Summary

Robust consumption and government spending have supported US economic activity recently, but we see a mild deceleration in growth amid a rebalancing in US labour markets.

-

The US economy grew at a stronger than expected pace in the third quarter, but the pace was slower than Q2.

-

On inflation, although we may witness some volatility, the overall trajectory is declining, allowing the Fed to cut rates.

- Other central banks such as the ECB and the Bank of England are also likely to ease their policies.

US real GDP (inflation-adjusted GDP) growth for the quarter ended 30 Sept. came in above expectations at 2.8%, driven by strong consumption. This was slightly below Q2 growth. Looking ahead, we think the case for a soft landing (mild deceleration) of the US economy is intact. As labour markets gradually weaken, wages may be affected and this could impact consumption. Another important factor for future US growth would be government spending. In fact, expectations on government spending and fiscal deficits (excess of expenses over income) have already caused sharp movements in bond yields. In addition, monetary policy, economic growth and inflation would collectively affect yields, not just in the US but also in Europe and the UK. We think as inflation continues to fall, central banks could ease monetary policies and that it may support bonds in select geographies.

Actionable ideas

- Global bonds & European credit

Falling inflation, and the central banks in Europe and UK reducing rates may support the case for government bonds and quality EU credit.

- Multi-asset for income and stability

A multi asset approach combines the stability of government bonds with the potential for additional returns through quality credit and EM bonds.

This week at a glance

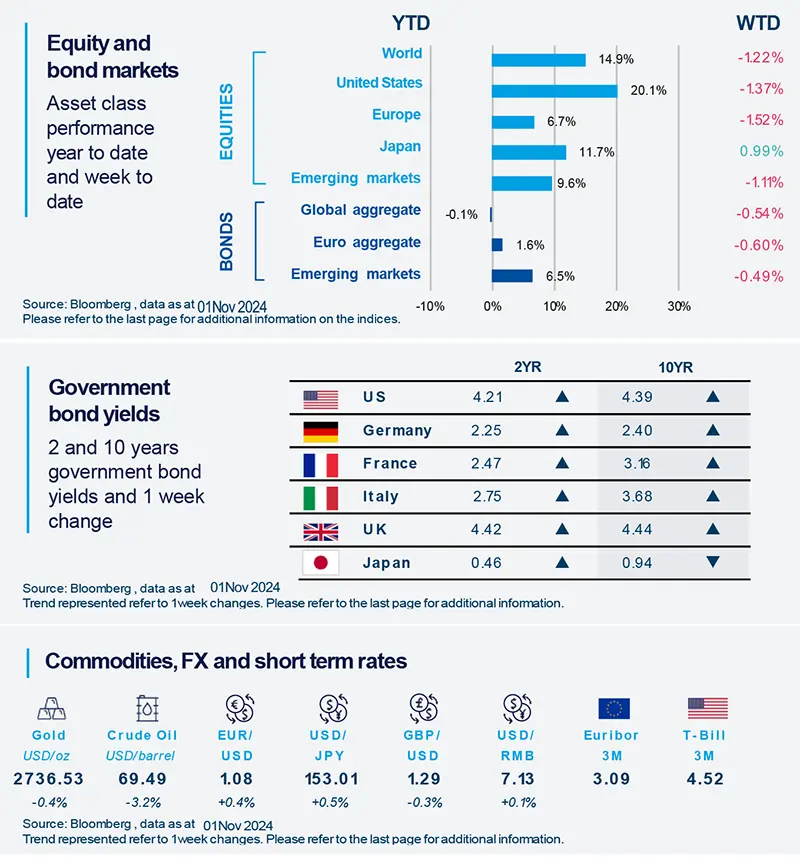

US stocks declined following mixed corporate earnings from some large tech companies. European equities also fell. In fixed income, bond yields rose on the back of concerns over high US debt and fiscal deficit. Geopolitical developments in the middle east pushed oil prices lower.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 1 November 2024. The chart shows the S&P 500 index and the S&P equal weighted index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US consumption holding up the economy

The Q3 growth data for US GDP indicated strong consumption and government spending. This poses some upside risks to our annual growth forecasts for 2024, but it doesn’t change our view of a mildly slowing US economy. Consumption, which is a large part of the economy, is expected to weaken as labour markets experience a mild slowdown. We also remain vigilant on government finances and fiscal deficit.

Europe

Eurozone growth surprised on the upside

GDP growth came in at a stronger-than-expected pace at 0.4% (quarter on quarter). This was led by robust activity in Spain and France, where the economy benefitted from the past Olympics. In addition, Germany dodged a contraction but Italy posted flat GDP growth. While the data are only preliminary, based on the individual countries it looks like private consumption has started to improve. But it seems investments are still suffering from the high rates environment.

Asia

Bank of Japan kept policy rates unchanged

The BoJ refrained from raising policy rates at its October meeting, but still appeared slightly hawkish, reinforcing our expectations of a rate hike in December. The central bank also seemed less concerned about market uncertainties and more confident on its inflation targets. However, any sharp market stress, such as the one seen in August, could lead the bank to delay rate hikes (low likelihood).

Key dates

|

5 Nov US ISM, Indonesia GDP, South Korea CPI |

6 Nov EZ PPI, Brazil monetary policy |

7 Nov FOMC decision, Germany and China trade balance |