Summary

Rotation and broadening in equities has started

Rally broadening, backed by the Fed put and improving earnings, could ignite a resurgence in previously neglected segments.

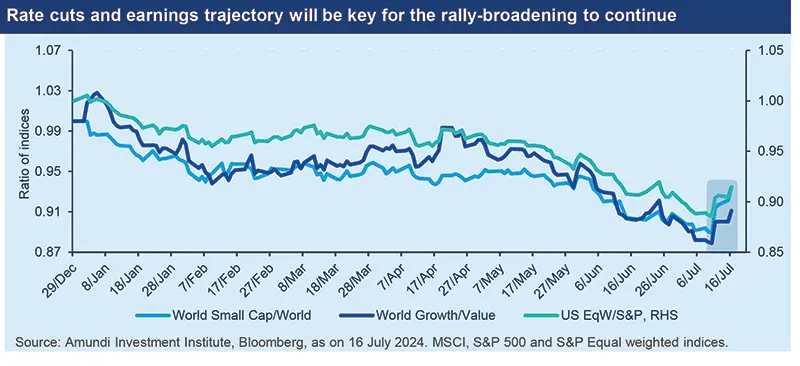

US mega caps significantly outperformed the rest of the US markets in the first half of the year, driven by better-than-expected economic activity, AI exuberance and superior earnings. Looking ahead, we see a potential for a rally-broadening, which will not be linear and is likely to have multiple legs. Some early signs of this rotation materialised recently after the July CPI report raised the chances of a Fed rate cut in September, while most recently fears on restrictions on the chip industry further supported this trend. This opens up opportunities into areas and segments (small caps, Europe, Japan) that have been left behind. Earnings trajectory is now key as well as themes such as:

- Mild deceleration expected in the US in the second half. Economic data and surveys point to this direction. The main feature of this deceleration would be a rebalancing in labour markets, weakening consumption and the dichotomy between affluent and low-income consumers.

- Little room for errors in monetary policy. Cutting rates too early risks inflation resurfacing later, while delaying cuts may require sharper reductions in the future. Hence, central banks including the Fed, the ECB and the BoE are being patient and are basing their decisions on incoming data, which according to us confirms the disinflation path.

- Fiscal profligacy and high levels of govt. debt will affect rates. Both Biden and Trump are likely to be fiscally expansionary. As we get closer to the US elections, the narrative on how deficit spending will affect borrowing costs in long term will likely get louder. To promote self-sufficiency and domestic economic growth, Europe may need to boost investments in the region.

We believe it’s essential to go back to basics, be aware of valuations and stay disciplined. Markets have been going too far in some areas, but when the trigger (lower growth, liquidity crisis, earnings disappointment) comes, the moves could be sharp and rapid. Hence, investors should differentiate between what is rich in valuations and what shows potential for sustainable growth. We outline our four main areas of investment conviction below:

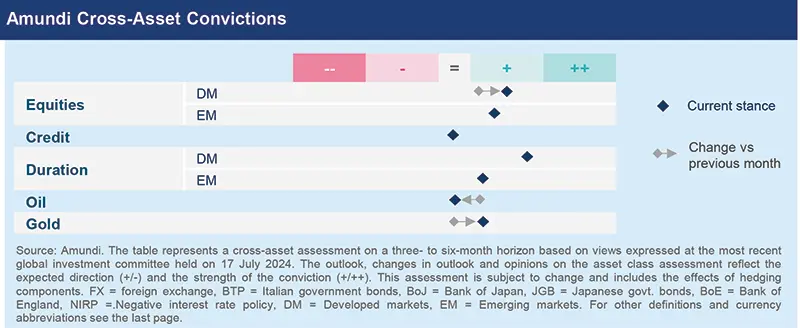

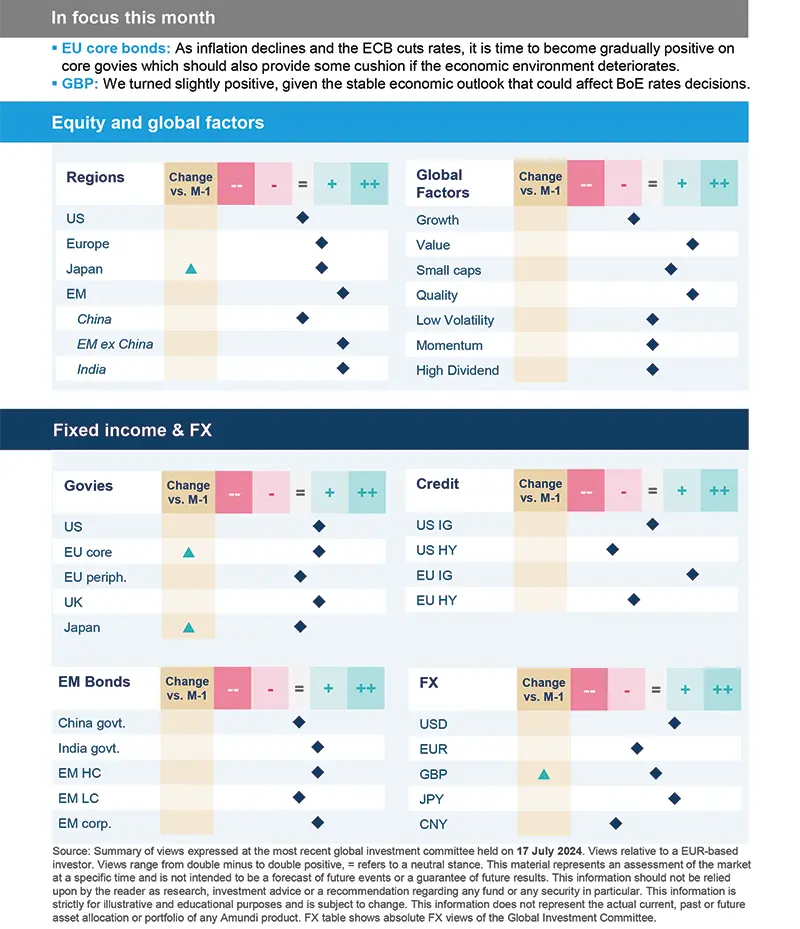

- Cross asset. Risks around US elections and additional fiscal spending could affect yields of medium/long maturity bonds. Hence, we remain positive on duration in fixed income in the US and Europe, but have adjusted our stance mildly. After new political leadership took charge in Mexico, we downgraded Mexican bonds but are still overall slightly positive on EM debt. Divergences are increasingly visible in equities, allowing us to turn constructive on Japan. We remain mildly positive on the US, European small caps and the UK, but have fine-tuned our views in favour of the improving domestic UK economy. Finally, geopolitical tensions and continued demand for gold allowed us to become constructive on the metal.

- Inflation readings in the US and Europe are supportive of rate cuts, allowing us to stay constructive on US Treasuries and UK gilts. In core Europe, we are slightly positive, but maintain an active stance. On Japan, we are vigilant on BoJ communication and are close to neutrality now. TIPS also offer long term value. Quality remains the story in credit and we continue to prefer Investment Grade over High Yield in the US and Europe. While we are slightly positive on EU IG we have trimmed this view to take into account tactical market movements.

- Segments of US equities are expensive, but valuations need a catalyst to play out. Hence, we remain cautious on such expensive segments, and instead prefer equal-weighted US markets, value and quality. In Europe, we retain our barbell approach favouring defensives, and quality cyclicals exposed to mega-trends such as energy transition, electrification etc.

- The Emerging Markets outlook is supported by sound domestic demand and the Fed pivot. But we are selective and assess individual risks, including those linked with geopolitics. In particular, we prefer hard currency and local debt and countries with attractive real yields, such as India and Brazil. In equities, we like South Korea, India, Brazil and South Africa.

Three hot questions

|

Monica DEFEND |

Macro data such as economic growth, labour markets and consumption are key variables that would affect central banks’ decisions to cut rates. Any volatility on these could impact the timing of policy decisions.

1| How would politics in the UK, France shape their economies?

The UK is likely to benefit from political stability after the strong mandate awarded to the Labour party. But it doesn’t have any significant room for fiscal stimulus and the new government seems to acknowledge that. We might see small stimulus measures amid strained public services and low productivity. In France, following the election results, yields on bonds have declined, but markets are now tracking how the hung parliament plays out. Our near term growth and inflation forecasts are unchanged. We think the country has limited scope for massive fiscal boosts to demand as it faces medium-term fiscal consolidation requirements under European Commission rules.

Investment Implications:

- UK: Positive on equities on cheap valuations, defensive play; positive on Gilts and on GBP/USD.

2| What’s the reason behind Fed, ECB policy divergences?

We expect the divergence between the Fed and the ECB to be temporary, reflecting marginal differences in the pace of growth and deflation and different economic backdrops. While the US economic growth would ‘decelerate’ to its potential levels in the near term, in Europe it is ‘converging up’ towards its potential growth. In addition, domestic demand in Europe is still below its pre-pandemic trend. Thus, the ECB has a bigger incentive to cut rates aggressively because policy rates are still overly restrictive. But eventually the Fed will cut because if inflation returns to its 2% target, then the Fed has no incentive to keep rates restrictive. Hence, any gains in the USD should be limited.

Investment Implications:

- Duration: constructive on US and EU core duration.

- EUR/USD target 1.12 for Q4 2024.

3| What are you views on China and the recent Third Plenum?

Domestic demand in China remains weak but exports are robust. And this could become tricky for China going ahead as US is its major export destination and a country with which China is in a geopolitical competition. Hence, China has a strong incentive to diversify its exports but doing this would not be easy. On the domestic front, the Communist Party recently concluded its third Plenum, which reiterated the focus on modernisation, sustainable and high quality development, and focus on high value manufacturing and technology. We think the government will not repeat previous mistakes of massive stimulus. Instead, it is fine with accepting short-term volatility, that could pave way for more stable long-term growth.

Investment Implications:

- Neutral on Chinese equities and government bonds..

MULTI-ASSET

Stay risk-on but well-diversified

|

Francesco SANDRINI |

John O'TOOLE |

We adjusted our stance in favour of EU duration in light of mild risks of excessive fiscal spending in the US if Republicans win the elections.

Softening economic activity in the US is reflected in the rebalancing labour markets and weakening consumption. This is happening at a time when the US fiscal deficit is increasingly in focus. In Europe, we expect growth returning towards potential during the year, although there could be some vulnerabilities. This mixed environment calls for a mildly positive stance on risk assets, but investors should diversify their risks. From a structural perspective, they should also consider sources of portfolio stability, such as gold, in times of deficits and geopolitical tensions.

We are positive on equities and moved up slightly on Developed Markets, following the marginal upgrade of Japan. Japan is witnessing improving corporate governance and potential buybacks that could support the markets. We are also constructive on the US, European small caps and the UK. But we recalibrated our UK views and diversified towards mid and small caps to take into account a better domestic economic environment, earnings growth potential and attractive valuations. In Emerging Markets, divergences keep us positive on select countries such as India and South Korea.

In bonds, we are constructive on duration overall, but have slightly reduced our views on the US in light of risks around fiscal policy and our diversification efforts. This allowed us to become more positive on core European bonds because we think the market is not fully pricing in the rate cuts by the ECB. We also continue to see value in Italian BTPs, but believe Japanese bonds could come under pressure from inflation and a less dovish stance of the BoJ.

EM bonds in general continue to present opportunities, but on Mexico now we see risks around extreme reforms and concentration of power after the landslide victory of Claudia Sheinbaum. We are monitoring the policies closely. In DM credit, fundamentals for EU IG companies remain healthy.

We maintain that the USD is a good diversifier and we are positive in the near term vs select G10 FX. In commodities, we do not see significant upside in oil in light of OPEC’s plan to raise production and supply in Q4. However, we became positive on gold amid geopolitical risks and support coming in from central banks’ demand.

Finally, we think investors should consider portfolio protection in US duration and in select corners of DM equities such as the US and UK.

FIXED INCOME

Fed gaining confidence in easing policy

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

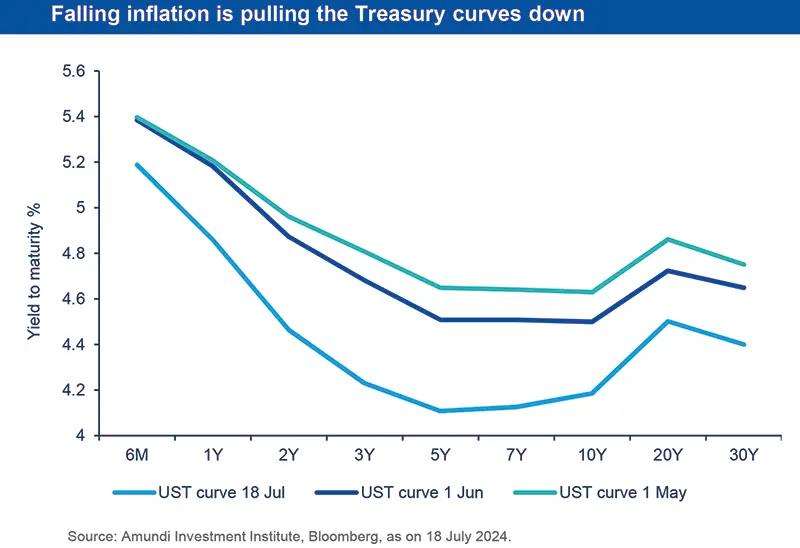

The downshifting of the US economy along with declining price pressures are indicative of the upcoming Fed pivot. Similarly, inflation is falling in Europe but some components such as core and services inflation remain a bit sticky. Hence, while central banks seem to be on the path to cut policy rates, any volatility on inflation or economic resilience could mean they would remain patient. On the fiscal side, deficits are important determinants of the premium for holding government debt in the long term. Given the high deficits in US and Europe, the risks of geopolitical tensions and of trade tariffs and barriers (these are inflationary), we think an active stance is crucial to navigate the medium term. There are opportunities in developed and emerging markets, with a tilt towards select government bonds and corporate credit.

- This is a time to be strategically positive on core EU duration. We are flexible in adjusting this stance to consider inflation volatility. We are positive on UK and breakevens.

- On Japan, we are tactically moving towards neutrality, even though longer term we stay cautious.

- In credit, we look for quality through EU IG. But in HY, we are cautious mainly via consumer and real estate sectors, although there is value in BB-rated debt.

- Amid concerns on soft landing of the economy and potential flight to quality, we stay positive and active on USTs and also on TIPS.

- Our view on yield curve steepening is maintained, and we think the short and mid maturity parts of the curve offer attractive value.

- We are raising our quality bias in corporate credit where we prefer IG to HY and financials.

- Securitised credit is attractive but we are monitoring housing market.

- Robust outlook for domestic demand and potential easing by the Fed are positive for EM debt. We are selective and prefer idiosyncratic stories.

- India offers long-term potential and in Brazil we find that carry is attractive. But we are monitoring fiscal risks in Brazil and how LatAm countries balance their relations with US and China.

- We also like HY and lowbeta countries such as Turkey, Egypt, Uzbekistan.

EQUITIES

Earnings resilience essential for rotations to sustain

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

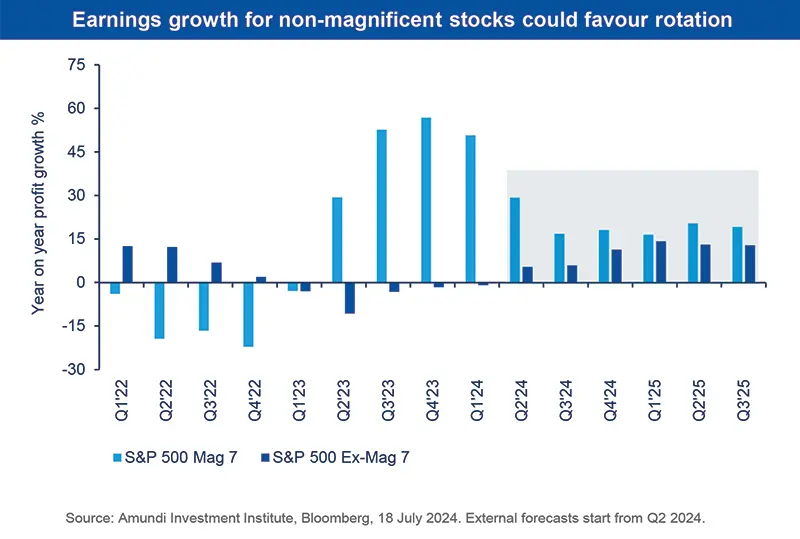

Equity markets are being driven mainly by rate cut expectations, politics, and economic momentum. The Federal Reserve is expected to cut rates due to slowing inflation, recent mixed economic data and weakening labour markets, which supports our view of a decelerating economy. Despite this, US large caps have remained strong, driven by rate cut expectations and following the narrative that bad news is good for the markets. However, we are starting to see signs of rotation. For this rotation to continue, the earnings season will be crucial. Earnings growth in the mega caps has likely peaked, at a time when earnings for the rest of the market should recover. Geopolitics may also affect sentiment towards tech stocks. This could open up opportunities in US value, Europe, the UK, and emerging markets stocks.

- We are positive on staples and health care sectors due to attractive valuations and robust balance sheets. We also like banks with strong capital positions and above-market earnings growth.

- We raised our views on industrials (electrical equipment) linked with green transition and AI.

- Businesses with no pricing power and sectors with intense competition are displaying profit warnings. Hence, we keep a quality bias.

- US mega cap valuations have risen dramatically but we saw some signs of this changing after the June CPI was released.

- We are cautious on market-cap weighted indices and favour an equal weighted approach, and value, quality businesses that can deliver sustainable earnings.

- From a long-term view, we are mindful of any upward pressures in companies’ cost of financing due to worsening fiscal deficits and rising government debt.

- EM companies are likely to experience a revitalisation in earnings particularly in 2H. Our long-term convictions are in South Korea and India, despite some high valuations.

- We are slightly more positive on South Africa after the new coalition government and on Brazil.

- More broadly, we are assessing how geopolitical tensions with the US (after the Nov. elections) could affect Chinese equities and other EM.

VIEWS

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.