Summary

Fed rate cut boosts the markets but for how long

Capital markets whipsawed between a weakening US labour market and hopes that the Fed would successfully steer the economy towards a soft landing. Markets are optimistically interpreting the latest policy action, which could potentially boost consumption and investment. The other narrative is that the Fed would not have implemented a big cut without having apprehensions on the economic front. Our view is that truth lies somewhere in between – a combination of the two narratives will most likely play out, depending on:

- The US being on a slight deceleration path, downside revision to eurozone. We maintain our views of only a mild deceleration. Labour markets, consumption pattern and savings rate remain key to monitoring the extent of the slowdown. In the eurozone, we trimmed our real GDP growth forecasts for 2025 from 1.2% to 1.0% mainly due to weak domestic demand.

- A Fed that is inclined to cut rates deeper would give more leeway to the ECB and the Bank of England to reduce their own policy rates. Higher number of Fed rate cuts means lower terminal rates for the Fed, with ripple effects on the ECB and BoE.

- US seems less concerned (for now) about fiscal deficits. The political leanings of Kamala Harris and Donald Trump are different, but neither of them seems to be bothered by high deficits. In Europe, it’s the opposite, and has caused investment and productivity gaps with the US over the years.

- China’s monetary stimulus is a definite boost to market sentiment. The monetary easing and changes to housing policy signal a renewed effort by the country to support the economy, but we await clarity on fiscal stimulus.

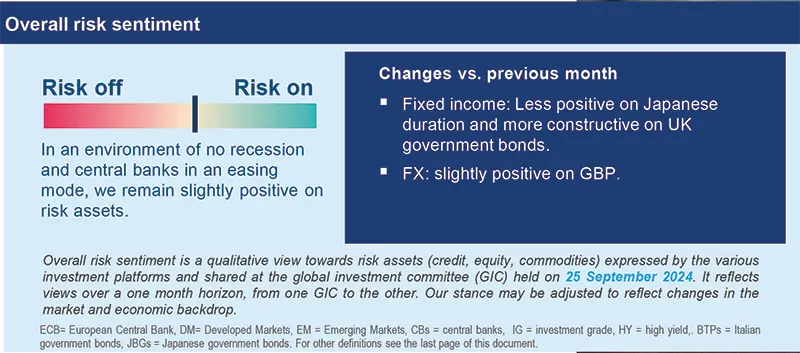

A mildly positive risk stance is the way forward as the economy is unlikely to enter a recession and inflation continues to decline, leading central banks to progress on their easing cycles. However, monetary easing alone would be unable to boost the markets sustainably. Rate cuts would take time to disseminate to the broader economy. We need favourable growth, strong corporate earnings and investments to enhance productivity for market performance in the long run. In particular, we see opportunities in following categories:

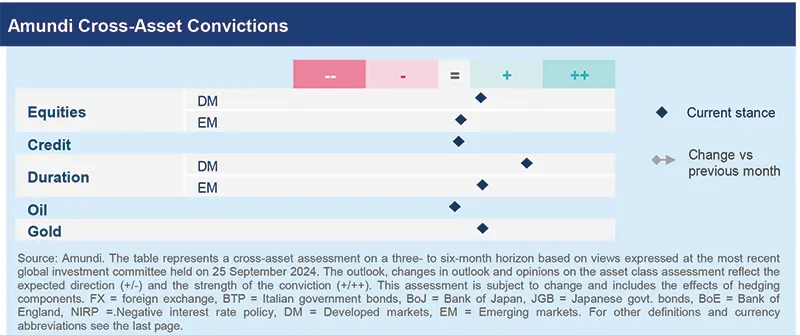

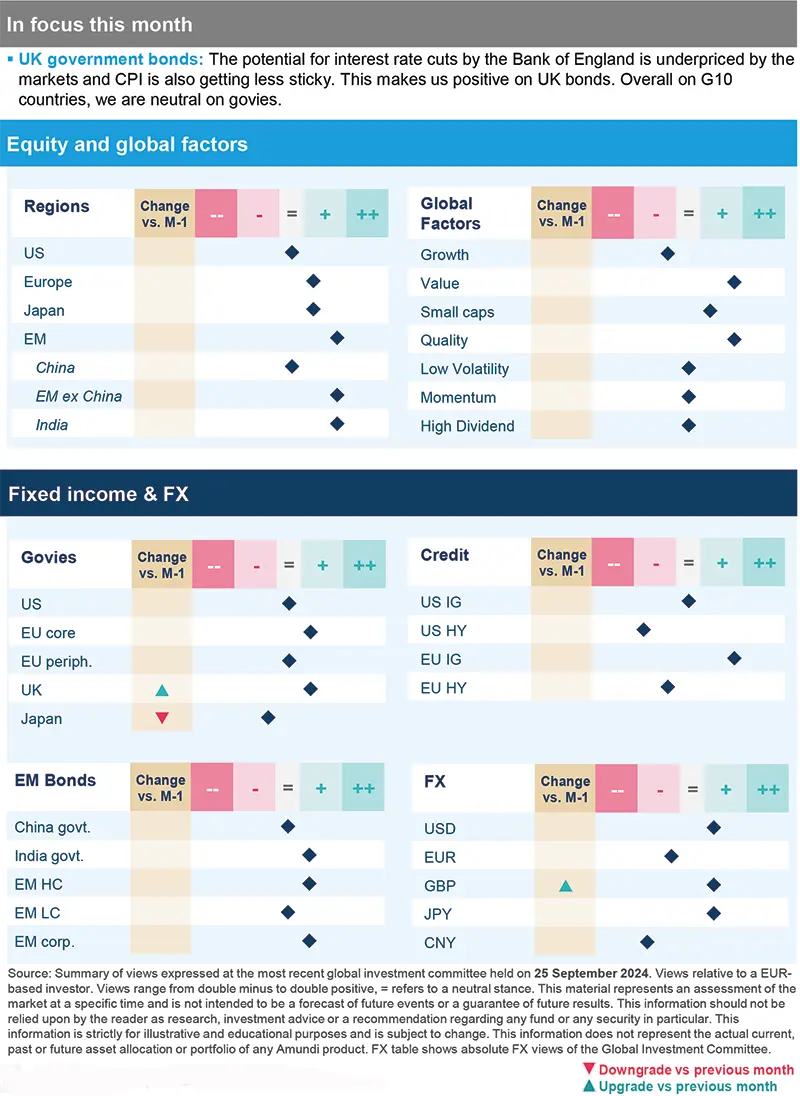

- Cross asset. We are constructive on duration, and explore global divergences across the curves. While staying positive on the US and Europe (slightly less so than before), we turned optimistic on the UK. In general, DM yield curves would continue to steepen, but some near term differences will prevail. In EM debt, yields are attractive but noise around US tariffs could affect segments with tight valuations. We are exploring entry points in equities and remain marginally positive on the UK and Japan. Gold provides resilience in times of high geopolitical uncertainty, particularly when central banks are cutting rates.

- Tactical and active on government bonds, positive on carry in credit. Yields on USTs are attractive from a long-term perspective allowing us to stay close to neutral. An active approach is crucial as central banks normalise rates in the US and Europe at different speeds. We upgraded UK duration amid receding inflationary pressures and persisting growth concerns. In US credit, we prefer financials over non financials, and in the EU, we like financials and subordinated debt, but are cautious on consumer and retail sectors.

- Prioritise fundamentals/valuations in equities. The transition to an economic recovery should help the markets. But until that happens, markets will be less directional and more dependent on rotations and valuations. We await a broadening of earnings outside mega caps and stay balanced in the US, exploring high quality defensives and value over growth. Even in Europe, we aim for a balanced stance through quality cyclicals and defensives.

- Global policy easing supports the case for emerging markets. We like hard currency bonds and are more selective on local currency where we are exploring markets that have seen excessive selling recently, and hence are attractive. Country wise, we like Brazil, Colombia and Peru. On equities, Asia presents abundant opportunities, and we remain selective.

Three hot questions

1| After the jumbo Fed rate cut in September, have you changed your policy expectations?

We now believe the Fed will ease policy by another 50 bps this year (75 bps previously expected), split equally between its two remaining meetings. We also added one rate cut to our expectations for next year, reducing our terminal rate forecasts from 3.50% to 3.0% which should be reached by Sept-2025. A dovish Fed makes it easier for other central banks such as the ECB to reduce their rates. For the ECB, we have penciled in an additional 25 bps rate cut for next year, taking our terminal rate expectations to 2.25% by April. We also lowered terminal rates for the BoE by 25 bps to 3.50% by 2025-end.

Investment Implications:

- Duration: Close to neutral on US and slightly positive core Europe. Turning constructive on UK.

2| How do you explain the divergence of the BoJ with the Fed?

Japanese core CPI accelerated in August, and we now expect it to stabilise around 2% for the next year instead of a mild decline as we thought earlier. The BoJ indicated its intention to raise rates if its economic forecasts are achieved. We think the bank would monitor wage growth, incoming data and external market stability which are all important factors for Governor Ueda to consider before he tightens policy. Accordingly, we believe the BoJ will hike rates in December and in May 2025 by 25 bps each, but we do not change our terminal rate forecast.

Investment Implications:

- Cautious on Japanese government bonds.

3| What is the impact of China’s monetary stimulus on the country’s economic growth?

The PBoC implemented monetary easing and liquidity-enhancing measures. It reduced policy rates, cut the reserve requirement (the amount of capital banks must hold as reserves) and made it easier for people to buy second homes. This seems to have infused new life into the markets. We welcome these measures and await more clarity on fiscal measures which could address the problem of high leverage in the economy and could encourage consumers to spend more. For a sustainable improvement in growth and market performance, it is essential that consumer sentiment and employment situation get better.

Investment Implications:

- We stay close to neutral on Chinese equities for now, and are monitoring the situation closely.

As it became more confident of taming inflation, the Fed gave strong forward guidance on rates, which is in contrast to its recent approach of staying vigilant/data dependent (on inflation). This, coupled with some concerns on growth, led us to lower our terminal rate expectations.

MULTI-ASSET

Opportunities across DM yield curves

|

Francesco SANDRINI |

John O'TOOLE |

In range-bound markets, we stay diversified and look to accumulate in segments where riskreward is symmetric

Economic growth is moderating but not collapsing across the developed world and inflation is falling in line with central banks’ targets, indicating that the central bank put is firmly in place. As a result, we are mildly positive on risks and aim to ensure that all elements for enhancing long term returns, and portfolio resilience (hedges and duration) are well-explored. On the latter, we are diversified across the curves and actively adjust this stance to accommodate regional nuances, taking into account opposing pressures (falling inflation, growth, fiscal deficits) on yields.

Our slightly constructive view on DM equities is maintained through the UK and Japan, but we are neutral on the US and the EU. The UK provides a good balance of domestic and international dynamics, and high dividends. Its exposure to the energy sector could provide some support in times of heightened tensions in the Middle East. In Asia, Japan could benefit from improvements in corporate governance and is also a diversification play. Overall, we are exploring other developed and emerging markets which provide a good balance of valuations, volatility and potential rewards.

We are positive on US duration and core Europe but have partly reduced our views on the latter in favour of the UK. The UK should benefit from slowing inflation and fiscal discipline, and Italian BTPs also present room for further gains. Given the movements in the Canadian curve over past months, we believe the scope for the curve to steepen further is limited. But in the medium term, yield curves in major DM (i.e. the US) should steepen. In Japan, the BoJ’s policies are likely to keep bonds under pressure.

In corporate credit, EU IG is attractive and shows strong fundamentals and low leverage. Furthermore, EM debt maintains its yield advantage over US, particularly in local currency. We remain constructive on EM debt, but reduced this view slightly. In some parts, tight valuations could come under pressure from any possibility of a Trump victory (protectionism) in the US. We are marginally positive on USD but are vigilant as it might be affected by Fed rate cuts. The AUD is attractively priced and could benefit from any improvement in China growth. In EM, we like BRL/EUR and INR/CNH.

Gold has benefitted from Fed easing and it continues to provide strong protection from geopolitical tensions. But to further strengthen portfolio safeguards, it is important to explore hedges on bonds and equities.

FIXED INCOME

Carry is attractive but tilt towards quality

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

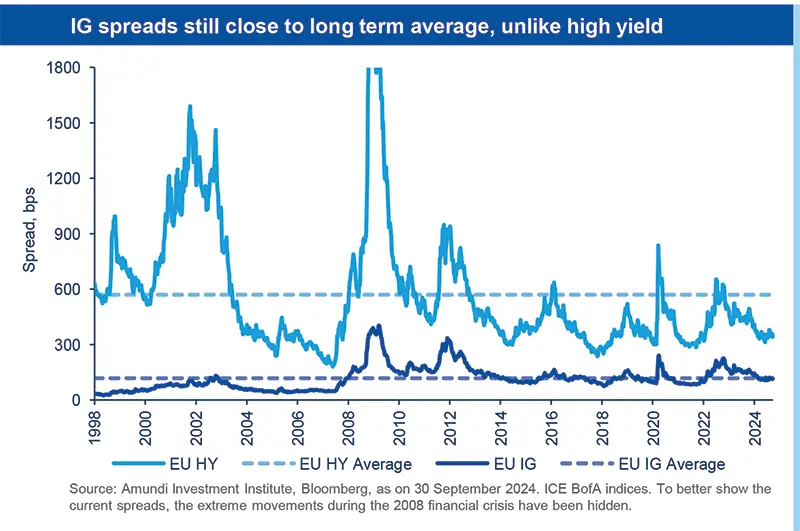

US elections have re-ignited the focus on fiscal deficits and debt not just domestically, but also in other parts of the developed world. Hence, while it is important to maintain a long-term focus on duration and how deficits could put upward pressure on bond yields, investors should not ignore the near-term market dynamics. On the monetary side, we are seeing a continuation of the rate cut cycle by the ECB, the BoE and the Fed, coupled with a no-recession scenario. This means there is value to be explored in credit but the case for differentiation is particularly strong as episodes of volatility could re-emerge. It is the quality businesses with robust fundamentals that would be better able to withstand potential market stress. Thus, balancing the need for carry with quality and liquidity is important across the US, Europe and EM.

- We are active on duration with divergences across countries, with a slightly positive view on Europe. We turned positive on the UK given receding inflation, but on Japan we are now cautious amid the BoJ’s indications of hiking rates sooner rather than later.

- Expectations of rate cuts and strong corporate fundamentals allow us to stay positive on credit through EU financials.

- We also like selective non-cyclicals segments.

- The long end of the US yield curve remains expensive owing to continued deficit spending, but the intermediate part looks attractive.

- The Fed may be able to engineer a smooth sailing outcome for the economy but we stay prepared, maintaining our quality bias in credit. In particular, we favour financials over non-financials.

- In securitised credit, agency MBS are attractive compared with other quality spread sectors.

- Declining US inflation and Fed cuts are positive for the asset class but wide divergences across EM, volatility around the Fed and potential tariffs discussions lead us to be selective.

- Notably, EM central banks have the flexibility to relax monetary policies.

- In local currency, we are exploring high carry debt for instance in Mexico which has been oversold. We like Brazil and Colombia in LatAm. In hard currency, we prefer HY.

EQUITIES

Participate and prioritize valuations

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

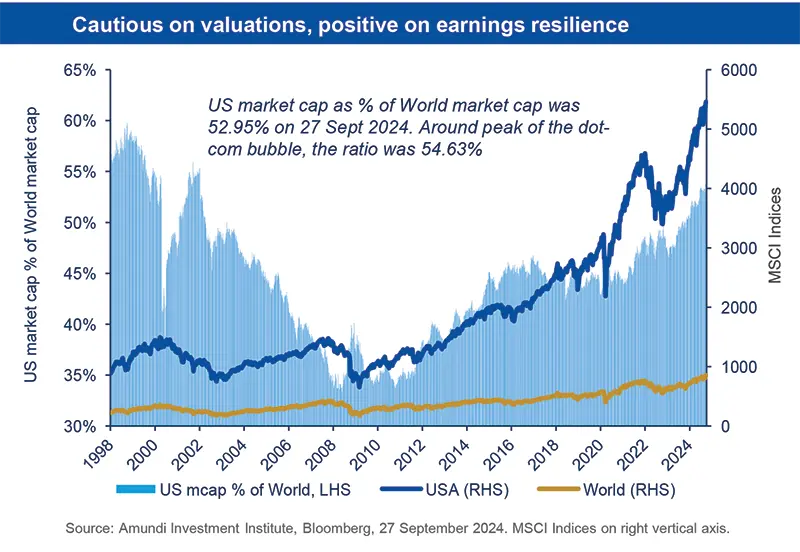

Weakening data coming from the US is consistent with a soft landing but any probability of a worsening environment is not priced in by the markets. With this slowing economy, it is difficult to see margin expansion and we believe earnings forecasts are likely to come down. On the other hand, some companies are generating strong cash flows and that has been supportive of share buybacks, which are supporting markets particularly in the US, and boosting positive sentiment. In the medium term, however, these high valuations do not form a strong basis of sustainable returns. As a result, we explore segments where earnings assumptions, pricing power and dividend prospects are robust but believe investors should be careful not to overpay. We see such businesses in Europe, Japan and EM.

- We aim to achieve an optimum balance between quality defensives and cyclicals. In defensives, we trimmed our view slightly through staples, but a pullback in health care is presenting ideas in specialised pharma names.

- We also selectively like quality banks with strong franchises, capital buffers.

- In addition, themes such as electrification, green transition, expansion of data center capacity present good opportunities.

- Weak nominal growth and high valuations is not a great combination for returns. Hence, we like to benefit from the rally but are tilted towards quality.

- Defensives outperformed cyclicals so far this quarter but this could change, underpinning our approach of identifying defensives with reasonable valuations. At the other end, we like quality materials, industrials and banks.

- We favour Value over Growth, and stay cautious on mega caps.

- China news has been overwhelming, and we stick to assessing how the stimulus could affect domestic consumption patterns, the real economy and other EM exporters such as Brazil, Mexico. For now, we stay neutral on China.

- Elsewhere, we are positive on financials in Indonesia, and on Brazil despite some concerns on fiscal environment in the country.

- At a sector level, we like real estate and consumer staples.

VIEWS

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.