Summary

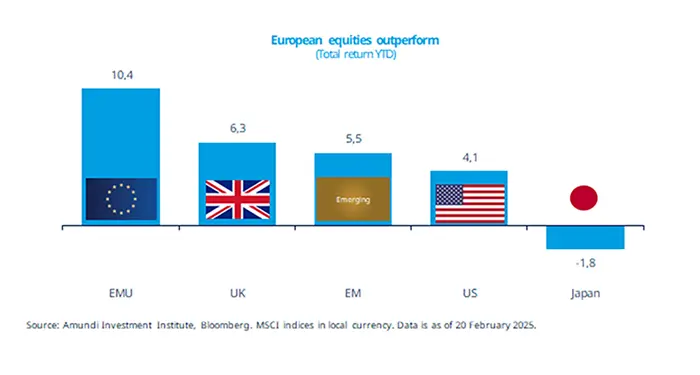

European stocks have been outperforming driven by positive corporate results. With ECB support and prospects of a ceasefire in Ukraine, positive sentiment is likely to persist.

- Outperformance in European equities has been mainly driven by banks, the industrial, and technology sectors.

- A possible ceasefire in the Russia-Ukraine conflict may be supportive for European stocks.

- Expectations of further rate cuts by the ECB would continue to be supportive for European assets.

The European equity market has been in the spotlight so far this year, outperforming major global markets, driven by strong performances in the financial sector and more recently in the tech and industrial sectors. The defence segment has seen significant growth due to rising EU defence spending since 2022 and prospects of possible future stronger rises. This possibility has emerged after US Vice President JD Vance’s speech at the Munich security conference, in which he questioned the Transatlantic defence alliance and NATO itself. Expectations for larger defence budgets, potential fiscal stimulus after the German election, and ECB support should help maintain this positive sentiment.

Actionable ideas

- European equities as a diversifier*

European equities continues to offer diversification* opportunities for global investors. Within Europe, we favour companies with strong balance sheets and pricing power.

- European bonds

With further easing expected from the ECB, European government bonds and high-quality credit markets should stay in demand.

*Diversification does not guarantee a profit or protect against losses.

This week at a glance

Global stocks lacked a clear direction amid ongoing tariff talks and concerns from US retailers. Optimism about AI developments in China boosted the Chinese tech sector, with the Hang Seng Tech Index rising 6% over the week. Gold remained in demand at above $2,900 per ounce.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 21 February 2025. The chart shows US CPI YoY growth. *Diversification does not guarantee a profit or protect against a loss.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US construction sector growth halts in January

Single-family housing starts dropped sharply in January, by 8.4% MoM, amid disruptions from snowstorms and sub-zero temperatures. This decline was partly a normalisation after outsized rises in late 2024 amid recovery from hurricane Helene. Prospects for a near-term rebound look grim, due to rising costs from tariffs on imports and high mortgage rates. Permits for future single-family homebuilding were stable.

Europe

UK inflation on the rise

UK inflation jumped sharply in January, up to 3.0% YoY from 2.5% due to increased food prices. Services inflation rose to 5.0% from 4.4% YoY due to payback from soft air fares in December. Core inflation was well behaved, but momentum remains strong, leading to more-sustained-than-expected inflation in the short term, mostly due to strength in labour costs and likely increases in regulated prices in April.

Asia

Japan’s inflation reaccelerate

National CPI continued to surprise on the upside, picking up to 4% YoY in January from 3.6% in December. Core CPI excluding fresh food and energy also increased to 2.5% YoY from 2.4%, confirming the reaccelerating trend. We expect some softening in the coming months, as the government released record rice reserves to tame food prices. However, inflation will stay slightly above the BoJ target, supporting further hikes.

Key dates

25 Feb US consumer confidence, US house price index, US Dallas Fed index | 26 Feb Germany’s and France’s consumer confidence, US new home sales | 28 Feb EZ inflation data, US personal income and spending |