Summary

- Both private equity (PE) and responsible investing (RI) have long-term investment horizons. By fostering the appropriate governance in portfolio companies, PE can facilitate their responsible transformation.

- Although the PE industry currently lags in the sustainability journey, it is catching up rapidly.

- Over the past decade, RI has been integrated into the different stages of the PE investment process; RI priorities vary across investors, but governance tends to dominate over climate and social elements.

- Challenges remain in terms of data availability and the lack of reporting standardisation. Any decision on RI should be taken at the highest institution level, to avoid facing possible mismatches regarding investments’ time horizon.

Due to its growing size, and the levers it holds in setting the strategy for portfolio companies, the PE industry has a decisive impact on how the global economy addresses the key challenge of climate change and, more generally, whether companies are managed in a responsible manner. At the same time, the association between PE and sustainability has not always come naturally. Cross-linking conclusions from academic research with our survey of PE investors – as well as using our experience as a PE investor – we have analysed how PE investors approach RI. The following messages are a summary of our more in-depth paper.

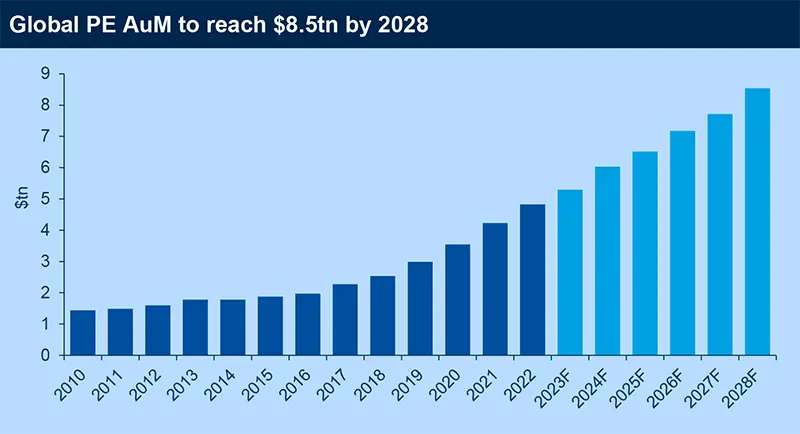

Source: Amundi Investment Institute, Preqin database. Data is as of 15 November 2024. AuM: assets under management.

Private equity and responsible investing: a natural combination?

Private equity’s long investment horizon is consistent with that over which a responsible investing approach is expected to bear fruit.

Several arguments justify the link between PE and RI:

- PE's long investment horizon is consistent with that over which a responsible investing approach is expected to bear fruit. If a company in a PE investors’ portfolio is subject to environmental or social risks, its value upon exit will be affected negatively. This justifies the integration of RI considerations into the management of these companies by PE investors. Moreover, PE investors can exercise a tighter control of portfolio companies from an ownership and governance standpoint.

- PE is much about fostering the appropriate governance in portfolio companies to accompany their growth. As a result, PE investors are well placed to help these companies in their responsible transformation.

Academic research supports this view, as PE has been shown to have a positive impact on sustainable innovation, particularly in industries related to the climate transition, and can contribute to the necessary move towards sustainability. Studies also show the positive impact of PE on growth through its benefits in relieving financial constraints and providing managerial expertise to portfolio companies, hence making them better able to address sustainability topics.

Private equity is rapidly catching up in integrating sustainability

Regulation has not been such a driver of responsible investing integration as it has for public assets, but this is starting to change.

Despite these arguments, the PE industry currently lags in the sustainability journey, at least in the United States which is dominant in the sector whereas European PE firms are more advanced. One explanation for this is that PE firms focus their investments on small- and medium-sized firms that are less equipped to implement an RI strategy.

However, progress is occurring, due to several factors:

- Intensifying pressure from final investors, as an increasing share of institutional investors want to invest responsibly.

- Pressure from stakeholders and employees, as well as the ability to attract talent.

- RI can be seen as a way to foster brand recognition.

- An evolving regulatory environment. Sustainability regulation is currently lighter for private assets than for public ones, but this is starting to change, at least in Europe due to the impact of Sustainable Finance Disclosure Regulation (SFDR) and Corporate Sustainability Reporting Directive (CSRD) regulations that will soon broaden reporting requirements to encompass smaller and unlisted companies.

Moreover, a number of investors believe that RI is favourable for the risk-return profile of their portfolio. Their perception that RI integration improves long-term return is difficult to prove in general terms and is mainly supported by bottom-up examples. While on the risk side, there is a broad conviction that integrating extra-financial criteria adds value to corporate risk analysis. As a result, according to an academic paper, ESG-integrated PE funds tend to be less risky and more diversifying than their non-ESG counterparts.

Implementation: focus on thematic investing and RI integration

Research shows that ESG has become a core due diligence criterion in private equity over the last decade.

Investors frequently apply exclusion policies, but some mention a risk that such policies might lead to an eviction effect even though it is key to support brown activities in the transition process.

PE seems particularly suited to thematic investing, for instance in the form of funds that specialise in innovative climate solutions. RI has also become a core criterion in PE over the last decade and is integrated into the different stages of the PE investment process, from due diligence to onboarding, through the holding period and upon exit, in the form of absolute as well as company-specific KPIs. Moreover, engagement intrinsically lies at the core of PE investing, as the latter’s goal is to directly influence portfolio companies’ policies. Finally, many institutional investors integrate RI criteria in their selection of PE managers.

RI priorities vary across investors, depending on their culture and beliefs, but overall governance dominates versus climate and social elements. Governance criteria, such as business ethics, compliance and – increasingly – cybersecurity, are systematically considered by PE investors, according to an interviewed GP, as “setting the right governance first is a key success factor”. On climate, priorities tend to be set in terms of measurement and the reduction of emissions, as well as net-zero commitments.

Challenges remain in data and reporting

Investors that are active in responsible investment consider that, in order to be successful, accountability should be taken at the highest level of an institution.

Challenges remain in terms of data availability, as it is difficult to find information about RI issues in portfolio companies and to measure them consistently. In addition, a lack of standardisation sometimes makes RI reporting a challenge. This has led some investors to join forces, for instance through the ESG Data Convergence Initiative.

In terms of organisation, investors that are active in RI consider that, in order to be successful, accountability should be taken at the highest level of an institution, as its implementation may lead to a potential mismatch between the long horizon over which certain sustainability strategies are expected to pay off and the shorter horizon of holding an investee company. Moreover, sustainability knowledge should be shared within the institution and embedded in its overall approach.