Summary

Macroeconomic focus

Views on the ECB

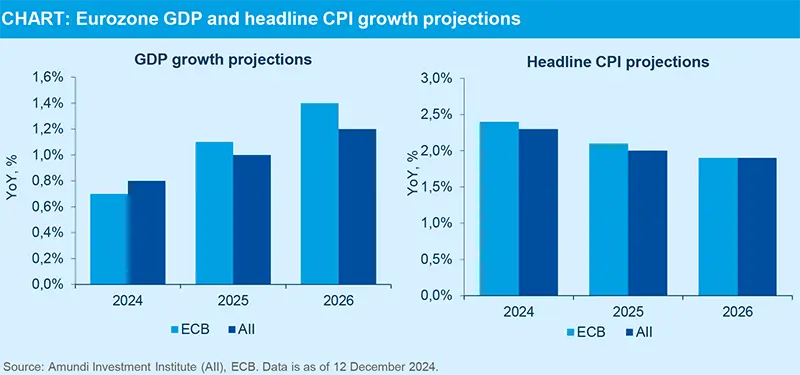

Inflation is coming down much faster than the ECB expected only last September, with the headline measure (2.2%) now inching very close to its target. The latest 25bp cut and its revised forecast on 12 December, suggest that the ECB should get to its target by mid-2025.

We expect the ECB to continue cutting by 25bp at each subsequent meeting next year until its July meeting to reach a terminal rate of 1.75% Inflation should get to around 2% by mid-year, if not earlier, because underlying wage pressures are subsiding, service sector activity is also easing and, with much less fiscal support among the larger countries (especially France, Germany and Italy), we expect a very weak recovery, largely supported by a mild pick up in domestic demand. However, this will depend on a significant move away from the ECB’s current restrictive stance.

The related discussion about the ‘neutral rate’ is likely to be an aside, especially if some of the risks to growth materialise and inflation falls faster. Though unobservable in real-time, there are still significant differences among senior ECB policymakers on what that neutral rate is. Some see it as around 2% while others at the ECB think it might be closer to 3%. We agree with those who think the policy rate can be set below theoretical estimates of neutral.

Policy rates are more likely to go below neutral (and our expectation of 1.75%) if Europe is subjected to tariffs from the incoming US administration. The United States is the largest destination for EU exports (a higher share than exports to China). We would expect at least a 0.2% hit to growth if the EU faces US tariffs of 10% and only a small short term spike in inflation.

The ECB should get to its 2% target by mid 2025, possibly earlier.

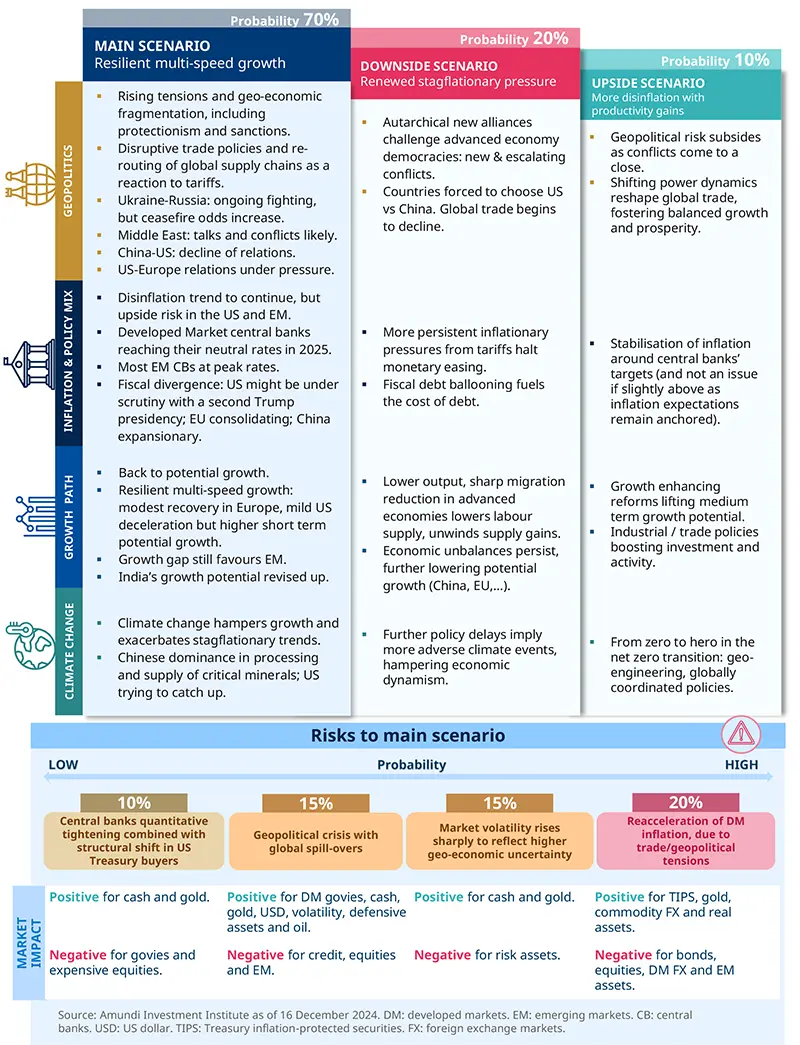

Main and alternative scenarios