Summary

The unknowns overwhelmed by the unknowables

Introduction and aims

After a prolonged era of cheap money and double-digit returns, the sharp spike in inflation to its 40-year high in 2022 was a game changer.

That the Goldilocks scenario of moderate growth and low inflation has been rudely interrupted of late is not in doubt; nor, for that matter, is central banks’ resolve to tame the current inflationary spiral. In the rich world, they are now walking a perilous tight rope, after virtually abolishing risk pricing in capital markets over the last 12 years. The scope for policy mis-steps now is enormous as central banks seek to pull off the highly desirable ‘soft landing’ that minimises both inflation and recession risks at the same time.

For pension plans, with their long planning horizons and multi-decade liabilities, there are too many open-ended and unknowable risks. The immediate one is whether central banks are actually able to arrest the current inflationary spiral and ensure that inflation expectations remain anchored to their policy targets. Another question is how central banks would react if inflation started to come down but then persisted well above policy rates as unemployment started to rise.

Central banks cannot predict what the future holds. They are as much in the dark as we are.

Research method

Hence, our 2022 Amundi–CREATE institutional survey seeks to shed light on how pension plans are responding, as their portfolios have been hit by the market impact of the latest surge in inflation in key Western economies. Taking a three-year forward view, the survey aims to obtain their assessment of four issues:

- Which scenarios are likely in response to the recent surge in inflation?

- How are pension investors changing their asset allocation?

- Why is theme investing likely to become a key pillar of investing?

- Will the balance between active and passive funds become more even?

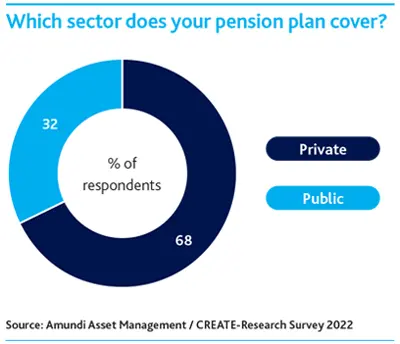

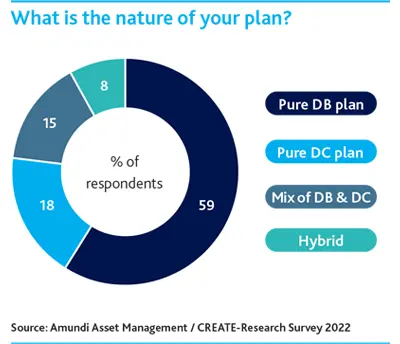

The survey is based on 152 respondents from 17 pension markets, collectively managing €1.98 trillion of assets. Their background details are given in charts below. The survey was followed up by structured interviews with senior decision makers in 30 participating organisations. The survey provided the breadth of information and the interviews the depth of insight. Both were conducted between June and October 2022.

|

|