Summary

- Federal Open Market Committee (FOMC) meeting and statement: On 27 July, the Fed hiked rates by 75bp to 2.25-2.50%, its second consecutive rate hike, bringing the Fed fund rate closer to its estimates of the neutral rate. The central bank (CB) maintained its hawkish tone and noted that economic activity is slowing but labour market remains strong. This means it is likely to hike more than 25bp, between 50-75bp at its September meeting.

- Press conference: Chair Powell emphasised that inflation is a priority and downplayed the mild deceleration in economic activity. He also clarified that the bank will not provide future guidance on rate hike because it is better to adopt a meeting by meeting approach that takes into account the actual changes to economic data.

- US GDP: The US entered into a technical recession as Q2 GDP contracted 0.9%, led by a visible deceleration in domestic demand. Importantly, this sharp deceleration was not completely a result of Fed tightening but was caused by other drags on US consumers and was compounded by the inflation tax on real incomes.

- Investment implications: The central bank’s meeting by meeting approach to rate hikes and Fed fund rates now in the 2-3% range have collectively led the markets to believe the Fed may be less aggressive going forward. we think, while the Fed removed forward guidance on rates, it mentioned at the beginning of the conference that ongoing hikes will be essential to tame inflation. No doubt a lack of clarity on future rate path could lead to volatility in financial markets but the Fed is treading carefully and is evaluating every data point before taking monetary policy decisions in an environment of high inflation and tight labour markets. The Fed also sounded less positive on a soft landing, indicating economic growth risks. This in turn means US bonds would continue to benefit from their safe haven appeal and act as portfolio diversifiers. Investors should remain agile, given that pressure on yields remain on both sides.

July 26-27 FOMC Review: Maintaining a Hawkish Course

The Federal Reserve hiked the fed funds rate by 75bp to 2.25-2.50%, the second consecutive 75bp rate hike. The Fed rate decision was widely expected. With today’s rate hike, the fed funds rate is within the 2 to 3% range of estimates of the long-term “neutral” rate. However, as Chair Powell reminded us during his press conference, policy needs to go beyond neutral into restrictive territory this year in order to reduce inflation.

FOMC Statement – The Fed noted some cooling in the economy

There were no meaningful changes to the July FOMC Statement. It retained its hawkish tone but it acknowledged signs of slowing economic activity. The most important takeaway is the FOMC believes, “ongoing increases in the target range will be appropriate”. This strongly suggests the Fed will continue to hike greater than 25bp at the September meeting where we expect the decision to be between 50 and 75bp.

- There was a mild downgrade in the growth outlook with the FOMC Statement pointing to slowing consumer and business spending.

- Interestingly, despite the deterioration in the jobless claims data, they maintained the labour market remains robust.

- There was a small tweak to the inflation part of the statement adding food to higher energy prices.

- There was a change to the Russia-Ukraine geopolitical event by removing invasion and adding war. It could be a sign that the Fed believes the Russia-Ukraine war is moving to a longer-term conflict. Nonetheless, we do not think this will have much monetary policy implications.

- Finally, the FOMC removed the impact of COVID related lockdowns in China adding to supply chain disruptions. The Fed appears more confident that supply chains disruptions have begun to ease consistent with recent PMI survey data that indicated supply delivery times have rolled over noticeably.

The Fed maintained its hawkish stance and downplayed the recent softening of economic activity.

Press Conference: Powell remained on course against inflation

Powell maintained a hawkish script during his press conference. He repeated inflation remains the primary focus and downplayed the recent softening in economic activity by suggesting the labour market remained surprisingly tight.

- Chair Powell stated the Fed would no longer provide clear guidance on future rate moves and thinks it is time to go meeting by meeting – effectively signalling the end to forward guidance.

- The Fed continued to prioritize inflation over growth and emphasised the need to see below trend economic growth and a softening labour market to achieve their 2% inflation target.

- Chair Powell expressed confidence that aggregate demand is running above supply and that policy rates will need to move to moderately restrictive territory.

- Questions during the press conference were dominated by recession jitters. Chair Powell refused to speculate if the US would have a recession. Unlike previous press conferences, he sounded less optimistic about a soft landing.

Q2 GDP release: weakening demand, labour market developments even more pivotal to the outlook

US GDP contracted again in Q2 by 0.9% QoQ (after -1.6% in Q1), thus configuring a so-called ‘technical recession’. GDP growth sharply decelerated to 1.6% YoY in Q2, which is already below potential, from 3.5%. There was an element of the sort of volatility that we recently have been used to (huge drag from inventories this time, subtracting approx. 2% from GDP growth), but the deceleration in domestic was nevertheless noteworthy:

- There was a visible deceleration in consumption, with signs of a shift from goods to services consumption.

- There was a visible slowdown in non-residential investments (due to a mild contraction in equipment investments and a continued decline in investments in structure), whilst intellectual property investments kept expanding at a strong pace.

- Residential investment contracted and its sensitivity to interest rates means it is likely to keep weakening.

Q2 GDP contracted owing to a huge drag on inventories, indicating weakening domestic demand.

In Q2, GDP growth moved below potential. Crucially, this sharp deceleration can’t be fully abcribed to the impact of Fed tightening so far since policy works with lags. Instead, it is mainly the result of other drags operating on US consumers (i.e. “post pandemic support fiscal cliff”) and the impact of inflation on real incomes. We may have not seen yet a wealth effect taking place eventually.

While inflation may have peaked, it will remain well above the Fed’s target in the coming quarters. Data on the labor market still appears resilient, which means consumption should be positive, even it’s weak. However, the outlook for domestic demand, and especially investment, will become more cloudy as the Fed’s rate hikes start to have an effect.

Market reaction and investment implications

Little market response following the Statement but a big rally after the press conference

With the Fed funds rate at the Fed’s long-term neutral rate, the markets are beginning to anticipate a slowing in the pace of rate hikes. Chair Powell’s statement on the need to evaluate rate decisions on a meeting-by-meeting basis and the need to weigh the impact from a very large and front loaded tightening cycle on the economy helped convince markets the Fed is looking to slow down the pace of rate hikes.

In this economic environment where inflation is elevated and the labour market remains very tight, every data point will act as a referendum on the next policy hike, keeping volatility high.

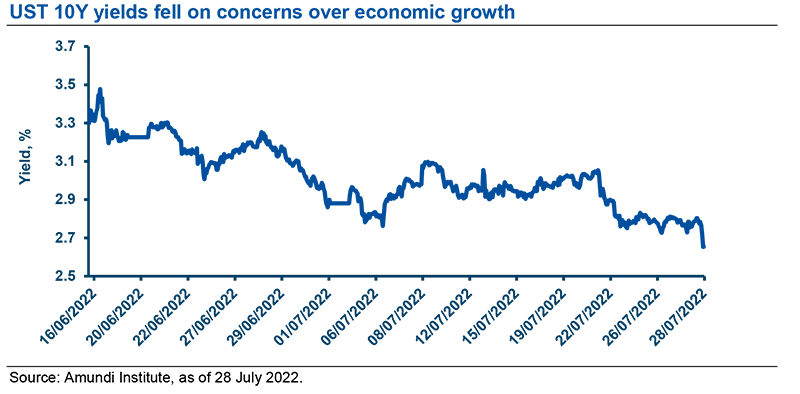

This triggered on the Fed announcement a sharp, broad based rally in financial markets as markets priced in a less aggressive path of rate hikes over the rest of the year. The yield curve steepened, while the US equity markets (S&P 500, Dow Jones, Nasdaq Composite) rose sharply by the end of the press conference. The USD index declined sharply by 0.7%. Volatility continues to stay high and today after the GDP release, yields on the 10-year Treasury have moved towards their lowest over a three month range.

Investment Implications: Market at risk of over interpretation?

The market interpretation of “meeting to meeting” is that we may be at the end of 75bp rate hikes but we believe that is simply not the case. Chair Powell made it very clear at the onset of the press conference that ongoing increases in the Fed funds rate will be appropriate. Significantly, he said another unusual rate hike is on the table and the Fed remains data dependent.

Overall, the “formal” end to forward guidance will create volatility in financial markets. The foundation of forward guidance was to anchor interest rate expectations. This was especially important when interest rates were pinned at the zero bound and the economy was weak. However, in this economic environment where inflation is elevated and the labour market remains very tight, every data point will act as a referendum on the next policy hike. This will likely inject volatility in financial markets from meeting to meeting.