Summary

Where will returns come from? Pensions in a new economic regime

The Great Moderation of the past 25 years was marked by stable economic growth, low interest rates and low inflation. This era was shattered by four pivotal changes: the severe monetary tightening by key central banks to tackle the inflation spike; worsening conflicts in the Middle East and Ukraine; the rise of populism in the West; and the US–China geopolitical rivalry fragmenting global supply chains. However, these rapid changes also create opportunities as capital markets adjust to the new realities. With public equity markets in the West nearing all-time highs, the search is on for good risk-adjusted returns. The 2024 Amundi–CREATE global pension survey examines two primary areas: private markets (illiquid assets) and Asian emerging markets. Pension funds worldwide were asked their views on their allocations, plans and predictions for these alternative sources of value.

Private markets

Private markets on the up, as rates move down

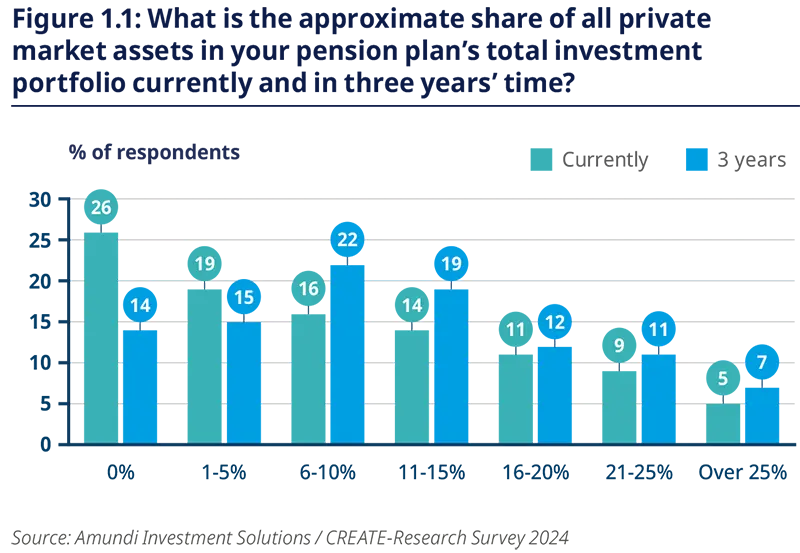

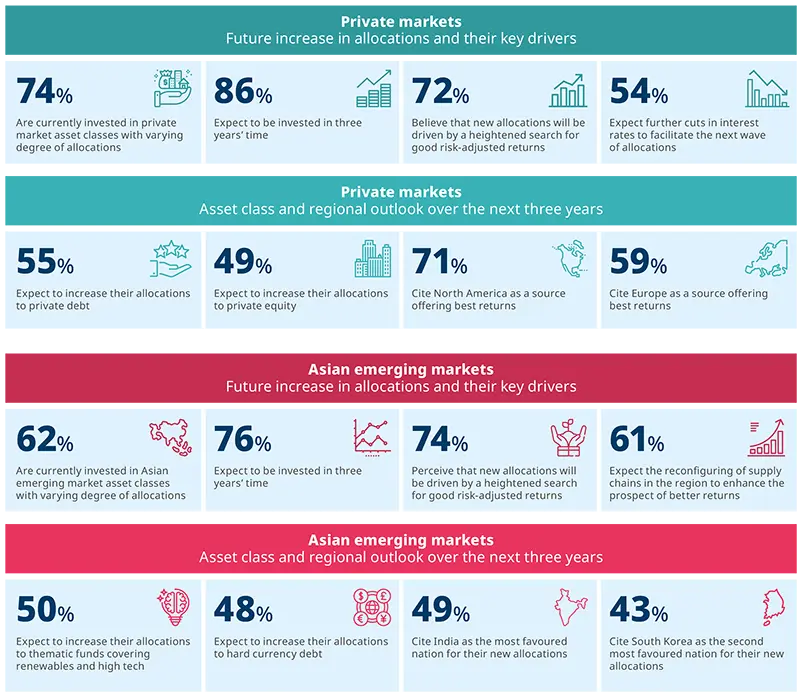

74% of survey respondents currently allocate to private markets, with significant investments in the US, followed by Europe and Asia-Pacific: 49% currently have allocations of up to 15% and another 25% have above 15% (Figure 1.1). This shift towards private assets is expected to continue, with 86% of pension funds anticipating an allocation in the next three years, as the rate-cutting cycle that began in 2024 is forecasted to improve the outlook for private markets.

The surveyed pension funds are at varying stages in the adoption cycle: 21% are at the awareness-raising stage, 5% are close to decision making, 22% are in the process of implementation and 52% already have a mature portfolio of different private market assets.

The size of private market allocations correlates with the pension funds' respective asset base, with larger funds having more capacity to invest in illiquid assets.

The motivation for investment is dominated by two principal factors: Good risk-adjusted long-term returns remain the top targeted benefit (72%) and achieving a triple bottom line: doing well financially, doing good socially and environmentally (56%).

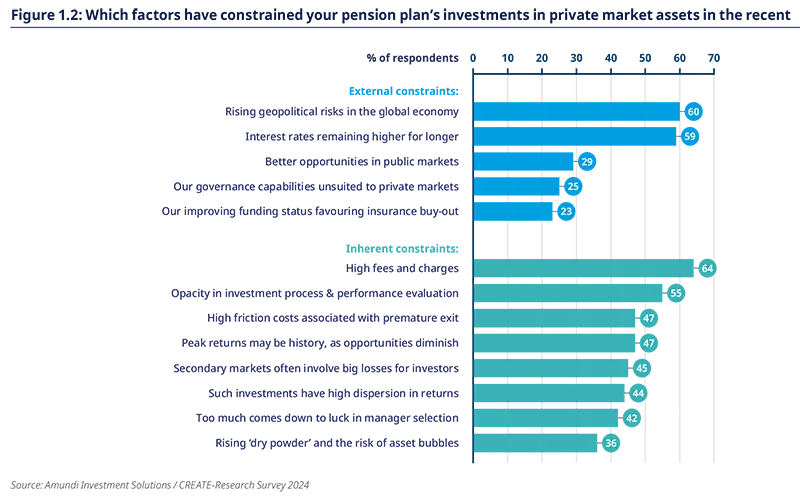

To date, allocations appear to have been constrained by two groups of factors (Figure 1.2), those external to private markets such as rising geopolitical risks (60%), which are difficult for investors to evaluate, or the prospect of interest rates remaining higher for longer (59%), which sparked a major reversal in private asset values. Barriers inherent to private markets are led by high fees and charges (64%), opacity in investment processes (55%), diminishing opportunities (47%) and high friction costs (47%).

How do pension funds approach investment in private markets?

Pension funds have clearly embraced investment in private markets. Many consider themselves to be long-term buy and hold investors as 51% of respondents treat private market investments as part of their strategic asset allocation, and a further 20% treat them as part of a dedicated stand-alone sleeve in their portfolios.

This focus on the longer term within a policy framework makes private market assets particularly suitable for ESG investing, especially for searching out climate opportunities. Many private market companies are at the cutting edge of green technology, which have long gestation periods that public markets struggle to price.

Many of the respondents’ allocations to impact investing – targeting financial, social and environmental benefits – have been channelled into private markets, especially private equity and private debt. These investments can result in more effective positive targeted impacts through direct investing in pure play companies whose business models are solely focused on the chosen themes. The ownership structure and customised covenants also allow for more productive stewardship.

Predominantly, pension funds have been allocating to stand-alone individual funds (49%), reflecting the use of funds of different vintages (private equity, private debt) or specific projects and asset types (infrastructure, real estate). The trend indicates a preference for single-strategy specialists, whether they operate as independent boutiques or as part of multi-strategy platforms.

Most pension funds are gravitating towards the less risky, senior segments of the capital structure, which aligns with a conservative investment philosophy. Those with smaller allocations to private markets are increasingly favouring open-ended multi-asset funds (14%), which aim to capture the illiquidity premium while managing liquidity constraints. These funds have gained traction over the past five years, particularly as pension plans have faced challenges related to the ‘denominator effect’—a phenomenon where declining public market asset values lead to an overweighting of illiquid private assets in portfolios.

Search for better returns will drive fresh allocations

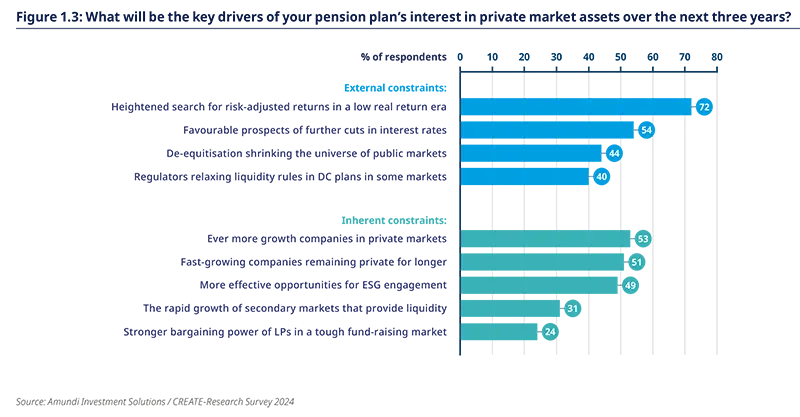

Two primary sets of drivers are poised to influence private market investments (Figure 1.3). External drivers include the ongoing search for attractive returns in an environment characterised by low real returns (72%), as well as the anticipation of further interest rate cuts by central banks (54%). Additionally, the structural deequitization of public markets (44%), marked by significant share buybacks and a declining number of initial public offerings, is prompting pension funds to explore private market opportunities more aggressively.

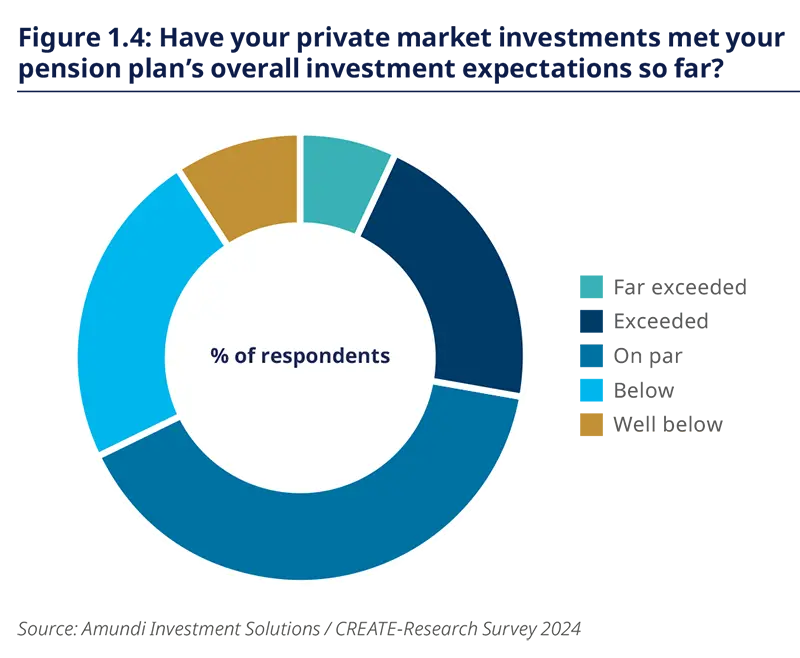

So far, investments in private markets have generally met expectations (Figure 1.4), but asset class and manager dispersion have been large.

Within private markets themselves, the increasing presence of growth companies in private markets (53%) and the trend of these companies to remain private for extended periods (51%) are driving allocations. As we have already seen, there is a growing emphasis on environmental, social, and governance (ESG) factors with 56% of respondents targeting a triple bottom line from their private market allocations. In this context, 49% of respondents look to private markets for more effective opportunities for engagement. The bilateral nature of legal covenants in private market investments facilitates ongoing dialogue on strategy and ESG issues compared to public markets.

Looking ahead: Continued Interest in Private Markets

In light of these growth drivers, private market assets are expected to continue to attract moderate net inflows, even though returns are likely to be lower with bigger dispersion. The market is now likely to be defined by three trends:

- Return to fundamentals

Investors seek sustainable earnings growth and margin expansion gained from improved business excellence and operating leverage. The illiquidity premium must rely more on the fundamentals of the underlying assets than fluctuating monetary policy tailwinds - Rise of secondary markets

With growing emphasis on fundamentals, secondary markets are expected to be a more efficient way of meeting periodic cash flow needs and avoiding forced selling - Preference for thematic investing

Direct investing in pure play companies can give access to mega-trend themes and predictable value creation in areas that have a higher likelihood of more positive targeted impacts.

The focus on quality is vital for private market assets to sustain and enhance their current distinctiveness in the investment universe. The current approach will remain a pragmatic blending of opportunity and caution. Successful private market asset managers (known as general partners) will be those who have learned lessons from the end of the cheap money era and reorient their business models towards what their clients need in a less benign environment.

This shift has reinforced the need for pension funds to select general partners who have credible value creation plans, sound execution capabilities and reduced reliance on the state of capital markets to drive future returns.

Far and away the most important criterion now being used by survey respondents is a good track record of delivering clients’ financial and ESG goals (78%). Performance also needs to be backed by an incentive structure in which fees and charges reflect value for money (66%). Another reported key requisite is more transparency around the investment process, performance valuation and the identity of fellow investors (58%).

Asian emerging markets

Not all Asian emerging markets are created equal

The geopolitical rivalry between China and the US is set to fragment the global order into two rival trading and currency blocks. This has cast a shadow over other countries in Asia. On the whole, Asian emerging market (EM) stocks have remained under-owned, despite their combined weight of 46% in global GDP. By 2030, Asian markets are expected to contribute 60% of global growth.

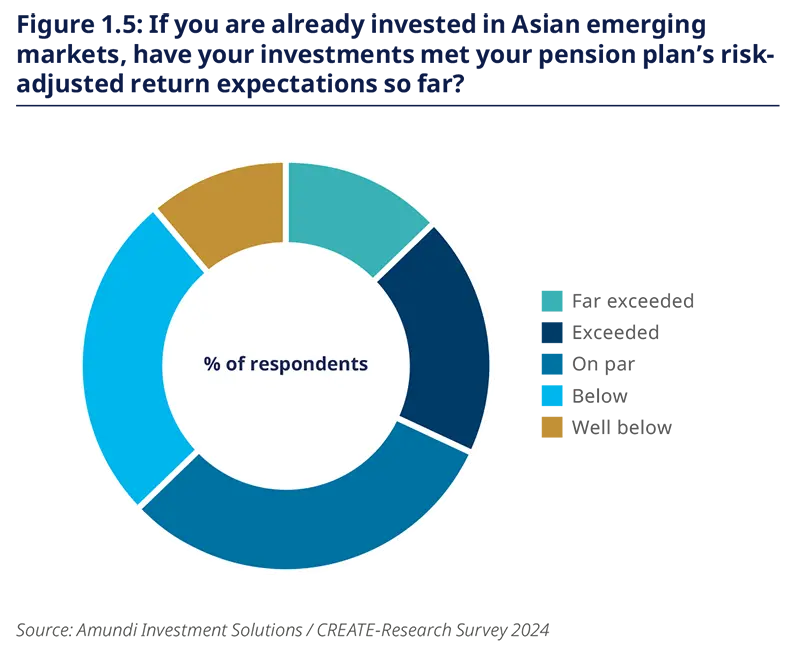

Most respondents are already invested in Asian EM to some extent (Figure 1.5), but the majority have allocations of no more than 5%. Geopolitical risks eclipse the favourable economic fundamentals. Investors remain wary of Asian EM assets, particularly eager to avoid a repeat of the 2022 delisting of Russia, as political tensions between China and the US rise. Moreover, the favourable growth dynamics have yet to translate into big investment gains.

Impressive returns are reportedly based on a high degree of selectivity. Some have focused on assets with high intrinsic value, based in countries that are politically stable with a robust rule of law and stronger shareholder rights.

Respondents whose investments did not do well fell into two groups. The first group were seeking prime mover advantage. But the targeted advantage has been slow to materialise. The second group lost out by relying overly on passive funds, where the recent underperformance of Chinese equities has drowned out the positive performance of other countries in the indices.

Various external and internal factors have constrained investors’ allocations to Asian EM in the past (Figure 1.6). These are led by the aforementioned worries about the geopolitical rivalry between China and the US (68%). Trade frictions related to this rivalry have also limited investment (58%). Another external factor has been the US interest rate cycle. The higher rates of 2022–23 (54%) hit Asian emerging market assets, as many of their companies had funded their growth with US dollar debt.

The internal factors are concentrated around concerns about high volatility (53%), and the disconnect between strong economic growth and rising asset prices (51%). Some markets also face opaque governance (51%) and government interference (48%) in corporate affairs, affecting investor confidence.

Reforms and realignment weighing on future allocations

Asia’s geopolitical upheaval may yet have a silver lining. The China Plus One strategy, where companies diversify production out of China, is creating investment opportunities in neighbouring countries with strong economic fundamentals..

In the past, although GDP growth in Asian EMs has been significant, this has not always translated to asset market performance. A renewed focus on governance reforms from Asian EMs was therefore mentioned by 55% of respondents as a key internal factor driving interest in the region.

Nonetheless, survey respondents expect only modest increases in allocations to Asian EM in the next three years. Driving these increases will be a search for good risk-adjusted returns (74%), structural opportunities created by the reorganisation of global supply chains (61%) also feature strongly, and the falling sensitivity of Asian asset prices to the US interest rate cycle (53%). Reforms to improve corporate governance (55%) alongside favourable growth dynamics (52%) and demographics (47%) are also driving interest.

Investors to become more selective and goal-focused

When we look to future allocations, the proportion investing in all Asian EM is likely to rise from 62% to 76%, with respondents set to focus on selectivity to reflect the unique dynamics of each country.

For active investment, three avenues are considered:

- Direct investment in companies listed in Asian EM (49%) – to focus on the intrinsic potential to convert growth forecast into earnings

- Allocations to developed market companies with high profit exposures to Asia (43%) – an avenue that offers greater liquidity and transparency, while benefitting from the huge revenues gained from emerging markets

- Investment in Asian companies listed in developed markets (26%) – allowing investors to benefit from familiar and consistent corporate governance, transparency and reporting practices

Within passive investment, 43% of respondents plan to gain access via broad index funds and ETFs focused on Asian EM. Single country focus funds are likely to gain traction (30%). This trend is in contrast to the broader current shift towards global equities rather than country allocations. Broad global emerging market index funds and ETFs are likely to be used much less (21%). Once touted as the primary low-cost access to emerging markets, such funds are losing their appeal given the pronounced gap between the best and the worst performing companies and the high company turnover in regular index rebalancing.

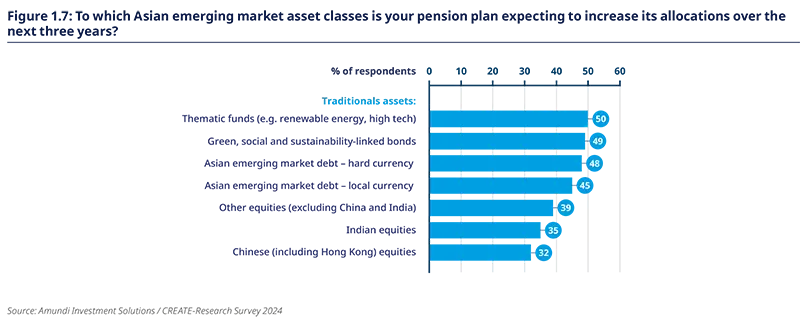

Mega trends (50%) such as AI, renewable energy or supply chain reconfiguration will play a significant role in new allocations, to focus on likely future sources of value creation (Figure 1.7). Bonds are preferred over equities, offering a value opportunity and for minimising portfolio volatility. Public markets are likely to prevail over private assets, where interest remains muted as liquidity takes precedence over opportunity.

Survey respondents also perceive the region as offering good opportunities to harvest ‘green’ alpha. Countries as diverse as China, India and Indonesia are expected to become major players in the green economy.

In the past, four large markets dominated investment: China, India, South Korea & Taiwan. However smaller Asian nations are attracting increased attention. India is expected to displace.

China as the most popular destination for increased allocations (49%), followed by South Korea (43%) and Taiwan (36%). Vietnam, with its rapidly expanding tech sector (30%), is set to narrow the gap to fourth placed China (34%), followed by Indonesia (24%) and Malaysia (23%), who are benefitting from the growing tech and green expansion and the China Plus One strategy respectively.

When it comes to manager selection, survey participants rank delivering clients’ financial and ESG goals as top priority (63%), followed by a value-for-money fee structure (59%), a deep talent pool capable of delivering innovative client solutions and strong stewardship (55%) to help deliver on ESG goals. Equally important, managers are expected to have a strong physical presence in the region (56%) to ensure managers are well-versed in the cultural and political nuances of the countries concerned.

Amundi-CREATE 2024 survey: Highlights

(% of pension plan respondents)

About the survey: each year, Amundi and CREATE interview pension plans to highlight insightful convictions for the year to come.

As pension investors transition to a new regime, one question has come to the fore: where will the returns come from? The 2024 edition has a twin focus on asset classes in private markets and Asian emerging markets and asks five questions:

- what are pension plans’ current allocations to these asset classes and how are they likely to change?

- which factors have constrained allocations so far and which ones will likely drive them in future?

- what specific investment benefits are being targeted and to what extent have expectations been met?

- how is the mix of components within each of the broad asset classes likely to change?

- which selection criteria will be used when awarding new mandates to external asset managers?

The survey is based on 157 respondents Asia-Pacific, Europe and North America, collectively managing €1.97tn of assets.

Read more