Summary

Concerns over US economic growth persist, and this highlights the importance of a global approach to investing in the developed and emerging markets.

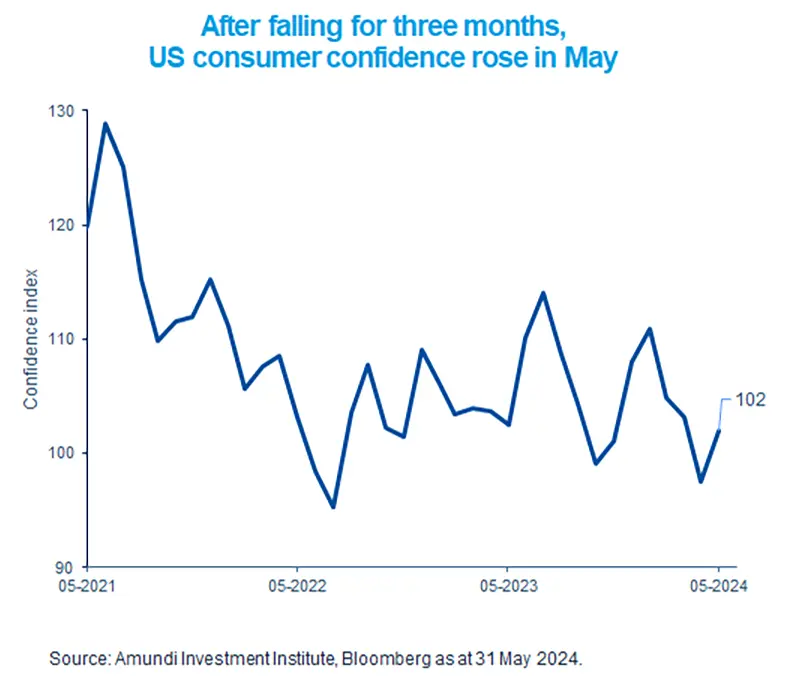

- A latest survey reading of US consumers rose in May, after declining for three months in a row.

- However, concerns over high prices, especially food and groceries, and high rates may impact US consumption later.

- Investors may consider other international markets for attractively-priced asset classes.

US consumer confidence came in better-than-expected in May, rising for the first time in the past four months. This could partly be a result of improving sentiment among the high income earners. However, if we look at past few months, consumer confidence has actually been deteriorating. Looking ahead, high interest rates, inflation above the Fed’s targets and rising household debt could affect overall consumption. A large part of the US economy is driven by consumption and thus any fragility on this front may affect growth.

Already, we are seeing weakness in labour markets and rising consumer delinquencies on loans. Hence, to achieve their objectives, investors may consider quality businesses across the world to meet their long term goals.

Actionable ideas

- Global equities

Global divergences and improving economic outlooks may present opportunities in regions such as Europe, UK and emerging markets.

- Multi asset

A multi asset approach allows investors to stay flexible and potentially benefit from the growth potential of diverse* asset classes and regions.

This week at a glance

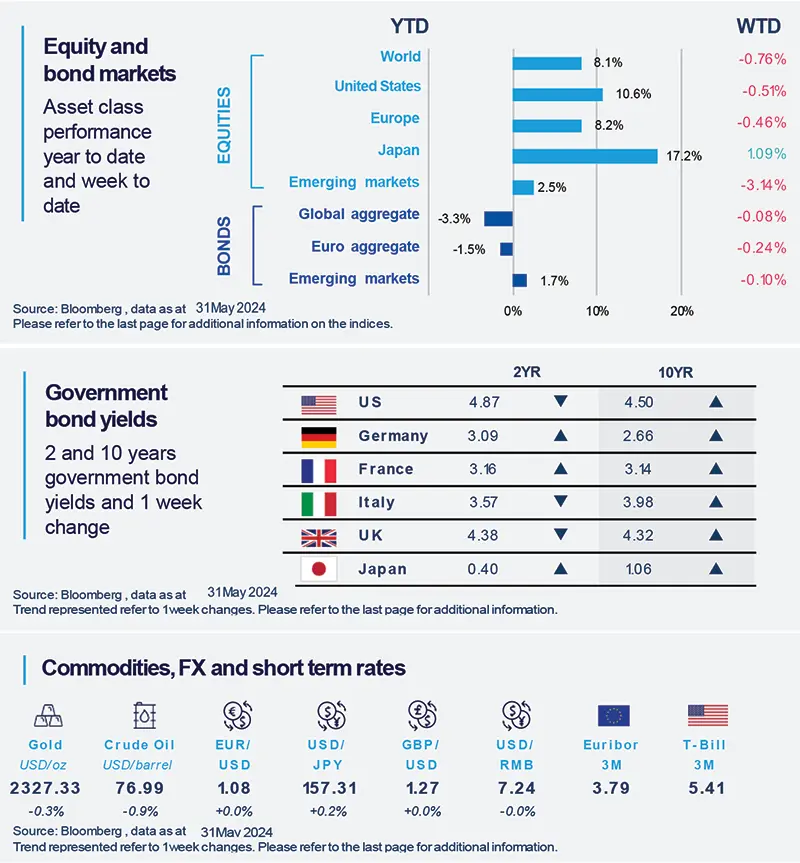

Most equity markets fell due to concerns over slowing US economic growth and weak consumer spending. In bonds, long term yields rose after sales of new US Treasuries, renewed fears of excessive government debt globally. Gold prices marginally declined over the week.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 31 May 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

US GDP growth lower-than-expected in first quarter.

The economy expanded 1.3% in the first quarter. The number was below previous estimates, primarily due to weak consumer spending on durable goods. It seems consumers were affected by high interest rates in this category. However, services consumption remained strong and real disposable income (income after tax etc.) also improved. Looking ahead, domestic demand is likely to stay robust in the first half, but we expect a deceleration later in the year.

Europe

Eurozone inflation picked up slightly in May.

Consumer inflation accelerated to 2.6%, year-on-year, in May compared with 2.4% in April. This was mainly due to services inflation, which is likely to decline only gradually. The number was broadly in line with our expectations and we believe the overall inflation trend should continue to decline. However, some components such as services could remain sticky and we remain vigilant on them.

Asia

India’s sovereign rating outlook upgraded.

A leading credit rating agency upgraded India’s credit rating outlook from stable to positive. In general, such a revision to the outlook eventually leads to a sovereign rating upgrade in the following couple of years. The country’s strong economic performance and government’s improving fiscal deficit (excess of expenditure over income) are the main reasons for this revision. This upgrade came just few days before the outcome of the national elections.

Key Dates

|

4 June Brazil GDP, South Korea CPI |

6 June ECB policy, EZ retail 7 June sales |

7 June US labour markets, EZ GDP, RBI policy |