Summary

EDITORIAL

- India is the fifth-largest economy in the world, according to the World Bank, in terms of nominal 2019 GDP in dollars, and ranks second by population (1.38bn). Although it is one of the world’s fastest-growing economies, its GDP per capita is more than 29x and 4x lower than the USt or China, respectively (also according to the World Bank, nominal 2019 per-capita GDP in dollars). The potential for a catch-up in income over the next decades looks huge.

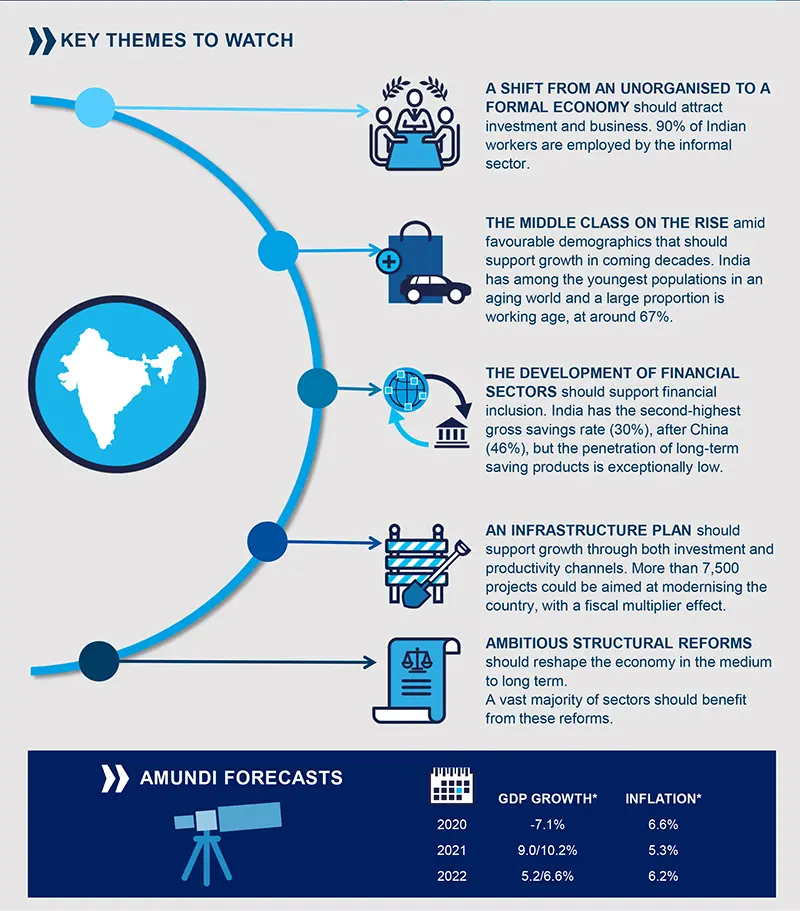

- There have been several developments that could help reshape initiatives the economy and unlock its long-tem potential. Different government inititiaves are in place to reinforce and modernise the economic structure to facilitate: 1) a shift from an unorganised to a formal economy, working in favour of setting up new businesses and attracting investment; 2) financial inclusion and modernisation of the financial sector to channel the highest gross savings rate (30%) after China (46%) into efficient financial instruments; 3) a broad set of structural reforms affecting a vast majority of sectors and offering significant benefits to the country in the medium to long term; and 4) a huge infrastructure development plan of $1.5tn, which could help to support growth through investment and productivity channels.

- India enjoys favourable demographics. The demographic dividend’s opportunity window is available until 2055-56, longer than for any other country in the world. This could support the development of the middle class and a strong domestic market. With over 67% of its population working age, India could supply more than half of Asia’s potential workforce over the coming decades.

- The recent budget is a milestone in creating a favourable framework for economic recovery. Capex is increasing, with a focus on infrastructure and initiatives, like the ‘Bad Bank’, supporting the corporate recovery. Sectors such as construction, steel, power, pharmaceuticals and healthcare should benefit from this pandemic budget. The new fiscal policy stance goes in the right direction to help the long-term growth plan and overcome execution issues.

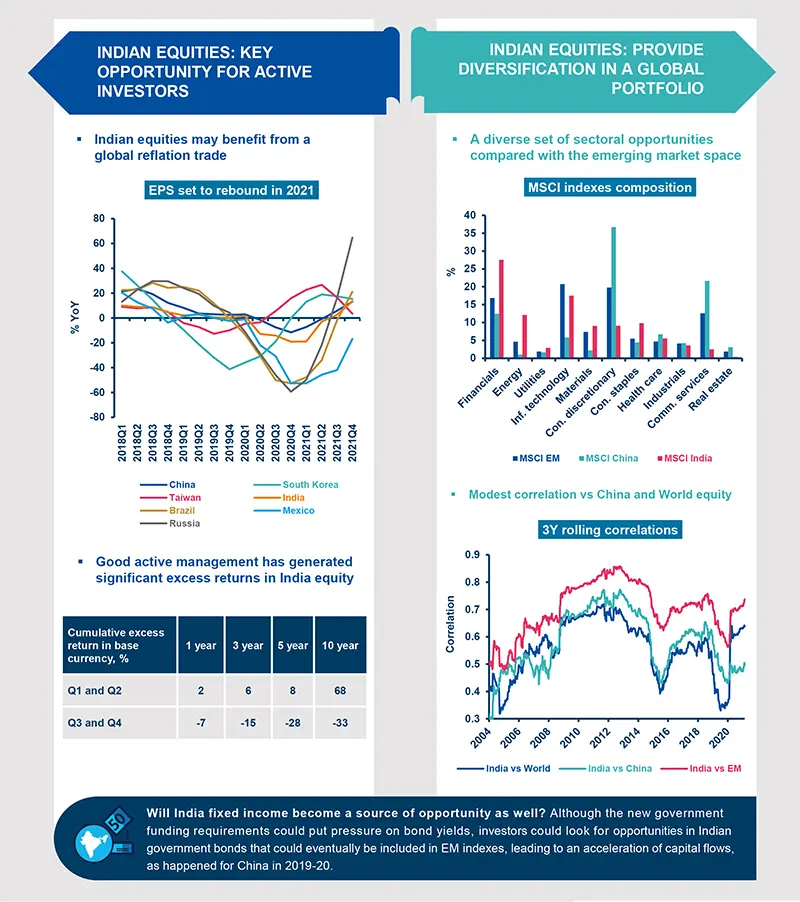

- We believe the modernisation of the Indian economy may open up opportunities for global investors in the medium term. The equity market is liquid and fast-growing. It includes among the highest number of stocks with market caps above $500m and among the highest number of stocks that quintupled in the last 10 years.

- ‘Make in India’ and ‘internal demand play’ are our key convictions. Government efforts to ease doing business – the country’s rank has improved considerably in the last few years – could impact property developers, healthcare (diagnostics sector), engineering and construction contractors, and, more globally, the retail and consumer sectors. Industrials and manufacturing should benefit most from reforms and ‘Make in India’ initiatives. Auto and components should also be a significant beneficiary, followed by pharmaceuticals. In industrials sectors, automation for industries is likely to experience exponential growth. Financialisation of savings might have a key role in the development of the asset management industry and insurance sector, playing on the Indian narrative of upscale of mass affluence and elite incomes. One sector in which India is a global champion is IT outsourcing services.

- The Indian market could be attractive as a diversifier in a global equity portfolio, as its correlation with global equity has been relatively modest, especially China equity. For investors willing to seek exposure to the EM domestic demand story, India could be a good complement with China equity in the EM universe.

- However, the market is very fragmented. Thus, the selection of a good active manager in India equity could make a real difference, considering the huge performance dispersion between good managers and mediocre/bad ones.

- Global investors could look at opportunities in the fixed income market. This is under-developed compared to the equity market, and is dominated by government securities. Recent reforms to improve liquidity and depth are paramount to make it more attractive to global investors. India is the largest ‘off-index’ government bond market with the scale to reach a 10% allocation of JP Morgan’s GBI-EM Global Diversified index. Based on recent developments, Indian government bonds could eventually be included in the index, leading to an acceleration of capital flows, as happened for China in 2019-20.

To find out more, download the full paper

Infographics

India’s opportunity to unlock its potential

Why investors should look at Indian assets