Bright spots in a world of anomalies

New forces are reconfiguring the global economy. While the big shocks of the past five years have largely worked their way through the system, geopolitics and national policy choices are creating a more fragmented world.

Monetary policymakers have so far done a good job of curbing high inflation without slamming the brakes on growth. The world economic outlook is therefore benign and global price pressures are expected to abate further, allowing major central banks to keep cutting interest rates. However, the risk of inflation remains, and the Federal Reserve may need to adapt to a potential shift in US policies.

The best investment opportunities will be found by drilling into sectors that are likely to benefit from the big themes that will dominate the coming years. Meanwhile, anomalies - such as low market volatility in a time of high uncertainty, or the resilience of the US consumer in the face of the sharpest tightening cycle in decades - are becoming more marked and may not last. A reversal of such phenomena could see inflation-linked debt and gold find more favour. Geopolitical tensions may also stoke demand for safe havens and highlight the need for greater diversification.

In a world of anomalies, there are plenty of bright spots. Identifying the opportunities created by policy choices and geopolitical shifts will be as important as safeguarding against the risks they entail.

Investment Themes for 2025

Source: Amundi Investment Institute, Bloomberg. 1 US Treasuries data projection on gross interest payments. 2. Fed FOF, data as of 30 June 2024. Households and Nonprofit Organizations; Net Worth as a Percentage of Disposable Personal Income .3. Datastream as of October 2024. . 4. Shillerdata.com, Robert J. Shiller. Refer to the Shiller CAPE. 5. Analysis on percentage change in average volatility levels in 2024 vs the 2013-2023 average. Bond volatility refers in levels of MOVE index (implied volatility indicator on the Treasury market), equity volatility refers to the VIX Index (implied volatility indicator for the S&P500)

Key convictions for 2025

The global economy is expected to soften in 2025. The US economy will moderate due to cooling domestic demand and labour market conditions. Disinflation may persist, but inflation risks loom and the Fed may need to adapt to a potential shift in US government policy. Europe is positioned for a modest recovery, with strategic investments in focus. Emerging markets are likely to continue to command a growth premium over developed ones, and Asia remains a major driver of growth.

Emerging Asian economies are enjoying strong growth, driven by the dominance of their IT supply chain and supportive fiscal and monetary policies. External demand and trade within the region will enhance their resilience and connectivity. India and Indonesia are positioned as long-term beneficiaries, while we expect continuous re-routing and policy support to stabilise the Chinese economy and mitigate the possible negative impact from tariffs.

Escalating geopolitical tensions, increased economic frictions, and ongoing conflicts will require companies to form new partnerships and relocate their operations to mitigate risks. The global reordering will generate opportunities to identify new beneficiaries in the investment landscape, and support traditional safe-havens such as gold.

As inflation decelerates to long-term averages, central bank policy will continue to become less restrictive. The gradual return to neutral monetary policies, combined with the low probability of recession, will emphasise bonds’ income-generating function given yields are higher than in the past. Opportunities are appealing in Investment Grade and short maturity High Yield credit, leveraged loans, EM bonds and private debt.

A positive backdrop for earnings, coupled with good macro liquidity, is positive for equity. However, valuations are stretched, particularly in US mega caps. Investors should look at pockets of value in Europe, equal-weighted indices, and sectors such as financials, utilities, communication services, and consumer discretionary. Value investing and mid-caps are good hedges against possible declines in Growth and mega cap stocks. EMs should outperform DMs.

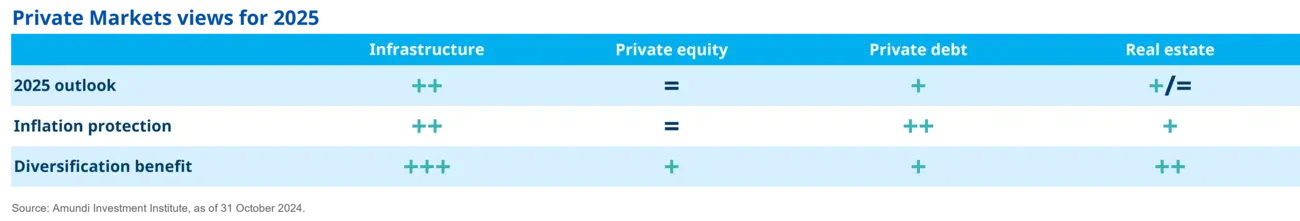

Private markets present attractive investment opportunities amid decelerating economic growth and expectations of more interest rate cuts, with a particular emphasis on infrastructure due to its strong growth outlook. Private debt offers appealing income, with companies still benefiting from strong bargaining power when negotiating lending contracts, while the outlook for the real estate market is expected to improve in 2025.

The economic backdrop offers bright spots in risky assets, but markets are underestimating the challenges. The macroeconomic outlook, high valuations and escalating geopolitical tensions warrant more nuanced diversification on multiple fronts. In particular, investors should be aware of the potential for geopolitical tensions to generate higher inflation and embrace risk diversifiers such as inflation-linked bonds and gold.

Seizing opportunities in risk assets, while balancing inflation risks, will be key in 2025. Investors should broaden their exposure to equities beyond US mega-cap stocks, look for income across liquid and illiquid assets, and implement hedges in a more fragmented world.

Asset Class Views

We’re seeing a shift in fixed income’s prospects that will continue in 2025, as US and European curves shift lower. Across major countries, US bonds are expected to be the main performer. In credit, we maintain a preference for investment grade over high yield corporates.In equities, there is scope for the rally to broaden beyond US mega caps. In Europe, small- and mid-caps could make a comeback in H2 2025. The Japanese market is also good value. The dollar may weaken gradually as US growth slows and the Federal Reserve cuts interest rates. This would support emerging markets, where equities are benefitting from strong domestic demand and growth. Uncertainty on multiple fronts makes it necessary to consider volatility, liquidity, and macro / geopolitical diversifiers.