Summary

Geopolitical outlook for the second half of 2024

Investors must assess evolving risks to adjust positions and implement hedging options.

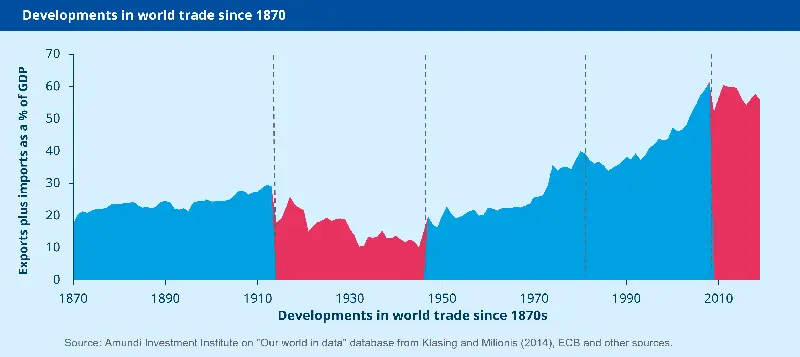

Our analysis suggests that geopolitical risk is likely to rise for the remainder of this decade. Protectionism, sanctions, tariffs, export controls and trade wars will only intensify. History tells us that the more economic friction, the higher the risk of military conflict. The next few months will be crucial in determining the direction of various geopolitical hotspots.

The outcome of the US election will be pivotal with US foreign policy differing significantly under a Biden or Trump presidency, although any incoming US administration will preside over worsening ties with China. The period between November and January, which could see a change in the US administration, presents a window of vulnerability, both domestically and internationally. Forces seeking to weaken US influence in the world could decide to explore how far they can go. China’s military manoeuvres in the South China Sea and North Korea’s positioning towards the South must be monitored.

We anticipate increased fighting between Russia and Ukraine in the second half of the year. Russia aims to capture as much territory as possible before a potential change in the US administration and a possible ceasefire. At the same time, Ukraine’s defensive capabilities are likely to improve with the arrival of new weaponry and more manpower at the front.

The crisis in Israel and Gaza will likely continue in the second half of the year due to Israel’s war goals and domestic politics. An escalation between Israel and Lebanon, as well as between Israel and Iran, remains possible and both could end up involving the US.

In Europe, a new EU Commission and parliament will come into office and will need to adapt to the new geopolitical realities. Europe will have to refine its approach to China: balancing growing tensions without ‘rocking the boat’ as the EU relies on Chinese inputs for its green ambitions and can also benefit geopolitically and economically from the US/China rivalry.

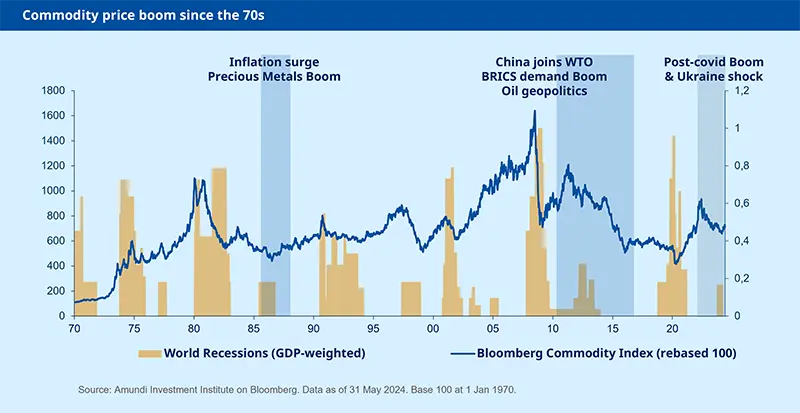

Implications on commodities

The dynamics of commodities and geopolitical tensions are interconnected.

Crude oil is a key stress marker in the Middle East. Base metals are tied to the energy transition and implicitly to the US-China tech war, amid mining tightness and supply concentration.

Metals are a crucial stake in Africa too, where the West is competing with China for influence.

Natural gas and wheat are being weaponised in the Ukraine war, while access to Russian resources is being dramatically reshaped.

Beyond its safe-haven status, gold is increasingly used as a means to diversify away from dollar transactions.

Water, another crucial mineral resource, sees demand from climate change, urbanisation, mining and industry colliding with tighter and more concentrated water supplies. Commodities are thus connected to most geopolitical tensions.

Commodity prices suggest geopolitical risk is set to structurally intensify, but we see more risk coming from Asia than from the Middle East. Supply/demand dynamics matter more for crude prices than escalation risk in the Middle East.

The implied odds that a major oil producer is drawn into a broad conflict, leading to a supply shock, are low. The bigger geopolitical forces in the region are filling the void left by the US’s strategic refocus on Asia and the gradual phasing out of fossil fuels.

This calls for diplomatic normalisation, a refocus on the economy and carrying out a number of mega projects, including Saudi’s Vision 2030 project.

Metals now appear more exposed to geopolitics than energy, particularly copper and rare earths. Rising gold prices evidence the general perception of structurally higher geopolitical risk.

We see oil prices in a range slightly tilted to the downside. Gold would reach $2500/oz and copper prices would settle above $10000/t.

Focus on oil

OPEC+ announces its QT but will stay data dependent. The cartel announced an extension of the group-wide 1.5mbd production cuts until the end of 2025 but plans to wind down its 2.2mbd voluntary cuts from October 2024 over 12 months, if allowed by market conditions.

The news suggests that OPEC+ intends to normalise its output even at the cost of slightly lower prices. The cartel likely hopes that lower rates would provide room to absorb spare capacity by then and that the phasing out of fossil fuels will be slower than planned.

In nuance, the supply of extra barrels would be lower than announced as some countries exceed their quotas. Also, after months of dissension, the decision reached a wider consensus. Finally, slightly lower prices put pressure on non-OPEC output.

We are keeping our 3M target at $85/b for Brent, and believe markets may be overreacting, while we have revised our 12M target down to $80/b.