Summary

Expectations of a Fed pivot to cut rates likely drove the recent, sharp surge in gold. Now, geopolitical risks and concerns over lack of fiscal prudence from governments could support the demand for metals.

- Gold prices have been rising amid expectations of Fed rate cuts and its safe-haven allure.

- Declining yields on US government bonds tend to boost the demand for non-yielding assets such as gold.

- Fundamentals point to continuing strength, but valuations are high, which could lead to some near term volatility.

Gold prices rose significantly since October, and touched an all-time high of $2,182.8/oz on 11 March. Falling yields on government bonds, slowing US inflation and safe-haven appeal of the metal likely supported this surge.

Higher geopolitical tensions among countries (US/China, US/Russia) heighten the risks around government and central bank reserves, if held in a foreign currency. This could lead to more demand for stable assets from individuals and from global banks such as the PBoC. From a long-term perspective, excessive government debt and governments spending beyond their earning capacity may create concerns around government-backed currencies. As a result, the metal, which is also traditionally seen as a store of value, attracted investor interest.

Actionable ideas

- Gold investing

Gold offers the potential for stability in times of excessive global debt and rising geopolitical risks.

- Multi Asset approach

A multi asset approach can benefit from investing across multiple asset classes including gold, which can help enhance diversification*.

*Diversification does not guarantee a profit or protect against a loss.

This week at a glance

Stocks were mixed this week, with European markets rising and Japan ending the week lower. Yields on long-term bonds rose after a higher-than-expected increase in US producer prices, uptick in oil and successful wage negotiations in Japan. However, gold prices retreated slightly.

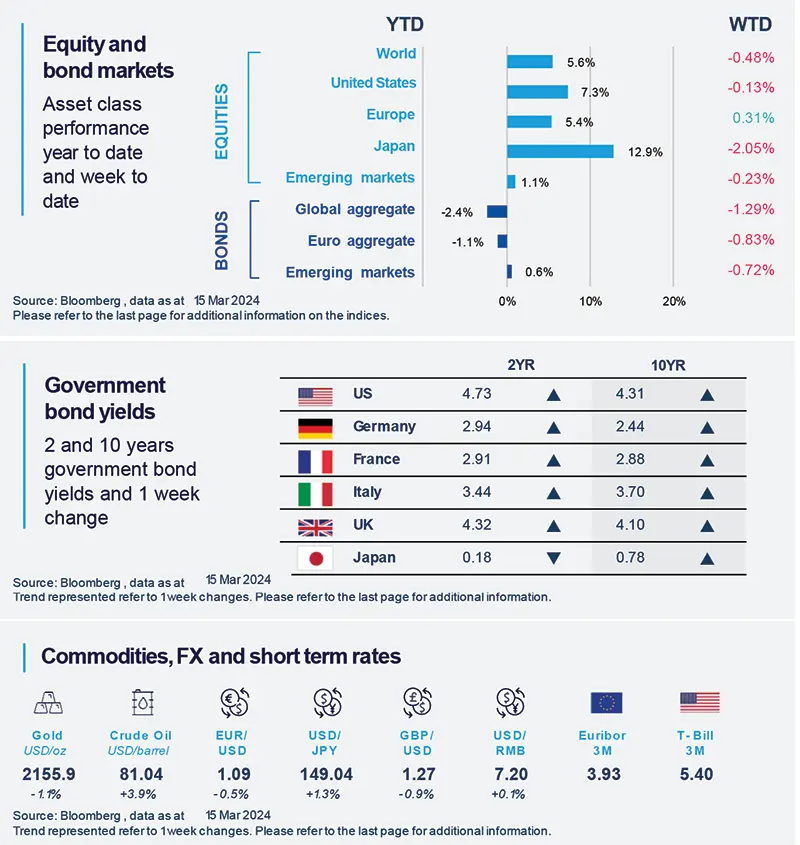

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD).

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as at 1 March 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

Amundi Investment Institute Macro Focus

Americas

US CPI in February came in strong.

Inflation rose at a higher than expected pace in February, for both headline (0.4%, mom) and core (0.4%, mom) data. We think the inflation momentum is strong and services inflation is the main headwind to a rapid deceleration of overall inflation. Within services, rentals are the key area to monitor for us. We stay vigilant on the evolution of inflation in order to judge the Fed’s policy actions.

Europe

EZ industrial production continues to be weak.

The January industrial production in the Eurozone came in at -3.2% mom, compared with consensus expectations of -1.8%. This was mainly due to subdued activity in Ireland. The bloc’s main countries such as Germany, however, registered relatively better performance compared to December. We believe the overall numbers for the region point to continued weakness.

Asia

Benign inflation environment in India.

Headline CPI printed at a stable 5.1% YoY in February, while core CPI eased to 3.3% YoY. In addition, keeping in mind the upcoming general elections, the government introduced new measures on fuel prices, thereby mildly moderating inflation perspectives. If we combine the inflation outlook with the country’s robust growth, we think the RBI should keep its policy rates unchanged in early April.

Key Dates

|

18 Mar EZ CPI |

19 Mar |

20 Mar Fed Monetary policy, UK and South Africa CPI |