Summary

Introduction

At Amundi, Alternative & Real Assets is dedicated to building long-term relationships with our clients and partners, rooted in proximity and authenticity. Guided by the belief that tomorrow’s economy must unlock new opportunities, we act as facilitators, bringing the right people together at the right time.

At the end of 2024, Amundi Alternative & Real Assets had the pleasure of welcoming over 200 professional investors at its annual conference on Alternative Investments. Leading hedge fund industry experts gathered for insightful discussions on themes such as the U.S. political landscape and the opportunities arising from the Trump election, machine learning and innovation, and the role of liquid alternatives in a strategic portfolio, among others.

During the conference, participants had the opportunity to take part in a poll of four questions on the opportunities and risks that they foresee for 2025. This first edition of the Hedge Fund Investor Barometer takes a deep dive into these questions. The Amundi Investment Institute provides Amundi’s house view and their analysis of the results while the distinguished guest speakers comment on each question.

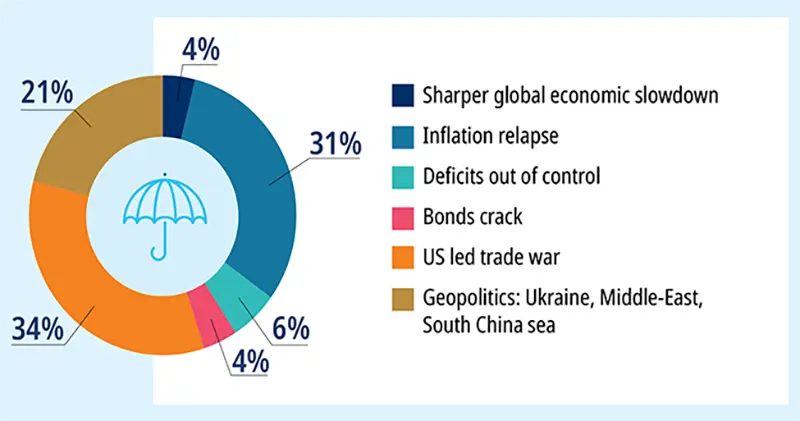

What is the biggest risk for investors in 2025?

Amundi investment Institute

Monica Defend,

Head of Amundi Investment Institute

The top key risks from polls are ultimately about inflation. We agree. That is also the top risk we highlighted in our Global Investment Outlook 2025. It is not highly priced yet, which is maximizing risk for both the economy and the markets.

Another risk that might destabilize the market is the discrepancy between the level of macro uncertainty and compressed equity volatilities, which might result in more frequent volatility spikes.

Alternative Investment 2024 - Conference panelist

Karen Karniol-Tambour,

Co-CIO, Bridgewater Associates

The uncertainty does feel highest about trade and so it makes sense that it is showing up as the top issue in the poll. Inflation is one of the likely consequences but will not be the only one.

The reaction-function of central banks adds a layer of uncertainty to trade. They might look at inflation induced by trade wars as a one-time effect and look through it and instead choose to ease into the economic disruptions caused by the trade war.

The key source of uncertainty from trade is whether tit-for-tat escalation leads to major disruptions or not.

This risk is magnified by the fact that a trade escalation is not highly priced in the market yet, as stocks most susceptible to trade wars have not been particularly punished.

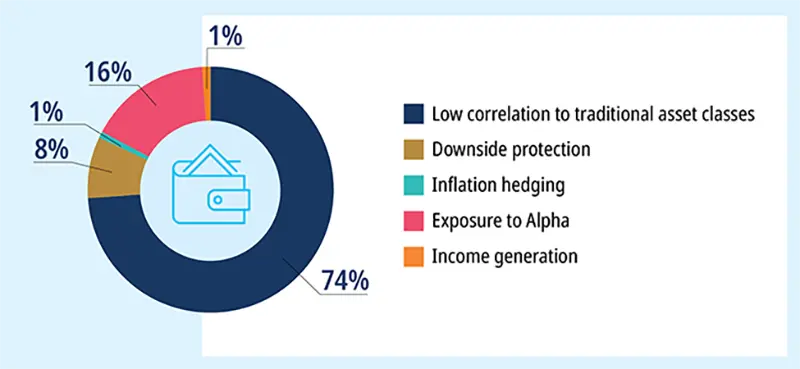

What is the primary role of alternative investments in a portfolio strategy?

Amundi investment Institute

The poll overwhelmingly emphasizes the appeal of hedge fund diversification. Investors recognize that hedge funds deliver an attractive risk/reward.

Hedge funds provide diversification as managers operate in most markets, favor relative arbitrage with longs and shorts, have dynamic market timing, with robust risk management processes.

Our latest capital market assumptions, published in November last year, put forward hedge funds as one of the top diversifiers for an investor with a moderate risk profile. The hedge fund return over the next 10 years, excluding alpha, is expected at 5.6 %* (in USD term).

One paradox from the poll: inflation being spotted as the top risk for 2025 in the 1st question, while few mention hedge funds as a means to protect against inflation.

*Capital market Assumptions 2024 - Nov 2024 - Amundi Investment institute.

Alternative Investment 2024 - Conference panelist

Penny Aitken,

European Head of Hedge Funds Research, Mercer

Diversification ranks first by far in this poll, which is not surprising. The common desire is to get diversification. This doesn’t disqualify the other topics, most of which are actually interlinked. Inflation for instance, is a risk factor picked up in correlation, and may be offset by the diversification provided by hedge funds.

In contrast, the small percentage for “downside protection” is more surprising. Hedge funds can be very beneficial in terms of long-term compounding and reducing drawdowns like what we saw in 2022. Back then, equities and bonds declined, while hedge funds proved resilient. Downside mitigation remains a key role of hedge funds in portfolio allocation in our view.

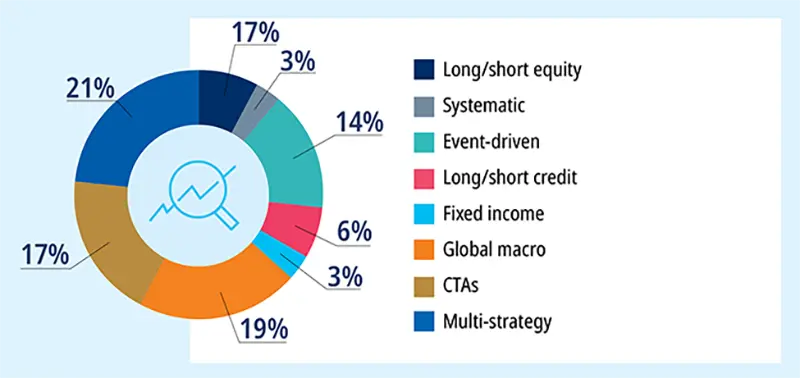

Where do you see the opportunities for 2025?

Amundi investment Institute

In 2024, hedge funds were up +9.7%*, supported by long/short equity, emerging markets focused, and deep credit event strategies. For H1 2025, we favor a more balanced allocation across strategies, with a mix of styles in long/short equity strategies and a mix of regional exposure in fixed income strategies.

While frequent inflection cycles and speculative catalysts will constrain top-down styles’ risk budgets and bottom-up managers’ playing ground, growing economic dispersion, volatility creeping higher, and greater focus on securities’ fundamentals are supportive for hedge funds and their alpha. In addition, they should continue to collect a comfortable contribution from cash.

We favor a more balanced allocation between bottom-up and top-down styles, with a tilt on Long/Short equity strategies. We prepare to re-weight Merger Arbitrage and Global Macro strategies as we head into H2 2025.

Alternative Investment 2024 - Conference panelists

Arnaud de Lasteyrie,

CIO, Machina Capital

The results of the polls put multistrategy at the top. This says that investors are looking for balanced allocation.

Thomas Feng,

CIO - Quant Strategies, Graham Capital Management

The results, quite balanced across the big strategies, make sense. We view this as a sensible approach too, putting one’s eggs in different baskets. This is how investors should be thinking. We do too, as a manager, every day: how do we diversify our bets and generalize our daily opportunity set as broad as possible.

Nicolas Gaussel,

CEO and Co-CIO, Metori Capital Management

When we look at the performance at the industry level, the strategy that has delivered the best results over the past decades has been the trend by far. We don’t see any reason why this should change in the future. Not only it has delivered good risk adjusted return but also zero correlation to equity. We have created Metori with the view that this is solid and this won’t change.

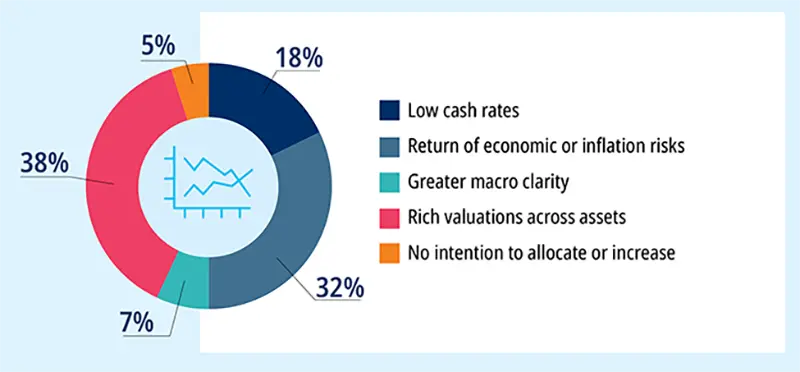

Under which circumstances would you allocate or increase your allocation in hedge funds?

Amundi investment Institute

Hedge funds tend to perform better during periods of macro soft patches, rate normalisation and changing inflation environments, above-par volatility and unstable equity/bond correlation.

In an environment that combines reasonably supportive macro conditions but intensifying threats from a flurry of risks of different natures, we favor strategies that can benefit the most from the former while navigating the latter the best, such as Long/Short Equity. We also favor a more balanced allocation across strategies and regions.

Alternative Investment 2024 - Conference panelists

Vito Menza

Partner and Assistant Portfolio Manager, Sandler Capital Management

The poll makes sense: valuations are rich, it’s the time to go for alpha. It’s true in equities, and it’s the same thing with credit spreads. They can’t get much tighter. We believe we are at midcycle. We think it’s a good time for adding alpha, by either picking credit or stocks, which are going to get more differentiated.

Drew Fidgor,

Portfolio Manager, TIG Advisors, LLC

Greater macro certainty is the key to increased merger activity. Last year, the regulatory environment posed a significant challenge to both returns and deal flow. We believe the Trump administration will ignite market confidence, spurring more deals over the next four years of his presidency. This shift could be a game-changer for deal flow, leading to more opportunistic and hostile bids.