Summary

Diversification* and a balanced approach are now more important than ever, as the news on tariffs, negotiations, and retaliations will keep markets volatile

- Trump has started to impose tariffs. His approach is transactional and subject to continuous negotiations.

- We expect tariffs to be negative for growth and add inflationary pressure starting from the second half of 2025.

- We believe this will call for further diversification*, expanding the investment universe both in equities and bonds.

Trump’s tariff announcements have taken centre stage, with markets focusing on their impact on growth and inflation. Tariffs are primarily directed at countries with high trade deficits with the United States, starting with Mexico, Canada (currently delayed), and China. Our simulations indicate that tariffs may negatively affect economic growth and increase inflation in both the country imposing them and those affected. The size, timing, and sequence of these measures will be crucial for understanding their final impact on macro fundamentals and monetary policy responses. For this reason, we expect all players to negotiate and strive to avoid a full-blown trade war. China can implement fiscal support measures, allowing it to reallocate production chains, while Europe has less flexibility, but could accelerate reforms and investments. The situation remains fluid, with volatility dominating the markets.

Actionable ideas

- Seek diversification* with a multi-asset approach

We believe rising inflation risks stemming from tariffs calls for further diversification* across different asset classes.

- Diversify* in equities with a focus on dividends

In our view dividend stocks offer attractive valuations and a valid source of diversification* to the US equity market, thanks to their different sector mix.

*Diversification does not guarantee a profit or protect against losses.

This week at a glance

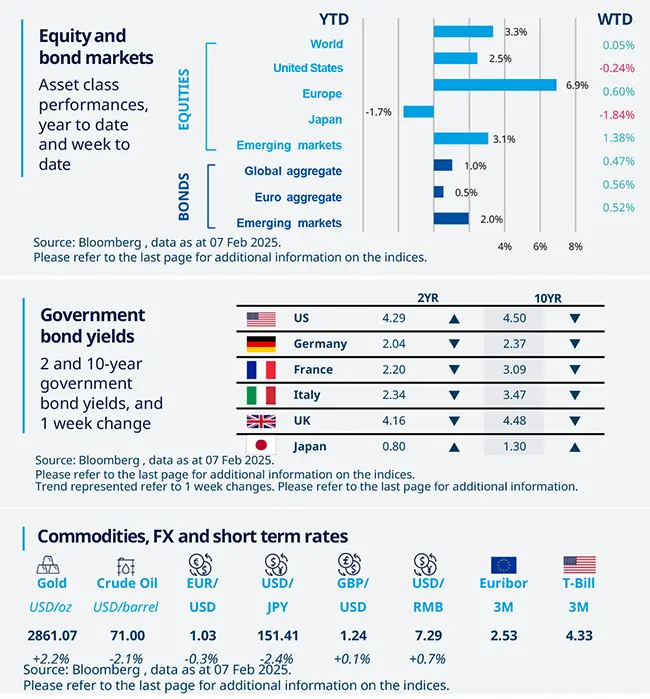

Global equity markets were little changed over the week, except in China, where the tech sector gained from enthusiasm around the AI company DeepSeek. Gold remained in high demand, reaching new highs, while oil fell for the third consecutive week amid concerns about demand.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 31 January 2025. The chart shows US CPI YoY growth. *Diversification does not guarantee a profit or protect against a loss.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US ISM surveys move into opposite directions

The January ISM manufacturing index increased to 50.9 from 49.2, back into the expansionary area for the first time in over two years. However, the new administration’s tariff policy may cloud the outlook for the sector if the main US partners retaliate. The ISM services index fell to 52.8 from 54.0, due to lower readings for the new orders and business activity components. The index remains consistent with solid service-sector growth, which appears untouched by tariff-related uncertainty for now.

Europe

BoE cut rates amid stagflationary scenario

The BoE cut rates by 25bp as expected. In line with our recent downward revisions to the UK growth forecast, the BoE also acknowledged the weaker momentum for the UK economy and cut its 2025 growth projections from 1.50% to 0.75%. On the inflation front, stickiness remains. Markets are now pricing in three additional rate cuts to end-2025, with rates at 3.75% by year-end, in line with our initial estimates.

Asia

India budget points to fiscal consolidation

The fiscal deficit for FY26 projects the budget deficit to shrink to 4.4% of GDP from 4.9% currently. The income tax structure has been revised to enhance disposable income for the middle class. Food subsidies are set to increase. Enhanced rural schemes are anticipated to improve economic conditions in rural areas. After the announcement, the RBI cut its benchmark interest rate by 25bp to 6.25% to support economic growth.

Key dates

12 Feb US CPI and core CPI, Fed Powell’s testimony, IND CPI | 13 Feb UK GDP, | 14 Feb EZ GDP, US retail sales and industrial production |