Summary

Executive summary

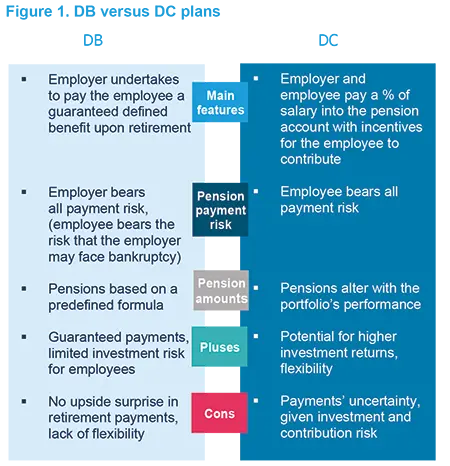

The importance of decumulation1 strategies in retirement has gained traction in recent years. Government pension reforms are driving a move away from defined benefit (DB) schemes, which promise an income for life, in favour of defined contribution (DC) plans which offer no such guarantee. In Europe, DC plans already account for 26% of retirement assets (USD713.9 billion)2 and are projected to rise significantly in the next five years, potentially increasing by USD2.5 trillion.3

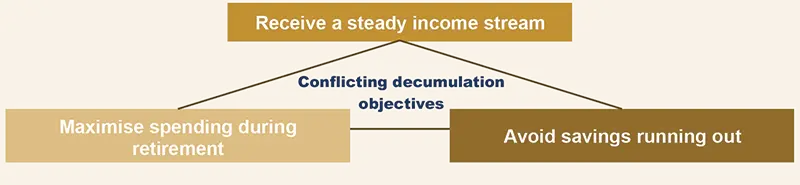

Designing decumulation strategies involve a high degree of complexity. For example, popular retirees’ goals include a desire to i) receive a steady income, ii) spend as much as possible during retirement (maximise withdrawals)4 and iii) be protected against the risk of outliving retirement savings. Yet, these cannot all be pursued simultaneously, as they may conflict with each other. Strategies also need to take into account individuals’ preferences for consumption rates, bequests (i.e. inheritance received by heirs or heiresses) and risk tolerance levels.

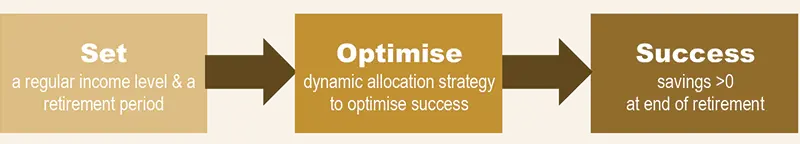

Our premise is that the management of risks such as inflation and sequencing (unfavourable timings of withdrawals and market losses) as well as longevity, require dynamic management during retirement. To determine decumulation solutions, we propose a new strategy called the “Success Rate Optimiser”.

This sets out income needs in advance, and then uses a dynamic asset allocation approach to optimise a retirement portfolio’s probability of success.5 Specifically, this approach offers an asset allocation strategy which decreases the risk asset exposure as the value of a portfolio increases. Importantly, it provides a planned income stream and retirees can customise their solutions by selecting consumption patterns, investment horizons and asset mix constraints as well as exit thresholds for bequests and/or annuities. Compared to more traditional decumulation approaches, the Success Rate Optimiser achieves higher success rates in different market environments.

Finally, since the security levels offered by public pension schemes vary across regions, so also do risk tolerance levels. Hence, the asset allocation approaches within decumulation solutions need to reflect these differences, making flexibility a key element in selecting strategies.

The Success Rate Optimiser optimises the probability of success while delivering a steady and sufficient income.

There is a trade-off to be made between the various investment goals in retirement. A dynamic asset allocation approach can enhance the probability of

success in the long-run.

What are appropriate decumulation solutions?

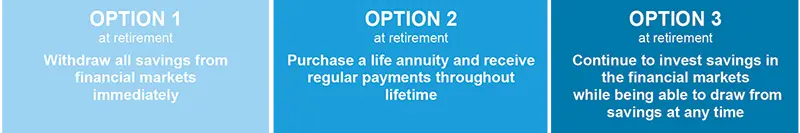

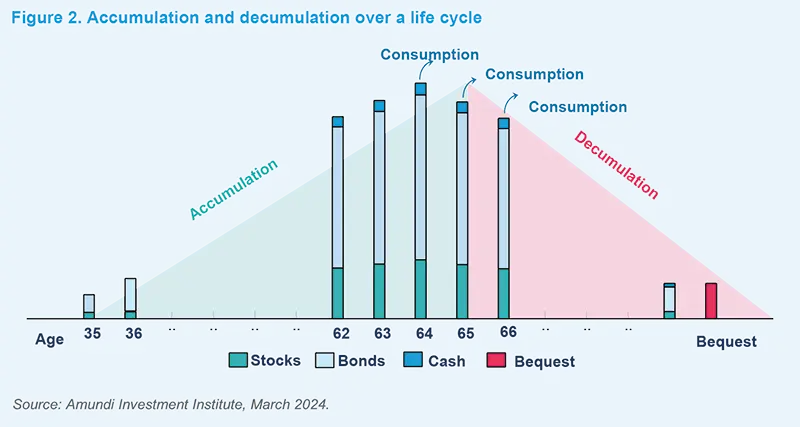

Individuals often strive to increase their saving rates and maximise investment returns during their accumulation years. Yet, equally important is the decumulation process. At retirement, retirees need to develop a long-term plan to gradually spend down their assets. Generally, they have three options to deal with their savings:

Following the third option, a decumulation investment strategy is a strategic way to convert retirees' pension savings into retirement income. The objective is to ensure retirees receive regular payments for the rest of their lives.

The importance of having appropriate decumulation strategies has gained traction in recent years. Depending on pension systems, pension providers have often moved away from DB schemes, which promise a defined income for life, in favour of DC plans which usually offer no such guarantee. These strategies involve a much higher degree of complexity than accumulation solutions with three key dimensions to consider that are unique to decumulation challenges: retirees’ goals and preferences, retirees’ specific risk factors and the decision variables, such as the asset mix and withdrawal plan.

GOALS: In terms of goals, the most common are those that include receiving a steady inflation-adjusted income, maximising withdrawals and minimising the risk of running out of funds.6

These goals are conflicting and, thus cannot all be pursed at the same time: it is clear, for example, that one cannot want to both spend as much as possible and leave a large inheritance to their heirs. In addition, retirees’ preferences surrounding consumption rates, risk tolerance levels as well as health issues also need to be considered when designing appropriate strategies.

There is a change of paradigm in the pension fund industry with the inexorable shift towards DC. This will lead to a greater focus on flexible solutions and dynamic asset allocation.

RISKS: Retirees are exposed to risks during retirement such as longevity, sequencing and inflation.

- Longevity risk relates to the risk that a retiree could outlive their pension savings, which is acute given the increase in longevity. This rises the financial risk that the money saved for retirement will not be sufficient. However, individuals’ health status can be assessed, and changes can be made within strategies to investment horizons and/or retirees’ expenditure to reduce this risk.

- Sequencing risk can result in a notable depletion of assets.7 For example, a market decline that occurs early in retirement will have a greater impact than a fall of the same level that strikes later. This is due to the fact that after a downturn, there would be less assets to benefit from a recovery.

Ultimately, this reduces the possibility of a portfolio being successful (i.e. surviving the investment period). In contrast, if a portfolio benefits from strong markets early in retirement, the accumulated wealth would be better able to resist any slump that happens later. One way of managing sequencing risk is to have a diversified portfolio.

- As regards inflation risk, this is often defined as higher-than-expected increases in the cost of living. While it might be perceived as manageable by those receiving regular wages (wage growth is typically aligned with or exceeds inflation), it poses a problem to retirees. It can result in portfolios being depleted faster-than-expected, increasing the risk that they will outlive their pension savings (longevity risk). To protect against inflation risk, retirees’ strategies’ need to focus on income and appreciation opportunities as well as take into consideration the inflation profile of retirees (i.e. in early retirement, they may spend a notable amount on travel and luxury items while, at a later stage, their medical expenses increase).

RETIREMENT DECISION VARIABLES: Retirees have to address two main questions:

Q1

How much can I withdraw?

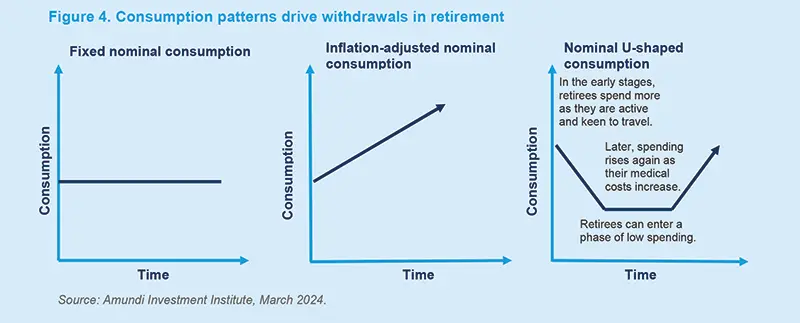

Deciding on the size of income withdrawals is a very challenging task for retirees, requiring a comprehensive consideration of long-term risks. The consumption needs of retirees may also vary due to differences in financial situations and pre-retirement spending levels. For simplicity, they can set the consumption demand variable as a constant, adjust it for inflation, or instead, customise it.

Q2

How do I invest the remaining funds?

A decumulation investment strategy can be a one-off decision taken at the point of retirement or a sequence of actions taken over time. For example, retirees may choose a constant mix of 60% stocks and 40% bonds. Alternatively, as we suggest in this paper, they can rebalance their portfolios based on market conditions as well as their remaining wealth and income withdrawal needs.

Decumulation strategies designed to optimise the probability of success are key in facing an increasing set of financial priorities and complexities.

The new Success Rate Optimiser strategy versus other traditional approaches

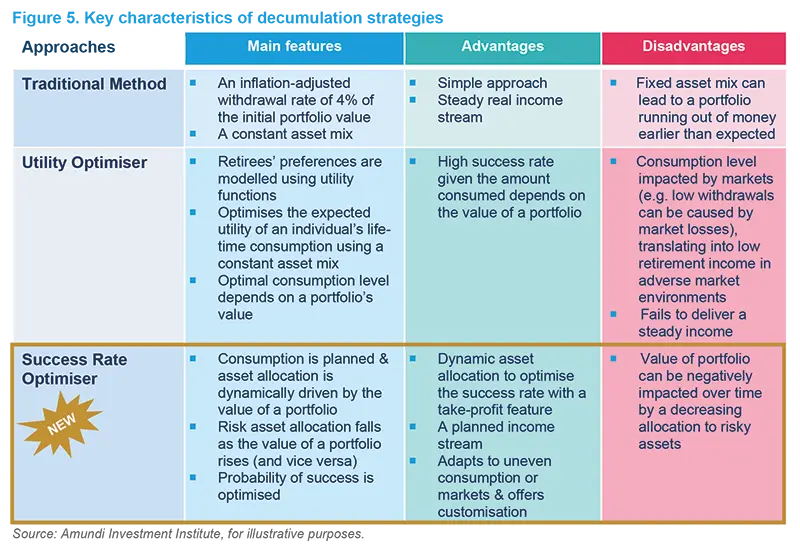

In our research, we compare three different approaches:

How it works: It proposes that retirees should use an inflation-adjusted withdrawal rate of typically 4% relative to an initial portfolio value. Its objective is to deliver a steady amount in real terms over the investment period (e.g. 30 years) with a high probability.

Static asset allocation: A conventional constant mix allocation between risky and risk-free assets is used (e.g. 50/50, 60/40, 70/30) which does not adjust to market conditions.

Inflation-adjusted consumption pattern: The consumption level is inflation-adjusted and steady.

Lower probability of success: This strategy heavily depends on markets: the probability of running out of assets is high. Also, in good market conditions, it may be considered ‘wasteful’, as a large amount can be left-over which could have been distributed as income during retirement.8

How it works: The expected utility of retirees’ life-time consumption is optimised. With risk aversion held constant, an optimal consumption level that is proportional to the value of a portfolio is determined. This, however, is impacted by the economic situation (more to spend in good years and nothing to spend in bad ones).

Static asset allocation: A fixed mix allocation is used that depends on the retiree’s risk aversion.

Unstable consumption level: Consumption levels are affected by the economy and markets.

High probability of success: With success being defined as the guarantee that $1 remains at the end of the retirement period, its probability is high given the amount consumed depends on the portfolio value. However, the irregular pension payment streams make this strategy unreliable.

How it works: The strategy seeks to optimise a portfolio’s probability of success by dynamically allocating the available funds (those remaining after adjusting for the nominal planned consumption levels) between risky and risk-free assets.9 This approach delivers a steady income.

Dynamic asset allocation: A dynamic allocation (with take-profit features) is used: it decreases a portfolio’s exposure to risky assets as its value increases.

Customisable consumption pattern: Future consumption and bequests are fixed. These are based on preferences and can be changed at any time by putting a new optimisation in place.

High probability of success: A high probability can be achieved in a variety of market conditions.

The Success Rate Optimiser and dynamic asset allocation

When compared to other retirement strategies, one important feature of the Success Rate Optimiser is its dynamic asset allocation approach. With the growing popularity of DC schemes, the concept of an asset allocation strategy that becomes more conservative as the value of a portfolio increases has captured the attention of investors. Such a strategy helps to dynamically manage the multifaceted risks within a DC pension scheme, where prioritising one risk over another can have unintended consequences.

For example, an overly conservative portfolio intended to minimise the frequency and size of portfolio losses may increase the risk of retirees outliving their savings (longevity risk). A good example of such a portfolio is one derived using the Traditional Method. Retirees follow a constant mix strategy to spread their investments between risk-free and risky assets, no matter what the wealth of a portfolio is, or how close they are to the end of their investment horizons. Alternatively, the Success Rate Optimiser fixes consumption so that when a portfolio performs well, the allocation to safer investments increases (e.g. cash), and when performance is poor, the allocation to more risky assets rises in the expectation that those assets will help to recover losses.

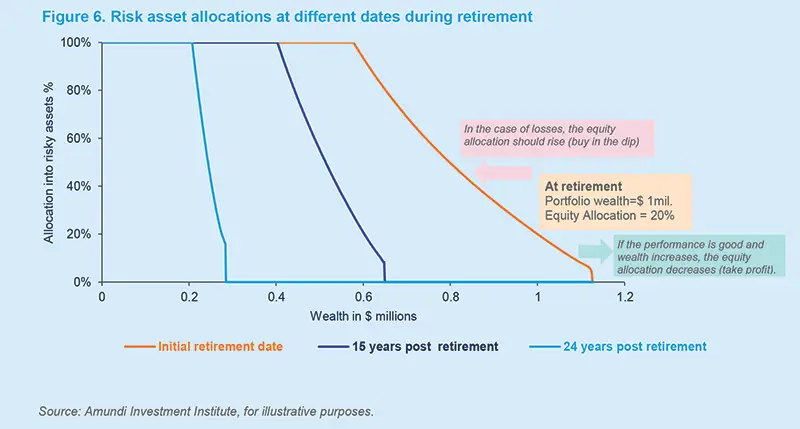

The figure 6 portrays the asset allocation strategies used in the Success Rate Optimiser where the allocation is done after taking aside the amount that is going to be withdrawn for consumption. For simplicity, the initial portfolio value is set at 1.0 (e.g. $1 million after adjusting for the amount needed to cover future consumption levels) and the investment horizon is 30 years. The curved lines represent risk asset allocation solutions (%) at different dates during retirement (the initial retirement date, 15 years after retirement and 24 years after retirement).

The orange line is the position of an individual at the start of retirement with a 30-year investment horizon. According to this line, if a retiree’s wealth is at $1 million, 20% should be allocated to risky assets. If wealth increases to $1.1 million, the allocation to risky assets falls to zero and, alternatively, if wealth decreases below $1 million, the same allocation increases rapidly. This highlights that when a retiree has less wealth, there is a need to invest more in riskier assets with higher expected returns in order to achieve his/her objective.

Customisation

Importantly, the Success Rate Optimiser offers the potential for customisation. For example, a maximum risk asset weight can be chosen as a constraint. Moreover, since future consumption is fixed, withdrawals can be met by investing entirely in risk-free assets as soon as the value of the portfolio exceeds a set threshold. This option to take profits contributes to these strategies’ high success rates.

Deciding on the amount of income withdrawal is a very challenging task for retirees, requiring a consideration of long-term risks (e.g. inflation and/or a rise in life expectancy) and consumption needs that may also vary due to differences in financial circumstances and preretirement expenditure.

A decumulation strategy can be a one-off decision taken at the point of retirement, or it could also be a chain of actions taken over time. The customisation of retirement solutions is crucial.

Robustness of strategies and future developments

In the detailed research paper (Optimal Decumulation Strategies for Retirement Solutions), we used variations of the different models to test the robustness of the strategies. For example, we considered complementary performance indicators in addition to the strategies’ average success rates (success defined as the occurrence of simulations where retirement savings are above zero at the end of the simulation), such as their survival times (how long savings last), or wealth levels reached at the end of the simulation. We also considered alternative interest rate and consumption rates environments.

Overall, Amundi’s research highlighted that decumulation investment strategies should be designed with a dynamic asset allocation approach, defined consumption goals, fixed investment horizons and clear objectives to optimise their success rates. However, Amundi will continue to carry out research on this important theme including: an examination of the impact of transaction costs (including how they can be reduced) within the Success Rate Optimiser approach; consider alternative definitions of the risk-free rate for retirees; and adapt the modelling (which has been done at the level of an individual) to mutualised strategies such as decumulation target date funds.10

Box 1. Retirement being dynamic in practice – Decumulation for different clients

At Amundi, we typically work with clients (who offer investment products to retirees) to assess if they are aligned with the needs of savers. A big difference with accumulation solutions is that decumulation default strategies are not common. Thus, it is the retirees’ responsibility to choose if they want an annuity (see Box 2) and/or select the appropriate mix of funds offered by the investment provider to face decumulation challenges. We need to make assumptions about the choices those investors will make to determine the success of the strategy.

As mentioned above, the strategies should take into account the specific goals of retirees. For the purpose of this paper, we will use the concept of the replacement income ratio as a proxy for the retirees’ goals. It is not perfect but has the dual advantage of: i) being translatable in a model and ii) encapsulating key problematics, such as the maintenance of one’s standard of living into retirement. When running analysis for clients, we use a wide variety of key performance indicators (KPIs).

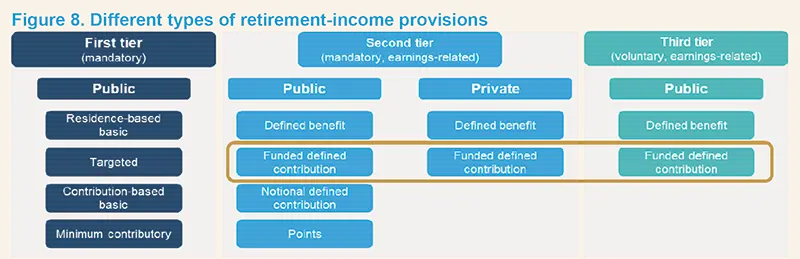

To give the full picture, this earnings replacement ratio should take into account the payments from the DC pension scheme as well as other retirement income that an individual may get (e.g. money from the government). Therefore, our analysis needs to reflect the intricacies of complex pension systems, often unique to each country, and sometimes to sub-groups within a nation. DC payments are only a component of the overall income of retirees, as depicted in the figure below.

Source: OECD (2023), “Pensions at a Glance 2023: OECD and G20 Indicators”, OECD Publishing, Paris.

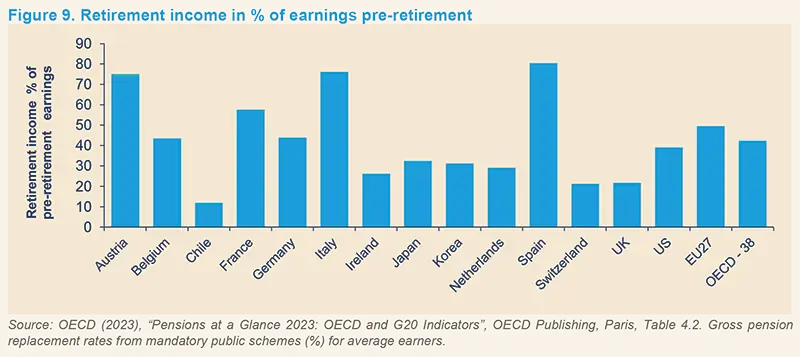

The following chart shows the retirement income perceived via the mandatory public systems.

According to this chart:

- A retiree in France should get on average 57% of their earnings pre-retirement through the public system. They may get additional DC income through voluntary savings (not depicted here).

- A retiree in the UK has a lower public retirement income (21% of the pre-retirement earnings).

When we run the analysis described above to determine the success of an allocation strategy, we need to take into account the specificities of the country to determine the starting risk position of a retiree. In the figure above, there was a number of countries (e.g. UK) with low risky asset allocations (21%), but for countries with larger risk appetites, the risky asset positions can be much greater. Regardless of the starting position, however, we are convinced that dynamic decumulation strategies are better than the ‘set and forget’ allocation choice.

Box 2. Addressing longevity risk

There are two components to longevity risk: systematic longevity risk, which is the risk of misestimating the population’s future survival probabilities; and idiosyncratic longevity risk, which is the risk that an individual’s date of death may differ from the expected date. The largest risk for individuals is the idiosyncratic risk as it is hard to predict how long he/she will live. Conversely, the systematic longevity component is relatively small in magnitude for individuals, as life expectancy surprises tend to be moderate from one year to the next.

While individuals can fully insure against longevity risk by purchasing a life annuity contract from an insurance company, this protection comes at a cost.

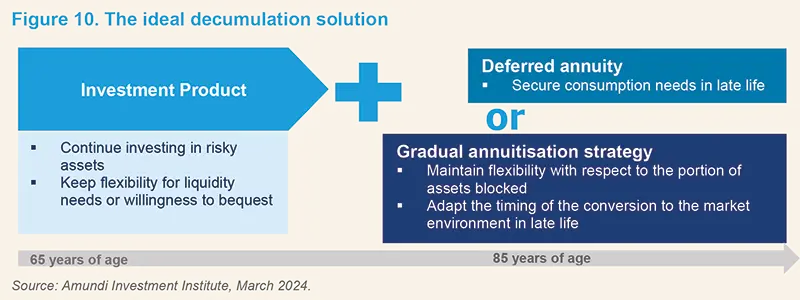

Also, fixed annuities (offering guaranteed nominal income) offer no protection against inflation, or the possibility of continuing to invest in risky assets in order to obtain a potentially higher level of income. Finally, they are irreversible and prevent an individual from handing down part of their capital to heirs, or in recovering capital in the event of unforeseen expenses. At the same time, individuals are exposed to the insurance company’s default risk. Amundi’s research has highlighted that an optimal retirement strategy should use both investment products and annuities.11 We are living longer and the duration of retirement is rising. This, combined with different interest rate levels and return potential from low-risk assets, ensures that the retirement phase could be seen as an active investment period.

Academic work advocates that an investment strategy combined with a gradual annuitisation strategy may be an ideal decumulation solution. The individual can continue to invest capital after retirement and converts it gradually into an annuity to secure late-life consumption needs. One important benefit of a gradual annuitisation approach is that it allows individuals to avoid having to take, on retirement day (or even before in some cases), an irreversible decision to convert all of their accumulated capital into an annuity. This decision may fall at an unattractive time in markets. In addition, it means that the conversion into annuities can be temporarily halted when rates are low and annuities are particularly expensive. Another solution is to start to combine an investment product with a deferred annuity later in retirement (for example at 85 years of age).

Amundi research12 has shown that a pooled annuity fund can be used rather than a life annuity. In practice, this is a collective plan where the idiosyncratic longevity risk is pooled, but the systematic longevity risk is borne by the individuals. These funds offer lifelong payments during retirement that adjust to changes in life expectancy. The plan maintains solvency as pension benefits adjust directly to changes in life expectancy. Although their benefits are marginally more variable than conventional annuity payouts, they are on average higher than those of an insurance solution involving a life annuity, when the pooled annuity fund and the life annuity have the same financial risk exposure. Our simulations show that a pooled annuity fund is an attractive solution. It offers a higher utility than a life annuity when both products have the same financial risk exposure (e.g. in the case of fixed and variable annuities, or even when the equity risk exposure varies with time, as in a lifecycle portfolio). These results hold for immediate or deferred annuities, various longevity scenarios and individual characteristics (gender, risk aversion).

Optimal Decumulation Strategies for Retirement Solutions

1 Decumulation refers to the drawing down of savings during the retirement period.

2 European Central Bank, Q3 2023.

3 Cerulli Associates, data as of 2022.

4 Maximise withdrawals adjusted for retirees’ desire for exit thresholds to buy annuities or to make bequests.

5 The definition of ‘probability of success’ is the chance that at least $1 remains in the retiree's account after 30 years of withdrawals. A high average survival rate is defined in the same way.

6 Guyton J.T. and Klinger W.J. (2006), “Decision Rules and Maximum Initial Withdrawal Rates”, Journal of Financial Planning, 19(3).

7 Sequencing risk is due to the fact that the strategy is dynamic as it is driven by the portfolio’s wealth. The latter is not constant and hence the proportion of risky assets changes continually.

8 Bruder B., Caudamine L, Do H., Gisimundo V., Granjon C., Xu J. (2023), “Optimal decumulation strategies for retirement solutions”, Amundi Asset Management, December 2023. Optimal Decumulation Strategies for Retirement Solutions | Amundi Research Center. In this paper, the Success Rate Optimiser is called the Ruin Date Utility Maximisation methodology.

9 Inflation is not an input parameter, but it is embedded in the optimiser.

10 A target date fund is a fund that seeks to grow assets over a defined period of time for a specific goal.

11 Briganti F. and Brière M. (2019), “Reflection paper on new strategies for decumulation”, Cross Border Benefits Alliance Europe.

12 Boon L., Brière M. and Bas W. (2018), “Systematic longevity risk: to bear or to insure?”, Amundi Asset Management.