Summary

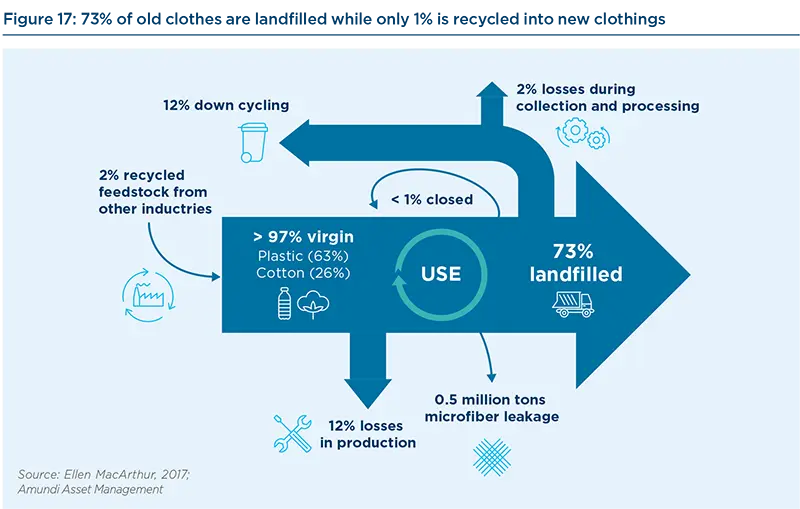

Over the past two decades, a concept called ‘fast fashion’ inherently changed the fashion industry. Between 2000 and 2014, clothing production has doubled while 50% of it is discarded within the year. In addition, 73% of our clothes are landfilled and only 1% is recycled into new clothes effectively. The impacts of fast fashion are detrimental to both the environment and society and the industry is in need of a circular makeover.

How can companies in the sector integrate the Circular Economy when their business-model today is based on sales, low prices and a fast turnaround of styles?

Fashion is one of the few sectors for which hard legislation is almost non-existent regarding the Circular Economy. Indeed, awareness of the sector's environmental impacts are recent and legislation has so far mainly focused on working conditions in the supply chain, especially following the Rana Plaza collapse in 2013 in Bangladesh. The sector must completely rethink its business model in order to drastically reduce its environmental footprint. To do so, Boards of Directors and Executive Management must define a clear strategy and above all review the way clothes are designed, sold and made for last, while managing and strengthening chemical safety.

Environmental impacts and consumer pressure are pushing the sector to become more circular

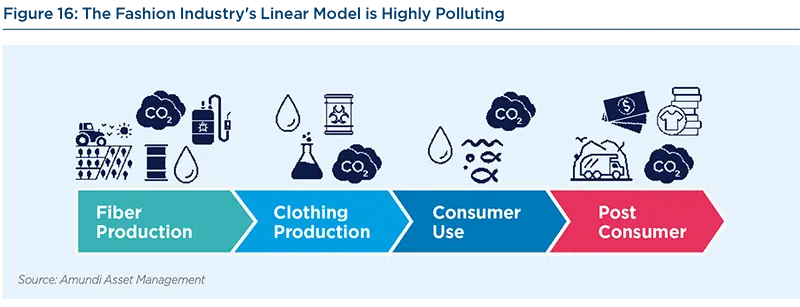

Fashion is currently a linear system that puts pressure on resources, pollutes the environment, degrades ecosystems and leaves circular economic opportunities untapped resulting in significant amounts of waste that are very little treated. Thinking of new business-models is becoming mandatory, even though the legislative pressure is nearly absent for this sector, unlike the other sectors of our engagement campaign (construction, TMT and autos).

The environmental impacts of the fashion industry are less known by the general public than the ones from other industries, such as the oil & gas or the transportation sectors. However, the fashion industry is a 1.3 trillion dollar industry that employs more than 300 million people along the value chain and has seen a strong increase in its environmental impacts over the last two decades with the rise in fast fashion.

Indeed, a growing middle class has increased per capita sales coupled with the rise of ‘fast fashion’, fashion brands characterized by quicker turnaround of new designs at lower prices with one reporting observing a fast fashion company having 52 “microseasons” in the calendar year1. Consequently, in the last 15 years, clothing production has doubled to reach more than 100 billon units a year vs 50 billon units in 2000.

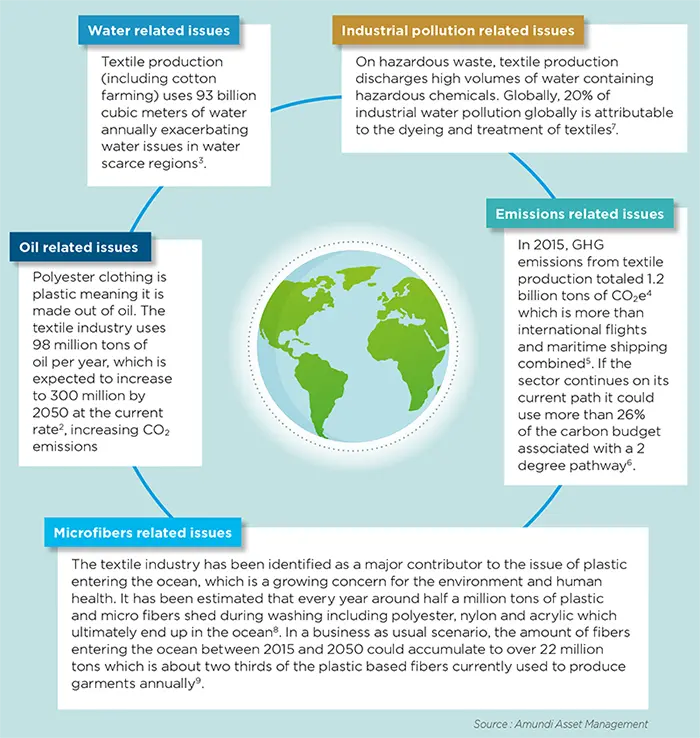

| THE CONSEQUENCES ON THE ENVIRONMENT OF THE HIGH INCREASE OF UNITS ARE NUMEROUS | ||

|

Poor methods of clothing disposal came to general attention in 2018 when Burberry confessed that it incinerated its 30 M€ unsold stock. While this one company in particular received significant media attention, the method is still widely used in the industry to this day. While consumers were shocked by the practice, the reality is that consumers have a part to play in the way they buy, use and dispose of. The environmental impacts of the fast fashion industry are exacerbated by the linear system in which the industry operates. More than 50% of fast fashion produced is disposed in under a year10. As seen in the figure below11, 73% of clothes are landfilled while less than 1% of material used to produce clothing is recycled into new clothing, representing a loss of more than USD 100 billion worth of materials each year12.

When clothes are recycled, most of the inputs (12%) are down cycled or converted into a product for other industries of lesser value such as insulation material, wiping cloths, or mattress stuffing. While this extends their lifetime, they are difficult to re-use after representing the materials final use before disposal.

Some countries have high collection rates for reuse and recycling - Germany has a 75% collection rate for textiles13 - but much of this collected clothing is exported to countries with no collection infrastructure of their own, meaning the clothing ultimately ends up in landfills or is burned.

Consequently, when making new clothes, more than 97% of the materials are virgin materials while more than two-third of clothes are landfilled. This is no longer possible when we think of the high environmental impacts, the limitations of raw materials, the costs and the social and ethics issues. It is time to implement the concept of Circular Economy in the fashion industry.

In order to do so, it is important to know what a Circular Economy means exactly for this industry.

Reinventing the way the fashion industry works to create a circular system

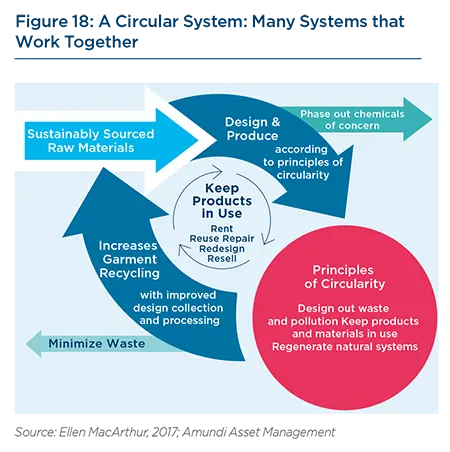

There is no one circular model but rather a variety of systems that work together to create a comprehensive circular strategy.

According to the Ellen MacArthur Foundation, one of the preeminent research institutions on plastic and the Circular Economy, the Circular Economy for fashion has three key principles:

- Design out waste and pollution: Design products without the negative impacts including GHG emissions, hazardous substances, pollution, and excessive water consumption;

- Keep products and materials in use: Design products for durability, reuse, remanufacturing, and recycling to keep products, components, and materials circulating into the economy. Circular systems will ideally make effective use of biologically based materials and encourage multiple uses before nutrients are eventually biodegraded;

- Regenerate natural systems: Avoid the use of non-renewable resources and preserve or enhance renewable ones such as by using nutrients to support soil regeneration or using renewable energy as opposed to fossil fuels.

A circular business model can present opportunities for the industry. If the fashion industry were to address the environmental and societal impact of the current industry status quo currently the overall benefit to the world economy has been estimated to be about EUR 160 billion in 203014.

A Circular Economy for fashion is not simply adjusting activities to reduce negative impacts. It requires a systemic shift to build long-term resilience, generate business and economic opportunities and provide environmental and societal benefits.

Based on our engagement campaign, we have identified three actions companies need to implement if they want develop Circular Economy in their process that we develop hereunder.

Defining a clear strategy on Circular Economy

While half of the analyzed companies do discuss Circular Economy at the board level, the topic is often strongly assimilated into sustainability overall, rather than being addressed as a distinct strategic topic. Consequently, the Circular Economy is not thought of as a business strategy that will influence or modify deeply the business-model of the company but rather than an addition of myriad of small actions. This does not enable companies to address the entire spectrum of opportunities offered by a circular model.

This is why we encourage companies to better define what the key priorities are for them in terms of Circular Economy and to define a clear direction. This will also help them to better identify their priorities, their commitments and their ambitions as we observed these are often too ambiguous in the companies. For example, all companies we engaged with had some type of commitments to increase sustainably sourced materials, which is good news. However, many of these commitments are shrouded in imprecise and unregulated terms such as “sustainable polyester” or “responsibly sourced materials”. The use of ambiguous vocabulary is suspicious and more likely green washing than concrete and ambitious actions.

We acknowledge that a true Circular Economy is not yet completely possible but we encourage companies to better define the vocabulary they use. Stronger and true commitments will inspire increased investment in areas that still require development, such as fully cradle-tocradle products, which no company had clear commitments on.

In order to do so, we recommend companies implement more comprehensive training linked to Circular Economy that enable all levels of staff from top management to those in more operational roles to be empowered with the skills and knowledge to better implement Circular Economy into all areas of the business. This can include people working in all types of roles including but not limited to sourcing, product development, marketing, omni-channel distribution, in store customer experience.

Rethinking the lifecycle of clothes: from design to waste treatment

Durability, Reparability and Longevity: the core foundation of a circular model

A Circular Economy in the fashion industry means to extending the life of clothes. Clothing utilization rates have decreased by 36% compared to 15 years ago. By helping clothing find a second (and third?) life, companies can address clothing waste and gain additional margins per item ultimately decreasing the production of new clothing.

Increasing durability, reparability and longevity is essential to make clothes last and it will involve actors across the entire value chain from manufacturers and brands to consumers. This includes manufacturing clothes made to last, marketing clothes as items to wear beyond a short micro season, and convincing consumers to help play a role in finding a second home for items they are not longer using.

Durability is essential to the Circular Economy but has historically only been an obvious characteristic for certain types of clothing such as outerwear and high performance sportswear. However, promoting durability should be key for all product types and does not mean reduced revenues. Patagonia has adopted a clear strategy around durability and has still seen significant growths in sales revenues. During the Covid-19 pandemic, many companies selling quality basics have seen sales soar15. Promoting product durability can help brands foster a closer relationship between a brand and a customer. Furthermore, warranties to promote durability can also incentivize customers to repair clothing and consequently help foster stronger customer loyalty and better access to customer data.

Reparability is thus also key to maximizing the longevity of a piece of clothing. Brands can promote reparability to consumers by offering reparability services to maximize longevity or personalization services to see damaged or worn products in a new and refreshed light. Repair or personalization programs can also incentivize increased foot traffic into stores and encourage new purchases while maximizing longevity of previous ones.

Unfortunately, we observed during our engagement campaign, that very few companies have entered the life extension market for their products. Only one company is really thinking about solutions to “refresh” purchased items with personalization and patch solutions for breaks or tears which demonstrates a massive gap in the sector regarding circular thinking.

To maximize longevity, companies can also promote product life extension by getting involved with the second hand market if a product no longer matches a consumer’s needs. Strong relationships between a brand and a customer better connect to second hand clothing markets, while enabling companies to earn additional margins off the second hand life of a product. Luxury has historically been a more attractive market for second hand products, but new companies such as ThredUp who compete with fast fashion players on both price, variety, and brand selection are changing the game.

We only observed one company in our study who was beginning to take an active role in the second hand markets of products, but we think there could be more potential for this in the future.

Other business models that promote longevity can also be a growth opportunity for companies. For example, clothing rental models which address demand for ‘new’ clothes while decreasing new clothing production, also have additional elements to their value proposition. Rental models can provide additional boutique services such as stylist services to customers and can benefit from increased customer data on key metrics such as sizing, comfort and styling concerns. Also, as switching costs are higher, subscription rental services can also encourage repeat business foster greater customer loyalty.

Consequently, we encourage companies to broaden their business strategies to include new business models that help foster a Circular Economy. In the first year of engagement we observed that the exploration into new Circular Economy linked business models was at the nascent stage for most companies. While it is up to companies to determine how to fit these new business models into their overall sustainability strategy we do see this as an area of great potential for fashion companies. Regardless, these new business models are popping up (often by rapidly scaling start-ups). They have the potential to destabilise the linear business-models used by large players of the sector posing a risk for large companies unless they come to the market with similar business models and services.

Encourage more effective clothing recycling through notably eco-design

Currently only 1% of textiles produced for clothing are recycled into new clothes and 87% of material used for clothing production is landfilled or incinerated after its final use. In addition to the environmental impacts, the low rates of recycling for clothing represent a lost opportunity of more than USD 100 billion annually. Increased recycling rates could help address high costs for landfilling and incineration.

During our engagement campaign, we observed that very few companies had any clear strategy about managing the end of life of their own products. While numerous companies had some sort of garment collection system, only one comprehensively reported on what precisely happened to the garments that were collected and, more specifically, how many were being made into new clothes or resold on a secondary market. One other company of note was beginning to think through a more circular strategy for collection of own items (where the company has certainty over the inputs and assembly) to make them into new products, thus creates a potentially perfectly circular system. This is the most promising circular strategy we observed as it means companies are directly trying to create a circular model, managing the impacts of their own clothing.

We do believe that robust collection infrastructure is necessarily to enable a circular model. Companies must start taking responsibility for the end of life of their clothing but do so in a way that helps, not hinders a Circular Economy. Clothing collection presents an opportunity for companies to source valuable CE compliant feedstock to make (and resell) products; however, there remains a disconnect between collection systems and recycling channels. In Europe and the US, nearly 70% of clothes collected are considered reusable16, but only 20% of these clothes are actually resold in domestic markets17.

Many companies are developing collection systems but they are often more of a marketing ploy and the company does little to actually manage the end use of these products (beyond outsourcing the collection to a third party and not taking an active role in the end of life of the product).

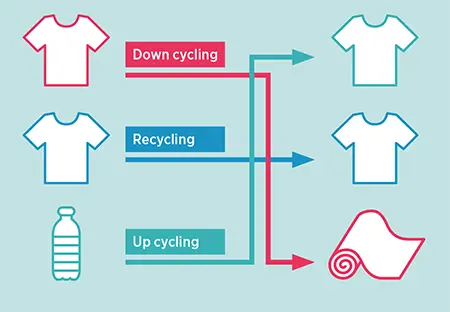

| WHAT IS THE DIFFERENCE BETWEEN UP CYCLING, RECYCLING AND DOWN CYCLING? | ||

There are three main obstacles to recyclability as of today: first, recyclability of the product is not taken into account in the designing process; second, designers use several materials for one piece of clothing making the disassembly more difficult; third, there is still a lack of transparency on material specifications between the various actors of the industry. Because of these main obstacles, the current reality of clothing recycling is not feasible in a closed loop system. We can classify the recycling process into three kind of recyclings: up-cycling, recycling or downcycling.

The ultimate goal in a circular fashion system is to take clothing feedstock and convert it to equal or greater value clothing. Currently only 2% of inputs for clothing production comes from recycled materials, most of this is made from recycled PET bottles and not from actual clothing. While this is a positive step for the industry, it is not completely circular. Furthermore, it could prevent the food & beverage industry from incorporating their own plastic back into their own system and suppress the market to incentivize clothing to clothing recycling. Source: Amundi Asset Management |

Developing effective clothing collection that feeds into a circular model will also help companies to reduce potential regulatory risks. Some governments are considering Extended Producer Responsibility policies where producers of a product are given the responsibility (whether financial or physical) to manage the treatment and disposal of post consumer products. While policies so far are not yet focused on the fashion sector, one day they could. Companies that are already managing the end of life impacts of their products are well prepared for possible legislation18.

We know that recycling clothing is great in theory but difficult in practice, mainly because garments are not designed for recyclability. This is why we encourage product developers to consider the recyclability of clothing when designing products. Clothing needs to be designed for end of life in addition to functionality, style, etc.

There are multiple ways of doing so. First, designers need to design for disassembly, which means considering the breakdown and recyclability of all components from threads to buttons. Second, we encourage designers to use as much as possible one single material or a well-defined blend that is known to be recyclable. The fashion industry uses a wide variety of materials and blends brought to the market for both cost and durability reasons, which makes it difficult for recyclers to capture the full material value of clothes they receive19. Third, we think that brands overall need to be transparent about their material specifications and guidelines are needed between designers, buyers, textile mills, and recycling facilities to ensure alignment. This will help increase the recyclability rate.

Maintaining and strengthening chemical safety

Chemicals in the fashion production enable a wide variety of colors, water and stain resistance, and increased durability. However, many of these chemicals have significant potential adverse affects in production, use, and after use phases. Every year 43 million tons of chemicals are used to produce textiles and are used throughout the production process from fibre production to dyeing, treating and finishing20. These chemicals remain within the garment both intentionally and unintentionally which raises concerns about the impacts they can have on the environment21. These chemicals can complicate a circular model as in the first life of a product these chemicals might be within safe limits, these chemicals can accumulate when garments are recycled reaching unsafe levels.

Unfortunately, the industry is characterized by very low transparency over chemical use making the true scale of chemical pollution and its associated impacts difficult to evaluate.

In our study, overall companies demonstrated strong concern and consequently seemingly strong management of chemical safety but concrete actions and reporting are still lacking. First, while companies commit to and abide by chemical safety standards such as EU REACH22 and ZDHC23. This is a strong step but much more is needed. Companies often have their own restricted substances list (RSLs) but a lack of standardization makes it difficult for supplies to abide by a uniform list and in fact eliminate all chemicals of concern. Standardization also means increasing commitments to chemical safety certifications that ensure chemical compliance with a Circular Economy24.

Sadly, no companies in our study demonstrated commitments to these certifications. While understandably difficult, certifications allow for full disclosure of materials used in a product, which is essential to enable a Circular Economy.

Second, companies need to increase collaboration and collective action to build up chemical safety standards for a Circular Economy. Chemicals that are considered safe for use in production does not mean they are safe for use in a circular system where the levels of chemicals can augment significantly if garments are broken down and rebuilt in the recycling process. Further innovation is needed to create momentum and scale for new, safer chemical alternative. Collaboration is needed between brands to help push for innovation but also collaboration is needed between all actor across the value chain including mills, factories, and chemical producers so that standards and ambitions are aligned.

Conclusion

In order to limit the environmental impacts of the fashion industry, three key words must now be applied to all clothing production: durability, reparability and longevity. Fast fashion has dedicated itself to low quality clothes that consumers do not even take the time to repair but prefer to throw away to buy new ones, thus leading to an extremely limited life span of the garment, all this at low prices. The “new” fashion should be the opposite: raw materials should be carefully selected to ensure the smallest environmental footprint (water, pesticides, etc.), design and quality thought so that the garment can be repaired and live as long as possible but also be disassembled easily as to facilitate the recycling of materials and thus ensure the manufacture of new clothes.

If the big established companies of the sector have difficulty in innovating and integrating the Circular Economy, we see many start-ups entering the Circular Economy game. These start-ups are experiencing dazzling success and are beginning to overshadow the major companies by competing with them, including by taking customers from them and by making the notion of “second hand” fashionable again –under the name “vintage”. The major brands are aware of this new competition and are trying to get in on the action, in particular by taking shares in these start-ups (Kering at Vestiaire Collective or Cocoon). However, the change in business model is still too discreet to speak of a real revolution. The European Union's New Circular Economy Action Plan and the change in consumer mentality are however signs of hope.

CASE STUDY

Adidas was one of the top performers in our study but there were a few particular points that made the Adidas case so interesting. Adidas has a clear strategy specifically on the Circular Economy. Discussed at board level, they have three clear strategy loops representing different avenues and opportunities of CE (scaling polyester loop, R&D loop, and regenerative loop). Adidas has clear goals around circular polyester and aims to replace all virgin polyester with recycled products where a solution exists. By the end of 2020, 60% of all polyester used for apparel and footwear ranges were recycled polyester demonstrating that circular thinking is already starting to scale.

What made the Adidas case so unique?

Concerning the end of life of their products, Adidas is aiming to implement a global product take back program to all key cities and markets where they will incentivize customers to bring in old Adidas clothes (in exchange for vouchers) so that the clothes can be re-made into new products. The Adidas strategy is to take back their own clothes - where they have certainty over the inputs and assembly - to make them into new products, thus creating a perfectly circular system.

What was so unique was their vision for this takeback program. Other companies in the study had much larger clothing collection programs, but the Adidas strategy is less about marketing and more circular in strategy. Being sure of the quality of the products will help Adidas transform old products into new products which is difficult if they know the exact inputs including fabric and chemical composition. While the global take back program is being implemented incrementally (as it takes time to scale), in the long term this could mean the difference between a marketing ploy and a real Circular Economy.

Going forward, are there any recommendations for Adidas?

While Adidas is proactive in advancing the Circular Economy, they currently have limited programs around promoting longevity and reparability of products. Quality is a key element to sportswear and there could be opportunities to more clearly integrate longevity and reparability into the value proposition of Adidas products. Furthermore, while they have ambitious goals concerning the Circular Economy, some of these goals could use more granularity. For example, while it is understandable that Adidas cannot yet commit to making certain products circular if there is currently no viable solution, it would be helpful to have a sense of what percent of the products do not have a solution at present.

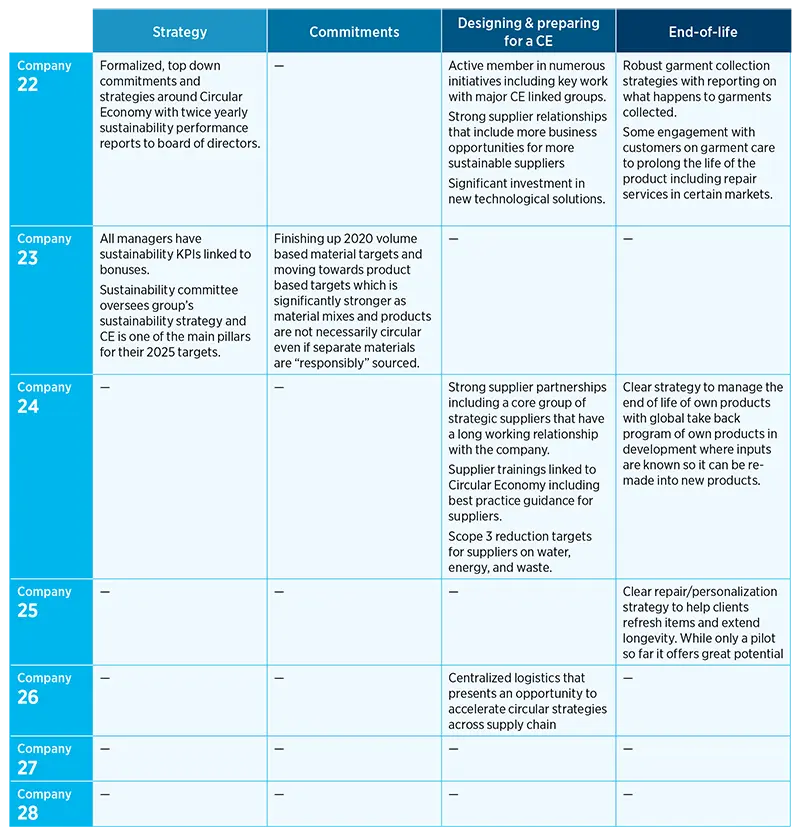

Table of best practices

The fashion industry

___________________

1. Cline, Elizabeth. “Overdressed: The Shockingly High Cost of Cheap Fashion” August 27 2013

2. Ellen MacArthur, A New Textile Economy, 2017.

3. Ellen MacArthur, A New Textiles Economy, 2017.

4. Ellen MacArthur, A New Textiles Economy, 2017.

5. International Energy Agency, Energy, Climate Change & Environment: 2016 insights (2016), p.113.

6. Compared to the IEA 2°C pathway 2050 which allows for 15.3 giga tons of CO2 equivalent.

7. Ellen MacArthur, A New Textiles Economy, 2017.

8. O’Connor, M.C., Inside the lonely fight against the biggest environmental problem you’ve never heard of, The Guardian (27 October 2014); International Union for Conservation of Nature, Primary microplastics in the oceans: A global evaluation of sources (2017), pp.20–21.

9. Ellen MacArthur, 2017

10. McKinsey & Company, Style that’s sustainable: A new fastfashion formula (2016).

11. EllenMacArthur, 2017.

12. EllenMacArthur, 2017.

13. Fachverband Textilrecycling, Konsum, Bedarf und Wiederverwendung von Bekleidung und Textilien in Deutschland (2016), p.37; Ellen MacArthur, 2017.

14. Pulse of fashion industry report.

15. https://www.nytimes.com/interactive/2020/08/06/magazine/fashion-sweatpants.html

16. Ellen MacArthur

17. Rodgers, L., Where do your old clothes go?, BBC (11 February 2015), http://www.bbc.co.uk/news/magazine-30227025

18. http://www.oecd.org/env/tools-evaluation/extendedproducerresponsibility.htm

19. Ellen MacArthur, 2017

20. For every kilogram of fabric, an estimated 0.58kg of various chemicals are used. Between 0.35 and 1.5kg of chemicals go into the production of 1kg of cotton textile (see Bluesign, Environmental Health & Safety (EHS) guidelines for brands and retailers (2011)).

21. Greenpeace, Dirty laundry: Unravelling the corporate connections to toxic water pollution in China (2011), p.70.

22. Mandatory EU Chemical Safety Regulation.

23. Zero Discharge of Hazardous Chemicals. Voluntary commitment to achieve greater transparency on chemical use in supply chains and commit to zero discharge of hazardous chemicals https://www.roadmaptozero.com/?locale=en.

24. Certifications include Bluesign, Cradle to Cradle, Oeko Tex Eco Passport