Summary

A semblance of a goldilocks ahead of Trump’s inauguration

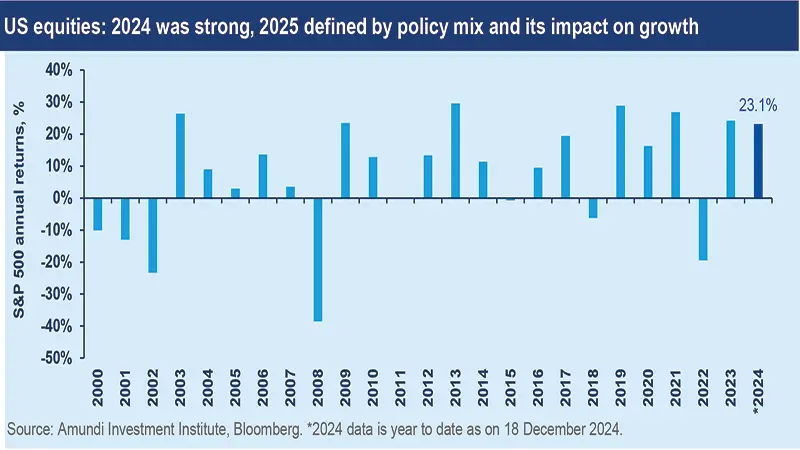

Markets have cheered any good news emerging in 2024 from the economy, corporate earnings and the political environment, although occasionally they were caught by surprise. Looking ahead, they will be driven by earnings momentum, a scenario of slowing US growth, and rebalancing labour markets but not drastically weakening. On the other hand, the Fed getting a bit more hawkish and Trump’s approach to trade along with the international response could create volatility. Outside the US, European growth and policy-making and China’s response to its domestic problems will drive the markets.

In particular, we see the following factors as key drivers of the global economy:

US growth resilient but still on a declining path and subject to uncertainty on Trump policies. Recent data are pointing towards better fundamentals in the economy, but the overall growth trajectory doesn’t change.

European growth struggling to stay on course. Governments’ attempts to impose fiscal consolidation (France, Germany) are clouding the growth outlook. In Germany, we could see a loosening of the debt brake, but it would only be gradual and the economic impact would be seen from 2026.

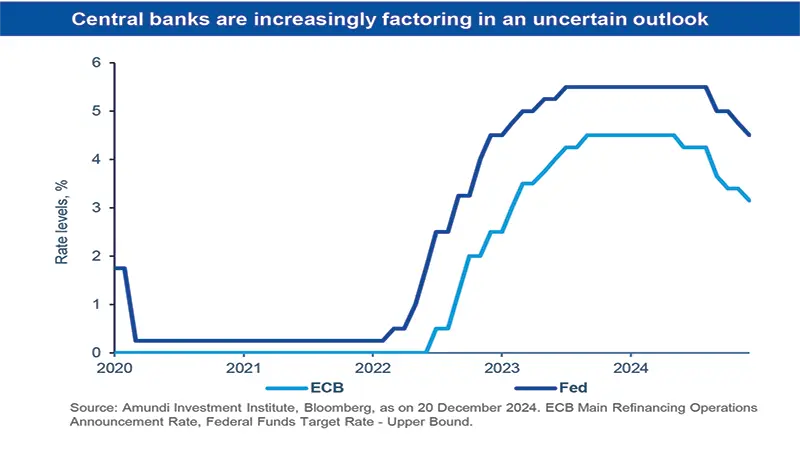

Uncertainty around the Fed, while the ECB is expected to be more dovish due to inflation falling faster. We have decreased ECB’s terminal rate expectations by 50bps to 1.75%, to be reached by July 2025. The Fed delivered a hawkish cut, meaning it has very close eyes on inflation.

Chinese announcements are big on intent. While the main points revolve around expanding the fiscal deficit and boosting domestic demand, we would like to see details about how the government intends to do it.

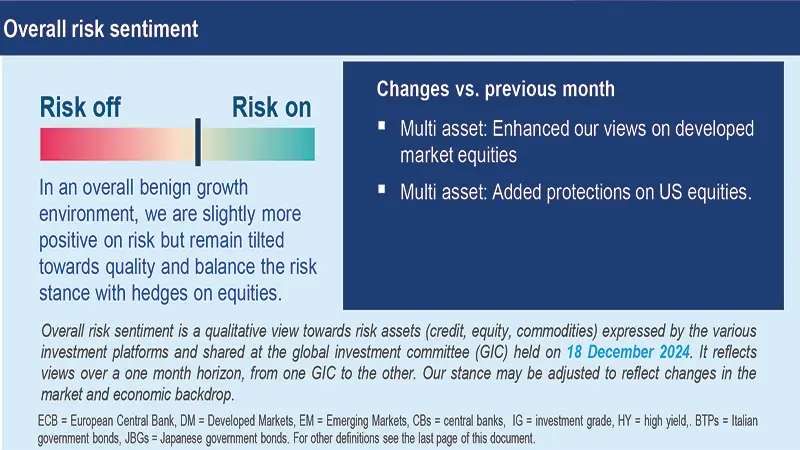

Given the risks that could impact market sentiment—from earnings revisions to weaker growth, stronger than expected inflation, and geopolitics—it’s important to balance the positive view in equities with sufficient hedges.

We think liquidity in markets is ample, credit conditions robust, and the profit environment reasonable. But the most important factors preventing us from significantly raising our risk stance are valuations and risks to earning revisions. We keep a mildly constructive view, outlined below:

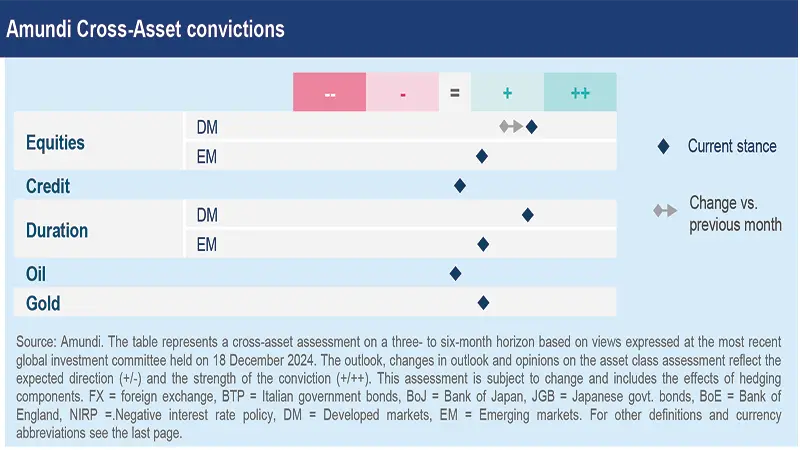

Cross-asset, modestly risk-on heading into 2025 with hedges in place. Economic growth in the US and Europe is reasonable, and inflation is slowing, painting a supportive backdrop for risky assets. We have strengthened our positive stance on US equities and turned constructive on Europe, while also maintaining a small positive view on the UK and Japan. We also continue to search for opportunities in emerging market (EM) bonds, in particular in the Czech Republic, South Africa, and Indonesia. To counterbalance this overall pro-risk allocation, we maintain a positive duration bias as a hedge against potential deterioration in the growth outlook. We have also added some equity hedges and keep gold as a diversifier.

Fixed income as an asset class will be increasingly affected by uncertainty around fiscal and monetary policies. As a result, we maintain a tactical approach to duration in the US and Europe, where we continue to look for opportunities on the expected steepening of the yield curves. In the UK, we are positive but are monitoring the recent strong inflation and wage growth data, while in Japan bonds, we remain cautious. In the credit market, we continue to favour investment grade, in particular in Europe, where valuations look more attractive. In contrast, we are cautious on US High Yield.

In equities, diversification is the name of the game, as concentration risk remains the top concern. In the US, we remain cautious on the mega caps and explore opportunities down in the capitalization spectrum in companies that could benefit from a resumption in industrial demand and economic growth but where the valuations do not yet reflect this. We also think the rally broadening towards more US value, cyclical stocks will benefit from an uptick in economic activity. In Europe, we favour banks that are less sensitive to rate changes and have strong capital buffers vs. those more sensitive to rate reductions.

Any dollar strength and rise in geopolitical risks will likely create volatility for EM, but their growth potential is strong and central banks are prudent. We aim to explore resilient bottom-up stories that are driven by domestic consumption themes in debt and equities.

Three hot questions

1| Have you revised your ECB expectations and why?

We have decreased ECB’s terminal rate expectations by 50bps to 1.75%, to be reached by July 2025. Our revision is based on: i) disinflation being quicker than anticipated by the ECB (headline CPI currently at 2.2% YoY against 2.6% expected by the ECB; core CPI currently at 2.7% against 2.9% expected); ii) much weaker-than-expected PMIs and slowing services sector; and iii) fiscal policy unlikely to add any stimulus in 2025. The main risk to our expectation is represented by full implementation of Trump’s tariffs policy. According to our estimates, tariffs of 10-20% should reduce growth by at least 0.2% on a full-year basis, with a muted short-term impact on inflation. Under such scenario, the ECB could cut rates below their neutral level.

Investment implications :

We revised our EURUSD forecast from 1.13 to 1.08 in Q2 2025 and from 1.16 to 1.11 in Q4 2025.

2| What is your take on the Fed’s December rate cut?

At its December meeting, the Fed cut rates by 25bp as expected, but the overall tone was hawkish. The Fed now expects inflation to hit target only in 2026 and mentioned that current policy rates are significantly closer to neutral than previously expected. Even though the Fed does not incorporate explicitly the possible policy changes under the new administration, the assessment of risks suggests they are incorporating the more uncertain outlook. Rates should stay high for longer, with the median expectation for Fed Funds in 2025 raised to 3.9% from 3.4% in September.

Investment implications :

- Given uncertainty on the new administration’s policy and its impact, flexibility will be key on exposure to the US Treasury curve.

3| How do you see the impact of possible US tariffs on different countries?

If implemented, US tariffs are likely to hit various countries in different ways. The Eurozone has a high reliance on export, which accounts for some 50% of GDP on average, but it varies across countries. China should be hit hard, and, to offset the likely impact of US tariffs, the recently held economic conference sets a pro-growth and pro-stimulus tone for 2025, with likely additional fiscal spending mostly to help domestic consumption. Details should be unveiled during the National People’s Congress in March.

Investment implications :

- We are close to neutral on Chinese equity, but given the fluid situation, this could change. On credit, we favour IG over HY.

China’s leadership should adopt a pragmatic approach to handle likely US tariffs, with a focus on increasing fiscal spending to support private consumption and address problems in the real estate sector.

MULTI-ASSET

Stay constructive with appropriate protections

| Francesco SANDRINI Head of Multi-Asset Strategies | John O'TOOLE Head of Multi-Asset Investment Solutions |

We remain mildly constructive on equities and prefer to play it through a quality tilt and by maintaining portfolio safeguards.

The 2025 global outlook is likely to remain benign amid a moderate US economic growth and a recovery in Europe. Falling inflation should support consumption in the region. However, monetary, fiscal and international trade policies could cloud the outlook. For instance, the Fed is now more likely to be cautious on cutting rates and vigilant on inflation. More clarity is also needed on Trump’s trade policies and the European response to them. Until then, we think investors should consider keeping safeguards and other sources of stability but at the same time aim to benefit from market sentiment, areas of attractive valuations and resilience in US economy.

We enhanced our views on DM equities by raising our stance on US and turning constructive on Europe. The former should be supported by economic strength and new government’s policies while being less vulnerable to weak global demand. Europe is appealing as a value play, and challenges from a worsening trade environment are heavily discounted. We remain positive on the UK and Japan and keep our constructive stance on China amid its attractive valuations. Recent economic conference affirms the policymakers’ stance in addressing the domestic problems.

In fixed income, we stay positive on US as a hedge against a possible worsening of the economic outlook. We are positive also in core-European and UK duration, along with a tilt towards Italian BTPs vs. German bunds. But we are slightly defensive on Japanese bonds. In EM bonds, we stay positive and became constructive on a basket of select countries’ debt that includes the Czech Republic, Indonesia and South Africa but believe appropriate hedges should be maintained. The risk premium of Czech vs core rates (US, Europe) appears attractive. We are monitoring any headwinds from the dollar. In credit, EU IG offers solid fundamentals.

In FX, we maintain our positive stance on USD vs. CHF and on JPY vs. CHF. The Swiss franc is among the most expensive currencies in G10. We also stay cautious on the EUR vs. JPN and NOK, amid a dovish ECB. Among cyclical currencies, we like AUD given its valuations and the potential to benefit from upside surprises in China. Finally, our positive views on the INR are also maintained.

A key pillar of our balanced stance is our view on gold and hedges (to US equities).

FIXED-INCOME

Ambiguous policy environment calls for agility on duration

| Amaury D'ORSAY Head of Fixed Income | Yerlan SYZDYKOV Global Head of Emerging Markets | Marco PIRONDINI CIO of US Investment Management |

Donald Trump’s fiscal and foreign trade policies would affect markets’ inflation expectations and yield volatility, particularly on the long end of the curve. This, in turn, is keeping the Fed vigilant on any risks to its own inflation objective. In Europe, EU’s countermeasures to US policies further complicate a situation of growth divergences (for instance, between Germany and Spain) within the region. Hence, we think the ECB’s task is not going to be easy as it will also be worried about growth. But the positive news is that inflation is likely to fall faster than the central bank had anticipated, and this should support real incomes. All this points to maintaining a flexible stance on duration. Beyond that, there are income opportunities to be explored from corporate credit of businesses in Europe, US and emerging markets.

- We stay tactical on duration overall, with a close to neutral view on core Europe and positive on the UK. In Japan, we are defensive but stay granular to identify maturities that offer value.

- EU IG, where we are slightly more positive, presents quality idiosyncratic opportunities, particularly among banks.

- We are neutral on HY and are mindful of liquidity risks. But areas such as B-rated debt offer a good balance of yield and quality.

- We stay tactical on duration with a preference for the intermediate part of the curve. TIPS are attractive also for long-term investors.

- In credit, we look for areas where credit spreads are wider or better compensate for liquidity risk. We favour high-quality and shorter maturity. We also prefer leveraged loans to high yield.

- Agency MBS should benefit from any potential easing of regulation.

- EM growth remains robust, but any dollar strength and potential tariffs on countries are a headwind.

- We stay selective on local currency debt, in favour of countries such as South Africa and in LatAm.

- Corporate credit valuations are reasonable, and we see opportunities in HY.

- We are vigilant on oil prices as any weakness there could pressurise exporters in the Middle East, and we could see some downgrades if prices fall.

Valuations chase profits in the long run

| Barry GLAVIN Head of Equity Platform | Yerlan SYZDYKOV Global Head of Emerging Markets | Marco PIRONDINI CIO of US Investment Management |

The pro-cyclical rally over the past few months in the US and Europe is an extension of a no-recession narrative. For markets, this is a positive scenario, provided corporate profits continue to meet expectations. However, this scenario could also lead to speculation and excesses in some corners, and when it happens, any disappointment on the earnings front could be brutal on valuations. In Europe, falling inflation could boost real incomes and eventually consumption. This is mildly constructive for European equities where most of the bad news seems already priced in. However, we try to balance that with a fundamentals-driven approach, which prioritises balance sheet strength, pricing power and profitability across US, Europe, Japan and emerging markets.

- Falling rates and subsiding inflation are supportive of European recovery, but valuations are discounting a weak economic scenario.

- In an overall barbell approach, we prefer staples and healthcare stocks with pricing power. We also like banks that show limited sensitivity to changes in interest rates.

- While we are cautious on tech and industrials, we see opportunities in industrial names linked with the longterm electrification theme.

- In a market with areas of extreme valuations, we focus on attractively priced stocks that may benefit from an increase in industrial demand and economic activity.

- We favour value, quality, and defensive beyond the traditional names.

- Sector-wise, we prefer materials and large banks that are structural winners and could benefit from favourable regulatory changes and lower taxes.

- We are constructive on EM equities, but we do see divergences.

- For instance, in China, the recent announcements clarified that the country has fiscal space, but whether it is willing to use this is a question. Some segments are attractively priced, but we stay neutral.

- Outside China, we are positive on Indonesia, Mexico, and Brazil, whereas we exercise caution on Taiwan and Saudi Arabia.

VIEWS

Amundi asset class views

Definitions & Abbreviations

Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.