Summary

DEVELOPED COUNTRIES

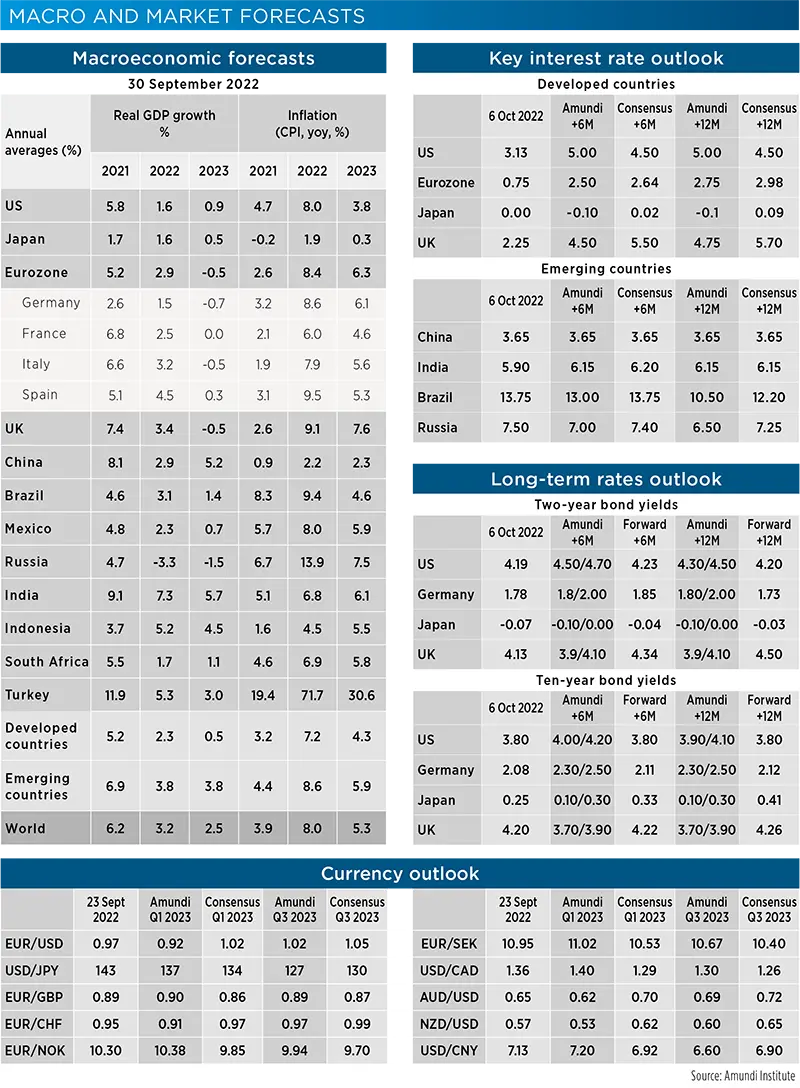

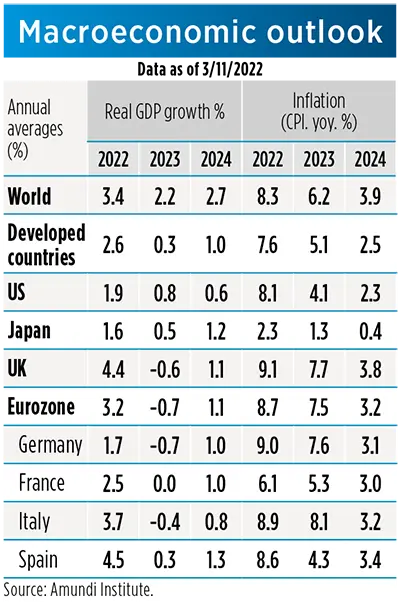

- United States: We cut our growth expectations on the back of tight and fast monetary policy action. We call for an extended period of sub-par growth for 2023-24, with increased downside risks from H2 2023. Should monetary policy become even more aggressive than anticipated, a recession may be unavoidable. Inflation: While headline inflation has peaked and should decelerate progressively, core inflation will remain sticky and close to current levels for a few months, before declining slowly, although remaining above target.

- Eurozone: We see a cost-of-living-driven recession during the 2022-23 fall-winter season, followed by a shallow recovery, as price levels remain elevated. We expect the Eurozone economy to contract by -0.5% in 2023 and to recover to 1.3% in 2024 , with downside risks into the 2023-24 winter season. Inflation: We believe inflation has to peak yet, rising into double-digit territory in Q4 2022-Q1 2023 (September 9.9%) and decelerate towards 4.0% by Q4 2023, staying well above target over the forecasting horizon. The outlook remains highly uncertain as highlighted by recent geopolitical events.

- United Kingdom: Growth: We foresee a recession extending for a few quarters, driven by increased cost of living and tight financial conditions. We expect the economy to contract in 2023 and then recover, expanding by 1.3% in 2024. Inflation: We expect inflation to remain elevated and in double-digit territory until Q1 2023 and peak in Q4 2022. Political uncertainty is adding further noise to the economic outlook.

- Japan: As the economy reopened fully in October, it will be boosted by resumed travel and services consumption in Q4. This positive catalyst will postpone Japan’s recession to early 2023. The expected global economy slowdown to 2.2% in 2023 will be the main driver of Japan’s growth. Meanwhile, the increase in underlying inflation is just at its initial stage. We expect core inflation (ex fresh food & energy) to climb above 2.0% in Q4 2022 and Q1 2023. The wage negotiation round due next spring will be a focal point, especially if unions can get wage rises above 3%.

|

|

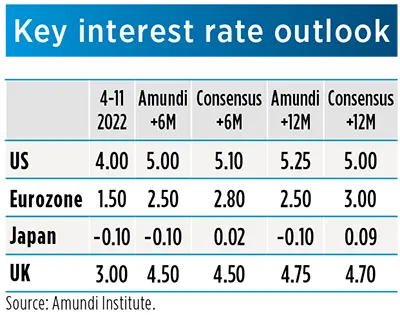

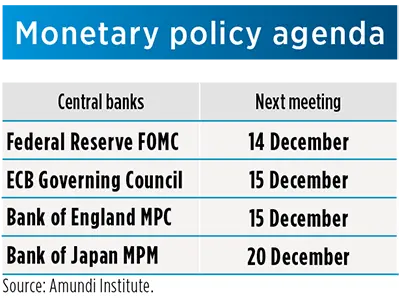

- Fed: We expect the FOMC to deliver a fourth 75bp rate hike at its November meeting. Following the upward revision in inflation forecasts for Q4 2022 and Q1, Q2, and Q3 2023 and according to our expectation for core inflation to surprise on the upside further, we upgraded our Fed terminal rate forecast to 5.25% from 5.00%. This expectation is based on the following assumption: 75bp hike in November, 50bp in December, 50bp in February, and 25bp in March. We see further upward pressure on the terminal rate in the short term. However, the stronger the monetary policy tightening, the higher the risk of having a strong deterioration in economic growth in H2.

- ECB: At its October meeting, the ECB raised its policy rates by 75bp with the deposit rate now at 1.5% and announced changes to the terms of the targeted long-term refinancing operations. By acknowledging the substantial progress made so far in policy normalisation, the ECB sent an important message through a more dovish tone, mainly on the back of deteriorating economic outlook. We expect the ECB to slow the pace of rate hikes in the next meetings. Accordingly, we cut our projection on terminal deposit rate from 2.75% to 2.50%.

- BoJ: As the dollar-yen exchange rate weakened to 150, a 32-year low, MoF intervened on the FX market to slow such depreciation. Meanwhile, the BoJ had to defend its yield-control targets by offering emergency purchases of JGBs. The unprecedented dollar strength and monetary policy gap are exerting upward pressure on JGB yields, as a weaker yen feeds into stronger imported inflation, driving markets to bet that the BoJ will eventually follow up with tightening. However, so far the BoJ has stick to its ultra-loose monetary policy, repeating that wage growth needs to be seen for sustained inflation to emerge.

- BoE: We expect the BoE to deliver a 75bp rate hike at its November meeting, following the two previous hikes of 50bp each. The scaling back of most of the fiscal package previously announced is seen lowering medium-term inflation and gives the BoE a way to less aggressive tightening than the one that would have been induced by the initial package.

At the same time, on the back of high inflationary pressures in the short term, we expect the BoE to keep its current stance, with a terminal rate forecast in the 4.50-4.75% area.

EMERGING COUNTRIES

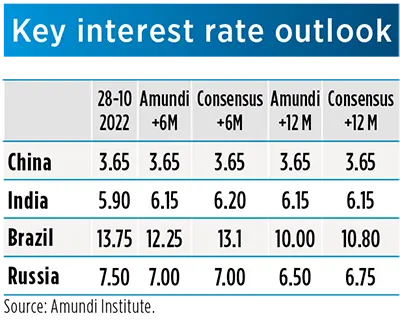

- China: Q3 growth came in stronger than expected at 3.9% YoY (Amundi: 3.4%). Solid headline growth, in part due to a rebound of trade surplus, masked the uneven recovery in domestic demand. Consumption remain soft except for auto sales, while investment growth was underpinned by public projects. We revise China’s 2022 growth up to 3.2% from 2.9%, given the better-than-expected Q3 result. At the same time, we cut our 2023 growth forecast to 4.5% from 5.2% on a dimmer Covid-19 policy outlook. Delayed reopening alone will lower growth by 1pp.

- Malaysia: In October, in a few days, the government presented the 2023 budget and called for early election to be held on 19 November. The 2023 fiscal deficit was set on a very mild consolidation path, as expenditure is reallocated from the pandemic fund to capex, while revenues should decline from the robust 2022 level (commodity-related). The budget announcement lacks any exit plan from the high subsidies disbursed, as well as any plan for structural measures to increase the revenue flow (VAT). The vote should bring stability, but is unlikely to change what people voted for in 2018, that lasted less than two years.

- South Africa: Inflation is subdued compare to peers (7.5% YoY) and has likely peaked (growth expected to slowdown, while global inflationary pressures should fade). However, SARB will have to hike further, as i) ZAR might be pressured by Fed’s tightening, ii) still much uncertainty on some commodity and food prices and iii) wants to anchor inflation expectations. Thanks to robust tax revenue growth mainly driven by high commodity prices and strong import taxes, public deficit is expected to be below 5% of GDP for FY 2022-23, but to widen next year.

- Brazil: Robust YTD economic activity is inflecting lower, as tight monetary policy is starting to weigh on credit dynamics and low-hanging reopening fruits are no longer available. Still, the economy will grow by around 3% this year, slowing to some 1% in 2023. Inflation peaked in April and keeps moderating. The BCB is on a hawkish wait-and-see mode, evaluating the impact of the aggressive hiking cycle that took rates to 13.75%.

|

|

- PBoC (China): We expect the PBoC to keep its easing bias throughout H1 2023, with further LPR cuts likely, in particular for the dive-year tenor to support housing sales. China’s economy remains weak, hit by the housing slowdown and Covid-19 restrictions. As the government indicates there is no timeline for reopening, we believe the PBoC is in a reactive position; it has to maintain an accommodative stance to stabilise the housing market, prevent a broader economic meltdown and spreading of systemic risks.

- RBI (India): The RBI has recently called for an additional MPC meeting on 3 November, before the official one schedule in early December. While the central bank has to explain formally to the Government the reasons for inflation remaining above the target after three quarters -- automatic mechanism) -- the RBI remains on a hiking path for domestic and external reasons. Indeed, the RBI may take advantage of this newly scheduled meeting (soon after the FOMC one) to hike again the policy rate, though in a smaller size than recent hikes (25bp).

- BCB (Brazil): Done hiking, hawkish wait-and-see in place. While the Fed is still front-loading rate hikes in order to deflate the economy and the labour market, the BCB has wrapped up its extensive (1.5 years long) and aggressive (COPOM raised rates by 12pp to 13.75%) rates hiking cycle by now. The CB is by no means entertaining cutting rates at this point in line with its split (first since 2016) September decision, at which the tightening cycle was halted. Instead, the BCB will continue evaluating the impact of the hikes on growth and inflation that affect the economy with a lag.

- CBR (Russia): The CBR cut the policy rate further on 15 September, by 50bp to 7.5%. The main reasons for the cut were declining inflation and subdued consumer demand. However, the CBR referred to the external environment remaining challenging. The CBR’s message was balanced (less cutting bias), referring to risks from the potential direction of fiscal policy and the reaction of external markets. Inflation keeps declining, down to 13.7% YoY in September from 17.1% in May. We expect another 50bp cut from CBR over the next six months and possibly additional 50bp after that.

MACRO AND MARKET FORECASTS