Summary

Foreword

The invasion of Ukraine by Russian troops has caught Europe off guard, reminding it of the darkest hours before the Second World War. NATO countries and European leaders have so far ruled out direct military confrontation because of the risk of escalation between nuclear powers.

However, the Western democracies and Russia have been engaged in an unprecedented confrontation over the past few days. This takes the form of a merciless economic and financial war, the declared aim of which is to suffocate the Russian economy. The freezing of the assets of the Russian central bank is a measure that undermines its financial sovereignty, preventing it from fighting the collapse of the rouble. The sanctions will result in a deep recession in Russia, which should prevent Putin from financing a long war.

Our baseline scenario is therefore “a short conflict”. But we keep in mind that in history, short conflicts can last for many months. Uncertainty about the outcome of the conflict is not likely to dissipate quickly.

Financial interconnectedness and the high degree globalisation give economic weapons a power that they hardly had in past centuries. Two orders are confronting each other: the economic-financial order and the military order, which is unprecedented in modern history. The resulting shock of uncertainty will inevitably have major consequences.

In this special edition, we seek to shed some light on different possible scenarios and questions. Paradoxically, it is perhaps in the longer term that the clearest consequences of the current crisis are emerging.

Politically, NATO has emerged stronger from this crisis and Europe has been able to show its unity on issues that were the subject of disagreement (defence policy, arms supplies, nature of sanctions). But the consequences go beyond Europe and NATO. The role that China will play will give a new shape to the new international order.

Investors should bear in mind that we are not living in normal times. We are in the middle of a regime shift characterised by unprecedented inflationary forces not seen in the past five decades. The regime we are moving into (see “Russia conflict marks a further step on the road back to the ‘70s”1) is not only inflationary in nature. It will come with a harsh readjustment of the geopolitical order (implying higher fragmentation), with the final death of globalisation and the emergence of regionalisation centred on new global powers. Among the winners will be China, whose economic cycle is gaining independence from the US and with a rising role for the Chinese renminbi as the currency of trade for the region.

In any case, the evolution of the conflict will have important (geo)political and economic consequences And we hope this document will help investors understand the issues for asset allocation.

______________

1 Pascal Blanqué. “Russia conflict marks a further step on the road back to the ‘70s”. Shift & Narratives #14, March 2022.

Anatomy of a crisis: Where we stand

Geopolitical impact

1. The West response to Russia’s invasion of Ukraine

The West is seeking to progressively stifle the Russian economy. The goals of sanctions are to trigger a systemic financial crisis and economic recession in Russia. The West will do whatever it takes to avoid a direct military confrontation.

At the time of writing, partial sanctions are in place and important decisions have been made:

- Individual sanctions on the Russian oligarchs with limited impact, as they had pre-emptively insulated their business

- Exclusion of several Russian lenders from SWIFT. Key lenders to watch will be VTB, Sberbank and Gazprombank

- Freeze on Central Bank of Russia reserves abroad to limit RUB protection. This has the most serious financial implications because it increases the risk of default on Russian assets

- EU bans its aerospace to Russian aircraft

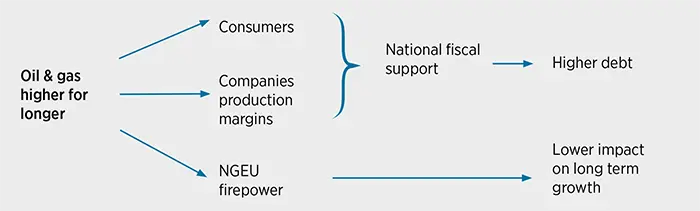

- Increase in military expenses announcements, starting with Germany, which is a paradigm shift

Key points to highlight:

- Sanctions need to be strong, but not so strong as to exacerbate soaring energy prices (Russia will still have access to several billion dollars’ worth of hard currency export earnings) or to put Putin in a position where he has nothing left to lose

- China in a wait-and-see attitude: a pragmatic and opportunistic stance

- China calls for a halt to violence; it doesn’t want to turn into the financial channel for Russian assets, but nor does it want to derail its commercial partnership with Russia.

- China is the game changer. China will want, at some point, to show that it will play a central role in the new world order

- China probably has no interest in a long-term conflict that would exacerbate global deflationary pressures. This would reinforce the international role of the renminbi and the diversification procured by Chinese assets, unless the current situation inspires a military resolution in Taiwan

- India remains loyal to Russia and abstained from voting the UN Security Council resolution which condemn Putin’s invasion

2. Ukraine and Russia: first diplomatic talks near the Ukraine-Belarus Border

These were not direct negotiations, but “negotiations on the formation of a package of the first round of negotiations – on where and when these negotiations can take place”. Although the first round was not conclusive, both parties agreed to meet for a second round. Russia has already stated that it will not stop the military operation even for the duration of these negotiations.

Ukraine is resisting, while Putin on Sunday ordered Russian nuclear forces to be placed on high alert, citing NATO aggressive statements.

Economic impact

3. Slower growth and higher inflation in Europe

The Ukrainian war is happening in the context of decelerating global growth and high inflation. The longer the conflict continues, the more consumer and business confidence will deteriorate, and the more likely inflation will remain high and economic activity will slow. It is difficult to anticipate economic spillovers related to the conflict, given the high level of uncertainty. This is a cold shower for investors, as, in addition to inflation, there will be an impact on growth, especially in Europe.

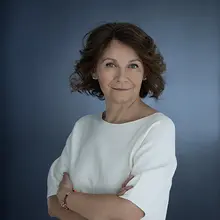

Europe has already been hit by the increase of energy prices, which is eroding consumers’ purchasing power and corporate profits, and diluting NGEU firepower via higher costs. Therefore, we expect slower growth and higher inflation: the risk of stagflation by the end of 2022/23 is increasing. The Eurozone is going to pay the highest economic price, even if the crisis is short-lived.

4. Monetary policy, a more challenging context for the ECB than for the Fed

The ECB and the Fed will err on the side of caution in the short term. Both will probably be keen to signal their willingness to normalise monetary policy this year in order to anchor inflation expectations, which will may exert further downward pressure on domestic demand.

However, the question of monetary policy will not be posed in the same terms for the Fed and the ECB. The Fed can more easily justify rate hikes and shrink its balance sheet than the ECB. The risk of a marked economic slowdown is much more pronounced in Europe than in the US.

5. The strategic autonomy of Europe becomes a first priority and changes fiscal policy

Because of its geographical proximity and energy dependence, the EU will need large fiscal support and will have to decide what has to get the priority: diversifying energy suppliers or defence.

- Diversifying energy supply:

The ultimate goal is to speed up the green transition and to diversify energy suppliers to limit external dependencies, but the evolution will take several years. Therefore, mitigation solutions will have to be implemented in the meantime:- German is rapidly building two LNG terminals to overcome its energy dependence on Russia.

- The EU has announced extraordinary bond issuance in March to allow loans to member-states and mitigate gas prices fluctuations ( SURE like instruments)

- U turn in military budgets:

The EU has approved a 450 million euros in military aid for Ukraine. Germany has announced a EUR 100 billion “special fund” for its military in its 2022 budget which is a regime shift as far as military budget is concerned. We can expect other European countries to follow suit as a major U-turns the European doctrine towards major spending in the military sector.

Key point to highlight:

- If the Europeans want to finance the green transition, diversify energy suppliers and increase defence spending at the same time, they will have to revise their fiscal policy doctrine considerably. But there has probably never been so much convergence of interest in Europe on this point.

Commodity impact

Energy prices to remain high: Europe will remain hostage to Russia until supply diversification and /or transition progresses.

Prices of food and chemical gas (for semiconductors production) have been lifted higher but might normalise if the conflict is short-lived.

Financial markets

Last week’s reaction was limited: long-term yields and FX almost unchanged, global equity up (HSCEI being the only exception). We expect this subdued market reaction to be short lived unless de-escalation materialises. We believe market action and asset prices do not reflect further military escalation and do not reflect the further evolution in the regime shift (towards more stagflation, at least in Europe). A market correction to reset risk premia looks likely in our view.

Anatomy of a crisis: What to expect?

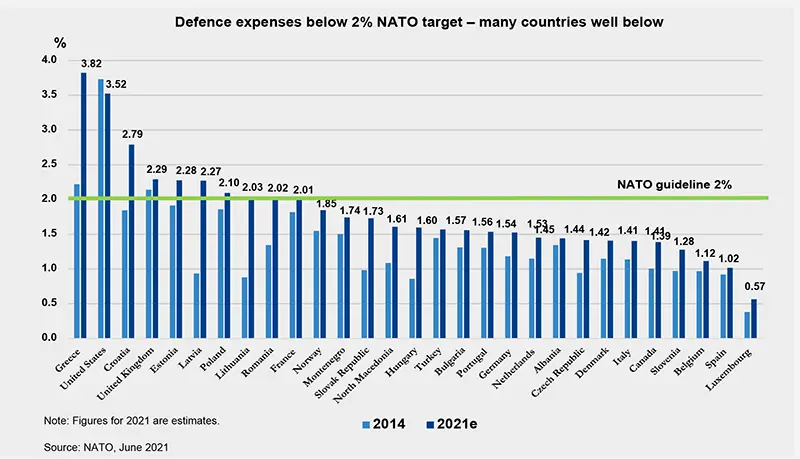

Below we describe two possible outcome [B] and [C] with the subset of potential evolution (1, 2, 3 …) and their economic and financial markets impacts

[B] Resolution in a few weeks or months

B1] Acceptable way out for Putin (recalling Cuba in 1962?) – Successful Ukraine /Russia diplomatic talks and / or sanctions deterrence

Economic impact (B1)

- Central banks back to their normalisation rhetoric, but European growth slows down and risks falling into recession (on the existing scars and the ECB’s policy mistakes in raising rates and tapering)

- US, LATAM commodity exporters and China are the favoured asset classes

Financial markets (B1)

- Defence and cyber defence stocks to be favoured

- IT stocks may ultimately also benefit from this crisis

- Energy prices remain high until a structural diversification of suppliers is settled (it will take years)

B2] Russia wins: ends Zelensky regime, replaces it with a government and gets ready to cross new red lines

Economic impact (B2)

- Ukraine conflict opens the door to Russia to continue rolling out in Europe, pointing to the Baltics and Poland

- Civil war in Russia/Ukraine with great human losses

- Russia tests NATO with cyber-attacks or NATO retaliates, Russia to cross new red lines in the future

- China will want to show its role in the new international order

- > Other military conflicts might flare up

Financial markets (B2)

- Energy prices to remain high

- Market instability (markets starting to price in that Russia may cross new red lines)

- Profit recession a tangible risk (Europe)

- Seek safe havens, sell off of liquid assets (equity, credit)

- Euro weakens

B3] Civil war, siege in Kiev, high number of casualties (Chechnya-style resolution)

Economic impact (B3)

- Massacre in Kiev and other cities: the number of casualties is unacceptably high for the Russian people

- This will likely entail some form of direct military confrontation with the West (but not nuclear escalation)

Financial markets (B3)

- Markets capitulation and panic-selling

B4] Russia loses: significant opposition jeopardies Putin’s regime

Domestic authoritarian repression gets harsher, leading to social unrest and/or civil war in Russia

Economic impact (B4)

- Russia runs into an economic recession and financial crisis with limited global spillovers if the new Russian set up is perceived as a “Western satellite”

Financial markets (B4)

- Markets sell off and then a fragmented puzzle type of world might favour US and Asian assets and possibly Europe if a deep recession is avoided

B5] Nuclear de-escalation endorsed by China: War rapid manoeuvres

- EU/US implement new sanctions, overwhelming power in a civilised form.

- China joins the West in condemning violence

- > Russia stops its military operations. The economy is frozen but the political regime survives.

Economic impact (B5)

- Commodity supply chains delays (including crude oil, natural gas, coal, nickel aluminium, palladium, titanium, iron ore), disrupts or holds back trade

- Drag on global economic growth

- Russia runs into a systemic financial crisis and economic recession (the depth of which depends on the war length)

- Fiscal and monetary efforts to get bolder. ECB steps back from normalisation

- Migrant crisis hitting Europe

- Europe moves into the new military doctrine

Financial markets (B5)

- Sustained pressure on energy markets

- Financial markets in unchartered waters (due to systemic risk on Russian markets)

- Flight to quality (classical safe havens)

- The cutting-off of some Russian Banks from SWIFT incentivises the use of alternative channels, including crypto-assets (e.g., Ethereum)

[C] Resolution of the conflict taking longer

Military deadlock, with Ukraine resisting and the Russian offensive continuing for months

C1] Prolonged military struggle but low-intensity conflict

Economic impact (C1)

- Civilian and military casualties

- Limited global supply chain disruption

- Growing public discontent and anger in Russia

- Escalation into sanctions inflicted on Russia

- NATO enlargement, with Nordics likely joining but no direct military confrontation

- Stagflation in Europe

- The ECB de facto loses its independence. It will have to reconsider asset purchases (to support defence and energy transition spending) directly or indirectly

Financial markets (C1)

- Fight against global stagflation: Central banks back to the forefront with a debatable move on the long end of the yield curve and global financial conditions

- Real rates to stay in negative territory: after a correction, investors would reposition themselves in equity, credit, searching for sources for real return in EMs

- Search for safe liquid assets (cash, treasury, high quality + value equity)

C2] Prolonged military struggle & high-impact: expect the worst

- Possible use of nuclear weapons

- Global systemic risk, global stagflation, financial markets crash and remain highly volatile

A period of war can justify a strong financial repression. Real interest rates will remain in deep negative territory.

You asked, we answered

Our answers to some of the key questions asked concerning the Ukraine crisis

1] Will the global economy enter stagflation or not?

| Pierre BLANCHET, Head of Investment Intelligence |

The Ukrainian war is happening in the context of decelerating global growth and high inflation. The post Covid-19 recovery is now behind us and economies were expected to head towards their potential as the freeing up of bottleneck and supply-chain constraints relieved inflation pressures. However, the Russian invasion has brought energy prices to record levels and reduced short-term visibility.

In Europe in particular, we expect weaker domestic demand dynamics – which are being adversely affected by higher inflation (rising energy and commodity prices), higher production prices impacting corporate profit margins, higher interest rates affecting investments and NGEU firepower –to be diluted by higher costs. This is a shock of uncertainty that may affect the dynamics of business investment and household consumption in the short term. Sanctions on Russia could limit exports of important raw materials and grains, on top of oil and gaz. Supply shortages could eventually have a negative impact on industrial production, and consumers could be hit by higher food prices.

The longer the conflict continues, the more consumer and business confidence will deteriorate, and the more likely that inflation will remain high and economic activity will slow. Because of its geographical proximity and energy dependence, the confidence shock would be stronger in continental Europe than in the US. This is all the truer as the current crisis could be coupled with a migratory crisis (there are already almost 400,000 refugees in Ukraine’s neighbouring countries).

We expect both the ECB and the Fed to err on the side of caution in the short term. Both will probably be keen to signal their willingness to normalise monetary policy this year in order to anchor inflation expectations, which will may add further downward pressure on demand. However, the question of monetary policy will not be in the same terms for the Fed and the ECB. The Fed can more easily justify a rate hike and stop its asset purchases than the ECB. The risk of a marked economic slowdown is much more pronounced in Europe than in the US. Several European economies could enter stagflation by the end of 2022 or in 2023.

At the end of the day, we can say that staglationary forces are already at play, due to slowing growth and high inflation. But stagflation in the true sense (a sharp slowdown or even recession with persistent inflationary pressures) will only happen if the conflict in Ukraine stalls and several layers of sanctions are implemented.

Finalised on 27 February 2022

The longer the conflict continues, the more consumer and business confidence will deteriorate.

2] Central banks policies: tapering or not tapering?

| Valentine AINOUZ, Deputy Head of Developed Markets Research |

The Ukraine crisis might delay, but not derail, the normalisation of Eurozone monetary policy and should have a very limited impact on the Fed’s decisions.

In February, market participants went through a radical repricing of inflation expectations and monetary policy actions. We think that, despite the dramatic military escalation, central banks will act and remove the accommodation.

Inflation in the US and in the Eurozone remains in record territory and the Russian-Ukrainian conflict is going to hit inflation prints, especially in Europe via energy prices (namely for natural gas). It will take time before second-round effects dent into growth via lower disposable income while, at the same time, the latest economic data confirm the strong recovery in developed economies.

The US labour market is booming with very strong wage growth. The labour market recovery is also impressive in all Eurozone countries, although wage growth has so far remained subdued.

In the Eurozone, new economic projections in March could open the door to a rate hike in 2022 and, implicitly, an end of the asset purchase program in Q3. However, we expect the ECB to be more cautious. Governing Council member Francois Villeroy de Galhau said the ECB is “obviously monitoring closely the geopolitical developments and their possible economic and financial implications. “Optionality – about the right monetary stance – and flexibility – to guarantee the right monetary transmission – are the two names of the game for our policy.”

The Fed will hike rates in March (by 25bps) and enter a “light” quantitative tightening in Q2 to avoid abating equity markets’ potential. We see an inconsistency between the Fed’s terminal rate, which should reprice higher, if the Fed want to get the inflation “genie” back to the 2% bottle.

Finalised on 27 February 2022

Russian-Ukrainian conflict is going to push inflation higher

3] How to play the equity value rotation in Europe in this new context?

| Éric MIJOT, Head of Developed Markets Strategy Research |

Since the autumn of 2020, the Value factor, as measured by the MSCI Europe index, has begun a rebound phase compared to the Growth style. The historical valuation gap between these two factors and the rebound in long rates and inflation expectations have strongly contributed to this turnaround. The MSCI Europe Value outperformed the MSCI Europe Growth by 15% from the end of October 2021 to 10 February 2022, when the US warned of a full-scale invasion of Ukraine. From then on, the MSCI Europe dropped (-7% to 24 February), a movement amplified by the banking sector (-14%), often associated with the Value style, but the MSCI Europe Value itself fell only slightly more than the market (-8%).

Indeed, the other overweighted sectors in the Value index have offset the banks’ underperformance. The index is exposed to three categories of sectors: 1) Financials (overweighted by 10%, including 6% for banks); 2) Energy and Materials (overweighted by 7%); and 3) Defensive sectors, such as Utilities and Communication Services, while traditional cyclical sectors (Industrials, Consumer Discretionary and IT) are underweighted by 16%.

On the economic front, the Russian-Ukrainian crisis could ultimately lead to less growth and more inflation in Europe, driven in particular by energy prices. Moreover, with the increase in risks, the cost of risk could also rise at the banking level. If the geopolitical situation becomes more complicated, the MSCI Value Europe index could then suffer further in the first group of sectors (financials), but exposure to commodities and defensive stocks should still allow it to absorb the shock in relative terms, as has happened in recent weeks. Finally, let’s not forget that the yield offered by Value (around 3.5%, compared to around 1.5% for Growth stocks) is an additional argument.

In conclusion, the Value style has the potential to withstand the turmoil. Combining it with the Quality style, which favours non-leveraged companies, also makes sense. Finally, let us not forget that crises arising from geopolitics are often temporary and generate opportunities that could well benefit the Value style in the medium term, especially as inflation levels are likely to be permanently higher in the coming years.

Finalised on 27 February 2022

The Value style has the potential to withstand the turmoil

4] What could be the impact of Ukrainian war on emerging markets?

| Alessia BERARDI, Head of Emerging Macro and Strategy Research |

As far as Emerging Markets are concerned, most of the negative impact will be concentrated in areas near the conflict zone and on net oil/gas Importers.

Eastern Europe will suffer through its direct trade exposure to Russia as well as indirectly through the weakness that the current crisis is inflicting on core European countries such as Germany, one of the region’s most important trade partners.

A prolonged conflict, could generate refugee movements, which would weigh on fiscal positions not yet restored after the pandemic. In this regard, the most vulnerable countries in terms of thin fiscal buffers are Hungary and Romania. For Poland, which is already struggling to comply with the rules of access to the European Fund, the refugee flows could divert resources from more productive items.

While Oil & Gas Net Importers will suffer an external and fiscal deterioration (high imports bill and high energy subsidies cost), in particular the ones with twin deficit like India, Commodity Exporters will benefit relatively from the recent events. Indeed, Latin America, not only is physically distant and the least commercially linked to the conflict zone, but even the most positively correlated to the Commodity cycle, either via Oil or Metals (only Mexico is less so). In the meantime, China shift of position to more strategically neutral is an important element to consider for more effective peace talks in the near future.

On the Equity side, while the stance remains cautious and selectivity is the name of the game, trends in place before the crisis should continue stronger: the Brazilian Equity Index, which is already being impacted by the rotation towards Value, has proven quite resilient at the front of the recent events.

In the Fixed-Income space, the preference goes to the Hard Currency Debt amid high Oil Prices and a more uncertain outlook for growth and inflation penalising Local Debt. Local currency bonds could end up being relatively less appealing at front of the crisis, as sliding towards stagflation means more persistently high inflation, as well as the possibility that delayed MP easing will reduce the appetite for long duration and as well as for EMFX.

Finalised on 2 March 2022

Most of the negative impact will be concentrated in areas near the conflict zone.

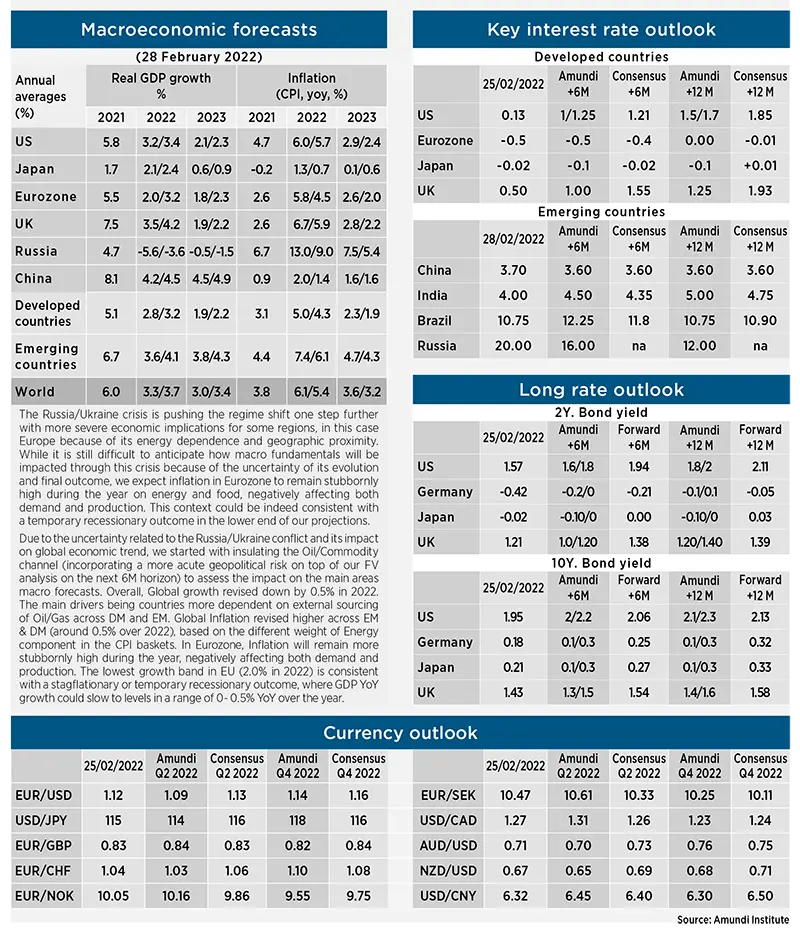

Macro and market forecasts

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.