Summary

Individuals face difficulties in making savings decisions due to the complexity of determining savings amounts and how to allocate assets, compounded by behavioural issues like ‘present bias’ and procrastination.

Many savers also prioritise having immediate access to liquid savings, which can hinder their commitment to long term retirement savings. We review the effects of various reforms implemented in different countries to promote private retirement savings.

Tax incentives have proven to be an efficient tool to boost retirement contributions especially for the most ‘active’ savers, and older and wealthier individuals. Encouraging automatic contributions from employers to retirement plans may be more effective to support a wider range of individuals to invest on the long term. Providing information on retirement saving needs can also be beneficial.

Using engaging tools like virtual reality, especially through financial advisors or accessible digital platforms (e.g., robot advisors), can enhance decision making.

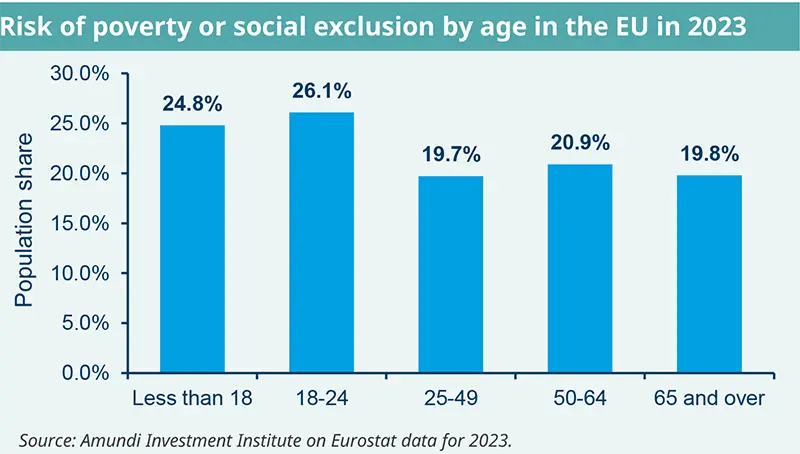

Under-saving for retirement is a major issue for many economies. Benartzi and Thaler (2013) have long diagnosed a ‘retirement savings crisis’. In the US, according to the National Retirement Risk Index, 39% of working-age households will not be able to maintain their standard of living in retirement.1 In Europe, more than 19.8% of people aged 65 years or older are at risk of poverty or social exclusion,2 and women are particularly at risk. To address these issues, many countries have introduced reforms to encourage private saving by providing tax incentives for voluntary pension contributions, automatic enrolment in pension plans, or trying to raise awareness about the importance of pension saving through retirement education material. What are the lessons learned from these reforms and how do the various incentives affect saving?

Many countries have introduced reforms to encourage private saving by providing tax incentives for voluntary pension contributions, automatic enrolment in pension plans, or trying to raise awareness through education material.

How efficient are tax incentives?

Today, countries differ in the tax treatment of retirement savings. In the US for example, in 401(k) accounts, contributions are made with pre-tax income – contributions are deductible from income tax – and withdrawals from the account are included in the savers’ taxable income. An alternative structure (Roth IRA) permits post-tax income contributions to the saving plan. In this case, withdrawals from the plan are not taxed.

In France, some contributions are partially exempted.

Tax incentives for individuals’ retirement savings

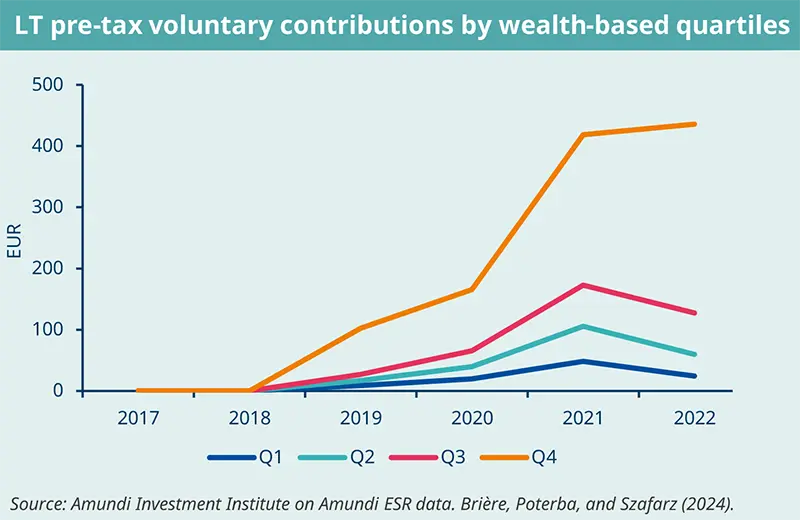

A large debate prevails as to the effectiveness of the various tax incentives.3 In a recent working paper,4 we contribute to this debate by analysing saving responses to Loi Pacte, a French law that took effect in October 2019 and was designed to encourage retirement saving contributions to supplement public pensions. Loi Pacte introduced a new tax deduction for personal voluntary contributions to employer-sponsored retirement accounts. We employ administrative panel data from Amundi to examine the voluntary saving choices of nearly 1.4 million workers at 2,679 French firms between 2017 and 2022. We focus on whether the new availability of tax-deductible voluntary contributions raised the level of inflows to employer-sponsored plans. The French case is particularly revealing because the defined contribution (DC) saving plans include not only retirement saving opportunities, but also medium-term saving vehicles, which allow withdrawal of contributions after five years, which allows us to test for substitution between long-term (LT) and medium-term (MT) savings.

We compare the saving behaviour of workers at firms that introduced the new option, focusing on their behaviour before and after this introduction. We use the saving behaviour of workers at firms that had not yet adopted the new option, as our control. We find that voluntary contributions to LT plans were affected by the Loi Pacte (on average individuals save 150 euros more), and that contributions to MT plans were not. This suggests little substitution between LT and MT savings. The most pronounced effects are observed among those who were making voluntary contributions before tax relief became available.

One criticism of tax incentives for retirement saving is that the benefits depend on the taxpayer’s marginal tax rate, which can result in larger benefits for high-income taxpayers in higher tax brackets than for lower income households. We compare the response to Loi Pacte among workers in different age, retirement balance, and income quartiles, and find that the take-up of the pre-tax LT contribution option was greatest among older employees with higher incomes and retirement plan balances. One lesson of heterogeneous response is that tax incentives may motivate some workers to raise their saving contributions, while others may be more sensitive to other saving plan provisions such as flexibility in making cost-free withdrawals.

All in all, the reaction to the Loi Pacte reform in France suggests that offering a voluntary pre-tax contribution option in an employer-sponsored retirement plan can boost contributions without a notable reduction in other employer-sponsored saving contributions. It also corroborates previous findings of heterogeneous responses to such incentives. Workers with larger pre-reform retirement saving balances, higher income, and who were closer to retirement were more likely to take advantage of the new saving option.5

Firms or individuals’ tax incentives?

If tax incentives can raise retirement savings for a substantial part of the population, what type of fiscal incentive is the most effective? In particular, is it preferable to encourage companies to make automatic contributions to their employees’ saving plans or to encourage employees to make voluntary contributions? The Pacte law, for example, has combined both effects by offering small companies with fewer than 250 employees a tax advantage for contributing to their employees' savings plans (part of the money going automatically into retirement plans), while at the same time allowing employees to make voluntary pre-tax contributions.

Denmark introduced a similar change in the taxation of voluntary contributions in 1999. Individuals had access to 2 retirement savings compartments: (1) with lump-sum payouts, (2) with annuity payouts, offering a tax advantage for voluntary contributions. In 1999, a change in the tax system made the annuity option less attractive. After the reform, 81% of individuals remained passive and made no changes to their contributions. 19% of individuals were active and modified their contributions to adapt to the new tax regime, but drew on their other retirement savings schemes to benefit from the tax advantage. In the end, there was a substitution effect between the various savings schemes, which rendered the measure ineffective overall. In contrast, policies that raised retirement contributions if individuals take no action, such as raising the automatic employer contributions to retirement accounts, increased wealth accumulation substantially.6

So, if tax incentives for voluntary contributions only affect mostly ‘active’ employees, those who are the most informed and already more inclined to save for their retirement on existing schemes, there is a great risk that the tax incentive will only have a substitution effect between different savings vehicles. Thus, tax incentives targeting firms offering retirement contributions (for example as part of their variable compensation package) might be more efficient.

Procrastination: do we need more automatic enrolment?

If a proportion of people are passive savers or procrastinate, would the introduction of an auto-enrolment solution paying, for example, a percentage of salary directly into a retirement savings plan be effective? In the short term, certainly. Several academic studies attest to this: switching from a voluntary to an automatic enrolment scheme can double the participation rate in retirement savings plans.7

But the longer-term effects of automatic enrolment are increasingly being debated. The ‘present bias’, which leads a significant proportion of households to take the default option via automatic enrolment, may also lead them to over-consume. Academic research has shown that individuals tend to cancel out the short-term effects of automatic enrolment by saving less in the future, or by unlocking their savings when possible. In the United States, when employees separate from their employer, the assets accumulated in their 401k savings plan are transferred to a more liquid IRA account. Some take advantage of this opportunity to spend their savings.8 In the UK, when employees change employer and the new employer does not have automatic enrolment, their participation rate drops by 13%.9 In the end, the median cumulative contributions of employees with and without automatic enrolment are identical after 3 years.

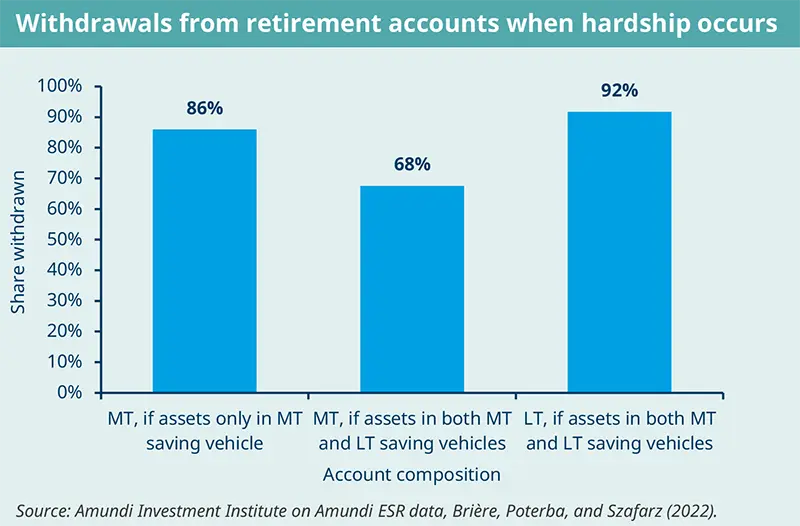

In French employee savings schemes, by default, 50% of the employer contribution (the variable remuneration called ‘participation’) is automatically paid into the retirement savings scheme when the worker makes no active choice. But we observe that in the following years, part of the effect of this automatic enrolment is undone by workers’ withdrawals, that are made possible under certain exceptional conditions.10 On average, employees withdraw 92% of the Long-Term (LT) retirement funds when a hardship withdrawal opportunity arises, whereas they withdraw only 68% of Medium-Term (MT) saving funds (locked only for 5 years) when the same opportunity arises.11

Similarly in the US, Choi et al. (2024) analyse nine 401(k) plans and show that when employees leave firms (often before matching contributions from their employer have been fully vested), a large percentage of 401(k) balances are withdrawn, and many employees opt out of auto-escalation.

Should retirement savings be locked?

Many retirement saving vehicles, such as the Retirement Savings Plan (Plan d’épargne retraite, PER) in France, lock in the money until retirement, unless there are exceptional reasons for withdrawal (such as purchase of principal residence, unemployment or over indebtedness). Locking in savings can be an obstacle, particularly for young people, for whom retirement is still a long way off and who are highly uncertain about their liquidity needs. This raises the question of the optimal degree of liquidity for retirement savings plans. If the plan is ‘too’ liquid, individuals may be tempted to consume their savings before retirement. But if they have a strong preference for liquidity, offering them the possibility of easy access to their funds in case of need can be an incentive to save.

Retirement systems differ in the degree of liquidity of their plans. In each country, different rules coexist depending on the type of pension plan. Generally, withdrawals are not permitted unless there are health-related issues (disability or serious illness) or financial hardships (unemployment, over-indebtedness). Some countries/schemes authorise withdrawals for the purchase of a primary residence. In the United States, early withdrawals are possible when individuals change employer. The funds accumulated in their 401(k) retirement savings plan are then transferred to an IRA account, where withdrawals are possible before age 59.5, subject to a penalty of 10% of the funds withdrawn.

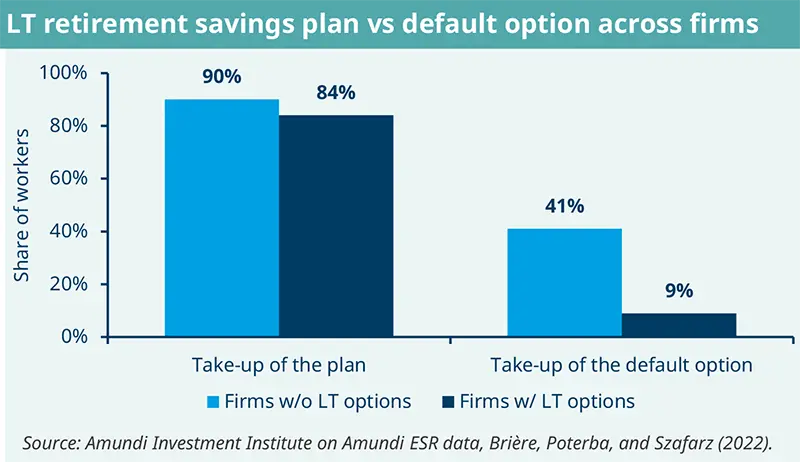

In the context of French employee savings schemes, there is a strong preference for liquidity. For example, employees are less likely to opt for the default option when this involves part of the profit-sharing being paid into the LT retirement option (9% of employees vs. 41% when the profit-sharing is paid entirely into the MT option, see the adjacent figure). Allowing more flexible withdrawals before retirement would undoubtedly improve the attractiveness of retirement savings schemes.

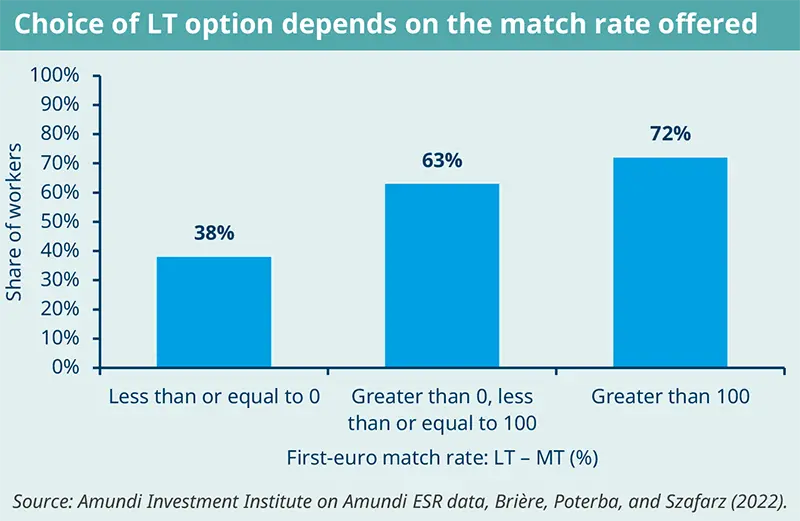

Furthermore, employees are more likely to invest in the LT option when it offers a better ‘match’12 than the MT one. If the LT match is the same or lower than the MT match, only 38% choose the LT option. This percentage increases to 63% when the LT match is positive but less than 100%, and to 72% when the LT match is over 100%.

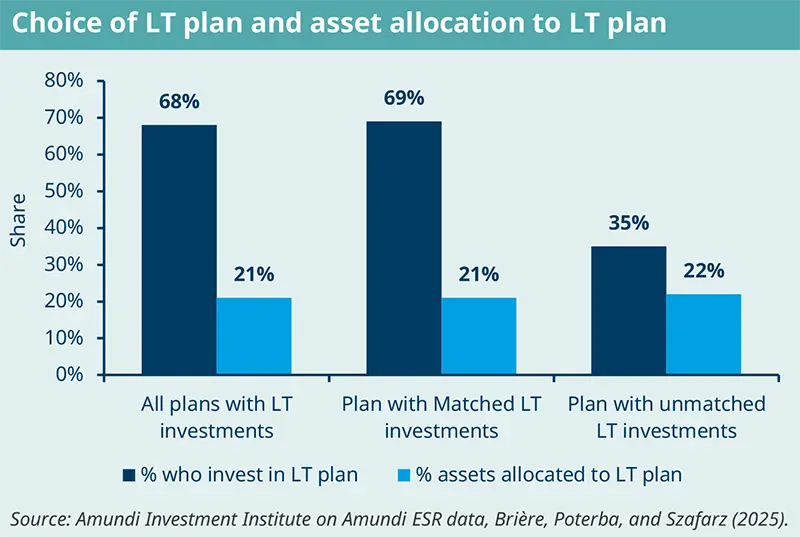

To understand the demand for long-term (LT) savings, we looked at the choices made by about 150,000 French employees who could invest in both medium-term (MT) savings (locked for 5 years) and LT savings (locked until retirement). These employees could decide how to allocate their new contributions between the two options. The second adjacent figure illustrates how employees allocated their assets between MT and LT savings.13

We also considered the sub-set of this group for which at least some of the offered LT investments are matched by the employer. The figure shows 69% of the ‘active’ workers chose to hold LT investments when the LT contributions were matched, while only 35% did so if there was no match. This suggests a limited demand for commitment without match incentives. The average share held by these employees was about 21% in both cases.

In the US, under the 2022 SECURE 2.0 Act, penalty-free emergency withdrawals are now permitted in 401k pension plans. Beshears et al. (2024) show that most participants continue making contributions after loans and hardship withdrawals. For plan sponsors considering the introduction of this new liquidity feature, these results suggest that most participants would be able to repay their withdrawals while maintaining their contribution rate to retirement savings.

Raising pension saving awareness

Evidence on the effectiveness of retirement information provision and financial education is mixed. Some experiments show that providing easily accessible information on one's pension entitlements has a significant impact. In Germany, for example, a policy of systematic information on pension entitlements was introduced between 2002 and 2005, with annual letters presenting projected retirement incomes for all individuals over the age of 27. This reform led to an increase in tax-deductible retirement savings and a rise in earned income.14

Duflo and Saez (2003) conducted a randomised experiment in which individuals were offered a financial incentive to attend an educational seminar on a retirement savings plan. Both the ‘trained’ individuals and their peers were more inclined to take up the retirement savings plan. Also, 17,000 University of Minnesota employees received retirement income projections based on their accumulated capital. Goda et al. (2014) observed a significant increase in their contribution rate and average contribution.

More recently, Bauer et al. (2022) examined whether peer information and financial incentives (in the form of a lottery) are effective in getting people to check their pension information and change their saving behaviour. They find that informing pension plan members about how much their ‘peers’ are saving for retirement has no effect on how much people check their pension accounts, but that lottery-type financial incentives do. However, the receipt of pension information does not lead to increased savings three weeks after our intervention.

Meta-analyses of the impact of financial education on financial decisions find that interventions to improve financial literacy explain only 0.1% of the variance in the financial behaviours studied, with weaker effects for low-income people.15 There are several reasons for this. People often avoid information when the outcome is too uncertain or potentially negative (the famous ‘Ostricht effect’16). Financial education impact decays over time. Even large interventions with many hours of instruction have negligible effects on behaviour 20 months or more after the intervention. The partial effects of financial education diminish dramatically when one controls for people's psychological characteristics.

We might expect more impact from informational treatments that deal with people's emotions. Innovative tools have been tested to promote retirement savings. For example, preliminary evidence from a controlled experiment suggests that allowing people to interact with realistic computer renderings of their future selves using immersive virtual reality hardware have an impact on the propensity to save.17

Combined with pension simulators, these virtual reality tools could raise people’s curiosity and awareness about retirement saving needs and be integrated in robo-advisory services.

After all, more than 80% of financial decisions are made after receiving advice from a financial advisor. Yet in the US, 46% of advisors say they do not have a retirement plan. Training financial advisors on retirement issues and allowing them to use retirement planning and simulation tools in order to interact with clients can be particularly effective.

Combined with pension simulators, virtual reality tools could raise people’s curiosity and awareness about retirement saving needs and be integrated in robo-advisory services.

Conclusions

Getting people to save and invest for retirement is not an easy task and there are many reasons for that. Saving decisions are complicated: people don't know how much to save, or how to allocate their assets for retirement. The easy solution is to leave the money in their bank account. Present bias and procrastination explain the lack of decisions. In addition, savers like to have access to liquid savings that they can use when needed. However, most retirement saving vehicles lock the money until retirement, unless there are exceptional reasons to withdraw. This raises the question of the optimal degree of liquidity offered by retirement savings plans. Tax incentives can have an impact on retirement savings. They tend to have a bigger impact on savers that are already ‘active’ savers or wealthy individuals. Incentivising automatic contributions from employers to retirement savings plans might be more effective to touch a wider audience of potential investors. Finally, the provision of information on retirement saving needs (perhaps combined with engaging ‘virtual reality’ tools) can be useful, especially if it is channelled through financial advisors or easily accessible digital tools such as robo-advisors.

References

- Bauer, R., Eberhardt, I. and Smeets, P., 2022. A fistful of dollars: Financial incentives, peer information, and retirement savings. The Review of Financial Studies, 35(6), pp.2981-3020.

- Benartzi, S. and Thaler, R.H., 2013. Behavioral economics and the retirement savings crisis. Science, 339(6124), pp.1152-1153.

- Berk, S.H., Beshears, J., Garg, J., Choi, J.J. and Laibson, D., 2024. Employer-Based Short-Term Savings Accounts (No. w32074). National Bureau of Economic Research.

- Beshears, J., Choi, J.J., Laibson, D. and Madrian, B.C., 2009. How does simplified disclosure affect individuals' mutual fund choices? (No. w14859). National Bureau of Economic Research.

- Beshears, J., Choi, J.J., Laibson, D., and Madrian, B.C., 2017. Does front-loading taxation increase savings? Evidence from Roth 401(k) introductions, Journal of Public Economics, 151: 84-95.

- Beshears, J., Choi, J.J., Laibson, D., Madrian, B.C. and Skimmyhorn, W.L., 2022. Borrowing to save? The impact of automatic enrollment on debt. The Journal of Finance, 77(1), pp.403-447.

- Beshears, J., Blakstad, M., Choi, J.J., Firth, C., Gathergood, J., Laibson, D., Notley, R., Sheth, J.D., Sandbrook, W. and Stewart, N., 2024. Does Pension Automatic Enrollment Increase Debt? Evidence from a Large-Scale Natural Experiment (No. w32100). National Bureau of Economic Research.

- Beshears, J., Choi, J.J., Dickson, J.M., Goodman, A., Greig, F. and Laibson, D., 2024. Does 401 (k) loan repayment crowd out retirement saving? Evidence from Administrative Data and Implications for Plan Design (March 5, 2024). Wharton Pension Research Council Working Paper No. Forthcoming.

- Blaufus, K., and Milde, M., 2021. Tax misperceptions and the effect of informational tax nudges on retirement savings. Management Science 67.8: 5011-5031.

- Bohr, C.E., Holt, C.A., and Schubert, A.V., 2023. A behavioral study of Roth versus traditional retirement savings accounts. Working paper series/Department of Economics 440.

- Brière, M. Poterba, J. and Szafarz, A., 2022. Precautionary Liquidity and Retirement Saving, AEA Papers and Proceedings, Vol. 112, pp.147-150.

- Brière, M. Poterba, J. and Szafarz, A., 2024. Does Tax Deductibility Increase Retirement Saving? Lessons from a French Natural Experiment, Amundi Working Paper.

- Brière, M. Poterba J. and Szafarz, A., 2025. Precautionary Liquidity and Worker Decisions in French Employee Saving Plans, forthcoming.

- Chetty, R., Friedman, J.N., Leth-Petersen, S., Nielsen, T., and Olsen, T., 2014. Active vs. Passive Decisions and Crowd-Out in Retirement Savings Accounts: Evidence from Denmark. Quarterly Journal of Economics, 129(3): 1141–1219.

- Choukhmane, T., 2021. Default options and retirement saving dynamics. Working Paper, MIT.

- Choukhmane, T., and de Silva, T., (2023). What Drives Investors’ Portfolio Choices? Separating Risk Preferences from Frictions, Working Paper.

- Dolls, M. et al. (2018), Do retirement savings increase in response to information about retirement and expected pensions?. Journal of Public Economics, 158, 168-179.

- Duflo, E. and Saez, E., 2003. The role of information and social interactions in retirement plan decisions: Evidence from a randomized experiment. The Quarterly journal of economics, 118(3), pp.815-842.Fernandes, D. et al. (2014),

- Goda, G.S., Manchester, C.F. and Sojourner, A.J., 2014. What will my account really be worth? Experimental evidence on how retirement income projections affect saving. Journal of Public Economics, 119, pp.80-92.

- Goldin, J., Homonoff, T., Patterson, R., and Skimmyhorn, W., 2020. How much to save? Decision costs and retirement plan participation. Journal of Public Economics, 191: 104247.

- Hershfield, H.E., Goldstein, D.G., Sharpe, W.F., Fox, J., Yeykelis, L., Carstensen, L.L. and Bailenson, J.N., 2011. Increasing saving behavior through age-progressed renderings of the future self. Journal of marketing research, 48(SPL), pp.S23-S37.

- Horneff, V., Raimond M., and Mitchell, O.S., 2023. How would 401(k) ‘Rothification’ alter saving, retirement security, and inequality?. Journal of Pension Economics & Finance, 22.3 (2023): 265-283.

- Karlsson, N., Loewenstein, G. and Seppi, D., 2009. The ostrich effect: Selective attention to information. Journal of Risk and uncertainty, 38, pp.95-115. Madrian, B.C. and Shea, D.F., 2001. The power of suggestion: Inertia in 401 (k) participation and savings behavior. Quarterly Journal of Economics, 116(4): 1149-1187.

- Sicherman, N., Loewenstein, G., Seppi, D.J. and Utkus, S.P., 2016. Financial attention. The Review of Financial Studies, 29(4), pp.863-897.

Read more