Summary

Despite the new highs, opportunities remain in European large caps with strong profitability, while small caps may benefit later on.”

- European equity markets fully recovered the losses of 2022 and are back at new highs.

- Economic activity data shows signs of improvement in an overall still weak environment.

- The ECB should start to cut rates later in May, favouring a return of interest to Europe and potentially to small caps.

European markets reached new highs, above the January 2022 peak, set before the start of the Ukraine war, now at its 2nd anniversary (24th February). European equities are up around 30% since the 2022 lows, reminding us that patience is a virtue when it comes to investing.

This trend has recently benefitted from improving economic data, within a still weak growth scenario. In particular, private-sector activity surveys hit their highest level in eight months, showing signs of relief, except for Germany amid very weak manufacturing activity.

Moving ahead, markets should favour companies with the ability to further generate earnings and later on small caps when the ECB will cut rates.

Actionable ideas

- Explore opportunities in European equity

After the recent rise and given the still weak growth outlook, investors should focus on more resilient companies which offer appealing valuations. - Start to look at European small cap for later opportunities

Small and medium capitalization stocks are more cyclical in nature. Further improvements in the economic cycle later in the year when the ECB will cut rates could favour a return of interest in this segment.

*Diversification does not guarantee a profit or protect against a loss.

This week at a glance

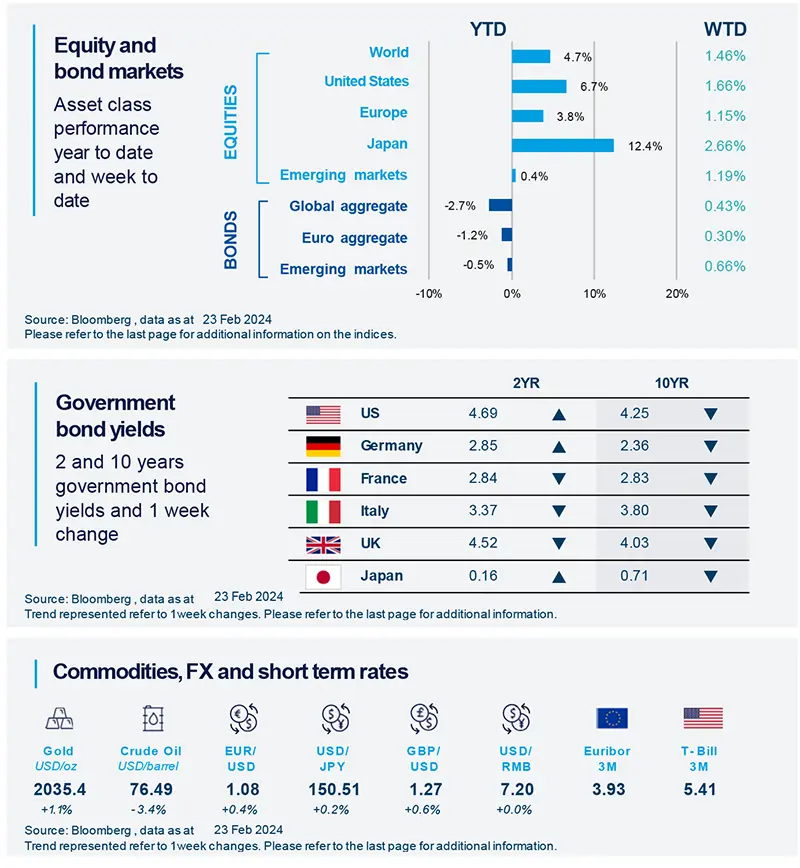

Equity markets hit all-time highs in developed markets, supported by optimism around artificial-intelligence and better than expected economic data. China equities were also positive at a time of celebration for the Year of the Dragon. Bond yields ended the week with little changes.

Amundi Investment Institute Macro Focus

Americas

Flash PMIs print in the US confirms economic resilience. Cost pressures eased in February

February’s PMIs data confirmed the message of a resilient economy at the start of the year. Manufacturing PMI (17-month high) improved further while Services and Composite PMIs were slightly worse compared to January’s print, but still signalling expansion. PMIs also signal easing cost pressures.

Europe

Survey of economic activity signals relief ahead for the Eurozone. Germany on a different route.

Thursday’s print of Flash PMIs signalled the third consecutive improvement in the Composite figure for the Eurozone, driven by services. Manufacturing posted a slightly worse performance than in January. For Germany the picture is different, as composite

indicators declined for the fourth consecutive month, dragged again by manufacturing.

Asia

China’s PBoCcut 5-year loan prime rate (LPR) by 25bp, larger than expected.

China’s PBoC cut 5-year loan prime rate but kept 1-year LPR unchanged at 3.45%. Since 5y LPR is the benchmark for mortgage rate, this move is intended to support the real estate market with a targeted approach. We don’t see this cut as a game changer, unless PBoC continues to cut at this pace across all tenors in the next three months.

Key Dates

|

27 February Japan Inflation |

28 February |

1 March Eurozone Inflation & |