Summary

A challenging rate-cut path for central banks

The economic backdrop appears more resilient than expected, but valuations are too stretched in some areas.

A fundamental approach, with a global focus is key at this stage of the cycle.

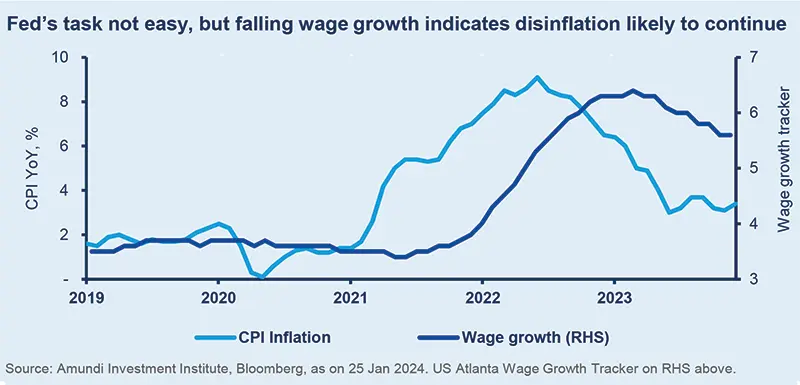

Markets are reassessing central bank (CB) policy paths amid slowing inflation and a potential economic slowdown but resilient historic data. The speed of disinflation, however, could be affected by tensions in the Red Sea, particularly for Europe. Thus, CBs job is getting difficult as they aim to maintain rates at a restrictive level for the right duration.

In terms of growth, we expect to see a prolonged slowdown in the US concentrated around mid-year. In Europe, we downgraded this year’s growth forecasts and we expect below-consensus inflation in China. These changes do not affect our views on economic activity:

- Weakening US labour markets. Wage growth is falling and most of the strength in payrolls was in non-cyclical sectors (government, etc). This could affect consumption, which is strong for now.

- No recession call for EZ but risks are high. Weak government expenditure and constraints (Germany, France) likely to weigh on the economy but personal consumption and wage growth are positives for the region. The latter is also important for ECB decision-making.

- Slowing eco. growth and disinflation risks in China. Fiscal bazooka appears unlikely as govt. tries to deleverage. But piecemeal efforts to lift sentiment won’t have a long lasting effect, given the fundamental problems in real estate and consumption pressures.

- Geopolitics/politics gaining prominence. Half of global population will elect their leaders this year. Relations between the US, China, EU, EM will be affected by the choice of leaders/domestic rhetoric.

The following areas remain in focus for us:

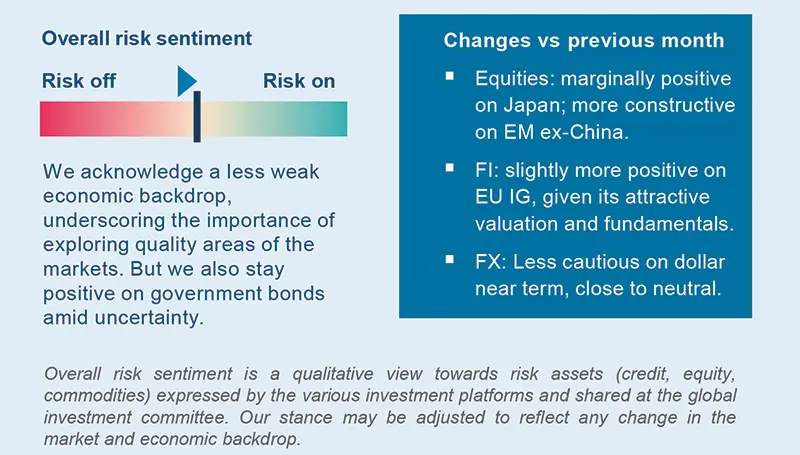

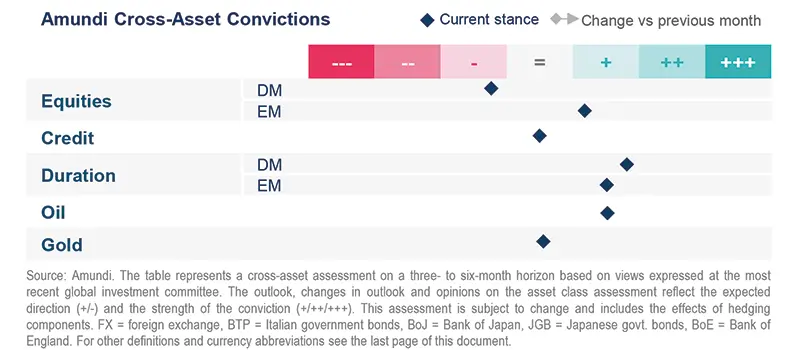

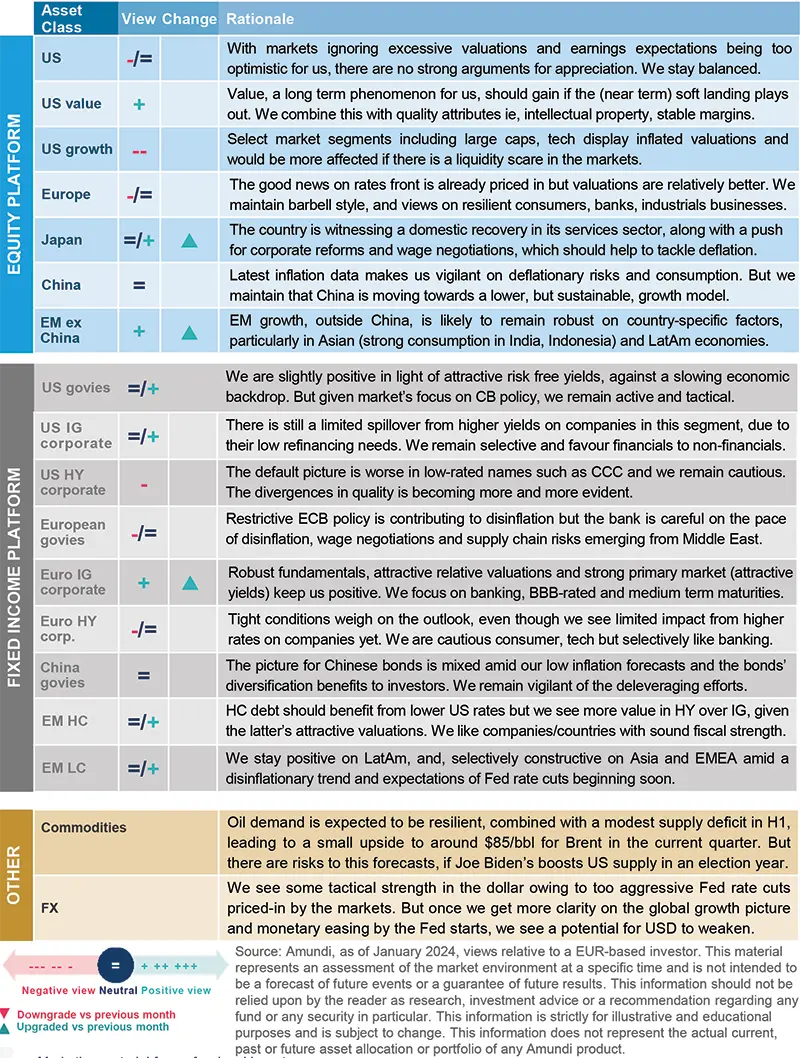

- Cross Asset. We are noticing a slowdown in the US but not a collapse in earnings. Earnings are likely to remain weak, leading us to stay vigilant overall. While we are defensive on DM equities, we are turning mildly positive on Japan. Even in EM, we stay constructive, but now mainly via Asia. We are also marginally optimistic on US and European duration as disinflation is underway but see a strong need to be active, particularly in Europe. We also think the region’s IG credit is attractive. In FX, we are less cautious on the USD vs JPY as markets have priced in excessive rate cuts already in dollar valuations. But the yen remains a good hedge for global growth risks and oil for geopolitical risks.

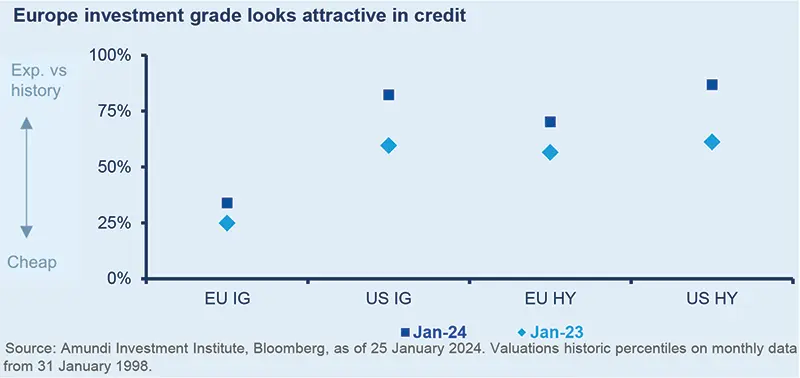

- In fixed income, we are slightly positive on US duration and mildly cautious on Europe and Japan. But given the market’s changing assessment of CB rate cuts, we stay flexible. In credit, we are slightly more constructive on quality EU IG (BBB-rated, banking) and believe investors may consider primary market opportunities. Likewise, US IG is preferred over HY, given the risks of defaults and high valuations. In addition, US securitised markets such as Agency MBS offer long term value but, overall, we are mindful of liquidity risks and rate volatility.

- Even as the broader US markets and Growth appear overvalued, we see segments (ie, US value) that offer attractive businesses and earnings growth prospects. Japan is also now showing signs of an ongoing recovery and a possibility of coming out of deflation that should be a positive. In Europe, where valuations are better vs. US, we stay balanced and like quality cyclical businesses and defensives.

- EM assets, particularly in Asia where more than half of the world lives, provide a strong backdrop for fixed income and equities. However, we are monitoring inflation and the fact that EMs are not homogenous: each of these countries in Latin America (Brazil, Mexico and Colombia), and in Asia (India and Indonesia) are unique. In bonds, we like HC and LC but favour HY over IG. We are also vigilant on geopolitical risks between the US-China and in the Middle East and this makes us somewhat cautious on the GCC region.

ECB= European Central Bank, DM= Developed Markets, EM = Emerging Markets, CBs = central banks, FI = Fixed Income, IG = investment grade, HY = high yield, HC = Hard Currency, LC = Local Currency. GCC = Gulf Cooperation Council. For other definitions see the last page of this document.

Three hot questions

|

Monica DEFEND |

The US consumer continues to spend, even if it is by using excessive debt, giving some support to the risk asset rally. But high valuations and economic uncertainty keep us vigilant.

1| What’s your take on the inflation and growth outlook in China after the recent weak inflation data?

We are not calling for outright deflation in China but downgraded our inflation forecasts to 0.2% and 0.4% for 2024 and 2025 respectively. Consumption in China is under stress. Households will be affected by pressures on wages and lower wealth effects because a large share of their assets is held in real estate (amid lower real estate prices). On the other hand, we see a faster transition of China to lower but more sustainable growth in the long term. However, if Beijing comes out with a large stimulus package (not our base case) in the form of social security spending or handouts and infrastructure, that may affect our weak growth scenario.

Investment consequences:

- Neutral on China govies and credit

2| How is your asset allocation stance evolving?

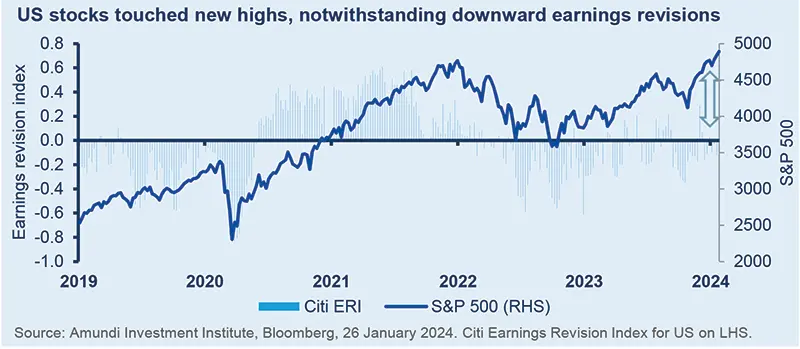

From a cross asset perspective, we remain vigilant overall, but we reduced our defensive view on global equities, to take into account a milder than previously expected US recession. On the earnings front, we do not see a profit recession this year, but earnings growth will still be muted. But valuations are elevated - it is difficult to see a large, rapid upside in equities.

Investment consequences:

- Equities: slightly cautious on global; positive on quality and high dividend in US and Europe; constructive on Japan.

-

Credit: positive IG, negative HY

3| How do you expect the economic environment to evolve in Europe this year?

We revised down our growth forecasts for the Euro area for this year (0.3%) and 2025 (1.0%), but do not forecast a recession in the region because labour markets are tight and household real income is likely to improve this year. On the other hand, weak industrial production, withdrawal of national level fiscal support and the quick transmission of tight monetary policy in the region are likely to weigh on demand.

Investment consequences:

- Slightly cautious on core European duration, neutral on peripheral debt.

- EUR/USD: Around 1.09 by Q2’24, but we could see marginal strength in the EUR in Q1.

Seek opportunities in Asia

|

Francesco SANDRINI |

John O'TOOLE |

We are close to neutral on our risk allocation, but believe it is time to explore regions/areas which diverge from the weak global growth narrative.

We acknowledge that the economic backdrop is a bit supportive – a milder than previously expected US slowdown should prevent a massive collapse in earnings and we do not see a profit recession in 2024. However, this doesn’t mean we agree with the market’s earnings expectations, which we think are too optimistic for the US as well as for Europe. Thus, while we remain vigilant on DM equities, we see some countries, for instance in Asia where backdrop is better. On the other hand, we maintain our positive views on government bonds, and also believe investors should remain well diversified through commodities.

High conviction ideas

Although we are cautious on US and European stocks, we became slightly positive on Japan. The country is witnessing an ongoing recovery in the services sector, corporate reforms and wage negotiations that would support the economy to come out of deflation. Even in EM, after the rally in Mexico, we shifted our views towards Asia through Indonesia and South Korea (semiconductor cycle) due to country-specific factors, while staying positive on India.

Disinflation in US and Europe is progressing as per our expectations. Thus, we stay positive on US and European duration but realise the need to be agile in both regions, given elections in the US that could affect fiscal prudence. We maintain our curve steepening views in US and Canada. On peripheral Italian BTPs, our constructive stance is maintained.

In Japan, however, we keep a negative view on JGBs which may suffer from a mildly positive economic outlook for Japan. This also acts as a diversifier of our overall duration stance.

EM bonds continue to show strong potential amid pivot indications from DM central banks that could result in lower rates in the US. Robust EM growth is also a positive, but we are vigilant over geopolitical risks and sanctions.

In credit, high grade European credit is a bright spot for us due to high quality and attractive relative valuations, which should benefit from monetary easing. However, we do not like US HY where valuations are tight.

In FX, Fed policy is key for USD movements and we believe the dollar will struggle once the Fed actually starts cutting rates. However, in the near term, it could strengthen, given that markets have already priced in excessive rate cuts, too fast. Thus, we reduced our positive stance on JPY vs the USD. The yen still remains a good hedge amid risks to global growth. In EM, we do not expect strong appreciation but maintain a relative preference for Latin America.

Risks & hedging

Geopolitical tensions in the Middle East and the recent news flow around the Red Sea underscore the need to hedge risks on this front through oil. Oil prices lagged the recent rally in other cyclical commodities, leaving room for some additional boost.

Use quality to navigate rate cuts and a slowdown

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

A slowing economy and policy cuts, could provide compelling entry points in credit, particularly in Europe.

Overall assessment

The strength in the US economy, so far, keeps us confident that the Fed will not begin policy cuts before May-end, and the ECB would also remain vigilant on disinflation. Sluggish growth expectations going forward mean the emphasis on quality credit and valuations, for instance in Europe, will increase.

Global & European fixed income

Growth concerns in Europe persist as forward-looking indicators are coming in weak. But on inflation there are risks from the Middle East as shipping costs (goods) from Asia to Europe increase. We are monitoring these risks and for how long they last and stay a bit defensive on duration tactically, although we are agile in adjusting this stance. Corporate credit presents opportunities but in HY risk/reward is sub-optimal, leading us to be defensive on this segment, particularly low-rated areas such as B- and CCs. However, on IG where valuations are decent from a historical perspective, we prefer BBB which are a sweet spot of quality and return. We also like medium-term maturities and the banking sector. In addition, investors may consider the primary market for attractive high-quality names, as was the case in January.

US fixed income

We maintain our view on Fed rate cuts but this relies on inflation coming down and economic activity slowing. Thus, we stay mildly constructive and recognise the need to be active in an election year with any potential fiscal push (not our main scenario). Importantly, if the economy stays strong, rates are unlikely to come down significantly. At the same time, we focus on agency MBS which offers an additional income and its valuations are also fair relative to history. Another segment where we see value is IG, where we favour financials over non-financials but believe investors need to be selective with issuer exposures. There are also opportunities in new issues, provided there is enough compensation for taking on liquidity and credit risks. However, we are mindful of rate volatility in HY and assessing how cyclical sectors could be affected as the economy slows.

EM bonds

We keep a positive stance on EM debt. But geopolitical risks in the Middle East and Ukraine, along with US inflation surprise and idiosyncratic risks, could create surprises. For instance, we believe China stimulus is unlikely to be a game-changer in the long term and the unconventional monetary policy in Turkey cannot be sustained. We like EM HC and corporate debt but favour HY over IG, given better valuations. In LC, we favour LatAm, and are selective in Asia.

FX

USD could see some near-term strength amid geopolitical risks and market movements, making us slightly positive. In EM, we are positive on LatAm FX and INR but are vigilant on MXN, given upcoming elections that could cause volatility.

Prioritise fundamentals and pricing power

| Andreas WOSOL Head of Value |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Investors should not ignore the valuations and earnings inconsistency, particularly when the margin for disappointment is small.

Overall assessment

Markets are trying to second-guess the timing of rate cuts and resilience of economic activity. We think Europe will see sluggish growth and a mild contraction in activity in the US will affect earnings – even though we don’t see an earnings recession, we think market expectations are high. Thus, we prioritise fundamentals, and explore strong businesses in Japan, US value. In EM, the outlook in select Asian countries (India, Indonesia) and Latin America is robust.

European equities

The rally is likely to be affected by the evolution of economic activity and ECB communications. In addition, the current earnings season may provide opportunities, particularly in the consumer sectors. But we do not expect strong guidance from companies because of the macro economic uncertainty and geopolitical risks. Overall, we stay balanced (quality cyclicals, defensive) and like quality businesses with strong pricing power, brands and cash-rich balance sheets. In defensives, we are slightly more positive on healthcare but mildly reduced our stance on industrials after the strong price movements in the transport sector. Nonetheless, industrials and banks (dividends and earnings growth) remain our main convictions. In contrast, we have been cautious on discretionary for some time because of concerns of eroding pricing power in areas such as sporting goods.

US equities

The market is displaying acute anomalies relative to the historical norm, with high valuation dispersion between growth and value and an extraordinary concentration in the largest securities. These anomalies tend to normalize over long term to the detriment of high valuations and mega caps. Furthermore, we see signs of slowdown in consumer and industrial companies. In particular, low-end consumers are vulnerable as they have mostly spent the extra savings accumulated during Covid and are now increasing their debt. In this environment, we maintain our end-of-cycle stance with the expectation that the economy will continue to weaken. We like financials but prefer business models that are well capitalized and less exposed to commercial real estate. The healthcare sector is another area that offers reasonably valued opportunities that are not dependent on the economy. Overall, we focus on quality and valuation in companies with sustainable business models.

EM equities

In an overall constructive environment for EM, we are turning more positive on EM-ex China. Incremental Chinese stimulus is positive for the near term, but is unlikely to change the economic growth trajectory or problems in the country’s housing sector. Our main convictions are in Brazil, Mexico and India, UAE. Sector-wise, we like real estate, and financials in India and Indonesia due to structural trends and attractive valuations. However, we are defensive on Malaysia, Saudi Arabia and are turning less positive on consumer discretionary in China.

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.