Summary

Key highlights

European insurance companies context

In a context of higher yield environment, closing of duration gaps but also risk of lapse, liquidity and recession, European insurers have started to shift their portfolios towards more liquid assets (while maintaining exposure to less liquid such as real estate or private equity).

The scope of overlay strategies is broad

Insurers use overlay strategies to achieve additional performance, provide risk protection, manage exposure as well as for accounting and/or prudential requirements.

While transitioning investment portfolios, incorporating overlay strategies can provide distinct and compelling advantages

The advantages of cost efficiency and prompt execution make overlay solutions an enticing option for investors seeking to make changes swiftly and at a lower expense. Additionally, overlays can serve as a transition tool, facilitating the ultimate goal of reallocating cash funds.

Some overlay implementation ideas to consider in the current context

- Implement overlay solutions to lock in gains against unused cash flow

- Use inflation overlay to hedge inflation risk

- Reduce volatility caused by foreign exchange exposures through currency overlays

- Consider asset allocation overlays to safeguard the portfolio against potential downside risks, for both economic and regulatory purposes

- Implement completion overlays for transitioning towards new strategic or tactical asset allocation

Some considerations when investing in overlay strategies

- Liquidity: look for overlay where both buying and selling are equally available

- Valuation: preference for overlays where several independent valuation sources are available

- Basis risk: ensure there is sufficiently high and stable correlation between the overlay and underlying strategies/positions

- Accounting treatment: ensure efficient accounting treatment

- Regulatory treatment: pursue efficient capital utilization within the limits set by local regulations

In the Insurance Fixed Income Outlook, we highlighted that lapse risk, yield management in the new interest rates environment, duration gap closing and volatility reduction were the major investment trends that have affected European insurance companies since the beginning of 2023. Cash flows and liquidity emerged as the main drivers for implementing these investment trends.

To complement this analysis, in this article, we explore overlay solutions and their ability to provide effective ways to overcome cash and liquidity problems.

1. Purpose of overlay solutions

We identified four key objectives among our insurance clients that drive the adoption of overlay strategies.

Overlay solutions have become increasingly popular among insurers seeking innovative ways to manage their investment portfolios. In simple terms, overlays involve the use of derivatives to modify or enhance an existing portfolio.

We identified four key objectives among our insurance clients that drive the adoption of overlay strategies.

- Additional performance: overlays can be used to incrase exposure to specific assets or improve diversification using dynamic overlay strategies.

- Risk Protection: hedging instruments like overlays allow to set risk limits and specific protection levels.

- Exposure management: overlays allow, for example, the implementation of strategic or tactical asset allocation, or for managing the transition towards a new asset allocation.

- Accounting & Prudential: derivatives used for hedging purposes enable control over accounting or regulatory key performance indicators.

In practice, an overlay solution can be used to achieve a single objective or multiple objectives simultaneously. For example, setting a protection limit can help reduce prudential capital when eligible techniques are used from a solvency standpoint.

2. Overlay trades that can be used in the current environment

Managing lapse risk and yield in a new interest rates environment, closing duration gaps, and reducing volatility can be achieved by using new cash when available or through rebalancing, albeit at a certain economic and accounting cost. It is also possible for insurers to achieve these goals using overlays, either because they offer a more cost-effective option in terms of transaction costs or as a transitional tool until rebalancing or sufficient cash flows can be utilized to achieve the initial goal.

Manage lapse risk

Managing lapse risk can be achieved if the insurance company can estimate a schedule of lapse negative cash flows, albeit with a degree of uncertainty.

A portion of that schedule can be addressed with redemptions or coupons (see the Insurance Fixed Income Outlook). For the rest, the insurer may be in a situation where redeeming historic fixed income holdings acquired at lower rates compared to the current yield is not cost-effective or advantageous from an accounting standpoint. As a result, based on the estimated schedule of lapse cash flows, while taking in consideration unrealized gains and accumulated reserves, overlay strategies can be implemented in order to lock-in gains against lapse cash flows.

Manage inflation risk with inflation overlay strategies

While life insurers have been globally quite immune to short and medium-term inflation evolutions, this has not been the case for Property & Casualty (P&C) insurers and reinsurers

It is fair to say that, in 2022, inflation was one of the main risk factors for most of the (re)insurance industry and this pattern is likely to endure in 2023. Our belief aligns with the market consensus suggesting that this risk has the potential to endure until the first half of 2024 (see our Cross Asset Investment Strategy – Special Edition: Mid-year outlook 2023). While life insurers have been globally quite immune to short and medium-term inflation evolutions, this has not been the case for Property & Casualty (P&C) insurers and reinsurers:

- P&C insurers focused on commercial insurance did not suffer much, as the market has been strong in the last few years and price increases were ahead of inflation.

- Retail P&C took most of the hit in 2022 and this impacted the current year loss ratio.

- The reinsurance sector was the second most affected by inflation pressures, after retail P&C. During Q1 2023, reinsurers have reported material headline price increases on average, which still translated into positive risk/inflation adjusted price increases. Reinsurers also took advantage of the absence of third party capital and overall tighter capacity to obtain improved terms on contracts.

Control the duration gap

Some insurers are contemplating duration gap closing or having a negative gap to lock in the rate gain on solvency. However, it does not yet seem to be on the agenda as of today for many companies. In this context, a duration overlay can therefore be used to control the duration gap:

- When interest rates rise, the returns on an insurer’s investment portfolio typically increases. As a result, some insurers have experienced mechanical closure of the gap between their assets and liabilities due to the rise in interest rates. Due to the impact of convexity, which refers to the sensitivity of bond prices to change in interest rates, adjusting the duration gap does not occur in direct proportion to the magnitude of interest rate movements.

- Therefore, employing an overlay strategy can be advantageous for better control or management of the duration gap.

- For others insurers, there could still be a need to close the remaining duration gap.

When an overlay is used, it permits quick and cost-efficient action to be taken, with the possibility to eventually replace the derivatives with cash positions when and where possible.

Reduce volatility caused by FX exposures with currency overlay

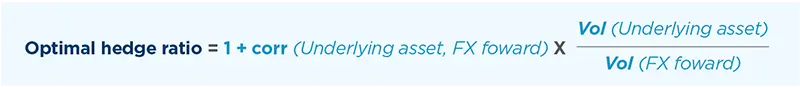

When there is exposure to a foreign currency, financial theory* states that the optimal hedge ratio in order to minimize portfolio volatility can be obtained through the formula below, which links the correlation and volatilities of the underlying asset and the foreign exchange (FX) forward rate*:

In practice, all of these variables are subject to constant change, which is why we believe a dynamic hedging program is necessary to effectively control the overall volatility.

One best practice could be to set a strategic hedge ratio range rather than a fixed target in order to minimize transaction costs. Furthermore, for insurers willing to allocate some risk budget to the FX risk factor it is possible to include some active FX positions.

Downside risk protection for economic and/or regulatory purposes

Insurance companies can utilize overlays and hedges with the objective of controlling total or extreme risk for a single asset class or at the overall portfolio level.

They can also select the derivatives used for hedging so that they qualify as eligible “Risk Mitigating Techniques*” for the purpose of the prudential regulation.

In both cases the risk capital that is released – economic or prudential risk capital – can be used to increase the economic or prudential profitability or it may be redeployed towards other sources of additional return.

This approach can be applied to all risk asset classes*. More recently, we have observed a growing demand for overlays in two asset classes, namely equities and foreign exchange rates. Credit bonds and especially High Yield bonds are other likely candidates, however the high level of basis risk make them more difficult to hedge in a Solvency II context.

Adjust the credit exposures or strategies

The risk-return trade-off of corporate debt versus government debt has changed significantly in 6 months. Insurance companies may contemplate adjusting their credit exposures or strategies.

During the low yield environment of the prolonged Quantitative Easing period, insurers have accumulated sizable credit exposures.

For some insurers, their credit allocation had even reached a size equal to their government exposures.

Furthermore , the escalating inflation caused by the War in Ukraine has prompted central banks to swiftly revise their interest rate policies.

In a six-month window ending in mid-April 2023, the yields of 5-year US (Bbg ticker : US91282CHE49*) and 5-year Euro government bonds (Bbg ticker : DE000BU25000*) have risen from negative territory to 3.62% and 2.56% respectively. Simultaneously , the Euro Corporate spread (Bbg ticker: LECPOAS Index*) has declined from 2.4% to 1.6% but it continues to exhibit notable volatility as of the present time.

As a result, the risk-return trade-off of corporate debt versus government debt has changed significantly in six months. Insurance companies may consider adjusting their credit exposures or strategies accordingly.

3. Key considerations when implementing overlay equity strategies

Using derivatives is a common practice among insurance companies, but the degree to which they are employed is contingent on their internal operational frameworks in place. Let us illustrate some of the key attention points to facilitate the utilization of derivatives in overlay strategies.

Accounting treatment

The accounting treatment of derivatives for insurers is governed by specific accounting standards, such as International Financial Reporting Standards 9 and 17 (IFRS 9 and 17)*. These standards require insurance companies to account for derivatives at fair value through profit or loss (FVPL), which means that any changes in the fair value of the derivatives are recognized in the company’s income statement. It is important to note that the use of derivatives may lead to an accounting mismatch if, on one hand , the derivatives are accounted for at fair value through profit or loss (FVPL), while on the other hand, the hedged assets are not accounted for at FVPL. For instance, bonds and equities can be treated through Other Comprehensive Income (OCI).

Additionally, regulations require insurance companies to report their financial position accurately and transparently to their stakeholders, including policyholders, regulators, and investors.

For these reasons, it is crucial for insurers to ensure that their advisors or asset managers, and their internal teams, have the required accounting knowledge to process these types of instruments. In addition, they must also ensure that internal business processes, administrative systems and risk management tools allow for the monitoring and assessment of derivatives overlay.

Liquidity

It is important for insurers to operate in markets that facilitate and optimize the sale of overlays when they are no longer required. This involves ensuring that the process is both convenient and cost efficient, just as it was during the initial purchase.

Valuation

It is crucial to ensure that multiple sources are readily accessible for pricing derivatives. While this is typically the case for listed derivatives, it is important to exercise caution when dealing with certain over-the counter (OTC) transactions*.

Basis risk*

It is important to consider the stability of correlation between an overlay and its underlying asset when using it as cash positioning replacement. The goal is to ensure confidence in the correlation’s consistency throughout the entire holding period, especially during market conditions that may prompt the sale of the overlay.

* Please refer to the glossary in the document for definitions of key terms used in this article.