Summary

Slowing inflation in the US and Europe, and expectations of improving earnings could pave the way for a continuation of the broadening of the rally outside the US mega caps.

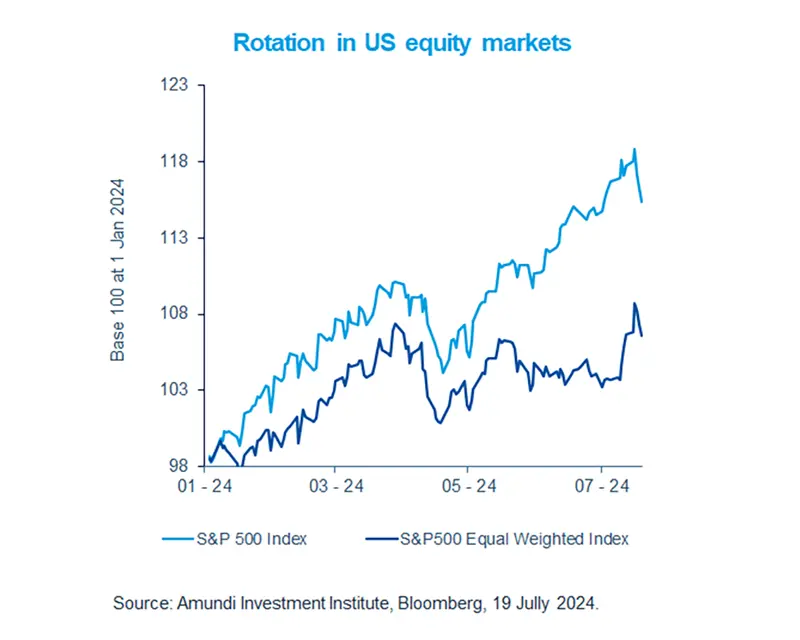

- Mega-cap companies in the US have had a strong performance this year, further increasing market concentration.

- Now, we are witnessing a broadening of the rally towards the equally weighted markets and smaller companies.

- ECB kept rates unchanged in Europe. More rate cuts expected later, potentially benefiting small caps.

The S&P 500, index which is highly concentrated around few mega caps, outperformed most other market in the US. This was led by enthusiasm around artificial intelligence and resilient economic activity. But soon after the June inflation was released, markets raised their expectations of Fed rate cuts. This caused some profit taking in the mega caps, benefitting the small caps and the S&P 500 equal weighted (where all 500 stocks have an equal weighting).

The continuation of this rotation depends on strength of earnings growth in these companies and economic outlook. Geopolitics is also relevant, as any hint of restriction on chip exports could negatively affect tech stocks. We think investors should now assess market fundamentals, and potentially explore attractively priced names with strong balance sheets.

Actionable ideas

- S&P 500 equal weighted or fundamental approaches

An equally weighted approach or a fundamental approach may be better suited to explore rotation opportunities.

- European small caps

Improving economic outlook in Europe and continuation of ECB rate cuts may potentially support prices of small and mid-caps businesses which are more linked to economic growth.

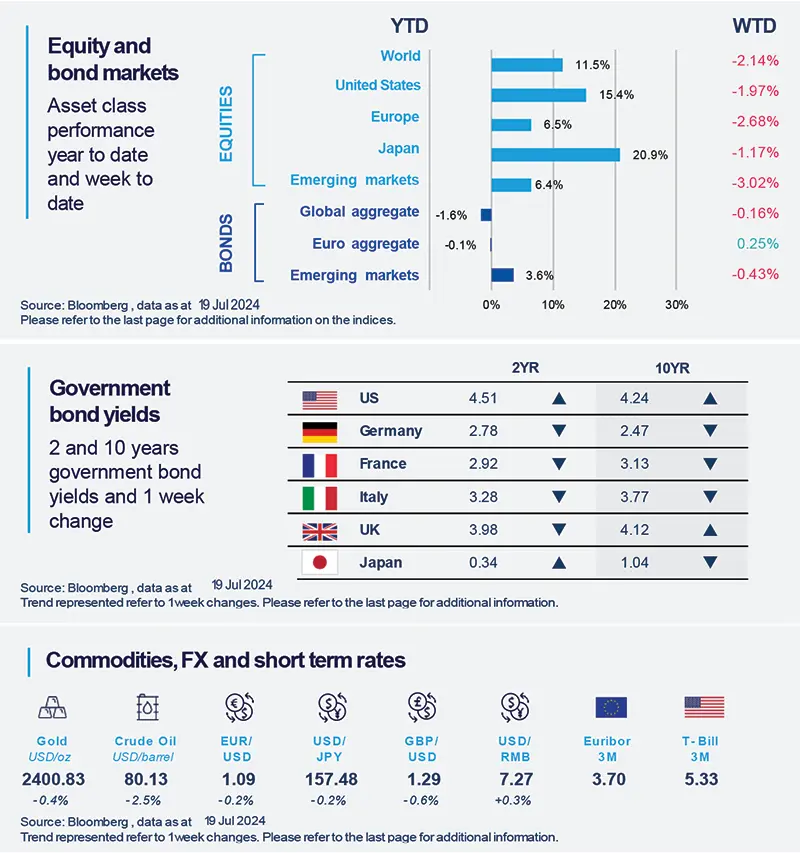

This week at a glance

Equities declined due to a sell-off in US tech sector that was exacerbated by global IT outages, which affected many stock exchanges. Concerns over restrictions on US chip exports also hurt sentiment. Bond yields were mixed, while gold prices touched new highs on hopes of Fed rate cuts.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 19 July 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US industrial production expands

Industrial output in US grew 0.6% in June driven by transportation and utilities sectors. This is in stark contrast to forward looking manufacturing surveys which paint a weak picture for the industrial sector as a whole. The data is line with our expectations of mild deceleration of economic activity in the second half of this year.

Europe

Eurozone industrial output contracts in May

Eurozone industrial production declined 0.6% (month-on- month) in May. There were large divergences across countries, but the contractions in Germany and France were more pronounced and dragged the overall data lower. Looking ahead, we expect weak performance in the near-term but easing financial conditions may support some improvement from the end of this year.

Asia

China’s Third Plenum confirmed policy continuity

Laying out reform goals for the next five years, Chinese policymakers have expanded their focus from improving economic efficiency to ensuring that economic development is sustainable, high-quality, and technologically advanced. The outlook for traditional stimulus measures, commonly favoured by the markets, appears limited. Instead, China is likely to maintain modest fiscal deficits with an emphasis on fiscal discipline.

Key Dates

|

22 Jul China prime lending rates |

25 Jul US GDP, South Korea GDP |

26 Jul US PCE, ECB CPI expectations |