Summary

Today, with developed market equities highly correlated and bond yields remaining subdued, investors are searching for other sources of income. In this respect, China’s assets could prove to be a useful diversifier for global portfolios, as they are likely to become increasingly independent from US ones. This holds true at a broader economic level too. We believe that the time has arrived for China to finally emerge from the United States’ shadow, in the US-China fight for global economic and financial supremacy.

The roots for higher independency

In the aftermath of the Covid-19 crisis, China has been pursuing successfully its affirmation as an economic superpower, while the United States has lost some ground, trapped in the trade war. Tapering from the US Federal Reserve could favour China even more in this dispute, leading to economic and investment consequences. Two major forces are at play on the road to China-US decoupling:

- Internationalisation of the renminbi as a key currency for trade, capital, reserves and savings.

- Growth rebalancing towards endogenous demand engines. This could increase the independence of the Chinese economic cycle and its insulation from global headwinds and US forces.

Conservative policies and currency strength have been key to achieving these goals. China has delivered on both with consistency and discipline:

- On the policy front, China has resisted the temptation to embark upon non-orthodox monetary and fiscal experiments, unlike many emerging economies. Conversely, the United States is in the driving seat regarding fiscal dominance and monetary complacency.

- On the currency front, the temptation to devalue China’s currency during the trade war was a trap set by then US President Donald Trump to jeopardise efforts related to the internationalisation of the renminbi and challenge China’s plans to rebalance its growth model. China did not fall into this trap.

Indeed, the long-term benefits of a currency perceived to be strong outweigh some of the elusive short-term relief from a trade war (e.g., people tend to save in an appreciating currency to keep – and possibly increase – the value of their savings). In contrast, the trap materialised for the United States, as it can only lose from a potentially more fragile global dollar liquidity base and has little to gain in economic terms from elevating trade barriers.

There are some natural upward pressures on the renminbi, driven by the dynamics of China’s balance of payments. The country is running a current account surplus (the Covid crisis has further widened the gap with the US’s deficit) and enjoying net capital outflows. The latter calls for the better channelling of domestic savings into Chinese financial markets and the real economy, and for China to embrace the role of net capital exporter in the global system.

The United States is in the opposite position, lubricating global growth and trade through structural deficits. This has allowed the dollar regime to flourish. This regime was initiated 50 years ago, following the end of the gold standard1, when then US President Richard Nixon ended the dollar’s convertibility into gold and signalling the end of the Bretton Woods system2. The system is based on the dollar dominance in the US-Asia relationship, where China has played a key role, both regarding monetary creation and the circulation of goods.

Generally, foreign exchange interventions have been aimed at maintaining the undervaluation of local currencies and inflating currency reserves – and therefore liquidity – in the relevant domestic economies. The dollar’s status as a reserve currency has allowed money creation in countries with positive global account balances, without a symmetrical reduction in the means of payment circulating in the United States. As such, the United States exported capital, which it had not saved, in proportion to the credit granted by emerging market (EM) central banks. Such a closed-circuit system has maintained the cost of capital at an artificially low level at both ends of the chain, possibly creating investment bubbles. In the end, this has encouraged a development model based on exports across emerging economies and excess liquidity has increased financial volatility, sometimes fuelling bubbles, as happened with the Asian financial crisis in 1997 and the global spillover effect of the 2001 and 2008 crises.

Under such a model, the United States has provided emerging economies with the dollars needed to support trade and to form liquidity and credit bases for their economies. Since 1993, US public debt has been monetised essentially by inflating the US current account deficit and the fixed exchange rate policies pursued by EM central banks. If the United States were to export fewer dollars, emerging economies would have to sell assets and price adjustments would occur. While the dollar is the currency of the United States, it also has a significant role to play for emerging economies.

Renminbi, the new ‘Deutsch mark’ for Asia

As part of its road towards global supremacy, China is trying to find a role in this US-EM monetary linkage, pursuing a strong currency policy and portraying the renminbi as an alternative to the dollar for Asian economies, especially for countries participating in the Belt & Road initiative. In this respect, the renminbi is taking on a role similar to that of the Deutsche mark in Europe four decades ago. In fact, while there is no official fixed rate, there is effective monitoring by central banks on the levels and volatility of most regional currencies against the renminbi. The creation of an Asian currency bloc could provide some insulation from US-related headwinds and the dollar in the trade equation. As happened with the launch of the euro, the internationalisation of the renminbi’s role in global portfolios is likely to drive it down temporarily. This should only be a liquidity effect, leaving any value considerations intact.

Today, new US tapering looming on the horizon is a good reason for China to remain on its guard and accelerate the renminbi’s internationalisation (the amount of transactions settled in renminbi). A key indicator of China’s progress on the way towards the internationalisation of the renminbi has shown good progress. Since China launched its own payment system, the Cross-Border Interbank Payment System (CIPS) in October 2015, transactions taking place through this platform have risen from zero to RMB45.2tn ($6.5tn) in 2020. At the same time, the renminbi share of global forex reserves has more than doubled, from 0.8% in Q4 2016 to 2.1% in Q4 2020. According to the Official Monetary and Financial Institutions Forum’s Global Public Investor 2021 report, some 30% of central banks worldwide are planning to raise their allocation to the renminbi over the next couple of years. Recent changes to tech regulation are steering them towards higher fundraising for tech start-ups via the renminbi. Yet another sign is the announcement – at end-July – that the People's Bank of China (PBoC) will support Shanghai’s trial to facilitate the free exchange of the renminbi.

Two factors will be needed for the renminbi to accelerate further its internationalisation process:

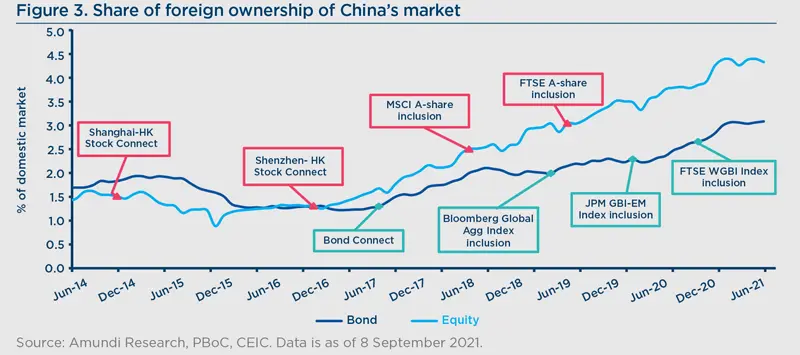

- Greater opening of China’s financial sector, as a more open, transparent and sophisticated market that delivers returns, to help retain foreign investments over the long term and drive renminbi inflows.

- Modernisation of the country, especially through innovative infrastructure, as the recently launched digital Chinese currency could play a key role in facilitating renminbi payments across borders. It may even include future arrangements among central banks.

The first factor will be critical. The recent regulatory crackdown may lead international investors – including US ones – to believe that China is not committed to opening up its financial sector, discouraging them from investing in the country and possibly amplifying the US-China rivalry up to financial war status. While we acknowledge the adjustment process towards a more regulated system may be painful in the short term, it should be beneficial over the medium term. It may help plug loopholes in the regulatory system, boosting competition and reducing systemic risk. In the end, this will make China’s financial system more mature.

Regarding the second factor, in order to build a modern country China will need to invest in human capital, (the population is set to peak in 2026 according to our estimate), transition to green energy with carbon emissions peaking in 2030 and channel credit more efficiently. In addition, to widen the spread of wealth, the share of population accounted for by the middle-income class should be increased, possibly through tax redistribution, and the urban-rural social divide should be smoothed.

Investment implications: Chinese assets are no longer peripheral or emerging

There are three key investment implications from China’s increased decoupling from the US:

- First, Chinese assets – particularly cash and government bonds – are likely to be the main haven for positive real returns for the foreseeable future in a US-led global arena affected by hyper-Keynesianism (e.g., strong government intervention). The price to pay for hyper-Keynesianism comes through inflation, currency value erosion or higher risk premia. For investors, the preservation of purchasing power per unit of risk will be the name of the game in a higher-inflation world where real returns will be key.

- Second, greater autonomy of the Chinese cycle and better insulation from global economic, financial and geo-strategic considerations will provide higher diversification benefits and the opportunity to gain exposure to areas of higher future growth. The shift away from low-value-added manufacturing activities towards an innovation-based economy could provide opportunities in strategic sectors such as semiconductors, artificial intelligence (AI), industrial automation and robotics. In order to meet this development goal, China has been spending prodigiously on research and development (R&D). Since 2000, R&D expenditure has been growing at over 15% per year, compared to 3% in the United States, and now accounts for some 20% of the global R&D expenditure. In addition, China’s government has implemented a supportive policy environment, establishing large-scale funding of research and incentives for tech entrepreneurs and academic researchers. This system has helped China achieve global leadership in some key areas, including AI. Although the United States remains the leader in designing chips for AI systems, China is leading in terms of AI applications, such as speech and image recognition. In addition, China has been the largest global investor in clean energy over the past decade and it is now the largest global producer of solar panels, wind turbines and electrical vehicle batteries. It holds almost three-fourths of the world’s manufacturing capacity for lithium-ion battery cells and controls even more of the supply chain. China is also poised to lead industrial automation – which should see strong demand given the shrinking working-age population – and in the field of quantum communications and quantum computing, with more patents across quantum fields than the United States. Currently, Chinese growth stocks are largely internet giants. As local champions develop out of this innovation drive, a broader set of growth companies will be available for diversification. These could be new domestic champions or potentially even new global leaders. Meanwhile, China is lagging in other areas, such as advanced chip and semiconductor production, where it still depends on the global supply chain. For China, achieving self-sufficiency in advanced chip production could take a decade or even more, as Western companies still control much of the software needed for advanced chip design. The reduction of long-term financial risks will be key to such developments and the crackdown on tech regulation may be heading in this direction. A more balanced equity market should reduce concentration risks for investors. This, combined with the long-term prospects of a stable and firm currency, could lead to more robust portfolios.

- Third, as happened for the Deutsche mark in the 1970s and then the euro, global investors could view the renminbi as a store of value. On the other hand, the dollar could see an erosion of its value, as this could be the price to be paid for the expansion of the Fed’s balance sheet and budgetary expenses.

These trends can only accelerate the shift into renminbi holdings as a core component of global portfolios. Chinese assets and its currency will no longer be either emerging or peripheral in terms of portfolio construction. We have not seen yet all the consequences of this shift, but we do not expect them to be dramatic. As the second-largest holder of US Treasuries in the world, China has little interest in precipitating a disordered slump of the dollar. As China increases its independence and influence, this financial link will be less necessary, but it is likely to become the new front in trade war negotiations. In the end, there are fundamental reasons for investors to embrace a gradual ‘go-it-alone’ approach regarding Chinese assets.

______________________________

1A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s and from the late 1920s to 1932, as well as from 1944 until 1971, when the United States terminated the convertibility of the US dollar to gold.

2The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia and Japan after the 1944 Bretton Woods agreement. The system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The chief features of the system were an obligation for each country to tie its currency to gold and the ability of the IMF to bridge temporary imbalances of payments.