations and depressed mobility. Medicine shortages are already in place. However, going forward, we do not expect Chinese government to backtrack. China has passed the point of no return. Its priority now is to reserve its scarce medical resources for those most in need, and to accelerate booster injections for the elderly. Soon governments will have to let go of most restrictions. Officials announced to drop quarantine rules for overseas visitors on 8 January, right before the Chinese New Year holidays (22 January), much earlier than we expected month ago.

A full reopening now looks likely by end-Q1. There will be a sequencing of peak infections in different regions. For instance, Beijing is on a first-in, first-out basis. Nevertheless, most cities in China will see the peak of the first wave by mid-January and the end of first wave by March. We expect most restrictions to be removed after the Chinese New Year holidays (in late January). Returning to work is expected to start in February, and full production is likely in March.

A full reopening now looks likely by end-Q1.

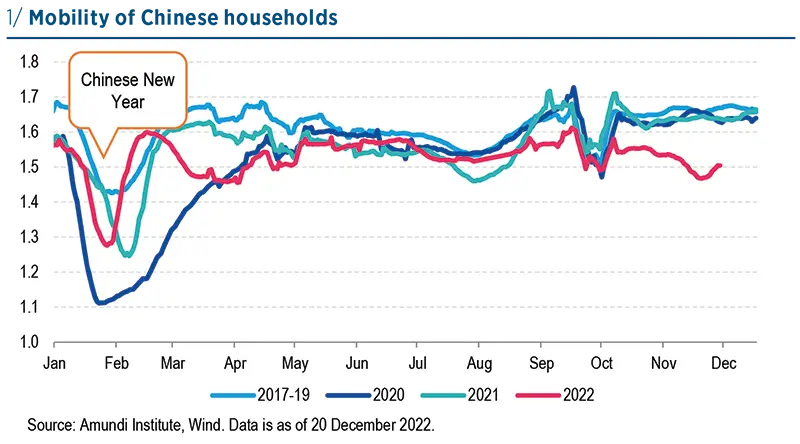

Winter recession, followed by strong rebound in spring

The reality is bleak at the moment. Economic growth plunged again in November, due to the additional tightening that local governments put in place right after the Party Congress. Consumption and the services sector bore the most pain. Mobility data (Chart 1) started to recover in late November, but the improvement has slowed and is likely to pause into the surge of infections. Lessons from other Asian economies suggest the whole reopening process takes two to three months before activities recover meaningfully. Also considering the quiet activity around Chinese New Year holiday period, we expect weak growth throughout February 2023. Meaningful recovery will follow in March and in Q2 2023.

Pro-growth policies for 2023

On top of reopening news, the Central Economic Work Conference (CEWC) held on 15-16 December reflects a broader policy pivot towards supporting growth. It is worth noting that leaders said it is fundamental to revive expectations and confidence. More specifically, we note a sharp turn in policies for platform companies, by recognising their role in creating jobs and supporting them to compete globally.

As for macro policy, the conference called for stepped-up spending from the fiscal pocket, while vowing to maintain an accommodative monetary policy, albeit in a more precise way by directing funding to small and micro enterprises, technology innovation, and green transition. Consumption is highlighted as a priority to expand domestic demand, including support for housing upgrading demand, electric vehicles, and elderly care services. This means a declining role of infrastructure investment, which is no longer required as a buffer to ease downward pressures on growth.

On the parallel track, the tightening of housing market is officially over. The policy stance helped stabilise the market and restore home sales, construction and land transactions from the sharp slowdown. By recognising that the housing crisis is systemic and that real estate’s role in the economy is crucial, officials plan to promote project deliveries, encourage M&A, meet developer financing demand, and resolve the risks hanging over high-quality names. With housing market returning to stability and economic reopening, we expect China’s growth to accelerate from a low base in 2022. The recovery trajectory will be choppy, hinging on how policymakers manage the reopening. Evidence on hand indicates a preference for brief and sharp short-term pains and a smoother path in most of 2023.

A broader policy pivot towards supporting growth.