Summary

- Election result: The outlook for the House of Representatives (House) and the Senate remains uncertain and the situation remains fluid. Republicans are still expected to have an eventual slender majority in the House, but a Democratic majority remains a possibility. The outcome for the Senate is also fluid, with it likely the Democrats will retain control of the Senate, though Republicans could still take control. The Democrats outperformed expectations and defied historical norms of losing seats during mid-term elections. In the Senate, the Democrats picked up one Republican seat in Pennsylvania, but there are four seats yet to be determined (three Democratic seats, one Republican seat).

- Key takeaways: Abortion resonated as an issue for voters and Generation Z turned out to vote, perhaps motivated by abortion rights, the environment and concerns over the threat to democracy. Voters shunned election deniers by motivating those voters concerned over democracy following the 6 January 2021 insurrection of the US Capitol building. Arguably, Florida Governor Ron DeSantis is now the frontrunner in the GOP primary.

- Market reaction and investment implications: The market expected a red tide, where Republicans took control of the House and the Senate, so the initial reaction was for some sell-off in equities, alongside a muted reaction on the Treasury market and on the dollar. Equities tend to perform well following mid-term elections, as the risk linked to political uncertainty fades. Having said that, this has not been a major driver of performance this year, as the focus has been on inflation, Fed hawkishness, the recession risk and geopolitics. Moreover, if a divided government – between the White house and Congress – does eventuate, this should not lead to major policy changes. In that case, the positive impact could be more muted this time. As such, we expect a positive-to-neutral impact on equities. On sectors, healthcare usually outperforms after mid-term elections.

- Potential agenda: We are unlikely to see any meaningful legislation in the next two years. Nonetheless, we would expect a Republican House majority to seek higher spending on defence and border security, an energy infrastructure bill and an extension of certain business tax breaks. Overall, tight fiscal policy would not aggravate the inflation situation in the United States. This could mean the Fed might be closer to a peak in rates.

- Implications on US foreign policy: We expect a tough stance against China on technology, national security and Taiwan. A larger Republican influence over policymaking would see the Democrats and Republicans agree on very few domestic policy issues. Limiting China’s perceived threat to the US economy and its security ambitions is one of the few topics both sides agree on. We also expect more export controls targeting China, especially in the technology sector (e.g., artificial intelligence, quantum computing, biotech and any high-tech tools linked to these sectors).

- Prospects for the United States-Europe relationship: The United States-EU relationship will also face hurdles next year. For one, the EU’s relationship with China will be increasingly affected by US decisions, making it difficult to maintain status-quo business relations with China. While the EU -- and especially Germany -- wants to ‘de-risk’ its relationship with China, there is no appetite for a ‘decoupling’ from China, akin to that of the United States. EU-US relations will be strained given the United States’ recent protectionist Inflation Reduction Act (IRA), which subsidises domestic industry. Trade tensions between the EU and the United States are likely next year. If the United States keeps up military aid supplies to Ukraine at current levels, the likelihood for the war to last longer and escalate increases. However, if military support begins to decrease because the Republicans increasingly voice their disapproval over the sums spent on supporting the war, a ceasefire between Russia and Ukraine becomes more likely.

Election outcome

The Democrats outperformed expectations and defied historical norms of losing seats during mid-term elections.

The day after Election Day, the outlook for the House and Senate remains uncertain and the situation remains fluid. Coming into the mid-term elections, the Republican Party was expected to sweep control of Congress in a red tide. Market expectations -- according to Predictit -- indicated a 91% probability of Republicans taking control of the House and 75% odds of Republicans taking over the Senate as of 4 November 2022. Republicans are still expected to have an eventual slender majority in the House, but a Democratic majority is still a possibility. However, everything needs to break perfectly for the Democrats to retain control.

The outcome for the Senate is also fluid, with it likely the Democrats will retain control, though Republicans could still take control. The Democrats outperformed expectations and defied historical norms of losing seats during mid-term elections. Since the post-Truman era, the party in control of the Executive branch lose an average of 30 House seats during mid-term elections. As of 9 November 2022, the Democrats have lost a net of six seats and there are 58 seats yet to be determined. In the Senate, the Democrats picked up one Republican seat in Pennsylvania, but there are four seats yet to be determined (three Democratic seats, one Republican seat). The Democratic Party defied poor political and economic fundamentals. However, the political fundamentals remain challenging for President Biden. Amundi’s poll of polls revealed President Biden’s approval rating was just 41.7% as of 24 October 2022, with a disapproval rating of 53.3%. An approval rating below 42% historically correlates with a loss of 35-40 seats in the House, based on a Gallup analysis going back to the end of WW2.

Key take aways

- Abortion resonated as an issue for voters. In the network exit poll, voters cited abortion as the most important issue in their vote and voters broke for Democrats over Republicans by 76% vs. 23%.

- Generation Z (voters aged 18-29) turned out to vote, perhaps motivated by abortion rights, the environment and concerns over the threat to democracy, making up 12-13% of the electorate, but voted for Democrats by a margin of 63% to 35% in the network exit poll.

- Suburban women turned out to vote. Women made up 52% of the electorate and voted Democratic by a margin of 53% vs. 45% in the network exit poll.

- Independent voters have been a good indicator of the winning party for the last four cycles and they went for Democrats by 2% in the network exit poll.

- Former President Donald Trump is a big loser. If the Democrats end up retaining control of the Senate, it is partly due to Trump's choice of weak candidates, a sentiment voiced by Senate Minority leader Mitch McConnell. Trump’s choice of candidates in Pennsylvania, Arizona and Georgia have either lost or are trailing in their races. The Republican nominee won only in Ohio.

- Voters shunned election deniers by motivating those voters concerned over democracy following the 6 January 2021 insurrection of the US Capitol building. Voters snubbed the overwhelming majority of election-denier secretary of state candidates (Michigan, Pennsylvania and Arizona). This was shown by the network exit poll, where 80% of Americans said they believed elections were free and fair.

- Florida Governor Ron DeSantis is now arguably the frontrunner in the GOP primary. He won the state by almost 20%. This could set up a contentious nomination battle between Former President Trump and Governor DeSantis.

Market reaction and investment implications

We argue that part of the reason for the fairly muted response by markets is due to the expectation that a Republican takeover of the House would lead to a divided government.

The market expected a red tide, where Republicans took control of the House and the Senate, so the initial reaction was some sell-off in equities, alongside a muted reaction on the Treasury market and on the dollar. We argue that part of reason for the fairly muted response by markets is due to the expectation that a Republican takeover of the House would lead to a divided government. Our analysis has shown that under this scenario, the S&P 500 has rallied approximately 13.5% on an annual basis compared with an all-Democratic government, which has seen the S&P 500 rally by about 10%. We have also seen an outperformance in ten-year Treasury returns, with a divided government seeing it rise about 8%, while a one-party Democratic rule has seen ten-year Treasury returns rising only about 1%.

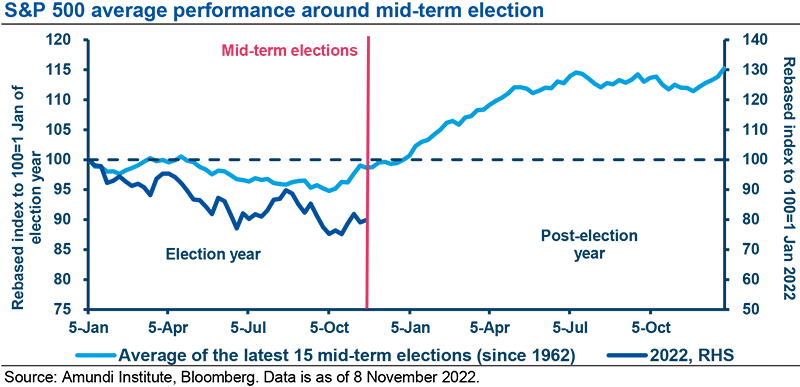

Usually, equities tend to perform well following mid-term elections, as the risk linked to political uncertainty fades. Having said that, this has not been a major driver of performance this year, as the focus has been on inflation, Fed hawkishness, the recession risk and geopolitics. Moreover, if a a divided government -- between the White house and Congress -- does eventuate, it should not lead to major policy changes. In that case, the positive impact could be more muted this time. As such, we expect a positive-to-neutral impact on equities. On sectors, healthcare usually outperforms after mid-term elections.

Equities tend to perform well following mid-term elections, as the risk linked to political uncertainty fades.

Potential agenda

We are unlikely to see any meaningful legislation in the next two years. The likely thin Republican majority does not signal a legislative mandate. Nonetheless, we would expect a House Republican majority to seek higher spending on defence and border security, an energy infrastructure bill and an extension of certain business tax breaks. We are also likely to see fiscal austerity similar to the Obama years, where Republicans demanded spending cuts for any spending increases. Overall, tight fiscal policy would not aggravate the inflation situation in the United States. On the margins, this could mean the Fed might be closer to a peak in rates and it certainly would not put pressure on the Fed to quicken the pace of rate hikes. Overall, financial markets like a divided government since it means we are unlikely to see populist policies, such as higher taxes and more regulation, that may be perceived as market unfriendly. In the unlikely probability of the House remaining under Democratic control, we could see parts of Biden’s Build Back Better plan being enacted, such as the Child Tax Credit, and more healthcare, infrastructure and green energy spending. Democrats will look to hike corporate and upper-income taxes. We think it is unlikely to pass the fiscal cliff or any meaningful piece of legislation during the lame duck session of Congress. The business tax provisions and Child Tax Credit are unlikely to garner support.

Implications on US foreign policy

We expect broad bipartisan support for continued military assistance to Ukraine and the US maintaining a tough stance against China on technology, national security, and Taiwan.

We expect a tough stance against China on technology, national security and Taiwan. A larger Republican influence over policymaking will see the Democrats and Republicans agree on very few domestic policy issues. Limiting China’s perceived threat to the US economy and security ambitions is one of the few topics both sides agree on. Republicans and Democrats are likely to compete over who is ‘tougher’ on China. As such, we expect more controversial actions next year, in line with Speaker of the House Nancy Pelosi’s recent visit to Taiwan. We also expect more export controls targeting China, especially in the technology sector (e.g., artificial intelligence, quantum computing, biotech and any high-tech tools linked to these sectors). Research and university collaboration will also be under scrutiny, while US passport and Green Card holders operating in China in sensitive sectors may face more restrictions. The Biden administration is merging security concerns with a protectionist agenda. The aim is to support a nascent domestic industry in areas such as climate change and technology, while also seeking to put competitors at a disadvantage.

Prospects for the United States-Europe relationship and fallout over the Ukraine war

If military support begins to decrease because the Republicans increasingly voice their disapproval over the sums spent supporting the war, a ceasefire between Russia and Ukraine becomes more likely.

The United States-EU relationship will also face hurdles next year. For one, the EU’s relationship with China will be increasingly affected by US decisions, making it difficult to maintain status-quo business relations with China. While the EU -- and especially Germany -- wants to ‘de-risk’ its relationship with China, there is no appetite for a ‘decoupling’ from China, akin to that of the United States. The EU will also be aware that by 2024, either former President Donald Trump or another ‘Trump-like’ Republican may take the White House, meaning the bloc cannot rely fully on the United States and it will therefore seek to strengthen its strategic interests that are distinct from those of the United States. For another, EU-US relations will be strained given the United States’ recent protectionist IRA subsidising domestic industry (American electric vehicle producers, among others), which undermines European business interests and could lead to an outflow of European investment and jobs to the United States. The EU is seeking to solve its concerns over the IRA at the upcoming EU-US Trade and Technology Council meeting in December. However, a substantial rewrite of the policy would require legal changes, which are unlikely. While individual company concessions may materialise to assuage European concerns, Biden’s ability to strike deals will be limited in an increasingly polarised domestic political landscape. Therefore, trade tensions between the EU and the United States are likely next year. For Europe, much is at stake when it comes to the US’s support for Ukraine. If the United States keeps up military aid supplies to Ukraine at current levels despite the divided government, the likelihood the war will last longer and escalate increases, as Ukraine would have little incentive to sit down for talks with Russia to seek to end the conflict. However, if military support begins to decrease -- as we expect -- because the Republicans increasingly voice their disapproval over the sums spent supporting the war, a ceasefire between Russia and Ukraine becomes more likely, most likely in H2 2023.