Summary

- We are entering a tough phase of the regime shift, as the risks over economic growth add to the already hot inflationary backdrop. This means that stagflation fears will continue to drive the market and risk assets are likely to remain very volatile, particularly the most indebted companies and those with still excessive valuations.

- Central banks have now acknowledged the inflation problem and changed their tone. They seem ready to act to protect their credibility, at least temporarily. However, they will probably not go too far and markets have already moved to incorporate their hawkishness. The extraordinary ECB meeting is a case in point of a central bank struggling to provide the market with a clear monetary compass and framework in a regime shift. In fixed income this calls for a neutral duration stance and a focus on quality credit and liquidity.

- In DM equities we remain cautious as the earnings outlook is still too optimistic, in our view, and the risk is to the downside. The current repricing is taking most of the overvaluation out of the market, but current levels are vulnerable to any deterioration in corporate fundamentals. Companies’ earnings resilience and pricing power will be key drivers of the great discrimination in equity markets. Our forecast of a possible earnings recession in the EU leads us to maintain a more careful stance on Europe and supports our preference for US vs. EU equity.

- Regionally, we find Chinese equities more attractive as these are more insulated from the current turmoil emanating from the developed world. They should also benefit from the reopening of the Chinese economy, as well as the country’s lack of inflationary pressure and current policy support.

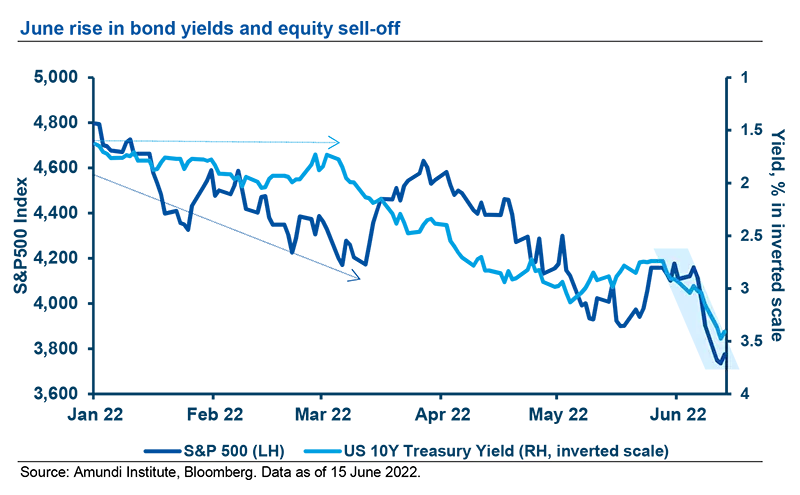

Dramatic price action has taken place over the past few days, following last Friday’s hot US inflation print of 8.6% YoY, a new 40-year high and an unexpected acceleration.

The US equity market has dropped almost 7% MTD, bringing the total YTD performance for the S&P 500 index to -21%, meaning it has officially entered a bear market phase. Bonds have been equally shaken as 10-year Treasury yields rose to above 3.3%, a level not seen since 2011.

In Europe a surge in bond yields followed the hawkish stance at the last ECB meeting, driving European equities to their lowest levels since March 2021 and Italian BTP yields to above 4% for the first time since the end of 2013. This prompted the ECB to announce an emergency meeting to tackle the market sell-off and avoid any fragmentation risk in the financial markets.

With rising risks on growth, risk assets remain under pressure. Bonds may continue to see some more limited upward pressure, as central banks try to assert their credibility.

The latest events are a reminder of the regime shift we are currently in, with rising stagflationary risks as we continue to see upward revisions on inflation and downward revisions on growth. We started the year with inflation in the driving seat of financial markets. As the inflation factor was dominant, bonds initially experienced the brunt of the repricing, while equities remained more resilient. At that time, equities and credit, the asset classes more exposed to growth, were still outperforming bonds.

More recently, we have entered a new phase in which the resurgence of stagflation risks and its consequences on growth expectations are driving markets. Hence, the growth assets of equity and credit are now repricing more heavily, while bonds remain pressured. In this new phase, a great discrimination is materialising across the board. Lower earnings growth amid the higher inflation and rising cost of debt put default risks under the spotlight. In the equity markets, the stocks of companies with higher default risks have experienced almost three times the volatility of the safest credit names, with liquidity drying up for the former.

This phase of a positive equity-bond correlation is set to continue as any sign of a rise in stagflationary risk can drive a simultaneous repricing of both equities and bonds, and any signs of relief will also benefit both asset classes.

The themes to watch amid the latest fears are:

- Hot inflation. New data makes clear that the inflation path is not an easy one to forecast and the peak is not behind us yet. While the supply bottlenecks are somewhat receding, signs of persistent inflation remain. Food and energy prices are still high and the continuation of the Ukraine war will keep commodity prices under pressure. Shelter inflation is at a 30-year high and service inflation continues to rise, as well as other measures of sticky inflation. As long as inflation has not peaked, markets will remain subject to volatility around any data pointing towards a more aggressive monetary policy reaction.

- Growth worries. Growth is set to diminish as inflation acts as a regressive tax on lower income consumers. This is occurring at a time when China is still in the reopening process, and it will face a tough Q2 before rebounding in H2. All of this means that the Eurozone will stagnate in 2022 (making the ‘stag’ part of stagflation real), while the US economy should decelerate to below pre-crisis levels, though it will avoid stagnation under our main scenario. At this stage, with equity markets on the bear side, assessing growth is key as any further deceleration towards a recession may trigger further downside, while the materialisation of a soft landing (still our main call) could trigger a rebound later in the year after we have passed the inflation peak.

- Warnings on corporate profits. A recession may occur, though it is more likely on the earnings than economic front in Europe. Inflation is starting to bite into profits, with the most growth-oriented names bearing the worst of the repricing.

- Increased risk of policy mistakes by central banks. Ultimately, central banks are the main actors in charge of fighting inflation, and the hot recent readings put them on an aggressive trajectory. Markets are correctly repricing the monetary policy path and we believe that at this stage the Fed will have to protect its credibility and move a bit further behind the curve, as confirmed by yesterday 75bps hike. The ECB is more challenged, as the road towards fighting inflation is also a road towards greater fragmentation, as recent market movements in the Italian BTP made clear. The ECB will try to help in both areas, as signalled by its willingness to design a new antifragmentation tool and its flexibility in the use of the reinvestment of the Pandemic Emergency Purchase Programme (PEPP).

- Turmoil in other areas such as the crypto space are adding to the market pain. The bear market in Bitcoin and cryptrocurrency is entering an abrupt phase, with Bitcoin down 30% MTD and the overall market cap of the cryptocurrency world plunging by almost $370bn over the past week1, and the risk-off environment and crypto-specific stories continue to weigh on investor sentiment.

Investment implications

We keep a balanced, diversified approach with a cautious stance overall and a strong focus on liquidity. In equities the depth of the correction over the last couple of weeks has contributed to absorbing overvaluations and bringing about valuations more aligned to fundamentals. However, we don’t see this as an indiscriminate entry point yet, or even a time to call for a further risk reduction: this would materialise in case of a deterioration of corporate fundamentals that was not completely priced into equity markets.

Instead, the current repricing opens up some selective opportunities and confirms some of our existing views. In particular:

- The recent bond sell-off makes this asset class selectively more attractive, as central banks’ hawkishness is now priced in and at a certain point, they could be forced to do less to avoid a recession or further fragmentation. The extraordinary ECB meeting is a case in point, showing that it cannot go too far without major consequences. Given the extreme volatility in peripheral bonds, we maintain a neutral stance on these and remain watchful on the ECB’s actions. We now know that 250bps of 10yr BTP Bund spread might be a pain threshold for the ECB, but we are not sure whether the ECB currently has the willingness and/or the firepower to defend that level. This normally means market participants might again test this line in the sand.

- We keep a slight preference for US IG credit, as we believe the Fed will have less of an impact than the ECB on demand/supply dynamics.

- In DM equities we remain cautious as the earnings outlook is still too optimistic, in our view, and the risk is to the downside. Companies’ earnings resilience and pricing power will be key drivers of the great discrimination in equity markets and in credit, where quality remains a key area of focus for investors. Our forecast of a possible earnings recession in the EU leads us to maintain a more careful stance on Europe and supports our preference for US vs. EU equity.

- We are becoming slightly more positive on Chinese A shares as these appear more insulated from the developed world, where there stagflationary risks are surging. We also expect this asset class to benefit from the reopening of the Chinese economy and the stimulus in place.

- For diversification purposes, we also maintain a small constructive view on oil because of the extremely low inventories and spare capacity. In addition, the reopening of some parts of China leads us to believe an immediate collapse in global oil demand is unlikely. On currencies, we keep our preference for the USD versus the Euro and, to a lesser extent, for the Yen.

The repricing in course is cleaning up some excesses and comes with great discrimination. Focus on credit quality and earnings resilience, adding additional diversification through Chinese equities and oil.