Summary

HF to lure more interest after a strong 2024 vintage for alpha

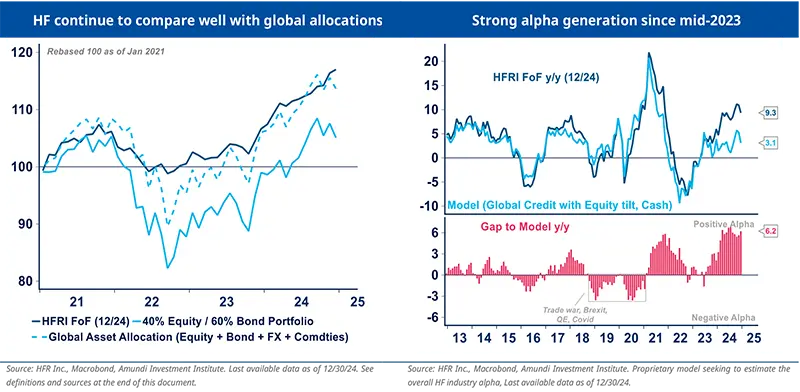

Hedge Funds (HF) were up +9.7% in 2024, supported by L/S Equity, EM-focused and deep Event-Driven strategies. CTAs were the main underperformers. HF outperformed diversified global allocations, including 40/60 equity/bond portfolios, up +6.2%. Furthermore, HF volatility was lower, with lower net exposures. Overall, the HF industry continued to produce very strong alpha in 2024, up an estimated 6.2% y/y. Positive HF performance and the search for diversification are spurring renewed interest and flows in the asset class. Preqin estimates1 that HF’s AuM progressed in 2024, reaching $4.9tn as of Q3..

Stage of the economic cycle is crucial for HF allocations

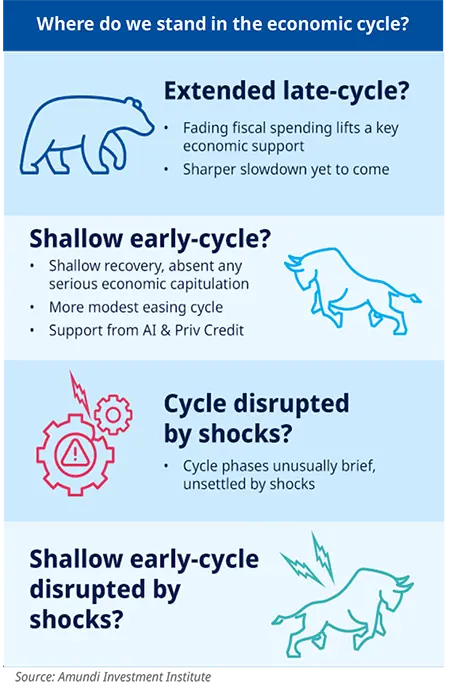

We remain in an atypical cycle: extreme inflation and rising rates resulted in a significant economic slowdown from late-2021 to mid-2023, but did not lead to a recession. Since then, economies have been recovering, reverting to cruise level, supported by central bank rate cuts amid continued disinflation and still elevated fiscal spending.

Going forward, three plausible scenarios come to mind regarding the stage of the economic cycle: i) an extended late-cycle, where still restrictive rates and fading fiscal support lead to a sharper economic slowdown; ii) a shallow early-cycle, supported by artificial intelligence (AI) investment and private credit, but capped by the absence of a true economic capitulation; iii) cycle disruptions due to shocks (escalating trade wars and a disorderly geopolitical reshaping of the MidEast and Europe), resulting in unusually short-cycle phases with reduced macro visibility.

The jury is still out. Market behavior is pointing towards a shallow early cycle, which will be unsettled by upcoming shocks with frequent stop-andgoes. How far trade wars escalate will determine the toll on growth.

Key themes that will matter for HF

Theme #1: Growing economic dispersion

Implications for HF: Appealing relative regional trades for top-down styles (+)

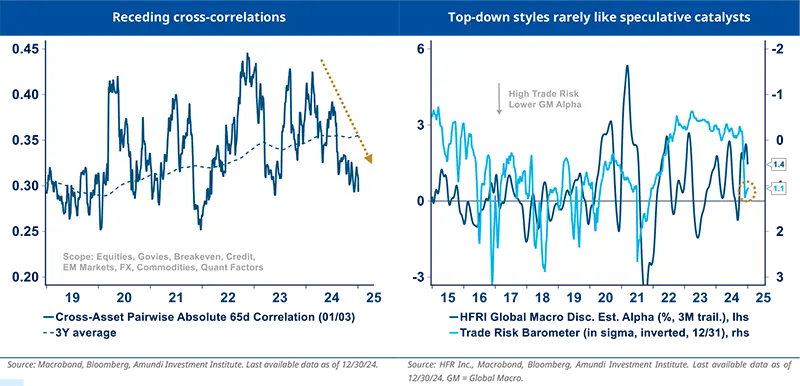

US exceptionalism, European core vs periphery’s economic and political divergences, Chinese structural deleveraging with targeted stimulus, and Japan’s gradual exit from ultra-low interest rate policies are already translating into economic and monetary fragmentation, which will likely be further accentuated by the upcoming trade war. Cross correlations, which are settling in a lower range, and surging regional discrimination across real rates are consistent with more regional relative value arbitrage. This is particularly supportive for top-down-oriented HF as we enter 2025.

Theme #2: Macro uncertainty is relayed by policy uncertainty (trade, fiscal, regulations, geopolitics)

Implications for HF: Traditional growth drivers will be easier to navigate for top-down styles (+), but will be unsettled by speculative decisions, requiring tactical skills (-)

As growth and, to some extent inflation, mean revert to their cruise levels, economic volatility and macro uncertainty are receding. Policy uncertainty regarding trade, fiscal spending, regulations or geopolitics will matter more going forward. These might initially be more impactful for markets than for the economy. While traditional growth drivers might prove easier to navigate, more speculative catalysts will constrain risk budgets and lead to sudden asset rotations, which tend to be challenging to capture. The most tactical strategies and arbitrage-driven styles, within the Macro Fixed Income strategy, look attractive given the likely numerous FX and bond opportunities in 2025.

Theme #3: More frequent economic cycle inflexions ahead

Implications for HF: More top-down risk, constrained risk budgets, hedging costs (-) and higher volatility (+)

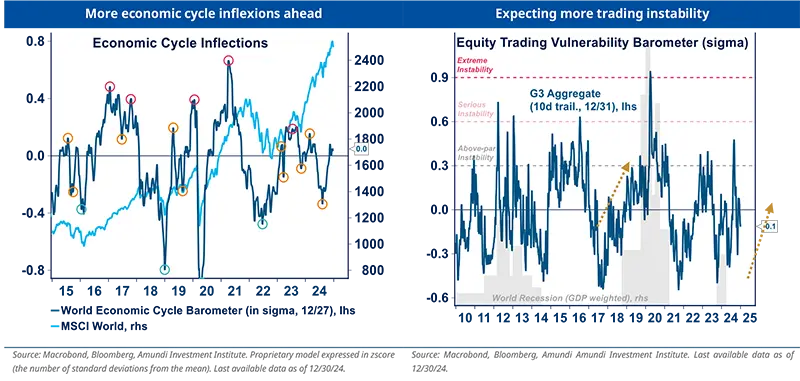

We expect frequent cycle inflexions as intensifying trade wars (and potential geopolitics) stoke inflation and then growth doubts. World economies enjoyed a sequence of positive economic surprises during H2 2024, which now leaves them vulnerable to negative surprises (the cycle of economic surprises usually lasts 6 to 12m peak-to-peak).

We thus expect more trading instability (as occurred during the 2017-19 trade wars) and more frequent phases of correlation anomalies, as markets struggle to read changing tides. Dispersion across top-down-oriented HF will likely rise. On the positive side, we see equity volatility reverting to average (up from its current low levels), historically a positive for HF, as it opens more trading windows and unleashes more market movers.

Theme #4: A benign cycle would mitigate markets’ downside risks

Implications for HF: Top-down styles to have more leeway to deploy trades. A repeat of the poor HF alpha during Trump 1.0 is less likely.

While we see more pitfalls for active management in 2025, a benign macro backdrop would contribute to limiting downside risks for markets.

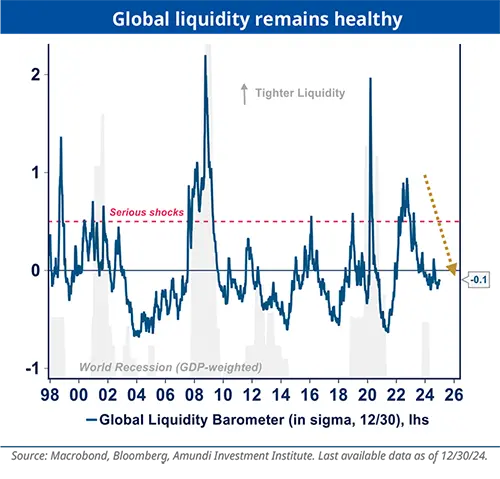

Robust safety nets include: reflation policies in the US and China; ongoing interest rate easing and reasonable easing expectations; comfortable central bank ammunition to support growth if need be; still healthy liquidity; and risk appetite not yet being at extreme levels.

HF alpha generation during the Trump 1.0 trade wars was negative. At that time, the Brexit saga added extra uncertainty while Trump’s transactional style was a surprise for most market players. The economic backdrop was also more fragile back then. We do not expect a repeat of negative HF alpha.

Theme #5: EM Fixed Income (EM FI) less intertwined with politics than Global Macro (GM)

Implications for HF: GM directly influenced by speculative catalysts than EM FI, which can find more isolated trades

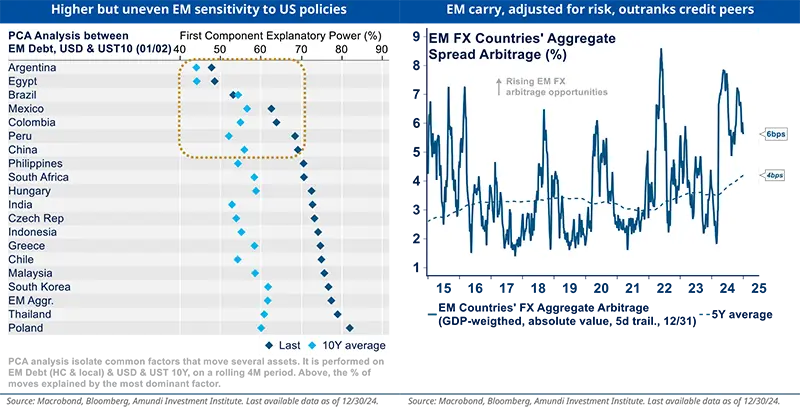

Global Macro managers primarily trade macro-driven DM markets (Developed Markets), which will be subject to changing growth, inflation, rate and dollar expectations as the Trump administration deploys its policies. EM assets are also more exposed to US macro policies than usual, but a third of the EM countries we track in the below left-hand table still show moderate levels of sensitivity, which can help managers diversify their portfolios. Some countries, which might benefit from geopolitics, and more local supply chains, also offer appealing alternative trades (including India, Vietnam, Mexico, Poland and Hungary).

Overall, the EM investment backdrop remains decent. Structural EM risks are stable, EM growth continues to outperform DMs, while EM rates have peaked. China’s deleveraging is an obvious threat but should remain manageable thanks to its targeted stimulus. EM debt valuations are fair to slightly rich, but the net carry (adjusted for risk) remains appealing relative to most other yielding assets. While we expect beta to dominate performance contributions, EM FI strategies look wellpositioned to navigate H1 2025. Our fundamental models suggest there are more FX than pure credit arbitrage opportunities for now.

Theme #6: Trendiness to switch from equity to macro assets

Implication for HF: CTAs back in favour later this year

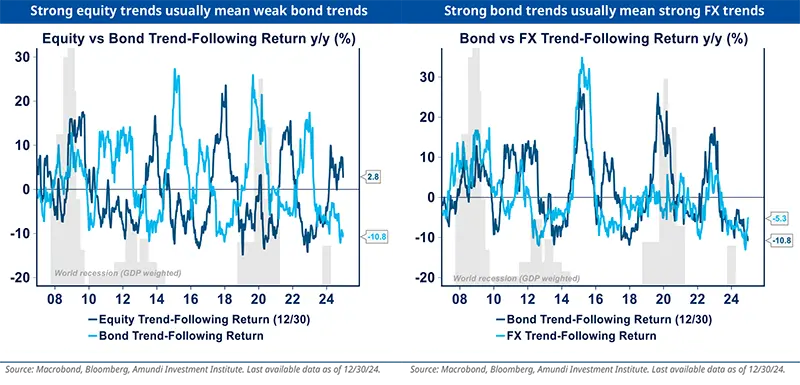

While trendiness is usually strong once an early cycle has started, it is more challenging to anticipate this time, assuming a shallow recovery unsettled by shocks, hence our neutral stance on CTAs. We expect the contribution from smaller assets to be more significant. After strong trendiness in equities, we expect a switch in favour of FX and then bonds later this year. Indeed, trends across assets tend to be asynchronous: significant trendiness in equities usually mean limited trendiness in bonds, and vice versa. Similarly, trendiness in bonds usually leads to trends in FX if unfolding with regional fragmentations. Trends in commodities are usually meaningful when they impact inflation.

Theme #7: Bottom-up fundamentals take center stage, amid rich equity and credit valuations

Implication for HF: Broadening and greater fundamentals pricing, ideal for HF (+)

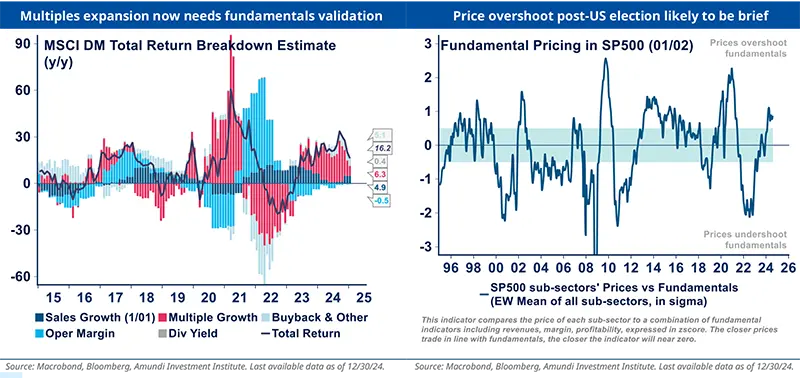

Nearly half of DM equities’ returns in 2024 were driven by multiples’ expansion (thanks to lower rates and a friendlier economic backdrop, albeit with regional nuances) and now need fundamental validation. Supportive credit corporate conditions are also already reflected in spreads. We expect a greater focus on securities’ fundamentals and a broadening beyond US indices and the tech sector in 2025. This would continue to support alpha generation, especially for fundamentalsdriven models. We would focus more on L/S neutral in the US and more on L/S diversified value in the EU.

Theme #8: Bifurcating drivers still make room for stock-picking, unlike credit that mainly relies on carry

Implications for HF: Selective but still strong Equity alpha (+), more limited in Credit (-)

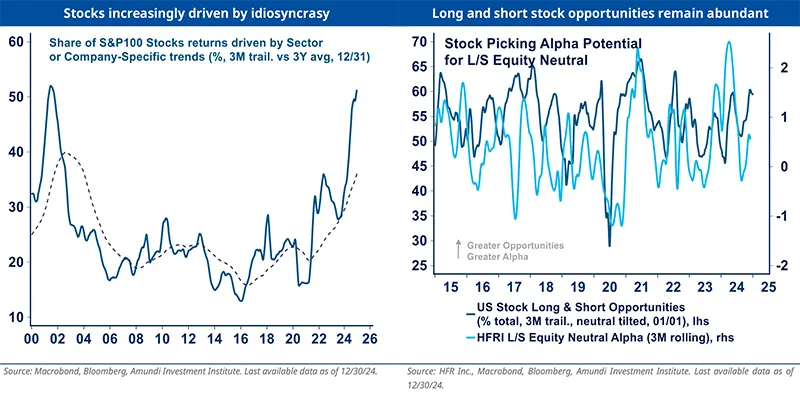

Stock pairwise correlations rose in the US and to some extent in Europe, with falling dispersion. However, the market structure hides a significant bifurcation between segments that are the most sensitive to US policies versus the rest of the market which is more driven by idiosyncrasy. Our L/S Equity Alpha Potential model, which tracks the share of stocks displaying an exploitable trend, suggests bottom-up opportunities remain abundant in equities, both on the long and short sides. We find more discrimination at an industry level than at a quant factor level.

In DM credit markets, room for bottom-up picking looks poor, given the limited dispersion and high correlation across rating, duration and sectors. The appeal for credit looks more linked to carry than alpha.

Theme #9: Animal spirits back in the US; the rest of the world remains herbivore

Implications for HF: Corporate activity is source of catalysts, good news for Event Driven and L/S Equity (+)

Corporate risk appetite has been recovering since 2023 and more recently bounced in the US, boosted by prospects of deregulations, re-industrialisation and corporate tax cuts. Corporate activity is reviving, helped by lower rates and moderate private leverage, as evidenced by investments, M&A volumes, primary markets issuance and activist campaigns. However, corporate activity does not fully reflect the progress in corporate sentiment. Concerns about the impact of trade wars and immigration policies on corporate margins and capex are capping the upside for now.

A more benign event-driven backdrop is favorable for merger arbitrage, which would benefit from a broader menu of opportunities. Merger spreads are also appealing and factor in more individual deal specifics. Cheap valuations in Europe also provide acquirers with appealing entry points. The dominant strategy risk remains policy uncertainty, which is imposing a significant premium for strategic and cross-border acquisitions. Whether or not a new capex cycle starts off will matter too. While waiting for more clarity on these questions, we will prepare to reweight the strategy in H2 25. In the meantime, credit special situations remain relatively more attractive.

Theme #10: Cash rate still high

Implications for HF: Elevated extra cash contribution for HF (+)

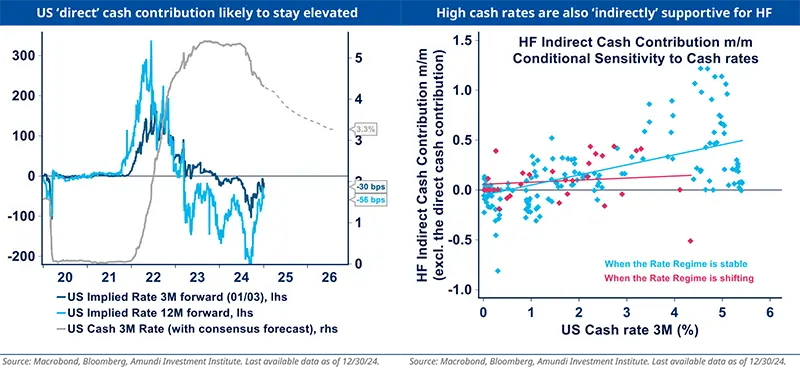

HF maintain below-par net market exposures and are therefore directly and/or synthetically long cash. On top of this ‘mechanical’ cash contribution, HF returns are also indirectly yield-sensitive because major rate inflexions reflect changing macro tectonics that will open up relative opportunities. On average, HF capture about 60-70% of the cash interest, accounting for friction costs. With the cash rate seen staying at an elevated level for the foreseeable future, the contribution to HF returns will remain meaningful.

HF are competitive1 when the cash rate is elevated, especially when alpha conditions are supportive, as they are compared to risky assets that deliver less attractive net-of-cash yields.

Theme #11: A brave new world for diversification

Implications for HF: HF are among the few assets providing sustainable diversification (+)

Portfolio risk management challenges are very different compared to those of the last decade. Liquidity is not as abundant and rates are higher. Absent a recession, the recovery phase will likely be shallow and result in more modest cyclical-asset returns. There are a lot more threats of a different nature including: more cycle inflexions; trade and globalization risks; geopolitical reshaping in the Middle East, the EU and Asia; high portfolio concentration in the US market and the tech sector in particular; FX carry trade vulnerability; and more trading instability.

Meanwhile, the equity/bond correlation remains unstable and unreliable, calling for alternative means of diversification.

Along with real assets, HF provide appealing diversification benefits as they operate in most markets, favour relative arbitrage with shorts, have dynamic market timing and deploy differentiated strategies (including fundamental, systematic and thematic styles).

HF allocation stances

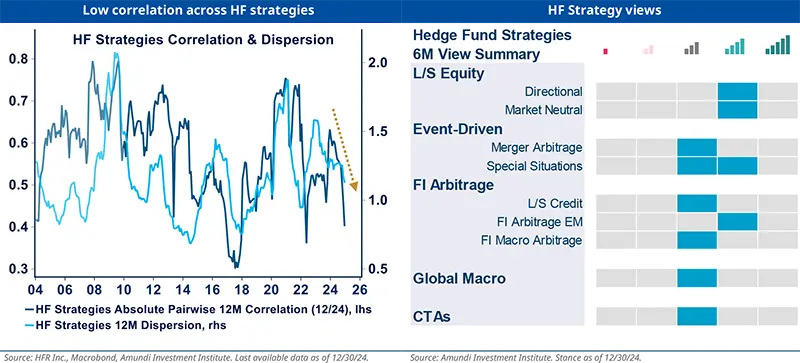

Overall, we seek a more balanced allocation across HF strategies than in 2024. Skewed towards L/S Equity Neutral, EM FI and L/S Credit in 2024, we favour a more diversified allocation within L/S Equity, between neutral and diversified styles, and a more balanced position across regions. We would also favour a more balanced allocation between bottom-up and top-down styles, with a tilt to both L/S Equity and EM FI strategies. We prepare to reweight Merger Arbitrage and Global Macro in H2 25. Fund selection would matter more for Macro FI, favoring the most tactical and/or arbitrage-oriented strategies. We would keep a neutral allocation to CTAs.

Hedge Fund Indices Performance

The index returns are provided for purposes of comparison and include dividends and/or interest income. The indices are unmanaged and fully invested. Although information and analysis contained herein has been obtained from sources Amundi AM believes to be reliable, its accuracy and completeness cannot be guaranteed. Investors cannot invest directly in indices. The indices referenced herein have been selected because they are well known, easily recognized by investors, and reflect those indices that Amundi AM believes, in part based on industry practice, provide a suitable benchmark against which to evaluate the investment or broader market described herein.

Index Description

Other L/S Equity: equally weighted performance of HFRI Equity Hedge: Sector - Energy/Basic Materials, Technology/Healthcare

Other Relative Value: equally weighted performance of HFRI Relative Value: Fixed Income-Asset Backed, Convertible Arbitrage, Volatility

Other Macro: equally weighted performance of HFRI, Macro: Active Trading, Commodity, Currency

HFRI indices: for a comprehensive description of the HFRI indices used in the above table, please refer to the index description on HFR website: https://www.hfr.com/hfrx-indices-index-descriptions

Global Benchmark Description

40% Equity/60% Bond Basket: Combines the MSCI World and the Barclays Global Bond Aggregate

Global Allocation Basket: Combines the MSCI World, the Barclays Global Bond Aggregate, Global FX Carry in USD, and the S&P GSCI Commodity index. All indexes are in USD unhedged. Gross of fees and taxation.

Investors can suffer a loss of their initial capital, up to total loss of their investment, because it is made on the financial markets and uses technologies and instruments that are subject to variations