Summary

A Trump-Biden rematch looks likely in November. As we move closer to the elections, market uncertainty will rise given the candidates’ divergent approach to foreign policy and geopolitics.

- A Trump vs Biden rematch is most likely in November elections.

- Both candidates have different views on geopolitics and this could keep markets volatile.

- Investors should stay vigilant on such uncertainty and explore opportunities across global markets.

The recent Super Tuesday result points to a tough election battle between Donald Trump and President Joe Biden. Trump is likely to secure a Republican Presidential nomination, after Nikki Haley announced her exit from the Republican primary. On the other hand, Biden performed strongly, highlighting his appeal among Democratic voters.

Interestingly, since 1949 (chart), average returns from US equities have been much lower in an election year (7.4%) than in a pre-election year (16.1%). Last year, the US market performance was very strong with 24.2%. This year we expect market uncertainty to rise owing to aggressive political campaigning by both the candidates. We got a hint of that from the campaigning in President Biden’s State of the Union address.

Actionable ideas

- Global equities

US equities have performed well this year. But political campaigning may trigger volatility which may be an opportunity to explore attractive global segments in EM Asia, Japan, Europe. - Multi Asset investing in times of uncertainty

Yields on bonds are attractive while risk assets could also benefit later in a scenario of slowdown followed by a recovery. Hence, a diversified* stance would help capture this evolution.

*Diversification does not guarantee a profit or protect against a loss.

This week at a glance

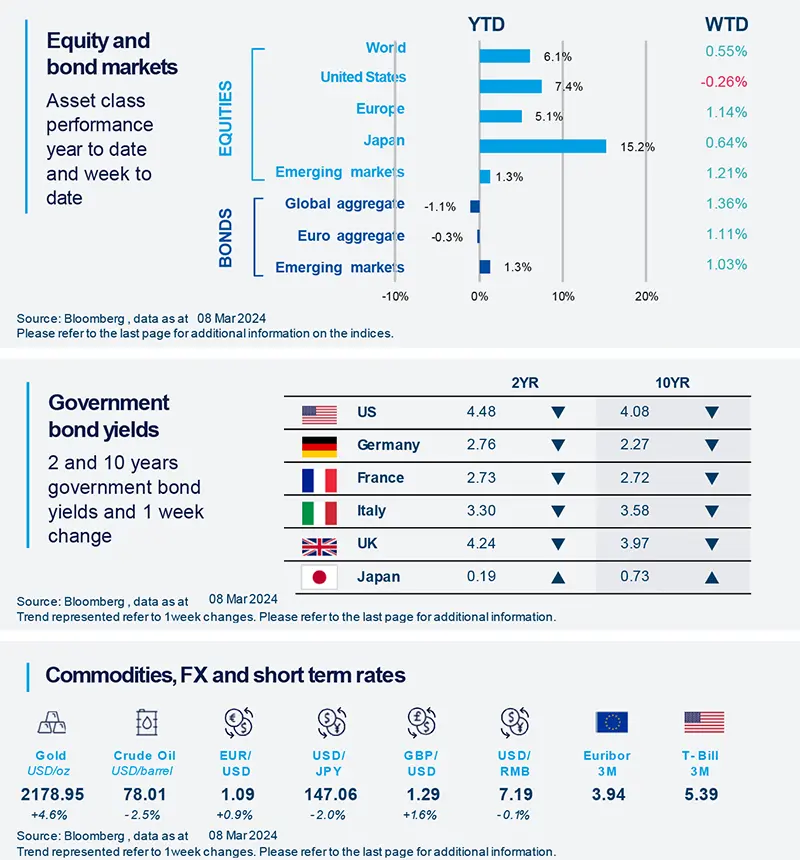

Global and European stocks were buoyed by central bank comments as the ECB signalled success in controlling inflation. Indications of rate cuts by this year led US and European yields to decline, although Japanese yields were marginally up. In metals, gold ended the week higher.

Amundi Investment Institute Macro Focus

Americas

Fed indicates modest improvement in activity.

The Fed Beige Book reported growth in activity in the majority of districts. But some districts signalled that consumer spending is losing steam as price-sensitive households are reducing spending on discretionary goods. Demand and supply of workers is also coming into a better balance, with moderation in wages and wage growth expectations now closer to historical averages.

Europe

ECB downgrades this year’s growth and inflation forecasts.

In its latest policy meeting, the ECB President Lagarde presented the bank’s current stance on interest rates and unveiled the latest forecasts for the Euro Area. The ECB marginally reduced 2024 growth forecast to 0.6% and also downgraded its inflation forecasts. Headline inflation is now forecasted at 2.3% for 2024. Importantly, the bank sees headline inflation stabilising at its 2% target in 2025.

Asia

National People’s Congress (NPC) in China.

The releases from the NPC show that policy stance remains complacently passive and unchanged from three months ago. This is despite the pressing economic challenges and market expectations for additional stimulus. With a moderately more expansionary fiscal deficit for the country, we expect low inflation to persist and GDP growth to undershoot the government’s 5% target in 2024.

Key Dates

|

12 Mar CPI: US, Germany, |

13 Mar |

15 Mar China lending rate, US |