Summary

The excellent results of the first quarter also conceal weaknesses. Excluding energy, they remain positive but much less flattering, and companies are wondering about the future. Revisions are now expected to be on the downside, which does not rule out counter-trend rallies. Markets’ behaviour could be tricky. Remain cautious.

The earnings season has been positive on both sides of the Atlantic; as of 20 May, blended earnings growth was +11.1% YoY in the US, compared to +6.4% expected at the beginning of April; in Europe, the rebound was even more spectacular, as the economy took longer to rebound: +41.5% YoY compared to +20.8% expected at the beginning of April. However, these excellent results, although better than expected, are far from reflecting what could happen in the next two years.

First of all, several remarks should be made about these results

On the positive side, we should already welcome the fact that these figures are better than expected in almost all sectors (except Consumer Discretionaries in the US and Consumer Non-Cyclicals in Europe). Moreover, while margins are falling in the US for the first time since the recession of 2020 (first-quarter revenue growth reported as of 20 May +13.8%, i.e., more than profits), they are still rising in Europe (revenue growth of +22.9%, i.e., less than profits).

On the down side, this is largely backwardlooking and, looking beneath the surface, there is little to inspire confidence about future earnings. About half of the increase is due to an exceptional contribution from the energy sector, which masks a less flattering reality; profits are up by only 4.9% in the United States and by 22.4% in Europe excluding energy, despite its low weighting in the stock market indices (only 3% of the MSCI USA and 6% of the MSCI Europe). Moreover, first-quarter results show little of the impact of the conflict in Ukraine, which began on 24 February. This implies that the next few quarters will be more challenging. Finally, beyond these figures, which reflect the past, companies have been getting gradually more cautious in their guidance for the remainder of the year and for 2023, given the conflict in Ukraine, the slowdown in China and the tightening of monetary policies.

What do we expect next?

Financial analysts have once again revised their forecasts upwards to +9.3% and to 10.1% in the US for 2022 and 2023 and to +13.1% and +3.7%, respectively, in Europe, according to IBES. However, these forecasts seem to us to be exaggerated. Analysts’ revisions for the full year were mainly due to this exceptional first quarter, especially for commodity-related sectors. As for us, in the US, we believe that growth at a high single digit [+5;+9%] is likely for 2022, slightly below consensus, but still good. In Europe, however, we think it should be between -5% and +5%, which is a more substantial potential revision.

Energy contributed about 50% to 1Q earnings growth

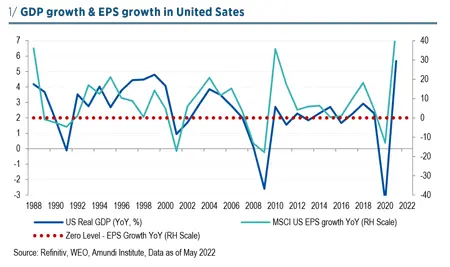

Indeed, there is a historically strong relationship between real economic growth and earnings growth. This has been true since the late 1980s, a period long enough to incorporate different inflation regimes. In the US, for example, real GDP growth of at least +2% is required to generate positive profit growth. Our economists expect +2.6% on average for the year. Moderately positive earnings growth would therefore be achievable; as for Europe, real global economic growth of +3.0% is required, which is precisely what our economists expect. Profit growth for the year as a whole should therefore be close to zero and even possibly shift to the negative side.

For 2023, GDP forecasts average +1.9% for the year in the US and +3.4% globally, with a downward bias; this is very close to equilibrium levels for profits and probably lower in 2023 than in 2022. It is therefore likely that the dynamics of profit revisions are now on the downside. Moreover, although the earnings outlook has been revised upwards by analysts, equity markets have been declining since the beginning of the year. P/Es have therefore contracted to below their historical average in Europe and are close to their average in the case of the United States; at this stage of the cycle, i.e., in an economic slowdown phase, it is usual for the decline in P/Es to be a precursor of downward earnings revisions.

Downward profit revisions and counter-trend rallies are not incompatible

What impact will this have on our main equity investment areas?

At the directional level, the next few months could hold some surprises and should be characterised by volatility. If the spike in inflation were to bend the Fed’s hawkishness, for example, and allow the market to consider for a time that a recession is avoidable, this downward revision of profits could take shape while the equity markets, paradoxically, begin a counter-trend rally. From current levels, such a rally in equities becomes an increasing possibility. However, it is best not to take too strong a stance on this as the longer-term trend is likely still downwards.

Regionally, some preference for the US over the Eurozone could be argued at the margin on the greater resilience of earnings growth as described above. However, the regional allocation is not a clear cut. Indeed, the valuation differential is clearly in favour of the Eurozone. Its P/E relative to that of the MSCI World has fallen to a level reached during the Covid crisis in 2020, the Great Financial Crisis of 2008 and even the EMS crisis of 1992. Any progress on the resolution of the conflict in Ukraine would thus be likely to trigger a significant rebound in Eurozone stocks. However, geopolitical risk is likely to remain and the current global slowdown, as long as it is not challenged, is not conducive to a sustainable comeback of investors to this area. Conversely, in the case of the US, the repricing of growth is a headwind, but the better resilience of earnings is a relative support.

Seek above all secure returns and capital preservation

In terms of styles, our approach is diversified. Our preference is for:

- Value, given the rise in real rates; However, we are starting to question the link between Value/Growth at the global level and US 10-year TIPS, which has been so strong since TIPS moved into negative territory in 2020, while they are now shifting into positive territory again. The Value opportunity may no longer lie in the classic sense of searching for the cheapest stocks in the index but in finding high Quality names that now trade at a significant discount to their own historical valuation and/or to the index as a whole;

- Quality, given the maturity of the cycle. This factor will respond very well to any widening of high yield spreads if it were to occur;

- High dividends, as dividends generally track inflation while being an important part of the return when expected equity returns are under pressure; the low volatility of this factor in a world now characterised by rising volatility is another argument;

- Minimum volatility, which is precisely more defensive and outperforms when capital preservation becomes essential.

What should be avoided:

- Small caps, because of their cyclicality; while this makes them a very attractive asset at the beginning of the cycle, it makes them less attractive when the cycle turns. The rise in high yield spreads would be particularly unfavourable for them.

- Momentum, as the current stage of the cycle plays for selling the rallies, no more buying the dips as it used to be in the more fundamental previous phase, when economic growth and companies’ earnings were accelerating.

- Pure growth, i.e., stocks supposed to have growth but where quality does not follow. These stocks have already fallen a lot; but beyond the rebounds in any short-term rally, which can be sudden, it will take time, like during the dotcom bubble burst, for investors to regain lasting confidence in them.

At the sector level, caution and flexibility are also required.

While defensiveness is a key characteristic to focus on at this stage, we would especially focus on defensiveness of profitability, pricing power and sustainability of margins/earnings. Often this will mean defensive sectors, but in some cases, cyclical sectors can offer those, as well, which is an argument for looking into some granularity and an opportunistic angle.

Commodity- related sectors, notably Energy, might have further upside as their outperformance is based on actual and significant earnings revisions. However, if we accept that in the next stage of the cycle commodity prices will have to correct, even partially, the case for starting to book profits and reduce the overweight becomes a strong one. The Mining sector should already have been avoided, given its large exposure to and dependence on the Chinese market at a time when lockdowns are having a significant impact on activity. This is a strong headwind for the sector. In addition, we see a strong case for any positions reduced in the Mining sector to be moved to other areas within the broader Materials sector, namely Chemicals and, to a smaller extent, Construction. The more defensive nature of the Chemicals sector looks attractive at this stage. Construction, in turn, offers opportunities, especially for stocks exposed to fiscal stimulus and government investments, which should have their profitability protected through the downturn.

Technology remains a challenging area and we would not move back into the sector at this stage. Within Tech, however, we can see the Software industry offering advantages, as it is more defensive than Semiconductors and Technology Hardware and tends to display more resilient profits in downturns.

Otherwise, the core of the portfolio should be based on the so-called defensive sectors. Even if their earnings growth has lagged that of most cyclicals during this first-quarter earnings season, the ongoing economic slowdown should reverse the hierarchy in their favour in the coming quarters. Healthcare has been the preferred defensive play for most market participants and had a very significant run, so we need to be more selective when looking for opportunities in the sector. There is a very wide dispersion in valuations within the Pharma sector that can be exploited. Staples is a very diverse sector and once again we see a wide dispersion in valuations, especially within the Household & Personal Care subsector and the closing of those valuation gaps could offer opportunities.