Summary

Executive summary

US long-term yields have risen in recent months on expectations of strong economic growth fueled by fiscal stimulus. Eurozone long-term government yields have followed this movement in a limited way, as Eurozone economies have been hit hard by the Covid-19 crisis. The pandemic has increased economic fragmentation across European countries, putting pressure on the ECB to pursue its highly accommodative policy.

Against such a backdrop, European insurers’ search for yield for their fixed income portfolios is tricky. Moreover, diversification needs are ever more relevant today, since investors have already significantly expanded the euro credit share of their investments, leading to risk limit saturations on the main European issuers. Hence, European insurers should reconsider their core fixed income portfolios and go beyond the traditional euro investment grade (IG) universe. This could be done by investing into the non-euro IG space or into illiquid assets, but also by adopting a crossover approach rather than a pure IG strategy.

The first strategy can be implemented via diversification to US municipal bonds, US IG corporate debt and emerging market (EM) IG corporate debt. US municipal bonds offer diversification amid low volatility and correlation to other fixed income segments. They should play a key role in funding green initiatives under President Biden’s ‘Build Back Better’ programme. Going further into credit, the US IG corporate market is about twice the size of the European one and accounts for over 700 US-domiciled issuers, of which about 600 have never issued in euros. As such, it allows European investors to be exposed to new names, while offering a spread pick-up vs. the euro for long-dated bonds. Finally, EM IG corporate debt offers huge diversification opportunities for euro-based investors, as the majority of issuers have never issued in euros. This comes with an attractive spread pick up vs. the euro for comparable ratings and maturities. When dealing with EM issuers, it is paramount to enhance a strict credit selection framework to detect those with a sound credit profile. The introduction of non-euro investments will require the hedging of currency risk to ensure their eligibility under the insurers’ regulatory framework. Hedging could be done either through short-term forwards or cross-currency swaps at maturity. The former hedges only the currency risk, while investors keep their exposure to dollar long-term rates; the latter allows both currency and interest rate risk hedging.

The second strategy extends the investment universe into illiquid assets, such as private debt and Dutch mortgages. Private debt can offer diversification opportunities to traditional BBB-BB rated issuers on public bond markets, while catching a significant illiquidity premium. We deem the current momentum as positive for private debt investments, as corporates still need financing, while bank balance sheets have ballooned during the crisis, leaving them with less lending capacity. In this scenario, investors can negotiate conservative financial covenant packages. Finally, we see opportunities in investing in non-tranched pools of Dutch mortgages, which are prime assets, with limited default risk and an attractive solvency capital requirement (SCR) profile. Their risk-return profile could be tailored, possibly targeting green mortgages only.

A final strategy is to widen the traditional risk framework through a crossover approach that can offer a better risk-return profile than traditional BBB and BB-rated mandates managed separately. It allows investors to be agile, capturing the best opportunities within the BBB-BB space, bringing yield pick-up and diversification into the insurer’s fixed-income portfolio. To implement such a strategy, strong credit research capabilities will be needed, coupled with a specific set-up in the investment and credit research teams to ensure continuity in the coverage of BBB and BB issuers.

Extending the investment universe to non-euro IG markets

US municipal bonds

Taxable US municipal (muni) bonds have become one of the fastest-growing fixed income asset classes currently available in the market, and are a compelling strategic fixed income option for global investors. These bonds are issued by state and local governments to finance essential services projects that have historically exhibited strong credit strength and offer relatively attractive yields. The asset class offers diversification benefits to an insurer’s portfolio as, historically, it has shown low volatility and correlation to other fixed income segments. Non-US insurance companies can benefit from exposure to US municipal issuers that qualify as infrastructure under Solvency II rules. The broad spectrum of issuance across the duration spectrum creates broad appeal to both life and property insurers.

The number of municipalities addressing critical initiatives has increased, and the opportunities within this space offer not only positive change, but also potentially lucrative financial opportunities.

With infrastructure improvements tied to green and other ESG initiatives, President Biden’s ‘Build Back Better’ programme could drive greater opportunity, as these projects can be funded by municipal bonds. Municipal bonds’ use of proceeds are aligned with social impact and responsible investing. Muni bonds can be considered the ‘original impact investment’ and still dominate the ESG landscape. According to the rules governing the federal tax-exemption of municipal bonds, muni issuances must have a public purpose and earnings cannot be used to benefit private people. In essence, muni bonds have been conceived for society’s greater good and are focused on improving areas such as education, public transportation, and city and state infrastructure. Beyond the broad scope of public utility, certain projects have an even greater and more targeted positive impact. In our view, this is where investors should focus:

Municipal issuers with potentially high social impact:

- Tuition-free public district and charter schools, focusing on socio-economic equality;

- Affordable housing projects, focusing on safe and healthy retirement living; and

- Not-for-profit healthcare facilities, focusing on quality medical care for all.

Municipal issuers with potentially high environmental impact:

- Water and sewer authorities, focusing on clean delivery and removal;

- Public transit systems, focusing on electric renewable energy and solar technology; and

- Waste disposal and recycling projects, focusing on pollution mitigation.

The number of municipalities addressing these critical initiatives has increased, and the opportunities within this space offer not only positive change, but also potentially lucrative financial opportunities.

US IG corporate debt

In terms of market value, the dollar IG credit market is twice the size of the European one and accounts for over 700 US-domiciled issuers, of which about 600 have never issued in euro. Therefore, investing in the dollar corporate bond market would allow European investors to get exposure to completely new companies. This is also true at the sector level, as underlying sector dynamics (e.g., the size and growth dynamic, consumer culture, regulatory framework) can be completely different in the United States from Europe.

Muni bonds can be considered the ‘original impact investment’ and still dominate the ESG landscape.

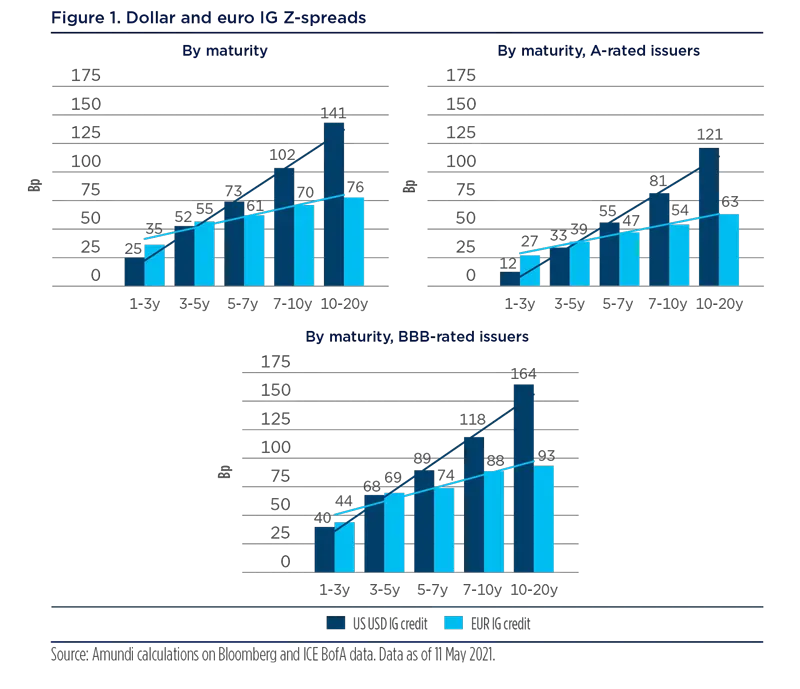

In addition, the dollar IG credit market offers a diversified set of exposures to longer maturities for European investors with ‘buy and maintain’ portfolios. Longer-dated bonds (ten years and above) account for 39% of the dollar universe, compared with only 10% in the euro universe. Credit curves of US domestic issuers are steep compared to euro ones, offering an attractive spread pick-up on intermediate and long-dated maturities. Such steepness is observable within every rating category (see figure 1). This is good news for those investors seeking to add credit exposure on longer maturities for yield or ALM reasons.

Investing in the dollar corporate bond market would allow European investor to get exposure to completely new companies.

Emerging HC IG corporate debt

With $800bn of market value, the EM IG corporate debt market offers significant diversification opportunities for euro-based investors, as the majority of issuers (about 400 companies) have never issued in euro. The emerging hard-currency (HC) debt remains dollar-centred.

Insurers tend to embrace a cautious approach when it comes to emerging corporate debt because of country risk, even if the issuer is rated as investment grade. However, the EM IG corporate debt universe is diverse in its composition and some selected issuers could be considered even for those with a ‘buy and maintain’ conservative approach. Global players with good revenue diversification and low exposure to a specific emerging country are the best example of low-risk issuers to be considered. However, some issuers with high exposure to a single economy could be considered by selecting national champions, for example, from the communications or utilities sectors. According to our estimates, some 80-120 issuers within the EM corporate investment universe could be good candidates for a ‘buy and maintain’ portfolio.

EM IG corporate debt market offers significant diversification opportunities for eurobased investors, as the majority of issuers (about 400 companies) have never issued in euros.

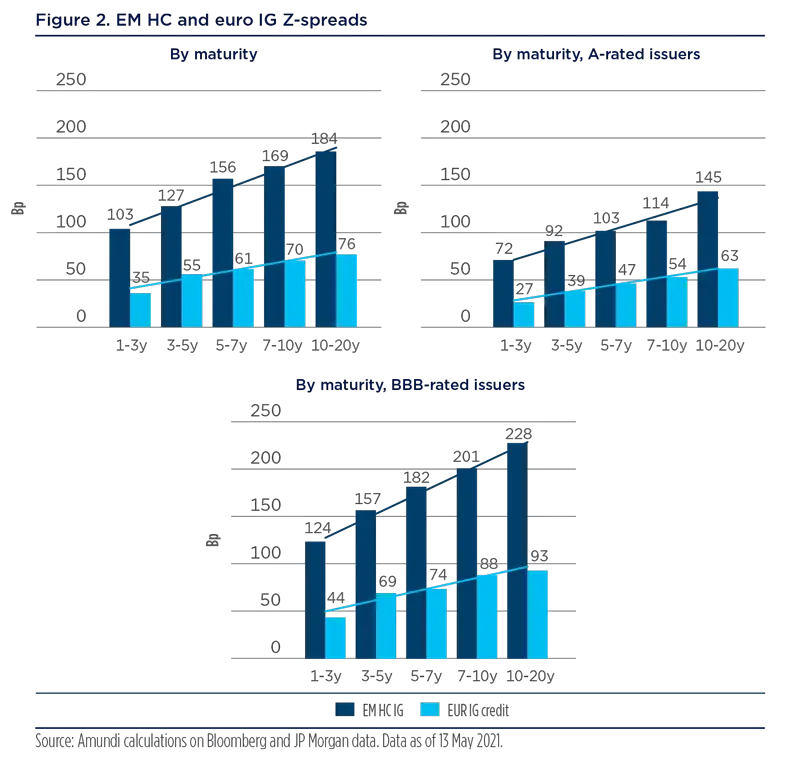

A strict credit selection framework is key when dealing with EM issuers. Being well equipped with strong credit analysis resources should enable detecting those issuers with a sound credit profile that could add value to insurers’ fixed income portfolios. The EM IG corporate market offers some attractive spread pick-up over euro credit. This is true across every rating category and maturity bucket (see figure 2).

A strict credit selection framework is key when dealing with EM issuers. Being well equipped with strong credit analysis resources could allow to detect those issuers with a sound credit profile that could add value to insurers fixed income portfolio.

The introduction of non-euro investments into insurers fixed income portfolios requires the hedging of currency risk in order to ensure their eligibility under the insurers regulatory framework (e.g., Solvency II). Two types of hedging strategies could be considered:

- Hedging via short-term forwards

Under this approach, the currency risk of dollar-denominated investments is hedged by selling dollars on a forward basis. Short-term forward contracts (one-twelve months) have to be rolled until the bond maturity. This implies uncertainty about the overall hedging costs over the life of the bond. For example, in 2014, while investing in ten-year dollar-denominated corporate bonds, hedging with short-term forwards was attractive, as hedging costs were very low. However, the latter increased afterwards and exceeded 3% in late 2018, offsetting a significant part of this long-term investment return. Since March 2020, short-term hedging costs have decreased significantly following the emergency Fed rate cuts in the context of the Covid-19 outbreak. Since then, short-term hedging costs have stabilised at around 75bp. For now, FOMC members still see the Fed funds rates at zero through end-2023. However, at its March meeting, the Fed upgraded its growth and inflation forecasts for 2021-23. If such a positive scenario materialises quickly, this could put upward pressure on US short-term rates and increase short-term hedging costs.

It is worth noticing that hedging via short-term forwards hedges only the currency risk and investors keep their exposure to dollar long-term interest rates. If investors want to hedge both risks, they should opt for the cross-currency swap strategy.

- Hedging via cross-currency swaps at maturity

On the other hand, hedging via cross-currency swaps allows for both currency and interest rate risk hedging. Investors will gain yield in euros until bond maturity, as if it was a euro-denominated bond. Long-term hedging costs have increased significantly over the past few months, following the increase in US long-term yields. Despite their penalising level today – around 155 bp annualised for ten-year euro-dollar cross-currency swap – we still see some opportunities on a name-by-name basis to implement this strategy into insurers’ fixed income portfolios. In particular, EM IG issuers offer attractive yields in euros after cross-currency swaps thanks to their relatively large credit spreads.

Extending the investment universe to illiquid assets

Private debt

Another option available to insurers is to extend the traditional euro IG credit investment universe to illiquid assets for both diversification and yield pick-up purposes. ‘Illiquid’ assets, such as fixed income private placements, are a good fit for the ‘buy and maintain’ style of insurance portfolio management. The development of the euro private placement (euro PP) market in Europe since 2012 has proven investor appetite for this kind of diversification. These non-rated private placements offer diversification to traditional BBB-BB rated issuers present on public bond markets, while catching a significant illiquidity premium. This type of placement is the perfect alternative to bank financing for smaller-size corporates that do not have access to public bond markets. Each operation is issued under a bond or loan format and involves a relatively low number of investors, allowing them to negotiate the main features of the operation, such as covenants, asset disposal limitations and make-whole clauses. From a regulatory standpoint, it is worth noting that such non-rated bonds offer a favourable SCR treatment under Solvency II rules.

We deem the current momentum as positive for private debt investments, as corporates still need financing or refinancing, while bank balance sheets have increased during the Covid-19 crisis, leaving them with less lending capacity.

After a long period of relatively low issuance due to the fierce competition of bank financing, that often accepts lower spreads for commercial reasons, since June 2020 we have witnessed a gradual recovery of issuance in the euro-PP market. We deem the current momentum as positive for private debt investments, as corporates still need financing or refinancing, while bank balance sheets have increased during the Covid-19 crisis, leaving them with less lending capacity. In this context, investors can negotiate conservative financial covenant packages.

We have also noted an increasing interest in ESG features. On this, the capacity to source large deals, as well as privileged access to leading broker dealers and the availability of a large developed corporate network, are the main keys to sound sourcing capabilities. Depending on their yield target, investors willing to have private debt exposure have the choice of investing either directly in bonds or through corporate-loan and leverage-loan funds.

Dutch mortgages

Non-tranched pools of Dutch mortgages can capture an illiquidity premium, with most loans originated for 30 years. Duration can be tailor-made, but is typically around ten years, with principal cash flows and fixed interest rates being repaid every month, most often from the settlement date to the 20th year. Thanks to their specific amortisation profile, these mortgages are useful tools for ‘buy and maintain’ portfolios to match liabilities, including long or very long ones. These mortgages combine several key advantages:

- They are essentially prime assets, originated using regulated guidelines. Dutch residential mortgage-backed securities (RMBS), which use similar collateral, have experienced historical losses of just a handful bp per year. Thanks to efficient public economic support, mortgages experienced limited payment holidays in 2020. Today, they enjoy reduced delinquencies and are expected to face only small-scale losses.

- The default risk can be limited by targeting low loan-to-value (LTV) assets, or even loans benefiting from the Nationale Hypotheek Garantie (NHG) public guarantee.

- Their credit-risk-related SCR is attractive. It is linked to the LTV ratio and will trend towards zero as loans are repaid. This favourable SCR is justified by the granularity of the pools and the double-recourse lender rights on the borrower’s revenues and on its real estate assets.

- Despite increasing investor appetite, the illiquidity premium remains attractive. The risk-return profile can be tailor made, with the highest returns for long-dated and high LTV mortgages.

- Green mortgages, relating to highly energy-efficient properties or with a use of proceeds dedicated to energy efficiency improvement, may also be targeted.

Thanks to their specific amortisation profile, Dutch mortgages are useful tools for ‘buy and maintain’ portfolios to match liabilities, including long or very long ones.

Widening the risk framework by including crossover investments

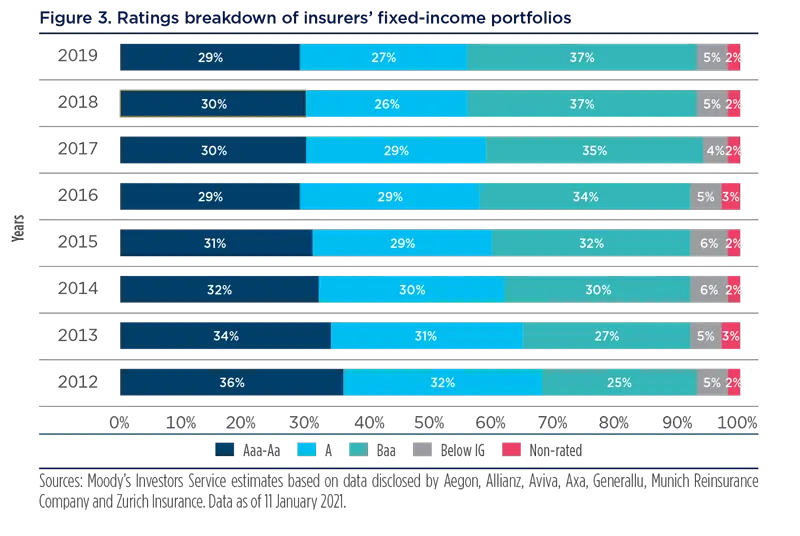

In the current ultra-low rate environment, European insurers’ search for yield has led to a reduction in the average quality of their fixed income portfolios. Over the past few years, insurers have increased their exposure to BBB-rated issuers at the expense of AA and A ones (see figure 3). Our experience shows that this move could be done in a more comprehensive way.

Today, we see that most insurers continue to limit their fixed-income investments to the IG segment, while taking exposure to the HY market beyond their core fixed-income book. We believe that a crossover approach can offer a better risk-return profile compared to traditional BBB-rated and BB-rated mandates managed separately. This approach is dedicated to BBB and BB issuers that are very close to the IG vs. HY threshold and can potentially move from one category to another.

First, it allows taking selective and smart exposure to BBB-rated names. A rather significant share of the BBB universe is out of scope for IG investors due to the high probability of being downgraded into HY territory, but also of HY investors because the timing of the downgrade and the introduction of these potential ‘fallen angels’ into HY indices remains uncertain. Thus, the de-risking of IG investors and the absence of buyers on the HY side could push these issuers’ spreads far into HY territory even if the potential downgrade is limited to BB+ and BB ratings, offering very attractive investment opportunities.

A crossover approach offers the best risk-return profile compared to traditional BBB-rated and BB-rated mandates managed separately.

Furthermore, a crossover approach allows exposure to BB-rated names to insurers’ core fixed-income portfolios. This is completely different from the traditional exposure to HY markets via mark-to-market funds. We believe that -- within this asset class -- there are some BB-rated issuers that could bring yield pick-up and diversification into insurers’ core fixed income portfolios.

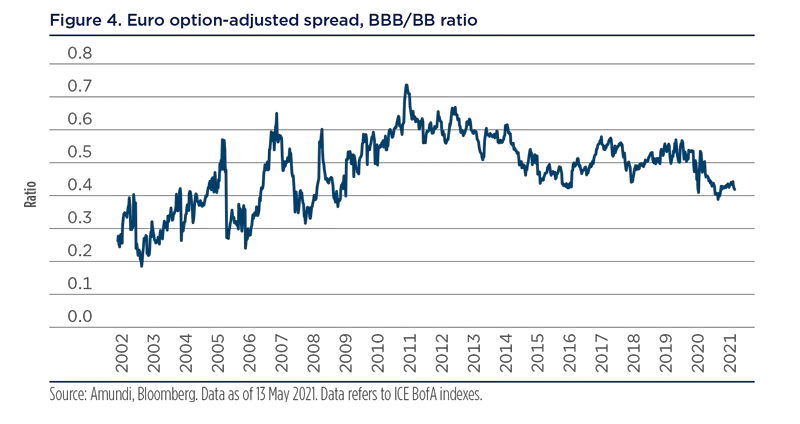

In addition, since relative valuations of BBB vs. BB names can change overtime (see figure 4), a crossover approach permits agility and allows the best opportunities available in both the BBB and BB universe to be captured. Flexibility is also useful to take profits when needed.

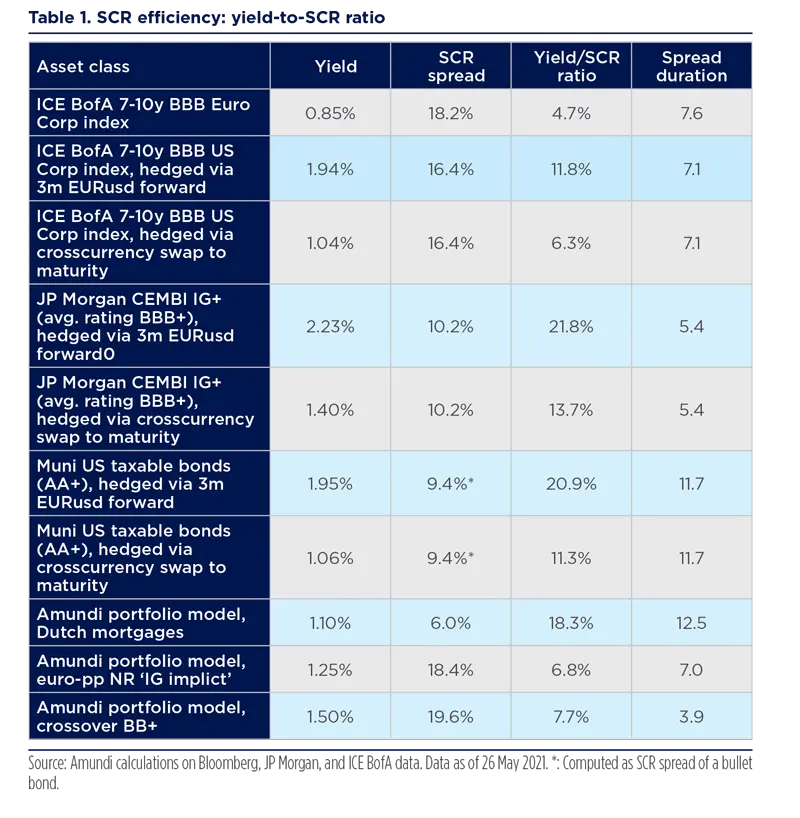

Finally, crossover issuers display a good SCR efficiency ratio (yield-to-SCR ratio), which is twice as good as the one shown by the euro credit IG market. In summary, a crossover approach allows the best opportunities within BBB/BB issuers to be captured, while avoiding the forced sale of potential fallen angels in IG mandates. To implement this strategy efficiently, investors should have a specific set-up in investment and credit research teams that ensures continuity in the coverage of BBB and BB issuers.

A crossover approach allows the best opportunities within BBB/BB issuers to be captured, while avoiding the forced sale of potential fallen angels in IG mandates.

A case study of diversification and yield enhancementContext: client X has asked us to run a global study on its portfolio to find new fixed-income strategies that could be included in its mandate for both diversification and yield-enhancement purposes. Currently, client X invests in euro IG credit senior debt only, plus a small investment in the BB bucket. We suggest expanding its investment universe to include:

In addition, we propose expanding the risk guidelines to:

Client X raises some questions:

We answer these questions as follows:

In the end, client X’s new investment universe would integrate these new strategies:

Client X will define new investment limits per rating, maturity, and strategy within its guidelines. |

Conclusions

In summary, all of the strategies described here should be considered by insurers for their core fixed income portfolios as they bring yield add-ons and diversification. Moreover, they are attractive from a Solvency II standpoint, as shown by Solvency II efficiency ratios (see table 1). However, a strict credit selection framework is key when implementing them.

Definitions

- ALM: Asset and liability management. It is the practice of managing financial risks that arise due to mismatches between the assets and liabilities as part of an investment strategy in financial accounting.

- Asset purchase programme: A type of monetary policy wherein central banks purchase securities from the market to increase money supply and encourage lending and investment.

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Bond ratings: If the ratings provided by Moody’s and S&P for a security differ, the higher of the two ratings is used. Bond ratings are ordered highest to lowest in a portfolio. Based on S&P measures: AAA (highest possible rating) through BBB are considered investment grade; BB or lower ratings are considered non-investment grade. Cash equivalents and some bonds may not be rated.

- Covenant: It is a promise in an indenture, or any other formal debt agreement, that certain activities will or will not be carried out or that certain thresholds will be met. Often they relate to terms in a financial contract – such as a loan document or bond issue – stating the limits at which the borrower can lend further.

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Default rate: The share of issuers that failed to make interest or principal payments in the prior 12 months. Default rate based on BofA indices. Universe consists of issuers in the corresponding index 12 months prior to the date of default. Indices considered for corporate market are ICE BofA.

- Diversification: Diversification is a strategy that mixes a variety of investments within a portfolio, in an attempt at limiting exposure to any single asset or risk.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- Duration times spread (DTS): It is the standard method for measuring the credit volatility of a corporate bond and is calculated by multiplying the spread-durations and credit spread.

- Fallen angel: A fallen angel is a bond that was given an investment-grade rating but has since been reduced to junk-bond status due to the weakening financial condition of the issuer.

- PEPP: Pandemic emergency purchase programme.

- Solvency: Solvency is the ability of a company to meet its long-term debts and financial obligations.

- Solvency capital requirement (SCR): A solvency capital requirement (SCR) is the total amount of funds that insurance and reinsurance companies in the EU are required to hold. SCR is a formula-based figure calibrated to ensure that all quantifiable risks are considered. The SCR covers existing business as well as new business expected over the course of twelve months.

- Spread duration: Spread duration is the sensitivity of the price of a security to changes in its credit spread.

- Waiver: It is a legally binding provision where either party in a contract agrees to forfeit voluntarily a claim without the other party being liable.

- Yankee bond: It is a debt obligation issued by a foreign entity, such as a government or company, which is traded in the United States and denominated in US dollars.

- Z-spread: The zero-volatility spread (Z-spread) is the constant spread that makes the price of a security equal to the present value of its cash flows when added to the yield at each point on the spot rate Treasury curve where cash flow is received.