Summary

Play market rotations, with a focus on China

Markets are shifting focus away from inflation towards growth, with a slightly less disruptive economic picture for Europe and a more optimistic view on China. This is creating strong rotations: outperformances for China and EM were the most visible trends, followed by the big reversal in the dollar’s strength. Intra-market rotations also materialised, with cyclical stocks favoured over defensive names in Europe while in the US, expectations of a less aggressive Fed supported tech stocks. Going forward, four themes should be crucial: (1) inflation/growth balance; (2) central bank (CB) actions; (3) dollar weakening; and (4) the corporate earnings trajectory. Any negative growth and earnings surprise could drive markets lower while there are no short-term triggers for upside at current valuation levels. This calls for a defensive allocation, but investors should play rotations as follows:

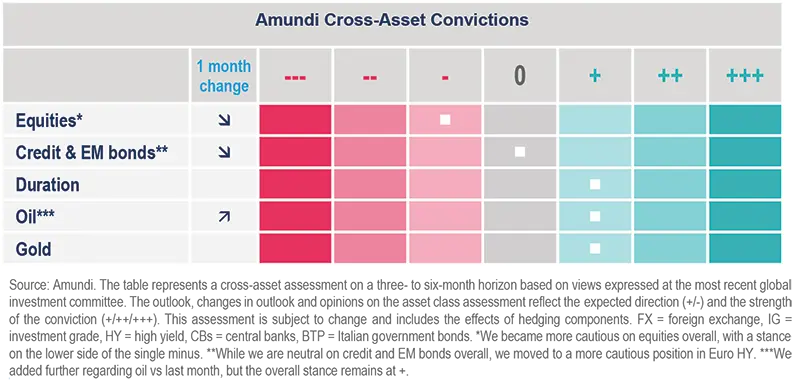

- Maintain a cautious risk stance, but recalibrate regional preferences. We are now more constructive on Chinese equities than on DM, regarding which we are cautious and more in line with market capitalisation (reducing negative stance on Europe equity). From a cross-asset perspective, we are slightly positive on duration as we believe government bonds are maintaining their portfolio protection advantages. We are becoming more cautious in high yield credit while we also keep a focus on diversification through commodities such as oil and gold.

- In FI, active duration management is key. Inflation and policy rate expectations are manifesting the fastest in bond yields, which have seen a downward move, supporting our slight positive view on US duration and a marginally cautious stance in core Europe. While near-term concerns on growth should be constructive, we do not recommend taking this for granted because inflation is still high. CBs are determined to address inflation, particularly the sticky services inflation, and this warrants an active stance. On the other hand, the BoJ is likely to exit its negative rates policy following an upward revision to its 2023 inflation forecasts, making us now cautious on Japanese government bonds.

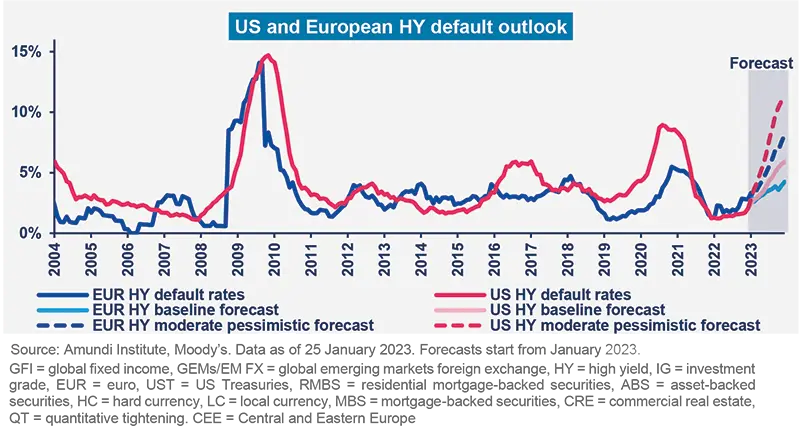

- In the “bonds are back” mantra, play credit with a selective approach. The effect of monetary tightening on corporate credit has been limited so far because of limited refinancing needs and the high use of internal cash. While the latter has supported spreads so far, it has also caused a deterioration in liquidity compared with a year ago, especially for CCC-rated issuers. Looking ahead, the effect of rising rates and low economic growth will be felt more by low-rated HY issuers. As a result, we continue to prefer IG over HY. From a regional perspective, European IG spreads are cheaper vs historical levels, whereas this is not true for US IG.

- For DM equities, investors should focus more on earnings resilience at the single-company level. The revisions on the macroeconomic front and the currency dynamics call for a more cautious stance in the US and Japan while improvements in the European economic outlook support a less negative view on the region. However, the positive scenario factored in by markets could easily turn sour due to geopolitical risks or more-hawkish-than-expected CBs. It’s also worth noting that often the beginning of the year does not prove a good indication of returns for the rest of the year. The current earnings season should present a clearer picture for H1.

- Opportunities in EM, beginning with China. China continued its fast-track economic reopening and is supporting its housing market, leading us to stay constructive as we have also upgraded our growth outlook for the country. This could have a positive trickle-down effect on countries with strong trade ties to China. On EM debt, the USD trend, the EM-DM economic growth differential, and valuations are among the key drivers of sentiment.

Overall, we are entering a riskier phase as markets reassess the earnings outlook which could cause some areas of the market to correct while some opportunities to add risk could emerge in the next few weeks. Importantly, we could see an earnings recession even in a ‘soft landing’ economic scenario. Hence, agility is key at this stage, but with a cautious tilt for now.

What if the ECB turns more hawkish than expected?

|

Monica DEFEND |

Annalisa USARDI CFA, Senior Economist Amundi Institute |

The inflation outlook for the Eurozone in 2023 is more linked to the dynamics in energy and supply chain bottlenecks, than monetary policy.

Current economic assessment

Recently, we slightly upgraded our economic outlook for the Eurozone (EZ), taking stock of the data portraying better-than-expected activity in the winter so far. Recent developments in the gas market and storage levels helped remove the tail risk of energy rationing. Lower energy prices, effective national fiscal support, and news of a faster-than-expected reopening in China also improved sentiment. Looking ahead, even if the winter economic downturn is likely to prove more shallow than feared, we think headwinds for the EZ economy persist. In particular, tighter monetary conditions would be passed on to the real economy and keep economic growth subdued throughout 2023.

Simulation of a hawkish ECB: if the ECB hikes policy rates to 4% and beyond

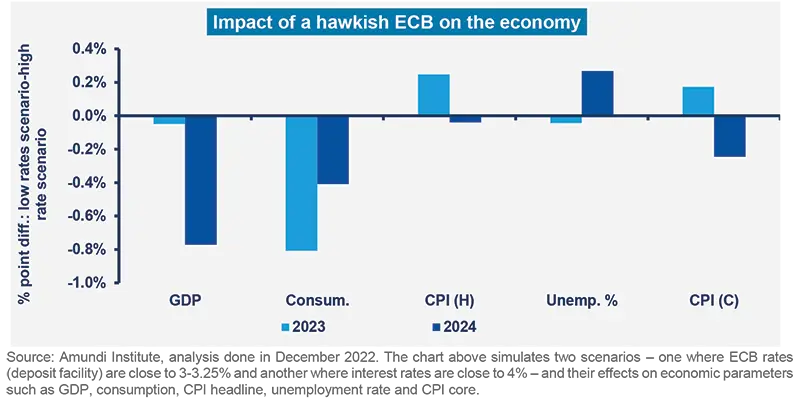

While headline inflation gave signs of moderation in the EZ and globally, underlying inflation remains sticky and on an upward trend, showing that the supply shocks that hit the economy earlier have not yet been fully eliminated. This supports a hawkish approach by the ECB, in our opinion, with some upside risks at this stage. Wary of this, we simulated the implications of higher interest rates and the ECB’s tighter policy for longer on inflation and economic growth.

Key assumption is that both growth and inflation prove more resilient than expected

For the ECB to stick to a deposit rate of 4% or higher, we assumed economic conditions in H1 2023 would point towards more resilience, in both growth and inflation, than is expected in the baseline scenario for Q4 2022 and Q1 2023 (where we assume only a mild contraction). At the same time, we assume that labour compensation continues to strengthen during H1, not only due to negotiated wages but also due to a pickup in wage growth in new open positions. This may be the result of a persistently tight labour market, which could raise concerns of second-round effects and inflation persistence among policy makers.

Sticky core inflation is leading the ECB to tighten policy aggressively and thus markets react. Dispersion of the cost of borrowing for non-financial corporates across Eurozone countries widens significantly and fragmentation risks mount. As a caveat, the scenario on commodities, oil, gas, global growth and government spending remains unchanged vs the baseline.

Implications for the economy

In this context, our simulations point to prolonged weakness from H2 2023, when we anticipate a severe contraction, followed by uncertain developments entering 2024. Overall, this translates to much weaker growth, especially in 2024. We believe this will be a result of a combination of the effects of monetary policy tightening, withdrawal of fiscal support, and persistent cost of living stress, given that underlying inflation, while moderating from the current highs, remains rather sticky notwithstanding the downturn. Briefly, such a development would resemble what could be interpreted as a “policy mistake”: although tighter policy negatively affects GDP, employment, income and investments, it doesn’t lead to significant progress in controlling inflation (as targeted by the ECB) over the forecast horizon.

From another angle, it equates to acknowledgement that much of the progress on the inflation front this year would not depend prominently on monetary policy, given that the nature of the shocks (supply side, i.e., bottlenecks, energy) that generated the inflation surge in the first place still have to be fully absorbed and passed through. However, we are monitoring key triggers and risks: wage growth dynamics and moves towards wage indexation; stickiness and breadth of core inflation; supply-side bottlenecks easing; cost of energy and food.

Benefit from divergences, but stay defensive

|

Francesco SANDRINI |

John O'TOOLE |

Our concerns around a profit recession in the US in H1 lead us to be cautious and strengthen our diversification.

We confirm our economic deceleration scenario but acknowledge the evolving backdrops around global earnings, inflation and monetary policy. However, we notice the divergences made possible by the evolving Covid policies and strengths of individual regions such as China. On the markets front, sentiment has improved of late, but this was mainly the result of the dollar weakening and a change in the pace of interest rate hikes by central banks. There is no indication of improving fundamentals at a global level yet. As a result, we stay cautious on risk assets and recommend investors consider benefitting from market rotations. This is also a time to enhance portfolio diversification through commodities such as oil.

High conviction ideas

We turned more cautious on DM equities overall mainly through the US and Japan. In the former, the earnings season should lead to lower guidance on margins and profits. We also adjusted our views on Europe to become less defensive, owing to our preference for maintaining a more consistent regional stance in line with our risk views. We are assessing how European earnings and valuations evolve vs the US. For the time being, we favour the US over the EZ due to higher risk of stagflationary shocks, and in US, we prefer small over large caps. In EM, we upgraded China due to the country abandoning its zero Covid policy and expectations around investor flows.

We keep a slightly constructive stance on duration through 10Y USTs. They should benefit from the Fed’s slowdown in the pace of rate hikes, lower inflation, and a weak economic outlook. Valuations also look attractive. Elsewhere, we are now defensive on Japanese government bonds. We think the BoJ is likely to relinquish its yield curve control (pushing yields higher) in H1 to control high inflation. In Canada, our view on 2-10Y swap curve steepening is maintained. The curve is one of the most inverted in this maturity segment and has the strongest bull steepening potential. Closer to home in Europe, we stay positive on 10Y BTP-Bund spreads, which have been resilient. Foreign investor flows are now less of a driver of Italian BTP markets than they were in the past.

Risks in credit markets persist and we expect economic growth to slow. We think valuations in US IG are close to fair value and we are neutral for now. In Europe, the HY outlook has deteriorated and we are now more cautious than before. The rally has gone too far and prices are not in line with our earnings and economic growth expectations.

In FX, we maintain our cautious stance on EUR/JPY as the yen should benefit from its safe- haven status and the BoJ’s policy stance. We are also defensive on the GBP vs the USD and CHF. The UK’s weak relative economic growth is a headwind for the cyclical pound. In addition, the NOK should continue to do well vs the CAD (cyclical FX). In EM, the BRL/USD is likely to benefit from positive domestic macro developments, China’s re-opening, and a less aggressive Fed, but we are monitoring the evolution of domestic politics.

Risks and hedging

Investors should consider a more diversified stance through oil, which should benefit from structural imbalances and is also a safeguard against risks from a potential geopolitical crisis involving Iran (vs US, Saudi Arabia, Israel). Similarly, gold offers diversification and protection in times of stress arising from a deeper-than expected-recession. Further, we think financial hedges in the equity and HY credit spaces must be maintained in order to protect against a potential weakening of fundamentals in Q1.

Credit in focus, but quality at the forefront

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

In the “bonds are back” market theme, play IG credit while staying cautious in HY.

Central banks are concerned about inflation, along with the risk of losing their credibility. As a result, they are hesitant to move to a dovish pivot yet. Markets, on the other hand, are worried about the impact of higher rates on end-consumption, which in turn could affect corporate profitability and cash flows. While companies spruced up their balance sheets after the Covid-19 crisis, they now face a host of challenges: higher funding costs, energy prices, and in some cases higher labour costs (US). We think the investment grade space is well positioned, as fundamentals have improved in recent years, while high yield is at risk, as the default outlook could deteriorate in the near future. Thus, with an overall vigilant approach, we stay selective, maintaining a preference for IG over HY. There are also select opportunities in EM debt amid a weakening dollar.

Global and European fixed income

We keep our marginally cautious stance on duration (core Europe and Japan, neutral US) but are vigilant regarding inflation, monetary policy, and yield movement dynamics to adjust this. On peripheral debt, while our stance is close to neutral, we are assessing yield curves across different regions to identify any discrepancies. The level of economic activity across the developed world has surprised to the upside, and that is positive for corporate credit. However, questions remain as to what extent the situation will improve, leading us to monitor credit quality and defaults. Hence, we are selective and keep a slightly constructive stance and a preference for IG over HY. We also believe valuations in EU IG are attractive, but follow a rigorous selection process based on idiosyncratic risks. In particular, we like subordinated financials and government-guaranteed debt.

US fixed income

US core inflation has been stickier than headline, and wage growth is also above the levels consistent with the Fed’s target for long-term inflation. Hence, policy actions and a ‘pause,’ if any, will be determined by the evolution of labour markets and services inflation. This leads us to actively manage our duration stance, with a positive bias currently. Although agency mortgages offer attractive long-term value vs government bonds, we are monitoring how shifting valuations and QT impact returns. For now, we remain careful, as spreads are tied to interest rate volatility. In corporate credit, we are very selective and believe investors should limit their spread duration. Specifically, we favour IG over HY and financials over industrials. Having said that, liquidity remains an important factor for us, but issuer fundamentals are robust, at least for now.

EM bonds

While we remain marginally defensive on duration, we keep a cautiously optimistic outlook. EM offers attractive carry after last year’s surge in global yields. HC bonds offer compelling entry points. In particular, we like Brazil and South Africa (commodity exporters). LC bonds and FX should benefit from a potential peak in the USD, as we explore upside potential in select CEE countries.

FX

We are now neutral on the USD on concerns of a potential reversal in capital flows, but on JPY and NOK, we stay constructive. A weaker USD could promote a positive environment for select LatAm FX, where we are positive on MXN and BRL. In Asia, we like IDR and THB, but are defensive on the TWD, PHP and certain Eastern European FX.

Excessive optimism priced in after the rally

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Notwithstanding the weak earnings growth estimates, we could still be surprised on the downside.

Overall assessment

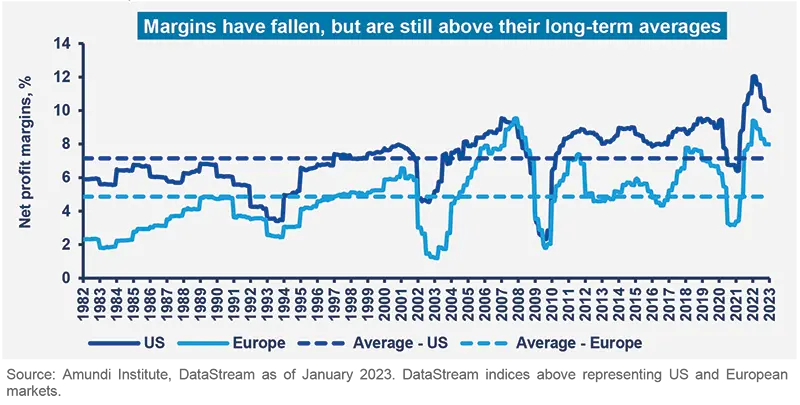

The double whammy of declining household purchasing power and slowing economic activity is creating pressures on earnings and margins. The downward trend is likely to continue for some time, but is already priced into many companies’ valuations. This has led to volatility and return dispersion, making it a stock picker’s market. Thus, our focus remains on valuations and on identifying companies with the ability to defend earnings and those with low debt. These are more likely to withstand higher borrowing costs and avoid any need to raise equity. Overall, we stay vigilant on corporate margins, with a preference for value, quality, high-dividend names.

European equities

We keep a balanced approach, combining a preference for high quality and value stocks. In particular, we like cyclicals (industrials), but are not tempted to upgrade after the recent rally. However, the problem of underinvestment in energy supply persists, leading us to explore the sector. In financials, interest margins and earnings should be boosted by higher rates. We prefer retail banks given their robust balance sheets and valuations. At the other end, select defensive names look cheap. We focus not only on a company’s quality of earnings, but also evaluate how our portfolios can maintain a diversified exposure to end-consumer markets. In staples, we prefer businesses whose pricing power ensures that rising input costs can be passed on to customers without affecting sales. Many of these businesses’ balance sheets provide a shield in times of rising rates. Conversely, we are cautious on utilities, tech.

US equities

Current earnings guidance does not fully reflect the upcoming economic slowdown, even as we see huge valuation anomalies in the market. This, along with the likely negative effects of the rising USD last year on Q1 and Q2 corporate earnings, and with profit margins at record levels, leads us to be very selective and cautious on mega-cap names. On the other hand, we are debating about the timing and which sectors would do well (beyond energy and banks) after the environment eventually improves. Being either too early or too late could hamper returns. As a result, we remain active and are moving only gradually by exploring businesses that could deliver earnings growth in a slowdown. We like banks, but credit risk remains a key parameter for us. From a style perspective, we like quality and value, but note that cyclical names are becoming less attractive after recent rallies. We avoid unprofitable growth and distressed value, and believe the staples, utilities and real estate sectors are not attractive.

EM equities

The asset class is supported by an earlier-than-expected China reopening, plus attractive valuations and earnings expectations. However, we are selective in light of geopolitical tensions (Ukraine war, China/Taiwan) and the subdued growth outlook in certain cases. We are becoming constructive on China, playing the Covid policy-induced rebound, and maintain our constructive view on Brazil. At a sector level, we are positive on consumer discretionary and real estate. We also prefer energy over materials, but remain cautious on healthcare and tech semiconductor names.

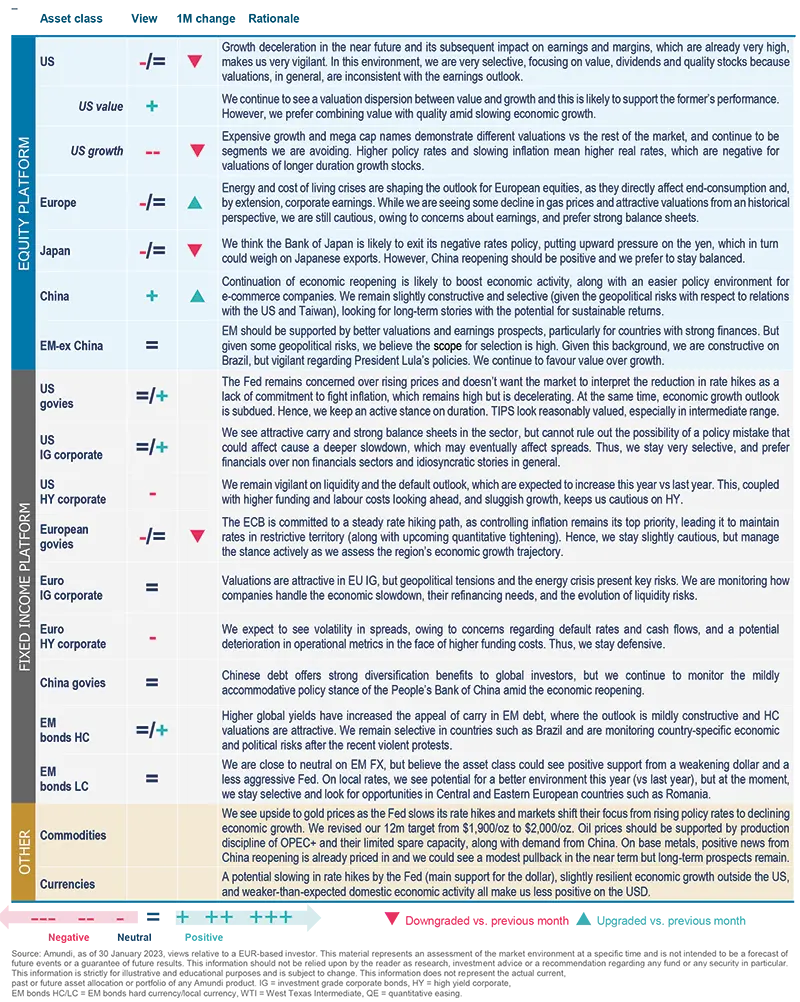

Amundi asset class views

Definitions & Abbreviations

- ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile.

- Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

- High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

- Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

- P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target. This approach is dramatically different from any central bank’s typical way of managing a country’s economic growth and inflation, which is by setting a key short-term interest rate.