Summary

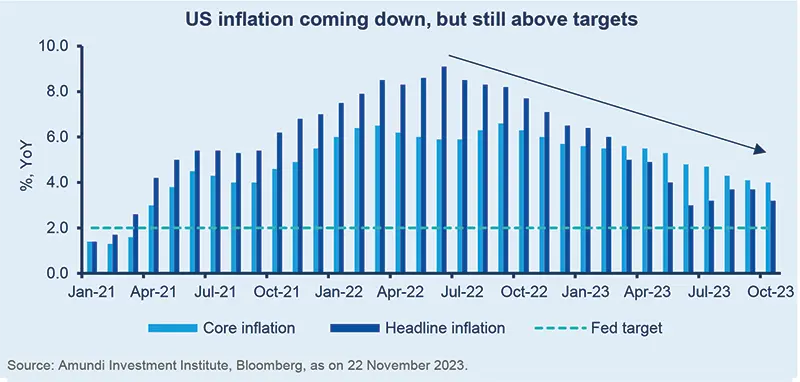

Receding inflation good news but inflation fight not over

The ‘perfect’ scenario priced in by the markets seems a bit excessive. Investors should stay defensive, with a slightly positive stance on duration, a cautious view on equities, and explore long-term value in EM.

November saw a recovery in risk assets on the back of continuing disinflation and indications that the Fed is close to peak rates, leading US and European yields to retreat. The big questions now are: how long until the victory on inflation is declared? and how will growth evolve? We think the following factors help with addressing these points:

- Subdued US economic outlook. We slightly upgraded our 2023 forecast for US growth to 2.4%, but we still expect a mild recession in 1H24, given that financial conditions in the real economy are tight.

- Euro Area likely to see sluggish growth without a recession, but the growth starting point is lower vs the US. Limited fiscal capacities ⎼ ie, in Germany ⎼ and EU fiscal rules add to the uncertainty.

- Central banks actions to be guided by data. Borrowing costs in the economy and strength of labour markets matter more to CBs. The Fed and ECB will monitor how these factors affect end-consumption and inflation (falling oil prices positive for this).

- Companies becoming cautious. Surveys indicate caution on companies’ employment and capex plans. This is evident in Q3 US GDP growth (decline in non-residential investment). The latest corporate results also highlight weak consumer demand.

- A multi-polar world, with continued US-China rivalry. A managed decline in US-China relations is likely, irrespective of who wins US elections next year. Secondly, the Israel-Hamas war should stay localised. Overall geopolitical risks could be high.

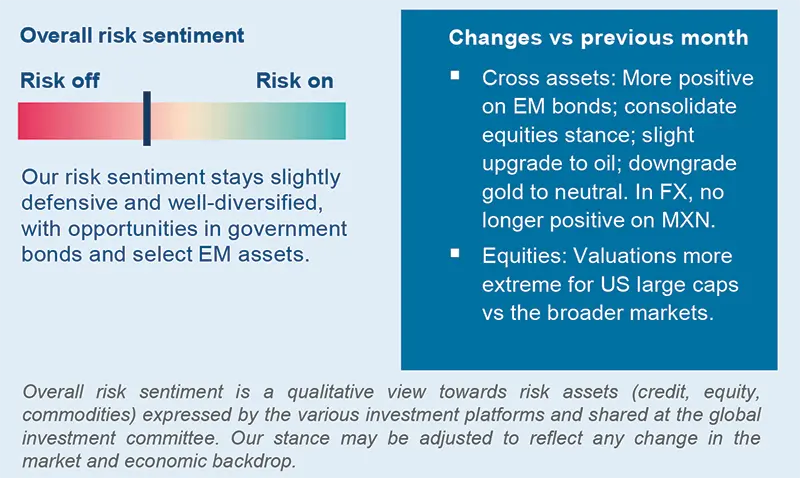

We believe in maintaining a cautious stance through the following pillars:

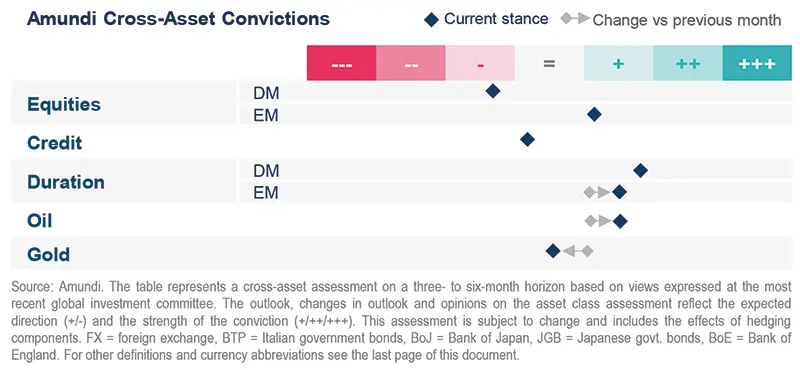

- Cross asset. We aim to balance our long-term convictions (for example, positive on duration) with tactical opportunities across asset classes and strengthening of hedges. Hence, we keep a cautious stance on DM equities, but we acknowledge potential for a marginal upside. In EM, rising country divergences lead us to be more selective now, focusing on long-term growth prospects in India, Mexico and Brazil. In our view, EM bonds, both HC and LC, now offer better value. As geopolitical risks will likely persist into 2024, we raised our stance on oil, but we moved to neutral on gold. In FX, after the recent appreciation, we see limited upside for the MXN vs the EUR tactically, but we keep our positive long-term growth outlook on Latin America.

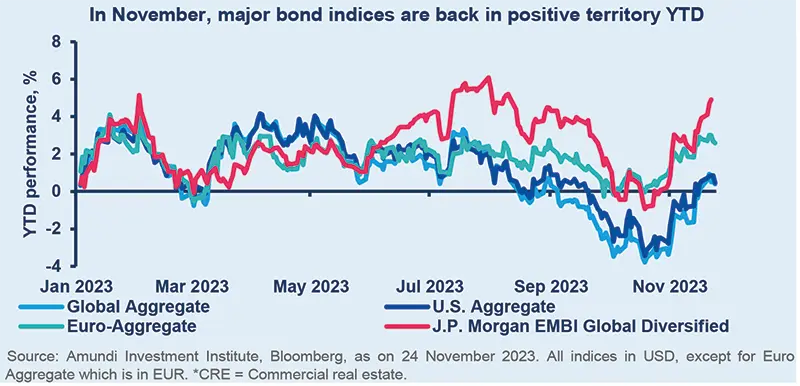

- The slide lower in yields confirms our views that there is lot of value to be exploited in government bonds. We stay positive on US duration, but are neutral on Europe and cautious on Japan, with an active stance overall. Corporate credit is becoming a sphere where we see increasing divergences, with the default environment deteriorating in low-rated segments, such as CCC. But balance sheets of IG businesses look stable. Thus, we favour a quality tilt. Regionally, we prefer EU IG and think US HY is very expensive.

- The recent recovery doesn’t alter our cautious stance on DM equities. However, if expensive segments ⎼ eg, US growth, large caps ⎼ are excluded, the valuation of the broader US markets looks less extreme. In addition, we are positive on attractively priced areas, such as value, quality in the US, as well as in Europe. The current earnings season confirms this view, wherein many companies missed their sales forecasts, in both the US and Europe. This indicates that consumption pressures are getting more broad-based.

- The disinflationary trends in DM and their subsequent impacts on CB policy would act as a tailwind to EM assets. HC and LC debt offer good carry, but we are monitoring any potential strength in the USD. In HC and corporate debt, we prefer HY over IG, although in the former, we remain biased towards quality. Equities also offer opportunities, particularly Asian equities, beyond China. We continue to like India, Indonesia and Brazil amid prospects for strong growth.

Three hot questions

|

Monica DEFEND |

Economic indicators for the EZ, along with tightening lending standards, point to a weakening of economic activity, complicated by fiscal constraints. But inflation appears to be falling to the ECB’s target by end-2024.

1| How do you see the fiscal situation evolving in Germany after the constitutional court ruling?

The court’s ruling questions the fiscal spending plans of the EZ’s largest economy. While for now the government has suspended ‘debt brakes’ by declaring 2023 to be an emergency year, in the long term, there is no easy fix. We think the coalition faces a difficult choice of reducing planned spending, raising taxes or revisiting the debt brake rule altogether. Separately, the EC* published fiscal policy guidance on the budgetary plans of member states. Nine countries would run deficits above 3% of GDP next year. But for now, the EC will monitor the situation until next spring.

Investment consequences:

- Fixed income: neutral core Europe duration, peripheral debt.

- Equities: slightly cautious Europe; marginally positive on quality, value.

2| Do you think the latest mini-stimulus in China could affect the country’s economic growth profile?

The stimulus involves issuance of additional sovereign debt to be spent on infrastructure and construction. There would, of course, be some boost to growth, which led us to upgrade our forecasts slightly: to 5.2% and 3.9% for 2023 and 2024, respectively. But it won’t completely offset lower demand and deleveraging in the real estate sector. If the government wants to achieve higher growth for next year, the country needs a bigger, expansionary policy, which seems unlikely at this stage. This is because of a structural shift towards debt discipline in the long term.

Investment consequences:

- China: neutral equities and bonds.

- EM Asia (excluding China): marginally positive.

3| How do you see the outlook for corporate credit in an environment of slowing growth?

In an environment of pressures on cash flows and earnings, and high interest costs, companies with higher refinancing needs and low profitability would be more affected, but this is not a concern in IG. For instance, defaults in global HY have risen, led primarily by CCC-rated names. Corporate fundamentals, such as interest coverage, are deteriorating, but they remain healthy for high-rated names.

Investment consequences:

- Cautious US HY, slightly positive IG.

- Regionally, favour EU IG.

Focus on duration and EM divergences

|

Francesco SANDRINI |

John O'TOOLE |

We see better prospects in EM bonds and believe in maintaining a well-diversified stance that could safeguard portfolios from any increase in geopolitical tensions.

The evolution of DM and EM economies, progress on inflation, and risks related to consumption and geopolitics drive our stance. We are cautious on risk assets, owing to some of the aforementioned points. Despite that, we do not rule out the potential for a tactical rally in select corners but believe these should not drive investors’ convictions. Instead, they should stay balanced, favouring duration and exploring opportunities in EM assets to benefit from strong growth prospects. At the same time, geopolitical risks highlight the need to stay well-diversified.

High conviction ideas

We are cautious on US and European equities but stay positive on EM. However, we think this is a time to consolidate EM views, given the increasing divergences. For instance, we are seeing signs of a slowdown in China, but see strong growth prospects in India, Brazil and Mexico. Brazil should benefit from favourable earnings dynamics and commodity exports, whereas India is a structural/long-term story of domestic demand and reforms.

We keep our constructive stance on US duration. But after the Fed’s less-hawkish comments, we see better value in intermediate parts of the yield curve. In Canada, we keep our curve steepening views. We also stay positive on European duration, given a weak economic outlook, and on Italian BTPs. Limited foreign holdings, favourable supply dynamics, and demand from domestic retail investors keep us constructive, on BTPs along with recent actions by rating agencies.

However, in Asia, we stay cautious on JGBs amid increasing inflation and expectations that the BoJ could end its negative interest rates policy soon. This view also acts as a diversifier of our overall positive stance on duration.

In EM bonds, we marginally raised our stance via a selection of LC debt and we are now positive on HC as well. Declining US inflation and expectations on Fed policy should be supportive.

On corporate credit, EU IG remains our favourite pick. While there has been some deterioration in fundamentals, the overall situation is still healthy. Lower supply is also positive. However, we remain negative on US HY due to a worsening default outlook and expensive valuations.

In FX, we are no longer positive on the MXN vs the EUR after the peso’s recent ascent but continue to like the BRL/USD and INR/CNH. In DM, we expect the USD to weaken vs the EUR. We also like the EUR/GBP, USD/CHF and AUD/USD. We are more constructive on oil, which could gain from the rise in tensions in the Middle East. But we are neutral on gold, which benefitted earlier from geopolitical uncertainty.

Risks & hedging

While we maintain a defensive stance on DM equities, optionality and hedges may allow investors to capture any potential upside in equities without changing their overall stance. In FI, we maintain our protection on bonds to guard against any higher-than-expected inflation and hawkish views from the Fed.

The bonds story has just started, stay agile

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

We have maintained for a while that quality credit and government. bonds offer strong value & the recent fall in core yields is an affirmation of that.

Overall assessment

The cumulative effect of monetary tightening will weigh on aggregate demand next year, which is why we think recession risks are high in the US. As a result, investors should focus on government bonds, and look for segments that offer a mix of quality and attractive yield.

Global & European fixed income

The European economy is being affected by slowing external demand and internal fiscal constraints. At the same time, inflation is not fully under control. As a result, although we stay neutral on duration, we are very active and see pressures from both sides on yields. In Japan, we are cautious but stay vigilant. We increasingly favour quality in credit and maintain a slight positive stance through financials, subordinated debt, and BBB-rated and IG. But, we are cautious on the energy, transportation and real estate sectors. We also observe significant divergences between IG and HY. Highly leveraged issuers, SMEs in particular, would have to refinance their debt at higher costs over the coming two years. CCC-rated issuers, which have led the increase in default rates recently, are more at risk. Thus, we stay attentive to any contagion to other ratings band.

US fixed income

Core yields have come down in the past few weeks as the Fed maintained rates at current restrictive levels and as inflation declined. We keep a positive duration bias, with an active stance, and a keen eye on fiscal deficit and supply of USTs. TIPS also offer value to long-term investors. In securitised credit, agency MBS spreads are attractive when compared with history. But we stay agile in adjusting our stance according to changes in spreads. Importantly, we see value in selective non-residential and CRE* securitised (multi-family housing) markets. These are supported by still-strong consumer balance sheets and an acute housing supply/demand mismatch. Regarding corporate credit, our preferences for IG over HY and financials over non-financials are maintained. Even where we think there are bottom-up ideas in HY, we lean towards higher quality.

EM bonds

Sentiment towards EM debt has been improving, following weak US data and Fed communication. While we were ahead of the market in judging this, we see interesting times looking forward. Geopolitics/politics, global supply chain reallocations, and idiosyncratic risks (Argentina) could also have a role to play. In HC, we prefer countries with a carry cushion, while on LC, selectivity is key. Regionally, we favour LatAm and like Indonesia on growth/inflation dynamics.

FX

We are vigilant on Fed actions, even as we stay positive on the JPY, NOK and CHF. Yen has been suffering lately, but a hard-landing of US economy and change in BoJ stance could offer support. In EM, we like the MXN, BRL, IDR and INR.

Seek opportunities outside expensive mega caps

| Fabio DI GIANSANTE Head of Large Cap Equity |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Weak corporate guidance from the latest results season affirms our stance to stay away from risky, expensive segments and tilt towards quality.

Overall assessment

The recent recovery in equities is not matched by forward guidance from companies (in the US and Europe) which are showing concerns on weak demand, even as cost pressures persist. We think markets could increasingly differentiate between attractively priced companies that are beating expectations through high pricing power and those that are merely riding the tide. Thus, we prefer robust businesses, in DM and EM, that have strong balance sheets.

European equities

As consumers’ real incomes come under pressure, pricing power of companies are likely to be tested. Companies that are missing earnings estimates and have high price elasticity of demand and weak balance sheets are more likely to be affected by a market sell-off. Thus, we maintain a balanced approach, seeking to blend quality cyclical businesses and defensives. In the latter, we marginally raised our views in staples and see potential in some discretionary names after the recent weakness. Elsewhere, we like renewable energy and believe the bubble in the sector has burst. This should give way to long-term winners that can capitalise on consumer demand for clean, renewable energy. Retail banks also offer good potential. However, we avoid segments where profits are too dependent on government actions. Tech is another area where we are not positive.

US equities

We are witnessing a dichotomy where valuations and earnings potential in some segments are high vs the rest and this allows us to be selective. For instance, mega cap valuations are extreme but outside these, equal weighted indices have not risen so strongly. Thus, we favour segments such as quality, value and those that are exposed to structural themes: electrification and automation. A lot of infrastructure is being built around greening and electric vehicles, but instead of betting on any cycle, we like to pick our stocks. In addition, a simplistic cyclicals vs defensives choice can be misleading because of wide variations in valuations. Hence, we stay balanced and explore defensives that are attractively priced, but not just the traditional ones. Sector-wise, our convictions are in energy (the sector has been underinvested in the past years and offers opportunities), materials, financials, life science tools. In banks, there are opportunities, but we are monitoring credit risk.

EM equities

Robust EM growth, earnings expectations, and attractive valuations keep us positive on equities. While geopolitical rivalry between the US and China should continue, the recent Xi Jinping and Biden meet indicated some moderation. We are also monitoring global geopolitical risks and impacts on oil prices: this is important for exporting EM countries. Regionally, we like Mexico and Brazil, and select Asian countries, such as Indonesia and India. At a sector level, we prefer real estate and consumer discretionary, but with important differences among countries.

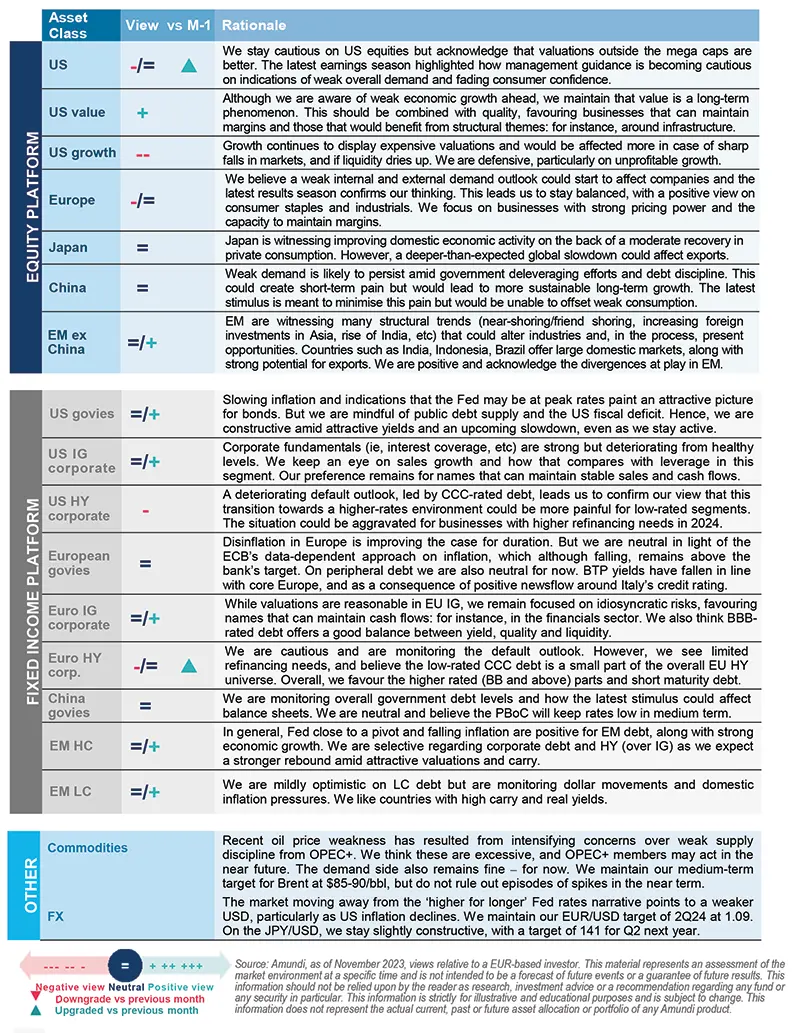

Amundi asset class views

Definitions & Abbreviations

- ABS: Asset-backed securities. These are financial securities such as bonds, which are collateralised by a pool of assets, possibly including loans, leases, credit card debt, royalties or receivables.

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS. Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash. Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core strategy is synonymous with ‘income’ in the stock market.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction). Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than shortterm interest rates or short-term rates dropping more than long-term rates.

- Bull steepening: a change in the curve due to short-term rates falling faster than the long-term rates. This leads to a higher spread between the short and long term rates.

- Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

- Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market. Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss. P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

- Net interest margin: It is a measure that compares a bank’s interest income from lending with its interest expense on its liabilities (such as bank deposits), expressed as a percentage of its assets.

- QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

- Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

- Non-SIFI: A systemically important financial institution (SIFI) is an institution that the US Fed and regulators believe would pose a serious risk to the financial system and the economy if it collapses. A non-SIFI is an institution that doesn’t fall in this category.

- RMBS: Residential mortgage-backed securities (RMBS) are a debt-based security backed by the interest paid on loans for residences. The risk is mitigated by pooling many such loans to minimise the risk of an individual default.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.

- Yield curve control: YCC involves targeting a longer-term interest rate by a central bank, then buying or selling as many bonds as necessary to hit that rate target.