Summary

The surprise in US services inflation suggests the Fed may be more cautious before starting to cut rates.

- The January inflation data showed a broad-based reacceleration of services prices.

- While the slowdown in inflation should continue, reaching the 2% target may take more time.

- A key implication is that the Fed may wait slightly longer before cutting rates.

The January inflation data in the US is not totally reassuring for the Fed. While goods prices continue to slow down, core services inflation is picking up, notably in Shelters, Medical care, and Education & Communication.

This could mean that reaching the 2% Fed inflation target will require more time than previously anticipated. At the latest meeting, Federal Reserve Chairman J. Powell already mentioned that more reassuring data on price patterns would be needed before rate cuts could start. Moreover, the US economy remained surprisingly resilient.

At the margin, this latest set of data may make the Fed even more cautious. We expect the first rate cut in the May meeting, and an overall gradual cut.

Actionable ideas

- Flexible in US fixed income

After the recent rise, yields in US bonds are back at appealing levels. We see value in US government and high quality bonds. - Seek diversified* opportunities in global bonds

Global government bonds and high quality credit can offer investors appealing income and the opportunity to benefit from different rates and currency dynamics.

*Diversification does not guarantee a profit or protect against a loss.

This week at a glance

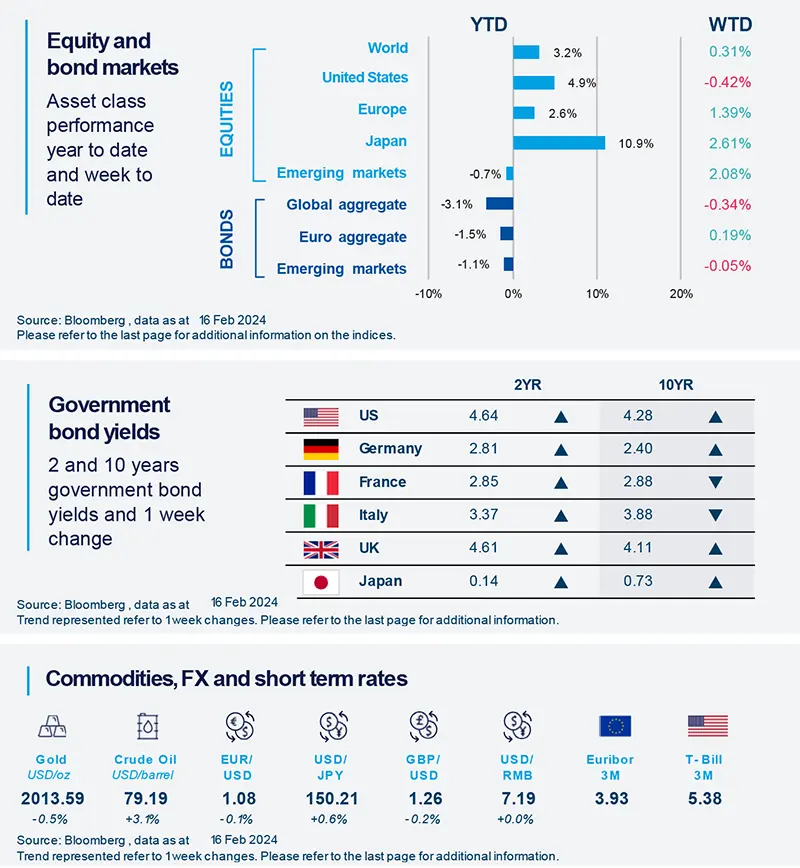

US yields jumped after the above-forecast inflation figures, moderating their rise due to disappointing activity data. Similar moves were observed on the dollar. Equities indices were mixed, flattish in the US but advancing in Europe.

Amundi Investment Institute Macro Focus

Americas

Inflation in the US surprised the market on the upside in January’s print.

US inflation data showed that the last mile of disinflation will be slow. Prices increased by more than expected (3.1% for overall inflation and 3.9% for the index excluding food and energy, respectively). Goods’ prices (excluding food and energy) continued to decelerate, but services inflation (shelters and medical services above all) saw an uplift compared to last month.

Europe

Q4 GDP print confirms flattish growth, while December industrial production sends a positive signal.

Q4 2023 GDP growth was flat – avoiding a technical recession – with GDP growing only 0.1% over the four quarters of 2023. Going forward we expect moderate growth, with downside risks due to tight monetary policy and moderating fiscal support. However, industrial production expanded for the 2nd consecutive month in December, posting a favourable sign.

Asia

Japanese economy fell into recession in H2 2023 but 2023 remained strong with 1.1%yoy growth.

Real GDP contracted by 0.1% in Q4 2023 and surprised markets (+0.2%) and our (+0.4%) expectations of positive growth. The weakness of domestic demand outweighed exports’ performance. The negative surprise came from private consumption that contracted by 0.2% for the third consecutive quarters. The third quarter was also revised from -0.5% to -0.8%. Over the 4 quarters of 2023, the economy still grew by 1.1%.

Key Dates

|

20 Feb China monetary policy |

22 Feb |

23 Feb Germany GDP |