Summary

- The calendar is busy for rating agencies regarding Italian debt: S&P conducted a credit assessment on Italy on 20 October. It maintained the stable outlook for Italian debt (BBB). Impending judgements by DBRS, Fitch and especially Moody’s in the coming weeks will be monitored closely, and could drive some volatility for Italian government debt.

- In 2024, the growth outlook for Italy is expected to cool down, reflecting the impact of higher rates and a more challenging global environment, but a recession remains out of sight: In the context of weak global economic growth, the Italian economy is expected to slow in 2023 and 2024 due to higher interest rates and prices weighing on consumption. However, the economy is projected to stabilise to above its pre-crisis growth potential in the longer term thanks to a recovery in demand and progress in implementing Next Generation EU (NGEU) investments. Decelerating inflation and reasonably healthy employment growth should help cushion weaker consumption and growth in the near term.

- Debt dynamics are under scrutiny in 2024, but should be on a steady downward trajectory later on: Italy’s Debt/GDP downward trajectory will be impacted by the legacy of the Superbonus incentive scheme (tax credit incentive for homeowners) which is putting pressure on the deficit this year and on tax revenues for few years to come. The current level of yields is an additional headwind for debt consolidation, although we must consider that the feed-through to the average cost of debt is going to be slow and therefore the arithmetic is not as bad as it might seem. Our analysis shows that the downward trajectory for the debt/GDP ratio is in question in the short-term (for 2024 in particular) but should not jeopardise overall sustainability, assuming Italy will proceed with implementing some degree of fiscal discipline (not necessarily too aggressive). A debt/GDP downward trajectory is expected to resume as soon as the superbonus effect on lower tax revenues fades (i.e. 2027). Combining conservative growth and average interest rate assumptions, we see the debt/GDP ratio being on a steady downward trajectory provided the Italian government sticks to the plan of moving the primary balance surplus to its historical average, which is in line with the Government’s projections to 2026.

- Domestic demand for Italian public debt should remain healthy and foreign investors have also become net buyers: For the rest of the year, Italy’s financial situation should remain stable, supported by a fresh delivery of NGEU funds and a successful government bond placement in October. Domestic retail investors, with deposit volume being high by historical standards, have increased their holdings of sovereign debt and there is potential for them to engage further in the market. This could mitigate the effect of the ongoing ECB quantitative tightening and higher issuance amid a higher deficit. Moreover, foreign investors have been attracted by interesting yields, attractive valuations and high liquidity.

- Volatility on the BTP-BUND spread is expected to continue in the short term. Further spread widening could open up opportunities for investors.

S&P decision and upcoming rating agency reviews

On 20 October, S&P Global Ratings announced that it was keeping its rating of Italian debt unchanged with a stable outlook. The rating agency’s decision kicks-off a wave of autumn credit assessments and will be followed by DBRS Morningstar on 27 October, Fitch Ratings on 10 November and finally Moody’s on 17 November. Moody’s judgement will be the most sensitive in terms of risk. Its rating is already at the lowest rung of its investment grade ladder and, contrary to the others, it already changed its outlook for the country to negative following the collapse of the Draghi government in August 2022. The S&P judgement provides an indication of what other rating agencies might do. At this stage, we believe they are more likely to express a judgement on Italy’s outlook, rather than make a rating change.

Prospects for the Italian economy: lacklustre growth in 2024, but no recession

The growth outlook for Italy is expected to cool down, reflecting the impact of higher rates and a more challenging global environment, but a recession remains out of sight.

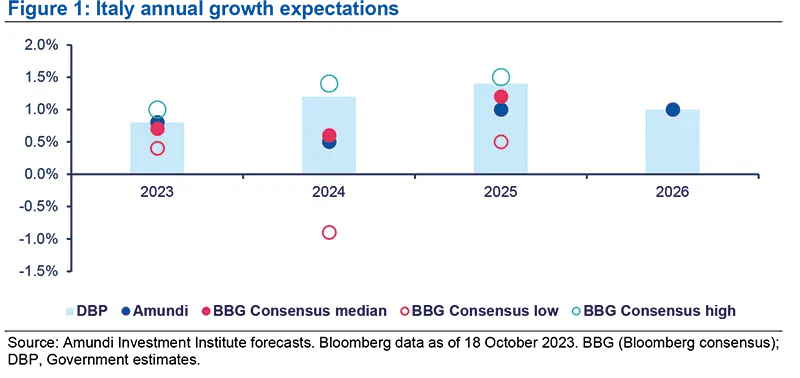

For 2023 we expect growth will align with government estimates, slowing to 0.8% from 3.8% in 2022. This deceleration is primarily due to a slowdown in personal consumption expenditure, as the drivers of domestic demand are constrained by higher interest rates and prices. Although price rises are decelerating, they continue to erode real income, as wage adjustments haven’t kept apace. Decelerating inflation and reasonably healthy employment growth should help cushion consumption, which we expect to slow but not contract altogether.

Our projections for 2024 are more conservative and in line with consensus expectations, but fall below government targets. We expect growth to remain around 0.5% (below the economy’s potential) due to the withdrawal of energy support measures and an overall more fiscally restrictive stance that will limit domestic demand. There is some potential for upside driven by the deployment of Next Generation EU (NGEU) funds, whose near-term impact could be higher than anticipated. Unemployment may rise from 8.1% to 8.4% next year, but it remains significantly lower than pre-crisis levels, and well below the 12.9% observed in the aftermath of the global financial crisis. Wage pressures should also remain moderate, staying in the range observed last year.

Compared to other European nations, inflationary pressures in Italy have been mitigated by the different timing of multi-year collective agreement negotiations and the use of a wage indexation benchmark that excludes energy. Therefore, we don’t expect further inflationary impacts from these wage policies, as the wage adjustment is still mostly catching-up. Overall, we anticipate a significant decrease in inflation overall; barring any oil or energy shocks, harmonised headline CPI should align closely to the ECB’s target in 2024.

Looking ahead to 2025-26, provided there are no unforeseen shocks, we see growth stabilising above pre-crisis potential levels, at around 1%, driven by monetary policy normalisation, a recovery in external demand and progress towards implementing NGEU investments. These developments should bolster both actual and potential growth, which we conservatively estimate at around 0.7%-0.8% from 2027 onwards.

Tax credit incentive for homeowners is weighing on debt dynamics, but fiscal commitment is maintained

The composition of the deficit illustrates the government’s understanding of the need for fiscal discipline, balancing lower revenues with prudent spending control.

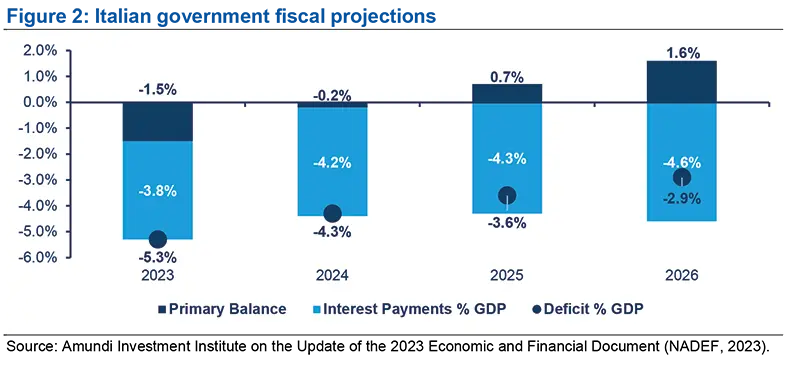

The Italian government’s new macroeconomic and public finance projections for 2023-26 reveal a worsening of deficit targets this year and next. The deficit target for 2023 has been raised to 5.3% of GDP from 4.5%, partly due to the ‘Superbonus’ tax credit incentive for homeowners, equivalent to around 1% of GDP. The 2024 deficit target was raised to 4.3% from 3.7% of GDP, of which around 0.5% is destined for new fiscal measures aimed at low-income households.

The budget deficit is not expected to return below the 3% Maastricht Treaty threshold before 2026, stoking concerns that an Excessive Deficit Procedure (EDP) will be activated to enforce fiscal discipline (in Italy, as well as other member states, including France), if a Stability and Growth Pact (SGP) reform and new EU fiscal rules aren’t agreed. Some reassurance can be found in listed government commitments and projections of a sustained and progressive path towards a primary balance surplus.

However, deficit dynamics are adversely affected by rising interest payments on existing debt, projected to reach 4.6% of GDP in 2026. This offsets the significant efforts to maintain a balanced approach on the primary deficit, which is expected to become close to balanced as early as next year (-0.2% of GDP) and should progressively move into positive territory in 2025 and 2026 (0.7% and 1.6% of GDP respectively), representing a considerable commitment to fiscal consolidation. While the composition of the deficit illustrates the government’s understanding of the need for fiscal discipline, balancing lower revenues with prudent spending control, deficit dynamics are more linked to higher rates than fiscal slippage.

Consequently, the debt-to-GDP ratio is expected to exhibit only a modest decrease from 140.2% in 2023 to 140.1% in 2024, 139.9% in 2025, and 139.6% in 2026. An important factor in this scenario is the impact of the Superbonus deferred tax credits, which will be used in the coming years (estimated at around EUR 24 billion per annum between 2024-2027, and EUR 2-8 billion in 2027, according to preliminary estimates). Without this impact, the debt/GDP trajectory would have shown a more sustained downward trend, declining by one percentage point (by 2024-2025.

There is still the risk of an upward move in the debt/GDP trajectory if growth dynamics move adversely versus the government’s forecasts. Our simulations indicate that a weaker outlook, similar to the divergence in real growth between the government’s and our projections for 2024, would bring the primary balance closer to -0.5%, the deficit closer to 4.8%, and would likely push debt up from the expected 140.2% in 2023 to 140.7%.

A stabilisation of rates and future ECB easing moves should lift some pressure from interest rate payments on Italian debt.

Current yield levels are exerting upward pressure on the average cost of debt. However, only around 10% of Italy’s substantial EUR 2.4tn debt is refinanced on an annual basis. As a result, the transmission of higher yields to the average cost of debt should be gradual, and may be mitigated by future ECB easing measures.

Domestic investors are absorbing the additional debt burden

We see untapped potential for retail investors to increase their presence in the market.

Italy’s financial situation remains supportive for the rest of this year, thanks in part to the recent receipt of the third tranche (EUR 18.5bn) of NGEU funds, and the successful placement of EUR 17bn in ‘BTP Valore’ government bonds in October. In 2024, the higher deficit, and tightening in the ECB’s Public Sector Purchase Programme (PSPP), should result in a net debt supply of EUR 110-120bn, similar to pre-quantitative easing levels. If the ECB decides to reduce its Pandemic Emergency Purchase Programme (PEPP) earlier than expected, markets would have to absorb the new debt, in the region of EUR 30bn per annum for Italy. Notably, the ECB increased its holding of Italian debt in the PEPP programme by nearly EUR 5bn yearto- date, indicating some flexibility in its PEPP reinvestment strategy.

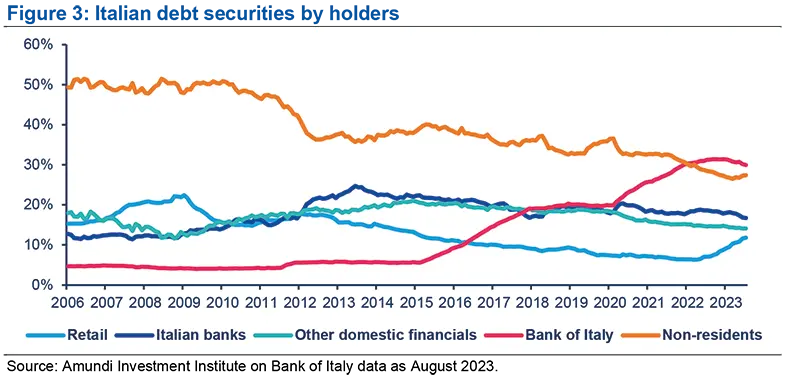

With valuations now at attractive levels, domestic retail investors have increased their holdings of Italian debt by approximately EUR 110bn, boosting their share among holders of tradable Italian debt to around 11%, nearly double the 6% (approx.) lows in the first half of 2022. Moreover, sovereign bonds now make up close to 5% of household portfolios. A detailed breakdown of holdings by financial instrument from the Bank of Italy (BoI) illustrates that, contrary to the past, Italian households have predominantly focused on a 2–5-year maturity range, investing in Italian government bonds (BTPs) rather than short-term bills (Bots) or floating-rate notes (CCTs). Changes in deposit flows indicate a shift from demand deposits to BTPs and, more recently, to term deposits (albeit to a lesser degree than BTPs). However, deposit volumes are still high by historical standards and are now close to long-term trends.

Even though there has already been a substantial increase, we see some potential for retail investors to increase their presence in the market.

After a period of prolonged outflows, foreign investors have also become net buyers of Italian public debt, with a positive inflow of EUR 35bn in the first seven months of this year. Additionally, they have increased their duration, with net sales of short-term maturity bonds amounting to EUR 17bn and purchases of longer-dated securities reaching EUR 52bn. The potential for further foreign demand hinges on Italy’s commitment to EU fiscal requirements and progress in implementing the National Recovery and Resilience Plan (NRRP). While we don’t expect next year’s budget deficit to lead to any serious confrontation with Brussels, the upcoming rating agency reviews will provide closer insights.

By contrast, Italian banks have slightly reduced their sovereign debt holdings this year, diversifying their portfolios by purchasing non-domestic bonds driven by more attractive valuations. The maturities of Targeted Long-Term Refinancing Operations (TLTRO) represent another limiting factor in the return of domestic banks to the market.

The ECBs influence on the market is gradually decreasing, but still constitutes 30% of the marketable debt, while Italian banks and other domestic financial institutions make up 31%. The weight of non-resident investors has declined to its lowest historical level. Netting non-residents’ holdings from assets managed abroad by Italian investors, the weight of foreign investors is close to 20%.

Outlook for rates and the 10-year BTP-BUND spread

The reduction in interest rate volatility is likely to encourage the return of carry trades, particularly in peripheral countries. Among these, Italy stands out for its mixture of attractive valuations and liquidity.

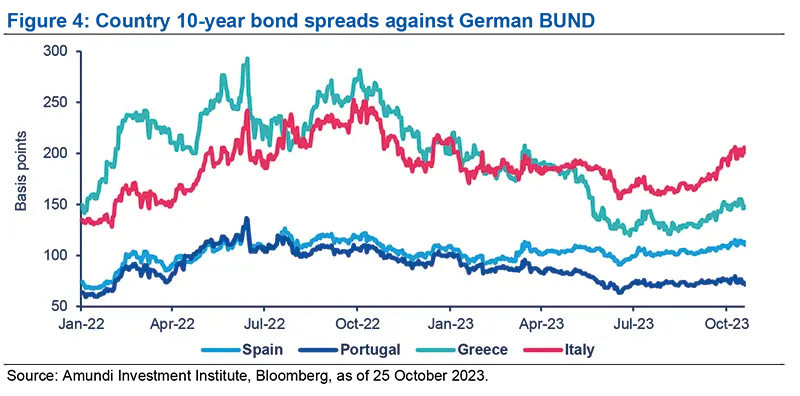

The recent repricing of the 10-year BTP-BUND spread, which touched 200 bp, was primarily driven by systematic factors, including a risk-averse sentiment and rising risk-free yields. To a lesser degree, it was also influenced by a challenging supply outlook in 2024, given the country’s higher deficit, and the ECB’s quantitative tightening in a weaker macroeconomic environment. Following the announcement of the Transmission Protection Instrument (TPI) and the fall of the Draghi government last year, the spread quickly reached 240 bp. Our view is that the spread could rise to these levels because of a less favourable supply/demand balance in 2024 and in case of a change in the outlook by rating agencies. We see this as an area of stabilisation as investors may be attracted by the appealing level of yields. In case of further market stress, the ECB safety net remains in place.

The medium-term outlook should be more supportive for peripheral spreads, as the central bank has likely reached the peak of its hiking cycle and should start cutting rates half-way through next year, on the back of a weaker macroeconomic picture and lower inflation from the ongoing transmission of monetary policy to the real economy. The reduction in interest rate volatility is likely to encourage the return of carry trades, particularly in peripheral countries. Among these, Italy stands out for its mixture of attractive valuations and liquidity.