Summary

After the 2023 rally, it’s time to embrace a diversified approach and search for opportunities across the board, including emerging markets.

- Resilient US growth and slowing inflation led the markets higher in 2023, as central banks indicated a change in their policy stance.

- 2024 started with rising bond yields, as markets reassess the extent of potential rate cuts.

- Emerging markets may offer opportunities, thanks to their growth advantage and strong local consumption and trade dynamics.

Markets delivered strong performance in 2023, following a significant boost to optimism in the last quarter. 83% of the main asset classes we monitor, delivered positive returns vs a meagre 20% in 2022. Japanese, North American and European equities led the way amid falling inflation and changing central bank policy stances. China equity was the laggard, as concerns over economic growth prevailed.

2024 started on a more uncertain tone, as markets reassess the economic and policy path ahead, following recent data. For the first semester of 2024, we see risks of a mild recession in the US and sluggish growth in Europe and we expect central banks to start cutting rates in May/June. Against this backdrop, we believe investors should look for opportunities across the board, including Emerging Markets that may benefit from their growth advantage.

Actionable ideas

-

Emerging markets in search of higher growth potential

On the back of strong earnings growth potential and domestic consumption, select EM in Asia (India and Indonesia) and Latin America offer potential opportunities in bonds and equities. -

Multi Asset to widen the opportunity set

At a time of divergences across economies and asset classes, investors may consider a balanced and diversified* approach that includes bonds, quality credit in Europe and Emerging market assets.

*Diversification does not guarantee a profit or protect against a loss.

This week at a glance

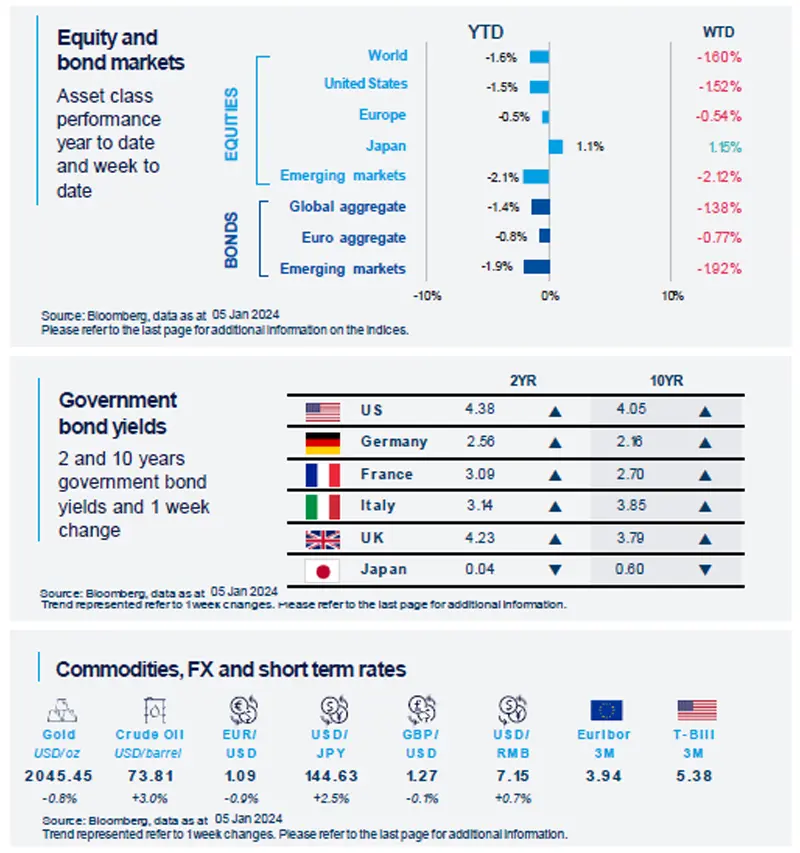

Equities and bonds retreated in the first week of the year. Markets lowered their expectations of central bank policy easing with bond yields in the US and Europe rising. However, oil prices and US dollar (vs Euro and yen) gained. The former was boosted by concerns over persisting tensions in the Middle East.

Amundi Investment Institute Macro Focus

Americas

Manufacturing survey shows slight improvement but remained weak

The US ISM Manufacturing rose slightly to 47.4 in December 2023. However, this is the 14th consecutive month when the data was in contraction territory. While production rebounded, new orders, employment, and inventories continued to fall. Price pressures decreased and supplier deliveries improved. Overall, this number is in line with our expectations of a weak economic activity.

Europe

Modest improvement in manufacturing despite broader weakness

Eurozone Manufacturing PMI rose marginally and came in above expectations at 44.4 in December. But the sector remained in contraction with ongoing output and job losses. Select sub-indices showed improvement, including slower declines in new orders and purchasing activity, and increased business confidence. Companies lowered prices through discounts to boost sales amid lower costs.

Asia

China activity remains subdued

China’s composite PMI continued to weaken to 50.3 in December, the lowest reading for 2023. The weakness stems from declines in manufacturing and services sectors. Services PMI remained below 50, indicating soft consumer demand. In contrast, construction PMI rebounded for the second straight month, thanks to increased public spending on infrastructure.

Key Dates

|

8 Jan EZ retail sales, China |

11 Jan |

12 Jan Japan and China trade |