Summary

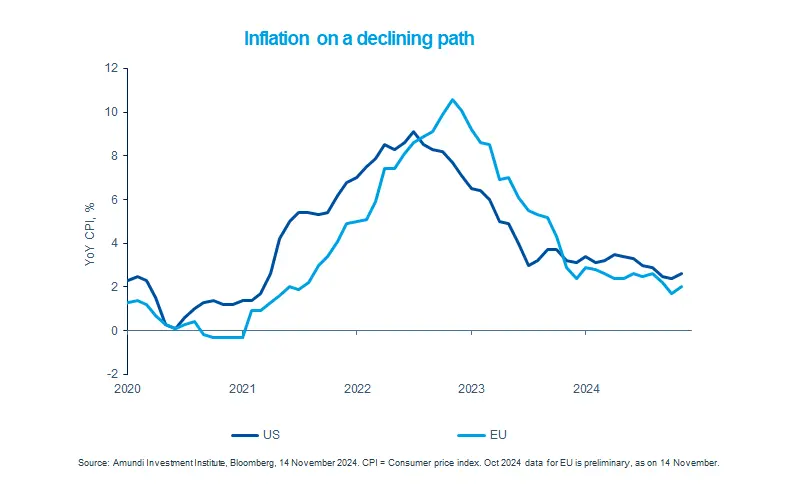

With ongoing inflation swings, central banks will be increasingly data-dependent.

-

Price pressures in the US and eurozone are abating, although some inflation components could be volatile.

-

On the growth front, economic recovery in Europe will continue, and, the US is also likely to avoid a recession.

-

This scenario calls for a global approach and a balanced stance across the US and Europe.

US CPI for October accelerated slightly to 2.6% owing to some sticky components around shelter. This latest data points to the volatility we expect around inflation (particularly if policies of new US administration are implemented), but we think the overall path is declining for now. In the eurozone, preliminary inflation data for October also points to a declining trend. While we believe the ECB could keep a close eye on data, the central bank could continue its monetary easing and reduce rates in December. These rate cuts, along with increases in real income (income less inflation), should boost household consumption and demand in Europe. We expect an uneven recovery across countries, with national policies playing a key role. In the US, a mild economic deceleration is likely. The overall environment is likely to remain benign.

Actionable ideas

- European fixed income

High quality credit in EU offers potential scope for additional income. At the other end, government bonds may provide the much needed stability in times of any stress in the economy.

- US equities

In an environment of only a marginal slowdown in growth in the US, some corners of US equities such as equally weighted segments, value and quality may provide sustainable returns.

This week at a glance

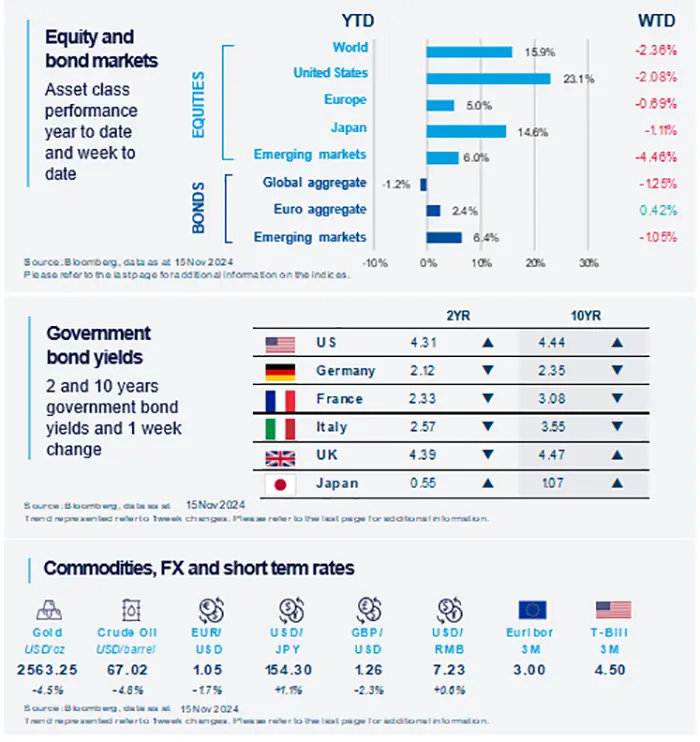

Global stocks pared back gains as they assessed the path of the Fed’s monetary policy. Emerging market equities were dragged lower by weak sentiment in China. Bond yields were mixed. However, the US dollar rose, putting downward pressure on commodities such as oil.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as 15 November 2024. The chart shows the S&P 500 index and the S&P equal weighted index.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US inflation inched up but momentum decelerating

Monthly readings for October CPI came in line with consensus expectations. We think that the disinflationary trend is still progressing, although some components such as rents remain sticky at the moment. We stay vigilant on all such components and on any impetus coming from policies of the new US administration next year.

Europe

Eurozone economic survey subdued in November

The ZEW economic sentiment index for November deteriorated. This reflects lacklustre economic growth ending 2024 and entering next year. In addition, the uncertainty related to the outcome of the US elections and concerns around potential US tariffs on eurozone exports may have affected sentiment. While we expect Europe to continue its recovery, we acknowledge some downside risks to our outlook from such tariffs.

Asia

Indian inflation accelerated in October

India headline CPI came in at 6.2%, year-on-year, with significant contribution from the food component. The number is slightly above the target range (2%-6%) of the Reserve Bank of India (RBI). Core inflation, headline excluding food and energy, dynamics were relatively subdued. Despite the RBI moving to a more neutral stance at the latest meeting in October, we think the central bank will stay on hold at its next meeting in December.

Key dates

|

19 Nov EZ and Canada CPI |

21 Nov South Africa policy, EZ consumer confidence |

22 Nov University of Michigan inflation, Mexico GDP |