Summary

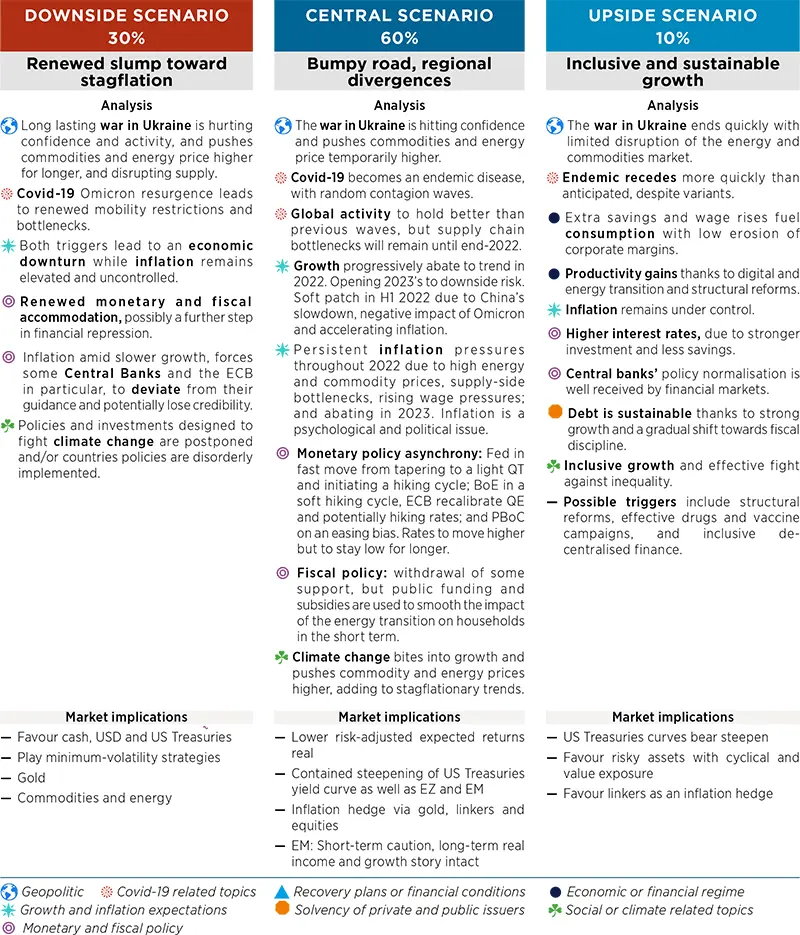

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We amend the narrative of our scenario to take into account the consequences of the war in Ukraine. We increase the probability of our downside scenario to 30% (from 15%) to reflect the rising risk of stagflation. The probability of our central scenario is moving down to 60% (from 70%) while the probability of the upside scenario is reduced to 10% (from 15%). We expect a repricing of risk premia across the asset classes in this new geopolitical and economic context.

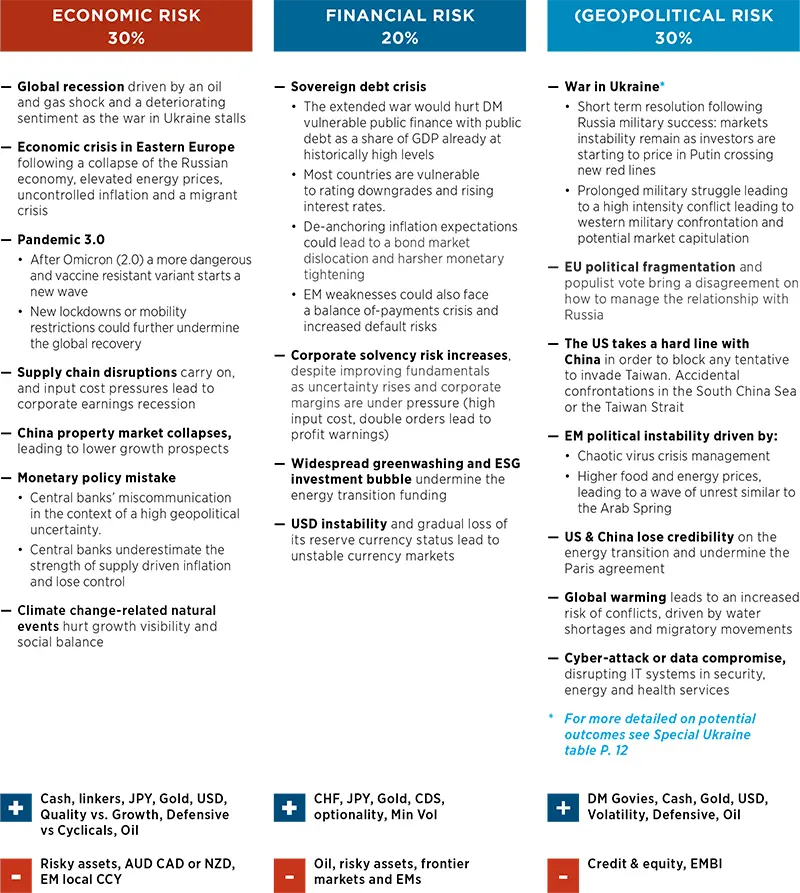

TOP RISKS

Monthly update

We increase the probability of economic and geopolitical risks to 30% from 20% to take into account the war in Ukraine and its potential implications on the economic and financial risks. We consider Covid-19-related risks to be part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.