Summary

Gold has been shining bright this year on the back of expectations of Fed rate cuts and rising geopolitical tensions. The metal may be used as a potential source of resilience in portfolios in an overall diversified* approach.

- The yellow metal has delivered strong gains amid monetary easing and rising risks around international conflicts.

- However, any change in market’s rate cut expectations could create near term volatility in gold prices.

- The metal could potentially be used to provide stability to portfolios in times of low economic growth.

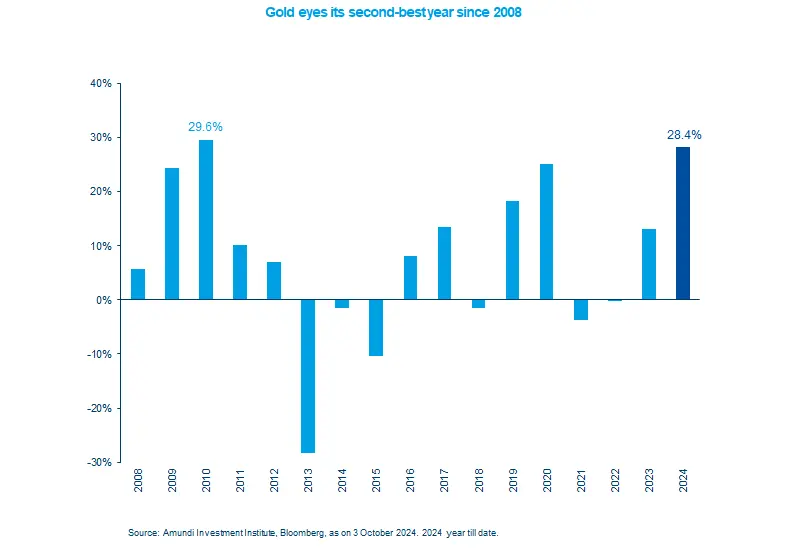

Prices of the precious metal have risen significantly so far this year (28.4%), well-ahead of the S&P 500 (around 20%). The move has been so strong that the precious metal appears to be heading for its second-best annual performance since the great financial crisis. There are multiple factors behind the rally that will likely continue to support prices in the near term -interest rate cuts by the Fed that raise the appeal of the non-yielding metal, heightened geopolitical tensions, such as the one in the Middle East, and purchases by central banks.

In addition, high fiscal deficits and government debt may boost the long term appeal of gold. Excessive spending (not backed by income) by governments could pressurise fiat currencies such as dollar and in the process erode its purchasing power. This, along with any potential worries on inflation, could potentially increase gold’s appeal as a store of value.

Actionable ideas

- Gold

Investors could potentially benefit from the safe-haven allure of metals such as gold amid low growth and high global frictions.

- Multi Asset

During an environment of low economic growth, a diversified* multi asset stance offers an optimum balance between portfolio stability and areas of opportunities.

This week at a glance

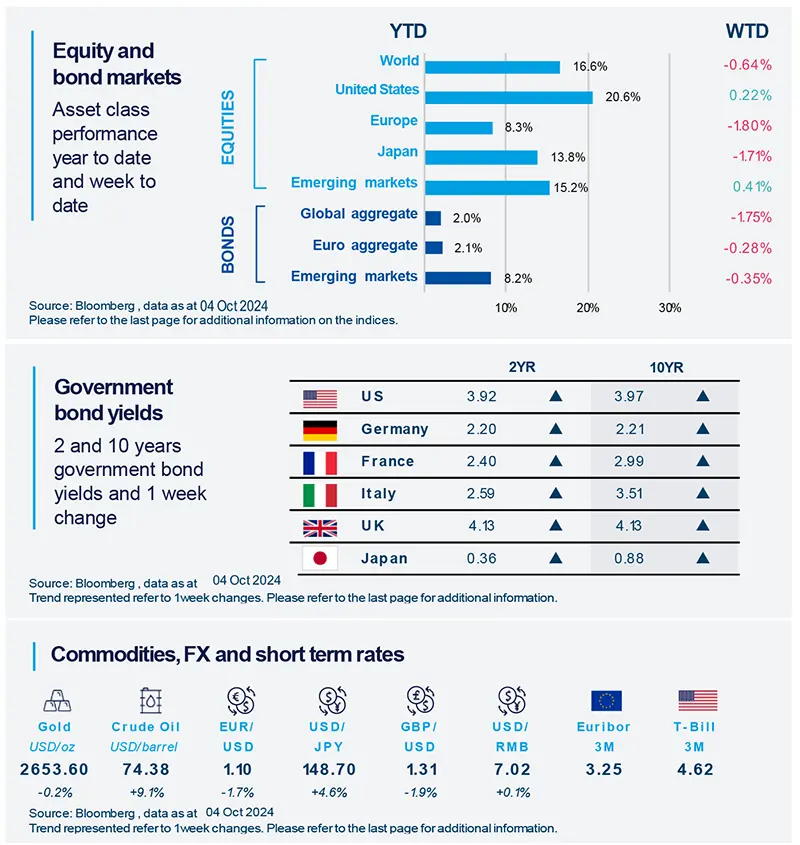

Equities were mixed over the week but oil prices rose due to concerns over escalating tensions in the Middle East. Bond yields were up as strong US economic data led the markets to reassess expectations on Fed rate cuts. This also pushed the dollar higher for the week.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 4 October 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US services index remains robust

The September ISM services index, a forward-looking indicator for the services sector, came in stronger than expected. The various sub-components of the index indicate robust activity but with some exceptions. New orders and business activity rose but the employment component fell, indicating further softening of the labour markets. Job markets remain an important factor for us as we continue to monitor US economic activity.

Europe

Euro area survey was mixed for September

Final reading for the Purchasing Managers' Index declined in September (vs. August) but still came in better than the preliminary estimates. Although the manufacturing sub-index points to protracted weakness, the service component was above 50, indicating continued expansion in services. These indicators are in line with our view of only a modest economic growth in the second half this year.

Asia

All eyes on fiscal stimulus in China

After the announcement from the People’s Bank of China, markets now expect fiscal measures from the government to support economic activity in the medium term. The key period to watch will be the week following the Golden Week (8-15 October), when markets anticipate announcements. We continue to monitor the situation to assess the impact of the potential stimulus measures on the real economy.

Key Dates

|

9 Oct FOMC minutes, RBI monetary policy |

10 Oct US CPI and labour markets |

11 Oct German CPI, UK GDP, Bank of Korea policy |