Summary

DeepSeek, China’s new entrant in the field of artificial intelligence, has shaken the highly-valued US tech sector. Investors should continue to diversify* their equity exposures in search of more attractive opportunities at a global level.

- The week served as a wake-up call for investors' high expectations regarding certain AI stocks.

- The economic backdrop remains supportive for equities, but investors may pay more attention to valuations.

- We expect the rotation towards less expensive areas of the market to continue.

Recent developments in artificial intelligence (AI) highlight how quickly the tech sector evolves, impacting companies that have built competitive advantages, and sparking investor enthusiasm in recent months. For these companies, the arrival of seemingly more efficient open-source AI models increases uncertainty regarding future earnings and investment plans. In our view, markets will increase scrutiny of their ability to meet high profit expectations. Considering their high valuations and weight in US equity indices, we can expect some volatility to persist in the market. This could favour a broadening of the equity rally and a healthy rotation towards sectors with higher earnings visibility, such as financials, healthcare, and consumer staples. In the tech sector, the environment becomes more favourable for stock selection, from early winners in hardware and data centres to companies involved in software and devices.

Actionable ideas

- Explore opportunities from market rotation

With increased scrutiny on US market valuations, investors should consider a globally diversified* equity portfolio and seek potential opportunities in Europe and Japan.

- Look beyond mega-caps in US markets

Expectations for some tech mega cap stocks are still too high, as some uncertainty about future growth looms. Investors could diversify* and look for some less expensive areas of the market.

*Diversification does not guarantee a profit or protect against losses.

This week at a glance

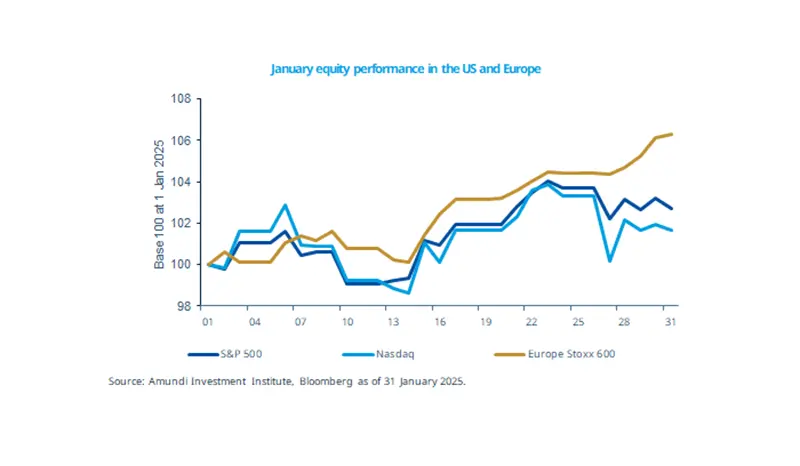

Equity markets showed signs of rotation in the aftermath of the DeepSeek announcement, with the technological Nasdaq index underperforming the rest of the US market and Europe. Bond yields were little changed, while gold touched new all-time highs.

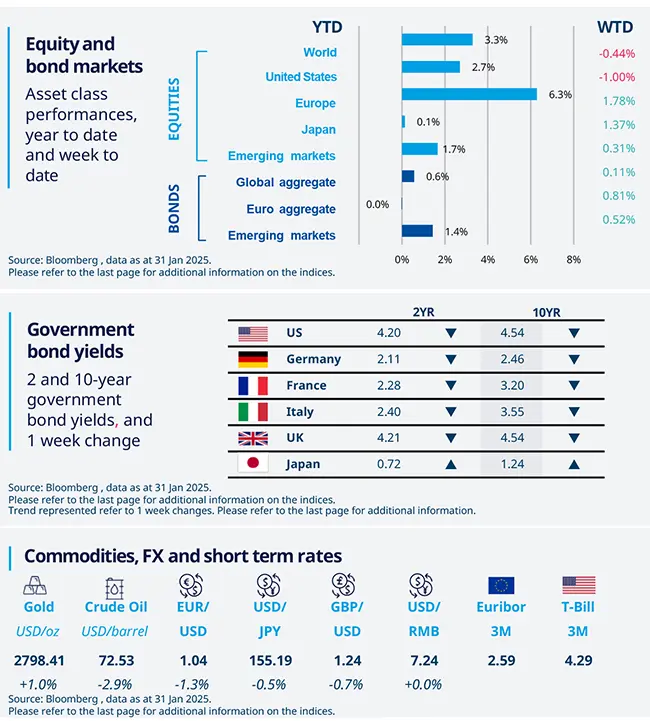

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 31 January 2025. The chart shows US CPI YoY growth. *Diversification does not guarantee a profit or protect against a loss.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

The Federal Reserve remained on hold

The US Federal Reserve (Fed) maintained an unchanged policy rate, as the decline in inflation towards the 2% target is slower than anticipated. Given the high level of policy uncertainty, we foresee a slightly higher hurdle for the Fed to resume its easing path. However, at current interest rate levels, monetary policy remains restrictive. Therefore, we continue to expect rates to decrease in the first half of the year.

Europe

ECB cut rates

The ECB cut its policy rate as expected and moved away from its longstanding mantra that rates would remain sufficiently restrictive. This is an acknowledgment that the weak growth backdrop will soon help it to achieve its inflation target. We continue to expect substantial further easing this year. We recently revised our GDP growth forecasts downward for the eurozone due to higher uncertainty on the policy front, and signs of a weak recovery in domestic demand.

Asia

China PMI signals softening of the economy

Following the positive economic momentum at the end of 2024, China’s January PMIs are signalling a renewed softening in the economy in both the Manufacturing sector, contracting to 49.1 (vs 50.1 in December) and Non- Manufacturing sector, at 50.2 (vs 52.2 in December). The fiscal stimulus, which details are expected in the coming months, should help mitigate the structural downward trend.

Key dates

03 Feb EU CPI (YoY), US ISM | 06 Feb BoE decision | 07 Feb US Nonfarm Payrolls, RBI |