Summary

European bonds have performed strongly over the second half of the year and remain appealing heading into 2025 thanks to projected ECB rate cuts.

- We expect slowing inflation and a weak recovery in Europe in 2025

- The ECB is most likely to cut rates further over the upcoming meeting.

- The economic backdrop is supportive for global cross-asset investing.

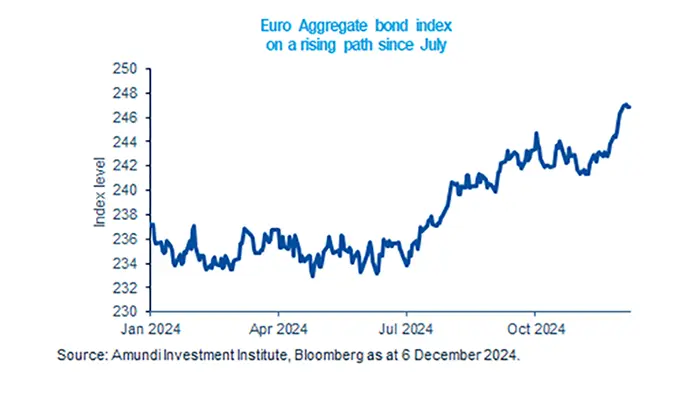

The Euro Aggregate bond index has been on a rising path in the second half of the year, with a performance of around +5%. The appeal of European bonds remains strong due to slowing inflation and anticipated rate cuts by the ECB. This will also benefit French bonds, which have experienced some volatility in recent days amid political uncertainty which led Prime Minister Michel Barnier to resign. The French debt market is characterised by high liquidity and depth, and all major rating agencies have reaffirmed France's quality rating, with the latest being S&P maintaining its assessment of 'AA-/A-1+' and a stable outlook. The outlook on peripheral bonds also remains stable and does not show any signs of contagion from France, further backing the appeal of European bonds.

Actionable ideas

- European aggregate bonds

With further easing expected from the ECB, European government bonds and high quality credit markets should stay in demand.

- Multi-asset investing

Multi-asset investors can exploit opportunities across asset classes, including exposure to European fixed income.

This week at a glance

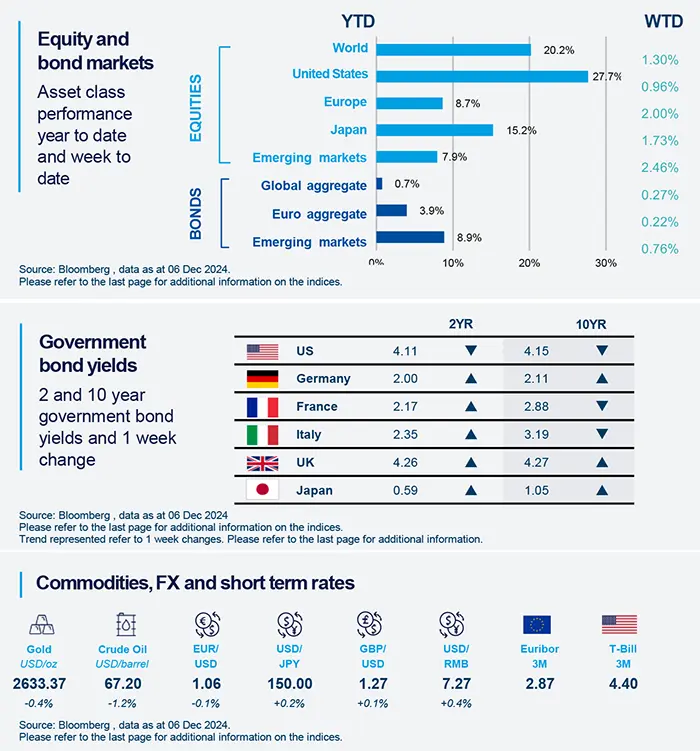

Both equity and bond markets closed positively. Chinese stocks surged in anticipation of potential policy support ahead of Wednesday's meeting. Meanwhile, bond yields remained stable, as investors await key economic data before upcoming central bank meetings.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 6 December 2024. The chart shows the Euro Aggregate bond index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Mixed signals from November ISM indices

November ISM manufacturing index raised to 48.4 from 46.5, remaining in contractionary area, supported by improving forward-looking indicators such as the new orders component, which raised into expansionary territory for the first time in eight months. Tariffs loom as a worry among respondents. The services index slipped to 52.1 from 56.0, still in expansionary area, with a slowing employment component. The two indices combined point to decent, but moderating US growth.

Europe

EZ retail trade pauses in October

The volume of retail trade declined by 0.5% MoM in October. It is the first monthly contraction since June and could be a payback after the strong summer acceleration, a sort of pause and savings rebuilding ahead of the holiday season. Also, it could signal uncertainty among consumers despite accelerating wages and falling inflation. This data supports our expectation of a gradual consumption pick up heading into 2025.

Asia

Asia central bank’s balancing act

The Reserve Bank of India defied market expectations of a rate cut by holding the repo rate unchanged at 6.5% at its December meeting, indicating in its forecasts that the growth slowdown will be shallow and transitory. The move is also a balancing act considering that inflation is likely to rebound on higher food prices, while its currency is under pressure due to extended dollar assets strength.

Key dates

|

09 Dec China CPI and PPI |

11 Dec US CPI (headline and core indices) |

12 Dec ECB interest rate decision, UK GDP MoM and industrial production |