Summary

Inflation moving towards the Fed’s target is allowing the central bank to shift its focus to economic growth. This underscores the importance of bonds as a diversifier* in an overall agile stance.

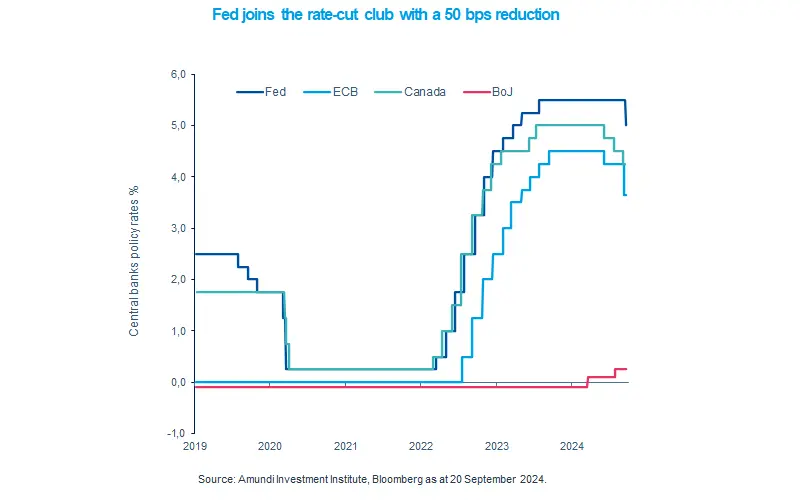

- The Fed cut rates in September for the first time since the Covid crisis, embarking on a new easing cycle.

- These rate cuts were echoed by other central banks in the UK and Canada in what appears to be converging policies.

- Despite these cuts, yields on US government bonds remain attractive from a long term perspective.

The Federal Reserve (Fed) cut policy rates by 50 basis points (bps) in its latest monetary policy meeting in September. We believe the Fed is now confident that the battle against inflation is won. Importantly, the central bank downgraded its growth forecasts for this year and upgraded its expectations of unemployment rate. We think going forward the labour markets and economic growth may become a bigger concern for the central bank, given that inflation is comfortably moving towards its 2% objective. This is consistent with our views of a deceleration in the US economy, indicating that the Fed could maintain this trajectory.

Furthermore, this monetary easing stance is also reflected in policies of other global central banks such as the ECB, with the Bank of Japan being the only outlier.

Actionable ideas

- US bonds

Government bonds may offer attractive yields and diversification* benefits in times of an economic deceleration. Investors could potentially stay flexible on duration.

- Multi Asset in times of uncertainty

A flexible multi-asset approach that includes assets such as bonds and gold could potentially provide resilience. It also allows access to stocks to benefit from a potential improvement in the economy.

This week at a glance

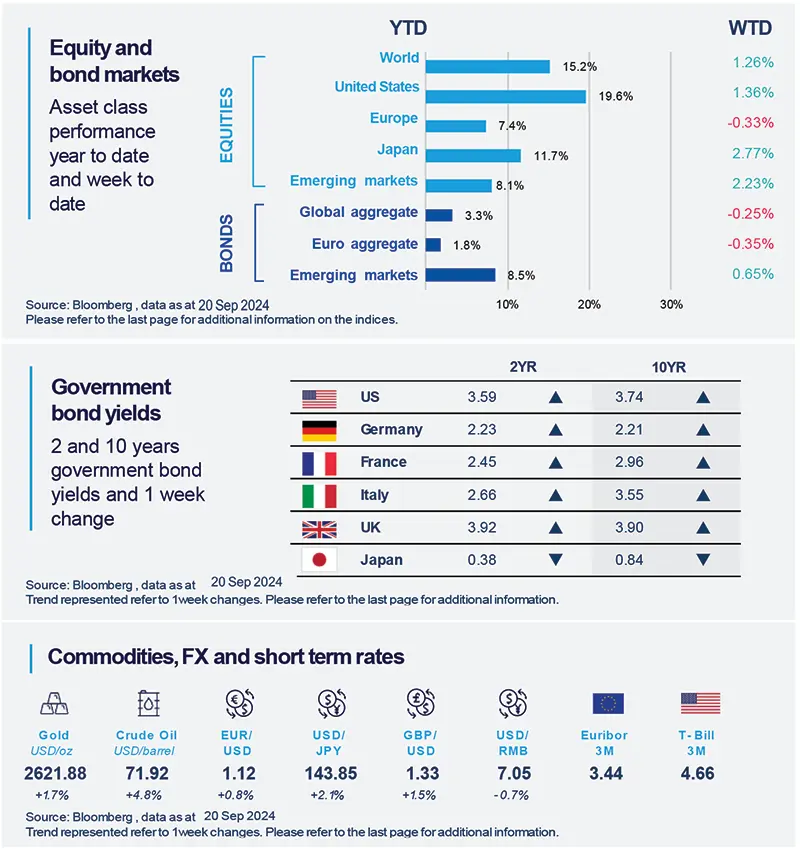

Global stocks rose on the back of optimism that timely rate cuts from the Fed would enable the US economy to avoid a recession. Bond yields were also up. In commodities, geopolitical tensions in the middle east were in the limelight, as concerns over supply pushed oil prices higher.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 20 september 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US labour market is cooling

Initial jobless claims decreased from prior week while continuing claims (i.e. the number of people already collecting jobless benefits) also declined. This data, together with other indicators of the labour market, show that the labour market is cooling, but not cracking. Finding a job quickly, is not as easy as companies are increasingly hiring less. Importantly, though, layoffs and particularly permanent layoffs are not accelerating sharply.

Europe

Eurozone inflation direction confirmed

The final inflation release for eurozone was confirmed, with headline inflation falling to 2.2% in August from 2.6% in July. The services category remains the main component showing stickiness, yet looking at the different components of inflation and less volatile categories shows that the general direction of travel in these measures is still down and that the disinflation process is well advanced.

Asia

Japan’s inflation supports additional rate hikes

The national CPI for August came in higher than expected. Looking ahead, this indicates that the core inflation (inflation excluding food and energy) is likely to stabilise around 2% for the rest of the year. A 2% core CPI, along with positive real wage growth (wage growth less inflation), raises the probability for the Bank of Japan to hike interest rates later this year. But the bank may be vigilant towards any market uncertainty, before raising rates.

Key Dates

|

25 Sept Retail sales: Germany and South Korea |

26 Sept US GDP, South Africa PPI |

27 Sept US core PCE, ECB CPI expectations, China industrials profits |