Summary

- The economic damage from the Russia-Ukraine conflict has made the Emerging Markets (EM) outlook more uncertain. While the uncertainty persists and the final outcome of the war is still difficult to anticipate, we believe that macro fundamentals will be impacted through indiscriminately higher inflation together with more subdued growth and deteriorating fiscal conditions, particularly for commodity exporters. That said, an overall higher inflation, when many central banks in EM were approaching the end of their tightening cycles, will raise the probability of prolonging the tightening phase further and challenging the next monetary policy path.

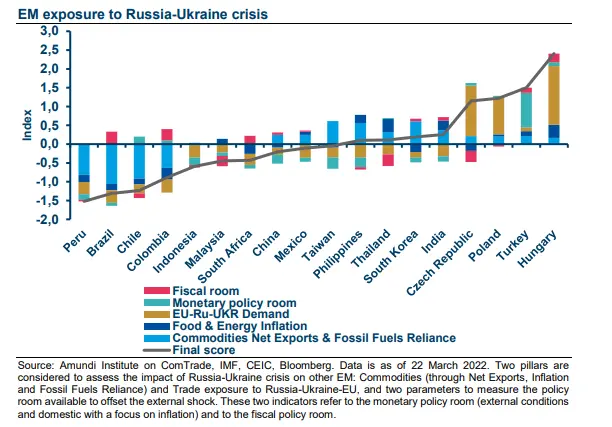

- Varying degrees of economic impact from the conflict point towards greater fragmentation in the EM world. Eastern Europe will suffer most due to its direct trade/investment exposure to the conflict zone and indirect exposure to the European economic deterioration as well as to higher energy prices. The impact of sharply higher commodity prices is not uniform in the EM space and some countries or regions could even benefit from higher prices, from the Middle East gaining from higher oil prices to LatAm where most countries are net commodity exporters especially for industrial metals and agriculture products. Asia could be more resilient as long as the two main economies, India and China, do not incur in any kind of sanctions. China also seems more insulated in terms of possible economic spill overs.

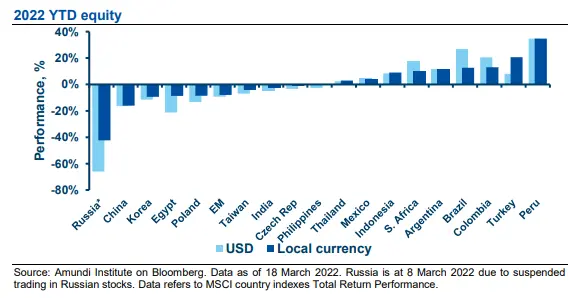

- Equity views: although valuations for EM versus DM equity markets appear rather attractive we maintain a conservative stance, we need more clarity on the evolution of the crisis, but investors should be aware that any geopolitical de-escalation will potentially trigger a sharp recovery in risky assets. We favour areas where we are less concerned about the deterioration of earnings via higher prices or could benefit directly from the rise in oil and commodity prices (LatAm markets, UAE).

- Fixed income and FX views: we remain cautious and seek to dynamically explore attractive entry points with a strong bottom-up bias. Our preference goes to hard currency debt amid high oil prices and a more uncertain outlook for growth and inflation penalising local debt. In the search for real rates, investors should consider Chinese sovereign debt, as this will also benefit from the monetary easing mode. We are very cautious on EM currencies as they will be negatively impacted by persistently high inflation and further monetary tightening. On the other hand, the growing role of the Renminbi as an international currency is supportive for the Chinese currency.

Macro-economic impact of the crisis in Emerging Markets world

Although it is still difficult to anticipate how macro fundamentals will be impacted through this crisis, because of the uncertainty of its evolution and final outcome, our perspective is that the crisis is negatively affecting the growth outlook and raising inflationary pressures. The impact of the Russia-Ukraine conflict is primarily on confidence and through commodity prices, given Russia is one of the world’s top exporters for grain, fertilisers, metals, oil and gas. Inflation will remain stubbornly high during the year, in the range of 6.5-7.5% for Emerging Markets (EM), while on the growth side, we have revised down global growth by 0.5% in 2022. For EM, the expected 2022 growth range is 3.3-.3.9%, with high country divergences.

The economic impact stemming from the crisis will be uneven across countries, with some economies potentially benefitting from the commodity boost and others challenged by higher inflation dynamics.

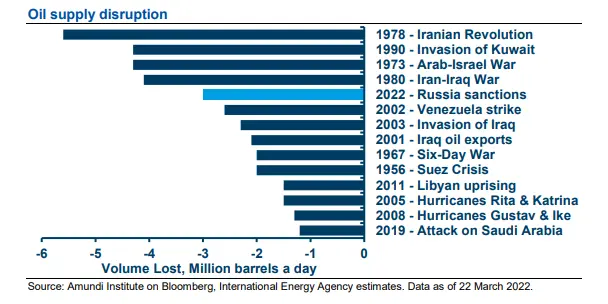

Higher oil prices will continue to be a key driver of EM growth

We think oil prices will remain above $100 for a while amid supply disruption from the conflict. Russian oil production is more than 10mbd and around 10% of the global production. The recent ostracism of Russian oil in the markets (more than 60% of oil exports are to struggling to find buyers) is creating a global shortage and recent decisions to ban Russian oil from the US and UK are exacerbating the overall picture. In addition, Russia normally also exports petroleum products besides crude oil, where there will also be shortages amid the conflict. Libyan exports are at risk and Iraq production is temporarily below potential for technical reasons. Iran talks and an agreement on nuclear activities can provide some relief to the market but cannot change the overall environment in the near term. This is creating divergences between net oil importers, such as India, and net exporters such as Indonesia or the Gulf countries.

An even more fragmented EM world

With the exception of Asia, most EM entered the crisis with subdued economic momentum driven by policy support withdrawal and additional inflationary pressure, stemming from the crisis, will challenge the monetary policy path for some EM countries.

As inflation was already at or above trend in EM in 2021, many EMs have already started to act to tame price pressure and this is expected to continue through several fiscal measures, seeking a trade-off between high inflation and fiscal deterioration. On the external side, a vast majority of EM have healthier current account balances with higher foreign reserves which puts them in a better position compared to previous crises. Finally, China could act as supportive factor. In fact, China, after becoming the main area of attention in 2021 amid its economic slowdown, is now showing a significant turn in policies and attitude from the authorities, who are willing to stabilise the economy and exhibiting a clear commitment to financial markets, while continuing to deleverage the real estate sector (see Focus on Chinese economic outlook at page 5). While relevant at a global level, this should support those Asian countries connected with China.

As usual, the picture for the EM universe remains very diverse, based on the country-specific features linked to different economic models and different stages in their policy stances.

In particular, divergences across EM will be driven by various factors:

- Dependency on oil and gas;

- Exposure to Russia – Ukraine crisis;

- Inflation and monetary policy trends;

- External vulnerability;

- Fiscal room.

Most of the negative impact will concentrate on areas in close proximity to the conflict zone (Eastern Europe) while oil and gas net importers will suffer external and fiscal deterioration (high imports bill and high energy subsidy costs), in particular those with twin deficits. Among the winners there are commodity exporters that will benefit relatively from recent events

At a regional and country level, there are different degrees of exposure to the risks stemming from the crisis:

- Eastern European countries are most exposed to the Russia-Ukraine crisis, being highly reliant on Russian energy imports. These countries will suffer through their direct trade exposure to Russia as well as indirectly through the weakness that the current crisis is inflicting on core European countries such as Germany – one of the most important trade partners for the region. Furthermore, a prolonged conflict could exacerbate refugee movements, which would weigh on fiscal positions not yet restored after the pandemic. In this regard, the most vulnerable countries in terms of thin fiscal buffers are Hungary and Romania. While hard to handle in the short term, migrant inflows for countries such as Poland could be a medium-term opportunity. The presence of Ukrainian immigrants in the country is already important and the Polish labour force desperately needs reinforcement (demographic tailwind).

- In the Asia-Pacific region, where central banks have been lagging in their normalisation process and the policy mix is still very supportive, a less benign inflationary environment could bring forward the expected hiking cycle. However, in many countries in the region energy and food prices are subsidised, smoothing out the impact on final prices and allowing the central banks to keep on a relatively gradual path. Asia, in general, appears to be less affected by events in Ukraine. Notably China could offer a source of stability, as the country is on a different economic cycle from the west.

- For net oil and gas importers, such as India, the impact on fiscal and current accounts could be more detrimental, diverting public expenditure towards subsidies from capex and penalising a more virtuous cycle for growth.

- The rise in commodity prices plays in favour of commodity exporters, such as Latin America which is not only physically distant and the least commercially linked to the conflict zone, but is also the most positively correlated to the commodity cycle, either via oil, metals or agricultural commodities (only Mexico is less so). LatAm assets look like a safe haven destination, with geopolitical concerns far outweighing local political and fiscal risks.

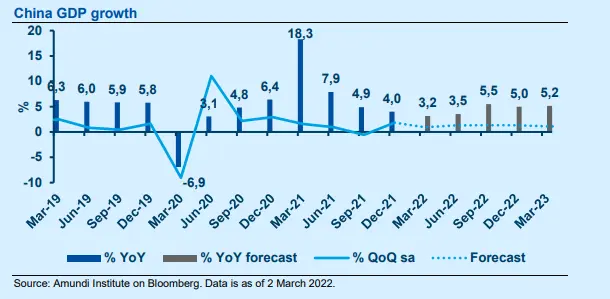

FOCUS: China economic outlook

The recent National People’s Congress (NPC) confirmed that stabilising growth will be a priority, setting the growth target at "around 5.5%” a consensual upper bound. The structural economic transition is ongoing, the success of Common Prosperity goes hand in hand with high-quality growth, boosting competition, productivity and reducing systemic risks over a long-term horizon.

Easing is already underway in China, particularly on the monetary policy side, departing from other economies that have begun to tighten monetary policy and we expect the overall economy to restart its engine slowly.

Easing is already underway, particularly on the monetary policy side, departing from other economies that have begun to tighten monetary policy. We expect the overall economy to restart its engine slowly. We expect inflationary pressures to remain contained in 2022. We may expect a further push from China to reach its target, moving forward we expect a combination of additional rate cuts and required reserve ratio cuts. With regards to its fiscal stance, we expect this to be more expansionary, but no excesses, as authorities want to avoid overheating and excess credit growth.

As for the housing sector, policies have turned to full easing mode in the sector to restore consumer confidence and the stance is supportive for one of China’s internal major downside risks, which is a sharper housing slowdown without timely policy adjustment. Another risk to consider is the impact of its zero-tolerance Covid-19 policy framework. In this respect, the recent lockdown in Shenzhen and Shanghai are impacting export supply chains, which will likely impact Q1 and Q2 growth.

China also has a long-term objective of being seen as a trustable and reliable partner, particularly with Europe, and also to build international relationships in order to strengthen its area of influence in Asia, as well as the growing role of the Renminbi as an international currency. Although the stance of China in the war has recently sought a more constructive role, we see more room for China to promote a diplomatic solution and offer itself as a conflict mediator.

Investment implications

The EM puzzle could offer opportunities along the following lines:

- Look at areas with lower inflationary pressures, where monetary reaction is on its way or close to peaking and real rates are back in positive territory. In this respect, Asia presents a benign picture and in China the PBoC has already moved towards easing.

- Favour countries exposed to the commodity cycle, which could benefit from higher commodity prices for cyclical or structural reasons (energy transition).

- Play the internal demand story, either within a well-diversified portfolio, actively investing in this theme, or by gaining exposure to China or India which are shifting their economic models towards domestic demand.

Cautiousness and selectivity are key across EM equity. Here we favour Brazil (benefitting from the value rotation), and countries linked to energy and commodities momentum.

Main convictions for investing in EM equity

While the stance remains cautious and selectivity is the name of the game, trends in place before the crisis should continue to be strong. In this respect, the Brazilian equity index, which is already being impacted by the rotation towards value, has proven quite resilient. Investors should favour other countries that could benefit at the current juncture from their links to energy and commodities momentum, such as UAE or domestically driven stories like India. At a sector level, we favour consumer discretionary and real estate and we maintain our tendency to increase value over growth. Although visibility is low at present, if we see some clarity on the magnitude of the changes taking place in the overall security situation around Ukraine, EM equity markets could show a sharp recovery, furthermore the asset class offers attractive valuations, opening entry points for investors.

The Chinese equity market has been highly volatile. While Chinese equities remained resilient at the start of the conflict, the tech sector, in particular, has increasingly been under pressure amid increasing regulatory risks. Moreover, a resurgence of Covid cases in the Shenzhen area has weighed on investor sentiment. However, after the statement made by Vice Premier Liu He promising to roll out policy steps favourable for its financial markets and boosting economic growth, stocks have jumped. The Hang Seng Index surged as much as 9% after the announcement. Apart from short-term volatility, we believe there are structural forces that should benefit this market with a long-term view:

- Its domestic demand and growth;

- Its low correlation with developed markets, considered a true diversifier;

- The greater autonomy of the Chinese cycle and better insulation from the global economic cycle;

- Its opportunity to gain exposure to areas of higher future growth.

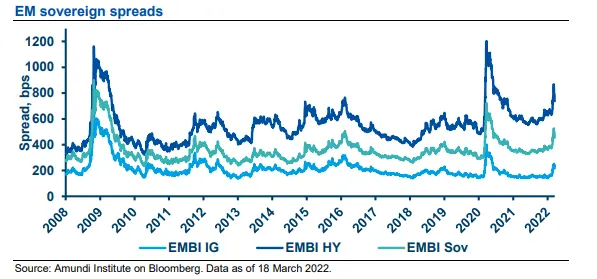

Main convictions for investing in EM bonds

With regards to EM fixed income, we maintain a cautious stance overall across the EM debt space during the current risk-off environment, while we stand ready to dynamically adjust our stance as we explore attractive entry points with a strong bottom-up bias. Our preference is for hard currency debt amid high oil prices (we continue to have a bias towards high yield versus investment grade) and a more uncertain outlook for growth and inflation penalising local debt. With different economic and monetary policy stances across countries, selection is paramount.

With further clarity on the geopolitical landscape, investors could take advantage of the higher yield offered by EM corporate bonds compared to US and European issuers for the same credit quality coupled with supportive forces, such as the looser monetary policy stance in China and strong commodity prices.

With regards to Chinese government bonds, the easing stance adopted by the PBoC, at a time when US monetary policy is getting tighter, offers an attractive environment for China’s sovereign debt, being one of the few markets to offer positive real returns. In 2021 the asset class outperformed DM bonds, and we believe that the trend could continue.

In a cautious environment overall, our preference is for hard currency debt, while the outlook for FX, despite attractive valuations, remains under pressure.

Main convictions for investing in EM currencies

Although EM central bank rate hikes in 2021 added to the carry attraction of EM currencies, offering more attractive valuations, the slide towards stagflation suggests more persistently high inflation, as well as the possibility that delayed monetary policy easing by EM central banks will reduce the appetite for EMFX. In times of increased global risk aversion, few currencies are considered to be a safe-haven currencies like the USD. We think it remains too early to be bullish on EMFX versus the USD. Following the EM fragmentation previously mentioned, selectivity remains key in the EM currencies space. We favour currencies with compelling valuations that could benefit from higher prices in commodities and that have improved their reserve levels and have healthy current account balances. We also look at the RMB as it could reinforce its status as a global reference currency, standing out for its stability and resilience.

Risk of Russian default

A possible default of Russian debt is now in the cards. Last week Russia made a payment of $117 million for two bond coupons, but speculation that the country would default remains elevated due to several more coupon payments and bonds maturing coupled with the sanctions and capital controls. The three main ratings agencies have downgraded Russia's sovereign debt into junk territory, reflecting the view that a default could be imminent. We consider that a default of Russian debt shouldn’t have global spill-over and the repercussions should be limited, due to its small financial linkage to the rest of the world and its relatively low debt, with the default already priced into Russian sovereign bonds.

Definitons

- CEEMEA: Central and Eastern Europe, Middle East and Africa.

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks are less correlated to economic cycles. Cyclicals sectors are consumer discretionary, financial, real estate, industrials, information technology, and materials, while defensive sectors are consumer staples, energy, healthcare, telecommunications services, and utilities.

- Dividend: A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- High yield: High yield paying bond with a low credit rating due to the high risk of default of the issuer.

- its per-share earnings (EPS).

- Value style: It refers to purchasing stocks at relatively low prices, as indicated by low price-to- earnings, price-to-book, and price-to-sales ratios, and high dividend yields. Sectors with dominance of value style: energy, financials, telecom, utilities, real estate.