Summary

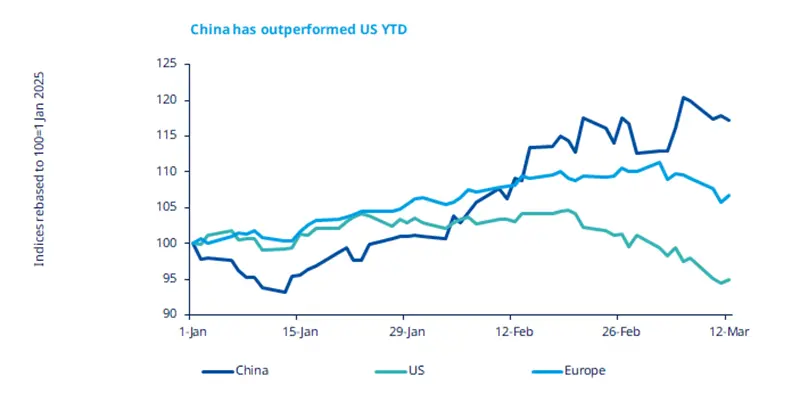

The weakness in U.S. stocks reinforces our conviction that a rotation away from expensive U.S. large-cap stocks may persist. We also believe there is more value to be explored in regions such as emerging markets, including China.

- China’s policy makers are ready to provide additional easing should domestic consumption fail to improve.

- The recent news of the development of Chinese cheaper AI systems has lifted sentiment in the Chinese tech sector.

Weakness in US markets may boost foreign investors’ appetite for China and other emerging markets such as India.

Source: Amundi Investment Institute, Bloomberg.Data is for MSCI Indices from 1 Jan to 12 March 2025. YTD = year to date

US equities underperformed other main global markets so far this year due to concerns about the health of the US economy, in light of the erratic statements by President Trump on tariffs, and recent weak economic data. This has led to a strong rotation out of US mega caps into Europe and China equity. Europe has benefitted from recent announcements on defence spending plan and talks towards a ceasefire in Ukraine. In Asia, Chinese equities’ performance has been even stronger, benefitting from the supportive policy stance, despite uncertainty on US tariffs. The arrival of DeepSeek and its cheap AI (artificial intelligence) model has also played a key role in supporting China’s tech sector, which has been the main contributor to the China rally.

Actionable ideas

- Emerging market equities

A weaker dollar and a US economic slowdown should support EM equities. The region could offer diverse* opportunities based on domestic consumption and exports potential.

- Chinese markets

Chinese markets may benefit from the strong rotation out of US mega caps, supported by better sentiment on the Chinese tech sector and domestic policy stimulus.

*Diversification does not guarantee a profit or protect against a loss.

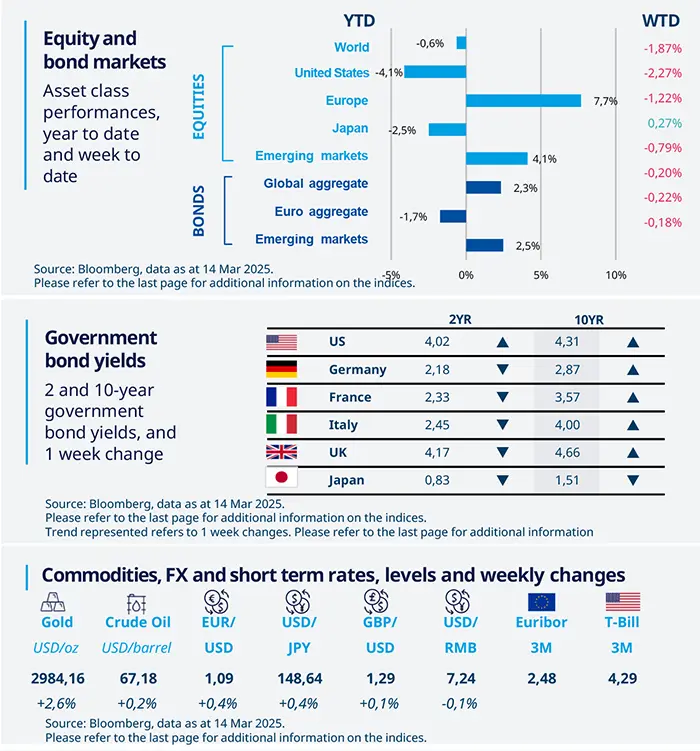

This week at a glance

Stocks fell due to renewed concerns of an escalating global trade war. The fall was led by US equities. Markets are worried that the trade tensions could affect economic growth. Unsurprisingly, this uncertainty pushed up the prices of safe-haven gold. However, bond yields were mixed.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, 14 March 2025. The chart shows rebased MSCI indices for the United States, Germany, and China.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US inflation for February slower than expected

US CPI for February decelerated to 2.8% (year-on-year), compared with 3.0% in January. Core inflation (CPI excluding food and energy costs) also slowed. The numbers might provide some reprieve to markets who are getting concerned about the effect of import tariffs. However, we think it may be a bit early to take a sigh of relief. This softening in inflation may well be indicative of subdued consumer demand. We will assess the data for the coming months to gain a clearer picture.

Europe

France inflation decelerated

Inflation slowed sharply in France in February to 0.9% (year-on-year), in line with the preliminary estimate. The number is less than 1% for the first time since February 2021. On a monthly basis, the Eurozone CPI was lower than initially announced. Having said that it is important to note ECB President Lagarde’s views that fragmentation of trade and defence spending could lead to higher inflation in the future. So, we stay vigilant.

Asia

India inflation slowed in February

Headline inflation printed lower-than-expected in February at 3.6% (year-on-year), a deceleration from January’s 4.3%. This was primarily a result of a sharp deceleration in food prices. While core inflation (inflation excluding food and energy) remained contained, it marginally increased due to higher gold prices. All in all, we think a benign inflation environment may trigger an earlier-than-expected rate cut from Reserve Bank of India in early April.

Key dates

17 Mar US retail sales, Brazil GDP | 19 Mar Fed monetary policy, Bank of Japan policy, EZ CPI | 20 Mar Bank of England rate, South Africa policy rate |